Table of Contents

Introductions:

A client asked me to do a Guest Captain Macro-to-Micro Power Hour on SPACs (special purpose acquisition companies), so I invited my go-to SPAC expert @sandiegosam to discuss them. Craig introduced me to George Kaufman who has the institutional perspective. His firm sponsors the $CHAQ SPAC among others. The result? An outstanding discussion on SPACs – from market structure, leadership, targets, and tickers to how both retail and institutions play in it. If that wasn’t exciting enough, we also brought in a macro lens to compare SPACs against treasuries, investment grade corporate bonds, liquidity and time! As a result of all the ground we covered, audience questions and review of many popular SPAC names, we ran a tad over in duration of interview. I don’t think you’ll mind though…

SPAC Attack

In this very special Macro-to-Micro Power Hour, LaDucTrading had the distinct pleasure of hosting two Guest Captains: Craig Samuels + George Kaufman to share their 2020 SPAC highlights, along with mechanics of trading these special asset class vehicles, plus their 2021 insights.

- Craig is an equity analyst/angel investor who has been trading and investing in SPACs since 2007.

- George is Partner and Head of Investment Banking at Chardan, writing the 3rd SPAC deal back ever done back in 2003.

First a definition:

A SPAC is different from a Direct Listing IPO or Hybrid IPO. The SPAC does an IPO first, when it is in essence an empty shell with nothing to say and no financials to project. Then it goes out and finds a target company and does a merger to take the target public.

A SPAC raises money from investors to write this “blank check” initial public offering, then uses the money to look for a private company to merge with.

In the merger, the target private company gets the money that has been raised and the SPAC shareholders get shares in the new combined company which trade publicly.

The result is that the target company has raised cash and gone public through the merger.

It is an alternative to an IPO that can be faster and perhaps offer better price.

How Big You Ask?

Maybe the biggest capital markets story of 2020 was the boom in SPACs.

Some $80 billion in SPACs were listed in 2020, meaning the year turned into an epic bonanza for investment bankers, lawyers and companies looking to go public in a SPAC deal and the investors that got in early…

The frantic pace of issuance has created a pool of almost $90bn in SPAC trust accounts — almost four times what it was a year ago. SPACresearch

Remember: SPACs typically seek acquisition targets that are at least 3-5 times the size of their trust accounts. That means the active class of SPACs may eventually take public roughly $350bn worth of total enterprise value. SPACresearch

Yes, There Are Risks

Misconceptions Matter

Leadership Matters

Matt Levine, Bloomberg Opinion writer talks about the risks in several referenced articles – Everyone wants a blank check.

Taking any private company public is an uncertain endeavor that could be a home run or a dismal failure, and a SPAC adds further uncertainty because it hasn’t picked a private company to take public yet. It’s a meta-IPO; you don’t know if the company it acquires will be worth the price, and you don’t even know what the company is yet.

Needless to say, SPAC investors must have trust and faith in its leadership.

Craig talked about those SPACs he thinks have outstanding leadership. Some investors of them concentrate their bets based on leadership. Others, like Craig, spread out their money into multiple SPACs betting one will get the target deal. Then there are the retail momentum day/swing traders that have piled in to chase the momentum, the story, driving up valuations. There were many tickers discussed – those Craig holds for the strength of the “Celebrity CEO” (Chamath, Ackman, Softbank, etc) to those with strongest track record of getting deals done. To get all the companies he covered – and he has done due diligence on most SPACs out there – you need to listen to the interview as there were many discussed!

Warrants Matter

This is magic. I have created value from nothing. You give me $10, I give you back your $10 with interest, and I also give you another valuable thing. The warrant costs you nothing, and is worth something. Matt Levine, Bloomberg

The value of a warrant—an option to buy a share of stock in the future for a fixed price—goes up as the volatility of the underlying stock goes up… and lately that is what has been happening!

Samantha mentioned she put together a list of 198 SPACs on Jan7th, 90% of which are in the green and a dozen by triple digits!!

Top performers just in the past week: $ACTC $RSVA $DLCAU $CCIV $VLVCU $BRPA $STPK $NGA $VIH $OAC $EXPC $IPOF $IPOE $IPOD $INAQ …many of these were discussed in the interview.

Targets Matter

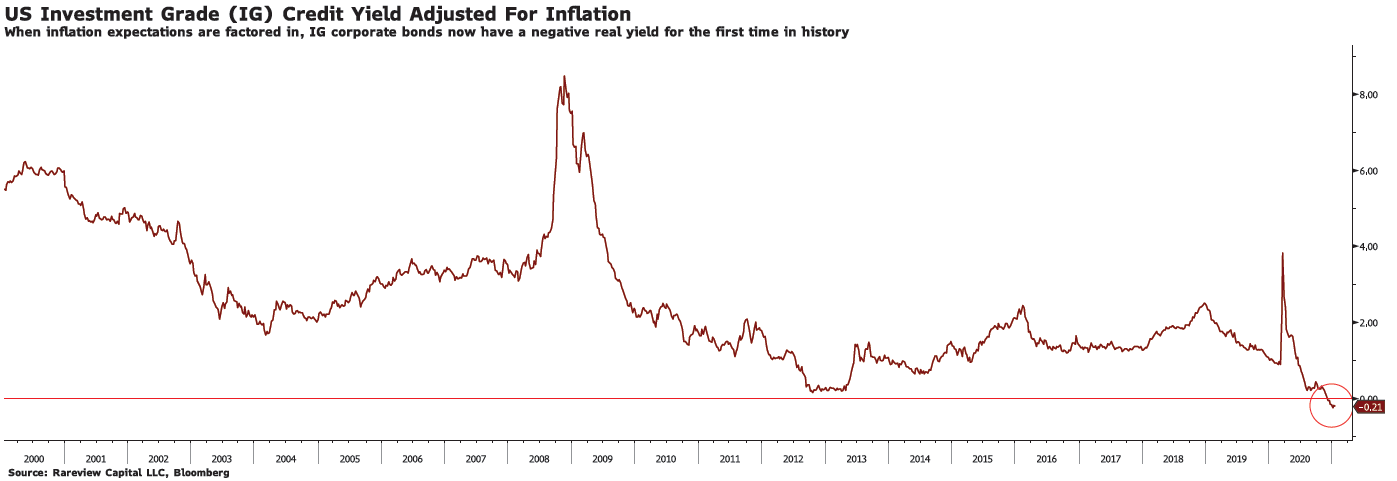

Macro Matters

Market Returns Matter

Free Resources:

A follower on twitter has started to compile a list of SPAC resources and sent it to me after we announced this episode. Have a look – it’s a great start!

Additional SPAC Resources:

- Active and Pre-IPO SPAC list: spactrack.net/activespacs

- SPAC Calendar: calendar.spactrack.net

- Completed SPACs (2019 onwards): spactrack.net/closedspacs

- SPAC Market Stats: spactrack.net/spacstats

- SPAC News: spactrack.net/spacnews