2022 TOP PREDICTION: Growth To Value Rotation Continues

From Samantha’s StockChartsTV Interview January 6th: One of my favorite rotations to time is from Value to Growth and vice versa. As a Macro-to-Micro analyst, educator and trader, I work to find durable trends to trade with and around for my clients. One such...

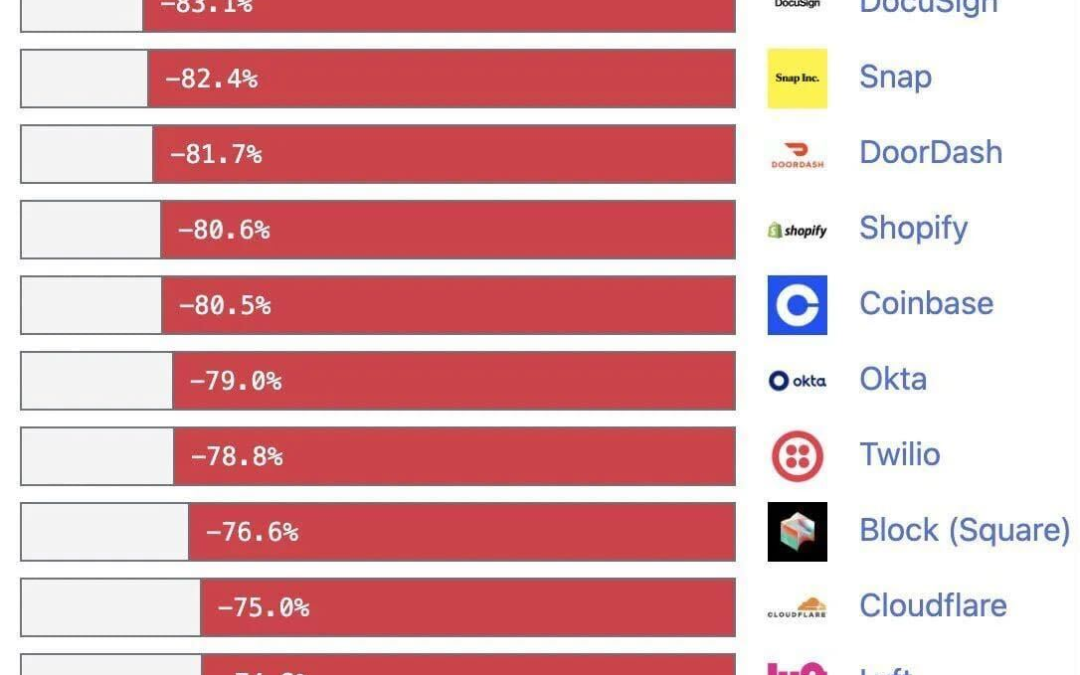

Oil as Public Utility

**The following oil analysis was posted by Samantha for LaDucTrading FishingClub and BigIdeas clients in their Slack workspace under #macro-to-micro channel. It was published on Wednesday November 24th during market hours to support her oil short thesis she had been...

