Trump has Covid. Nobody knows what will happen – to the Trump’s or to the election. FinTwit is aflutter with conspiracy theories! I have mine. None of them matter.

I don’t even have to write about the legal and political implications, the “what if scenarios“, for clients. I’m just going to send you a bunch of links to political-odds articles that have been sent to me by clients as they are best read over wine or hard liquor this weekend:

- We’re in the final stages of the presidential election. What happens if a candidate withdraws or dies?

- With News That the President Has Tested Positive for Coronavirus (and He Was in Contact with Joe Biden at the Debate Earlier in the Week), What Happens If a Presidential Candidate Dies or is Incapacitated Before Election Day? A Mess

- What Happens If A Presidential Nominee Can No Longer Run For Office?

There is a school of thought that Trump’s diagnosis of Covid will be “rocket fuel for patriotism”.

“A reminder to all Americans that the net effect of our prime minister (BoJo) catching COVID-19 was that it prompted a surge of patriotic support. From which he emerged with renewed popularity. It also silenced press & parliament at key moment in crisis from asking critical questions. And when it was announced he was moving to intensive care was moment of national shock. Everything about this is rocket fuel for ‘patriotism”/ @carolecadwalla / Guardian

Others fear Trump’s brand of patriotism and election uncertainty will fuel political violence – from both sides but especially the rising Proud Boys movement after hearing Trump’s dog whistle at the debate this week. I hope not, but I don’t know. I think it’s dangerous to bet against America, but I also recognize the match-point Trump is playing for – deflection, digging in, democracy-be-damned.

Trump may get the sympathy vote. Supporters may turn all patriotic for him. As the narcissistic incumbent, it is still Trump’s election to lose. But news of Trump falling ill let alone testing positive will benefit market players as it favors a Biden win.

Before the news today, I had already fully expected the election (voting, results, transition) and Covid resurgence to reassert themselves as main drivers of this market so much so that I told clients to expect wide volatility swings starting in October that will not let up. As my recent premium videos for clients hopefully demonstrate, my intermarket analysis still shows both fender benders and car crashes heading our way into January.

The bright light? Clients in my live trading room know I have been patiently waiting for Q4 to enter any ‘value’ plays, in anticipation of The Turn in the Growth-to-Value trade (or momentum to anti-momentum, covid-destroyed economically-sensitive plays. A Biden win, at least in the markets’ eyes, would be fiscal-stimulus positive and help fuel a rotation into these oversold sectors.

Harnett (of Refinitiv) agrees: H/T @TheMarketEar

Long global banks, energy, oil vs short US and EM tech.

Bearish trade is long USD, defensives, util, long long bonds and short industrials….

There’s a solid reason why there is danger in being positioned overweight technology – the risk of inflation expectations are rising.

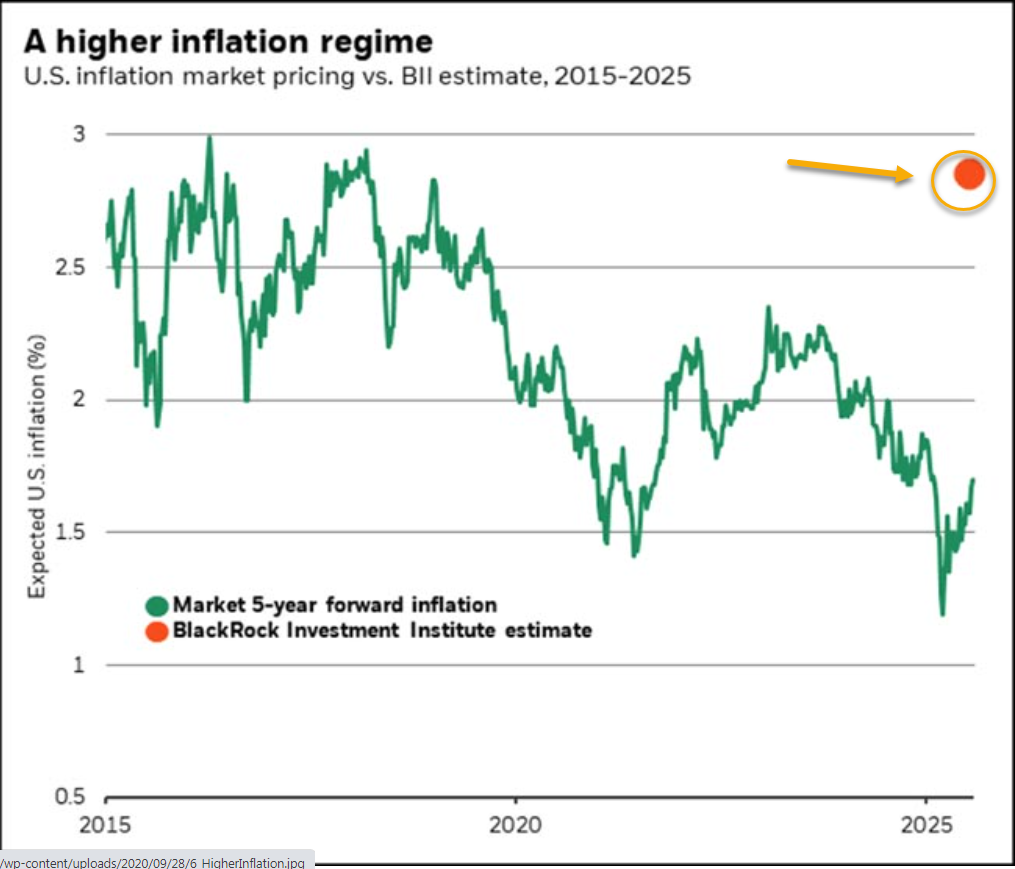

Here’s Blackrock’s estimate for US inflation market pricing:

Value Plays Win

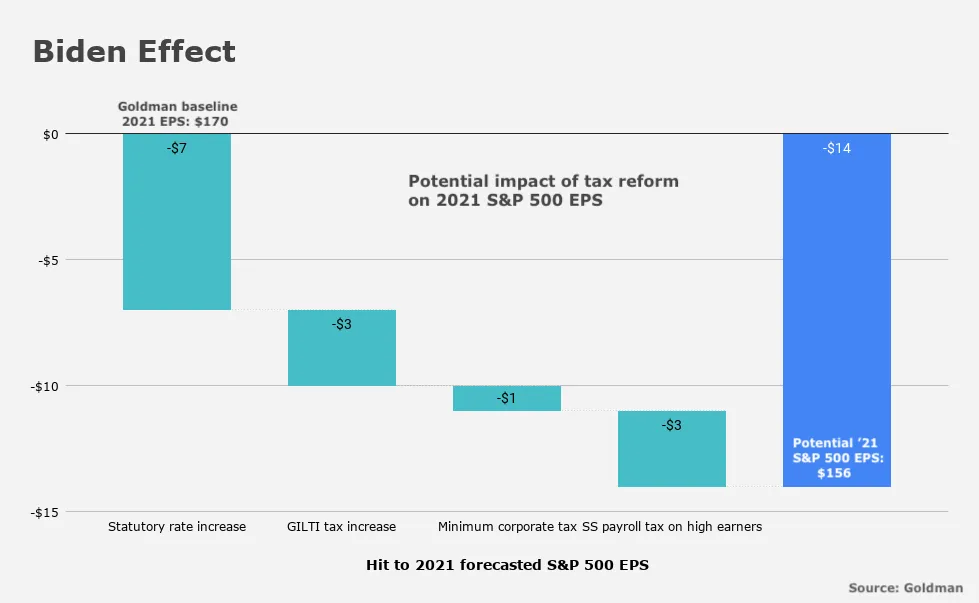

Basically, with the attention focused on Trump’s health and elect-ability, the market odds are turning toward an outcome of an outright ‘Blue Sweep’. For one, fiscal stimulus is much more likely to get passed. It is also assumed Biden will repeal the corporate tax cut. The data analysts will assess both the corporate margin impact and economic growth scenarios, against the backdrop of macro dynamics like supply rebalances, low job participation rate and spiking corporate defaults.