Pivoting on Oil: Value Rotation Spike

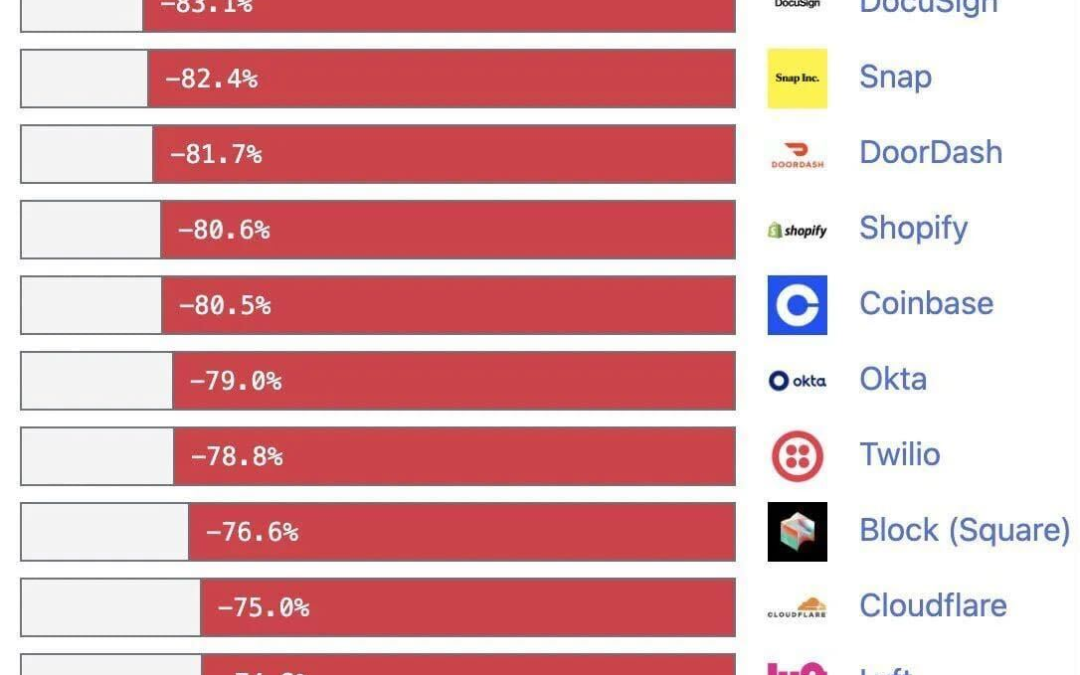

Growth-To-Value Rotation Spikes Clients know I have been calling a Growth-to-Value rotation since last April and again spoke directly to its continuation when invited 1st of year to present my StockChartsTV 2021 Predictions. JAN 16, 2021 StockChartsTV: 2021...

Gone Fishing Newsletter: 2021 Predictions

I was recently asked to present my 2021 “Look Ahead” for StockChartsTV CHARTING FORWARD 2021, “a yearly market outlook special featuring technical analysis icons Tony Dwyer, Rick Bensignor, Samantha LaDuc, Mary Ellen McGonagle, Craig Johnson and Gina...

SPAC Attack: A Very Special Macro-to-Micro Power Hour Guest Captain Interview

Introductions: A client asked me to do a Guest Captain Macro-to-Micro Power Hour on SPACs (special purpose acquisition companies), so I invited my go-to SPAC expert @sandiegosam to discuss them. Craig introduced me to George Kaufman who has the institutional...

Gold, Silver, Miner Short Update

In follow up to… August 8th, 2020: Gold, Silver and Miners Due A Rest – where I top-ticked Gold’s fall… …to Nov 16th, 2020: Gold Lacks A Short-Term Catalyst – where I recommended pressing short the Gold complex… Here’s why I continue to be bearish Gold and related precious metals like Silver and Miners as recommended […]

Outliers Revert and These Are Outlier Charts

I follow a very articulate bear who is under-the-radar in large part because he is anonymous. Some, like Harry Dent, have been loud bears forever, and @SuburbanDrone may also have been a bear forever, but I have only found him recently when we engaged on twitter a few months ago. I do not know what […]

Reopening Rotation Rally Risks

A Reopening Rotation Rally is underway since last Monday when Pfizer announced a promising vaccine candidate which sent value stocks – energy, emerging markets, banks, and many small caps and oversold economically-sensitive plays – into FOMO chases while...

Gold Lacks A Short-Term Catalyst

My thesis for my recommended Gold short Aug 8th was as follows: If current and future QE turns into ‘spending QE’ (as opposed to mere Asset Swap QE), economy will feel higher inflation expectations with higher yields. Gold will suffer. Fast forward to today’s Moderna’s vaccine trial announcement following Pfizer’s last Monday: Perception of “cure” […]

Bull Stampede Expected: To All Time Highs Or Over A Cliff?

Last week was the biggest down week since March… and yet, S&P futures positioning reached a two year high. So many positioning long into the election. Even Friday’s call buying near end-of-day helped foretell the gap up this morning… and yet, I still contend this market is not safe. Before this latest pullback, clients had […]

VIX Flashes Warning for Credit and Equities

Last Week – Speculators Unwind Big Nasdaq Short in Futures. The increase was the second biggest on record in data going back to 1999. Upon seeing this I then wondered – and expressed as such in my trading room – when do these net short non-commercial positions on $VIX futures unwind too? https://twitter.com/MacroCharts/status/1318144867336269824?s=20 Leading into today […]

What Does Q4 Have In Store

First, here are some over-arching comments on the list of 35 recommended trade ideas and where to from here out of the universe of stocks to choose from: I am still excited about many of these stocks for Q4: ROKU, TWTR, SNAP, SQ, FTCH, CHWY, PINS, PTON, GOGO, GME, ZNGA … I am not very […]

The Biden Bid Meets Value Rotation

Value or Value Trap? Of the major indices, the SmallCap Russell 2000 index was the top performer this week – in large part as energy and financials benefited the most from a spike in oil prices and Treasury yields. Financials are the 2nd worst performing sector...