As proposed, the Biden corporate tax plan would arithmetically reduce S&P 500 2021 earnings by roughly 9%, excluding any potential second-order impact from economic growth, business confidence, or other factors”, Goldman wrote, in a note dated September 17. “Of this $14/share impact, roughly half is due to the proposed hike in the statutory domestic rate”

That said, over the longer-term, Biden’s fiscal policies could actually increase corporate earnings, a scenario the bank’s David Kostin outlined this week.

Adding to the ambiguity is the possibility that the unwinding of “doomsday” hedges tied to the view that the election is sure to produce a contested result, could end up slingshotting stocks higher in a Biden landslide. Nomura’s Charlie McElligott discussed Tuesday. In a Democratic sweep scenario, long-end yields “should” rise on the prospect of additional fiscal stimulus, higher spending, wider deficits, and more borrowing.

Sectors that favor Biden projects and campaign promises will get most attention. Think: united basic income (UBI), green technologies not to mention big infrastructure spending.

With that, I see a forgotten segment that will see attention – the left-for-dead energy complex, specifically stranded assets.

Referring to the Energy complex: “we anticipate an inflection from 3Q20 marking the end of negative earnings revisions” Goldman

Think capital appreciation and dividend yields. The assets that can deliver positive growth moving forward in real terms likely won’t be bonds with interest rate risk. Market needs more choices.

An individual equity carries more risk than a 10 year sovereign bond. But the risk of the 10 year bond has gone up too: the duration of high grade bonds is greater than it has ever been before, meaning they carry unprecedented interest rate risk; their diversifying properties vis a vis equities are declining, and the massive increase in government debt implies that they are probably not really risk free. Bernstein

But reflation to things from paper doesn’t necessarily mean indices move meaningfully higher, nor does it connote lower volatility. Instead it could mean a reset of the “Momentum” trades, especially as inflation gets factored into valuations…

If all the company’s value is found in the projected, long-term (5-10 year) future cash flows, and the probability of inflation rises 3-5 years out, those FUTURE cash flows are WORTH far LESS! Larry McDonald

In my Lindzanity podcast with Howard Lindzon August 6th, I told him that my #1 Tell for a Tech repricing would be higher inflation expectations, USD stability/strength culminating in a (sustainable) rate spike. We have met two out of three criteria and the 10yr treasury yield has risen 50% since that interview. Yet, we aren’t quite there yet on ‘sustainable’. A few more weeks, especially as a Biden win gets priced in.

It almost feels as if we needed to rotate from stagflation narrative to deflation to now inflation again. The strong flows into bonds, gold and bitcoin were a better basket to trade in a “stagflation” environment. Since then, markets experienced a strong and steady pullback in Lumber, Gold/Precious Metals, Copper and Oil.

“Looking at election event risk in USTs/rates, the market is actually hedging more for a potential ‘blue wave’ risk scenario, with puts over calls and expressions of steepener options to protect current longs in duration / flatteners”, Nomura’s McElligott said Tuesday. The market’s thinking, he wrote, is that even if a blue wave triggers an initial risk-off move and attendant bull-flattening, there will likely be “a second move / sequencing risk medium-term” where Biden, with a Democratic Senate and House, ushers in “a whole new world of deficit spending with low barriers to unprecedented fiscal stimulus [from] UBI to infrastructure”. Heisenberg

Trading this wave of growth-to-value rotation will not be without testing, especially as markets gyrate on headline risk from not only Covid in general but with Trump in particular. The near-term election risk finds me in the camp where I see tighter financial conditions causing a headwind to equities – certain equities – at the same time fiscal relief stimulates small caps and economically-sensitive sectors and infrastructure plays. Higher inflation expectations will also be good for small caps and cyclicals as inflation signals growth but also higher yields, and it is this inflation impulse – after the most recent deflation impulse – that we may be ready in Q4 for a sustainable turn into reflation and out of bond proxies (cloud, big tech, nasdaq).

So I will continue to size up where money is flowing. I suspect it flows into Value in Q4 – despite and in spite of election risk.