Table of Contents

Value or Value Trap?

Of the major indices, the SmallCap Russell 2000 index was the top performer this week – in large part as energy and financials benefited the most from a spike in oil prices and Treasury yields. Financials are the 2nd worst performing sector year-to-date, down 21%, exceeded only by Energy’s YTD return of -48%. Both have turned strongly higher this week as the growth-to-value rotation started the month off strong – as I suggested it might:

As the US dollar fell, lifting the precious metal and tech complex today, be mindful that longer-term rates are at five-week highs as the 10-year yield hit 0.799% – up 100 basis points since Friday. They will rise even more if Trump’s posturing for a $10 trillion fiscal policy (or any part of that) gains momentum in the Senate.

With that, those dividend yields in oversold sectors are well above Treasury and even corporate bond yields. The 10 yr yield will be quickly on its way to my next price target of .89 in a New York minute if this out-sized Covid relief deal passes. And then next stop is .957 on way to 1.16%, at which point MANY bond proxy holders will rotate HARD into every piece of junk asset with decent yields. This will be epic!

But first, I think we need to get through Options Expiration next Friday and the Big Tech (FAANMG) earnings reports soon after.

But then, my intermarket analysis intonates the rotation is more than just a bullish impulse move like May. There are strong waves of bottoming forming.

Small caps are one proxy for value rotation, but so too is SPHB – a way to see that SPY cyclicals are ready to break out:

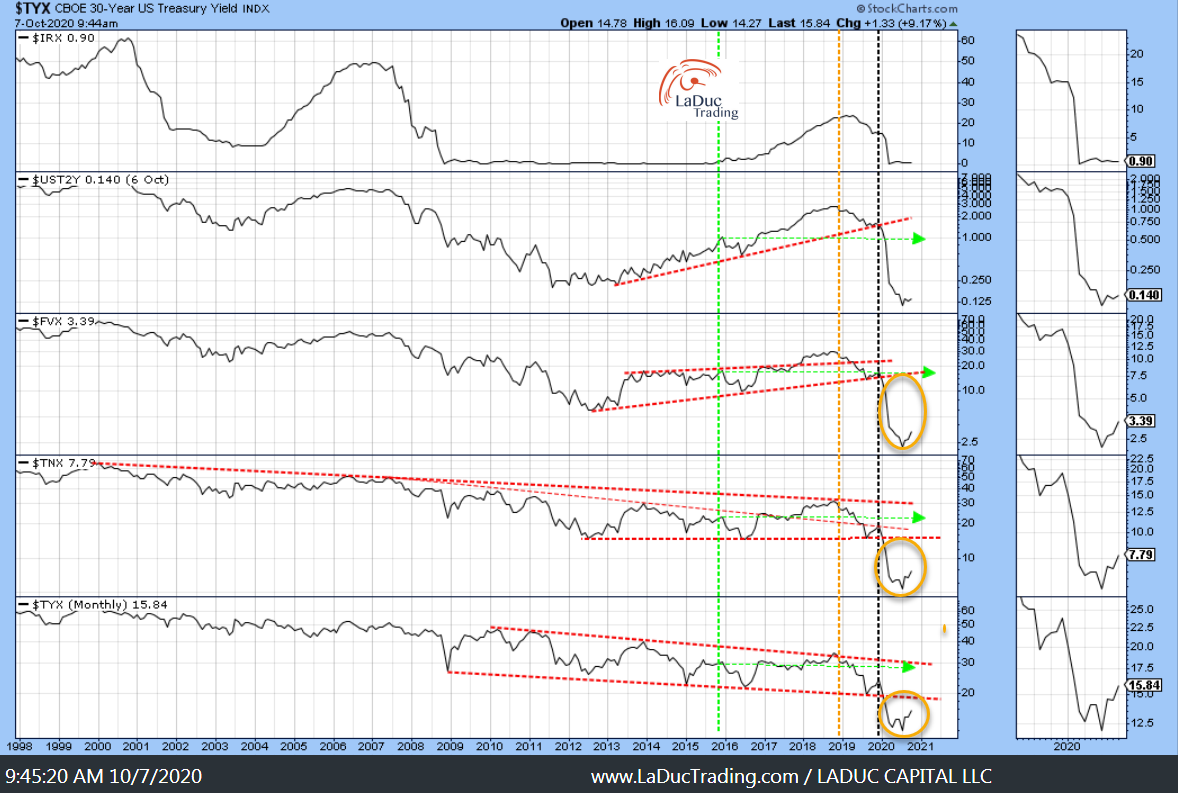

This is a chart of different duration treasury yields – stacked. The longer end yield spike is certainly stronger and potentially moving back to where they broke down in March (black vertical line). This idea is not in anyway shape or form consensus.

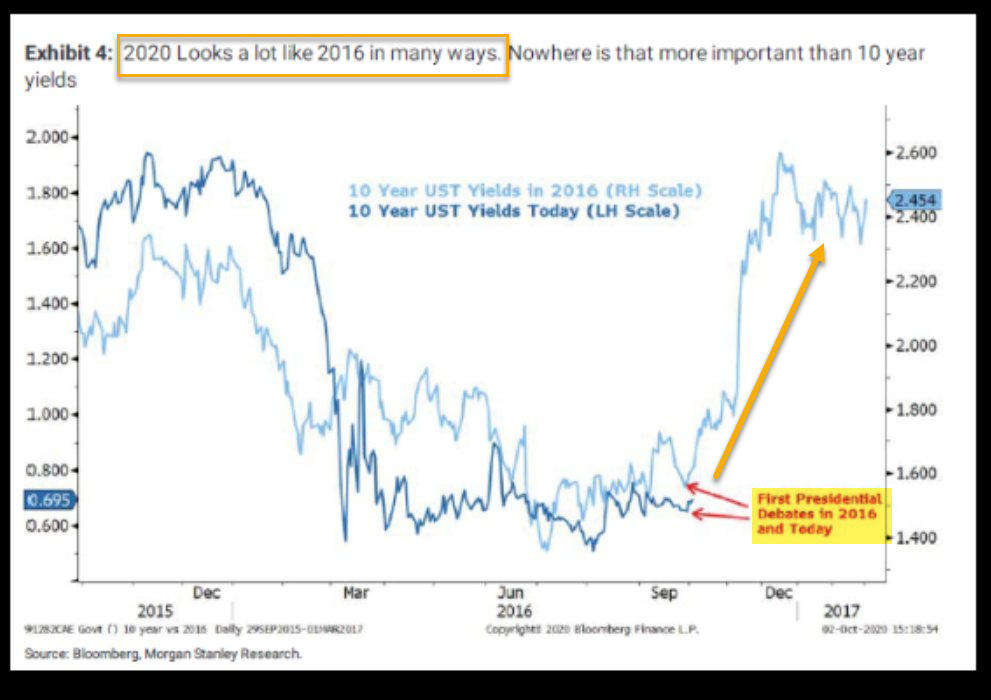

2020 in many ways resembles 2016 – rates rose into the election. In this case, the election may expand into a contested fight into January inauguration.

Growth to value SPY looks ready to reverse this constant bid for momentum plays. In fact, this ratio of growth:value is intonating a very big trend reversal from overbought levels.

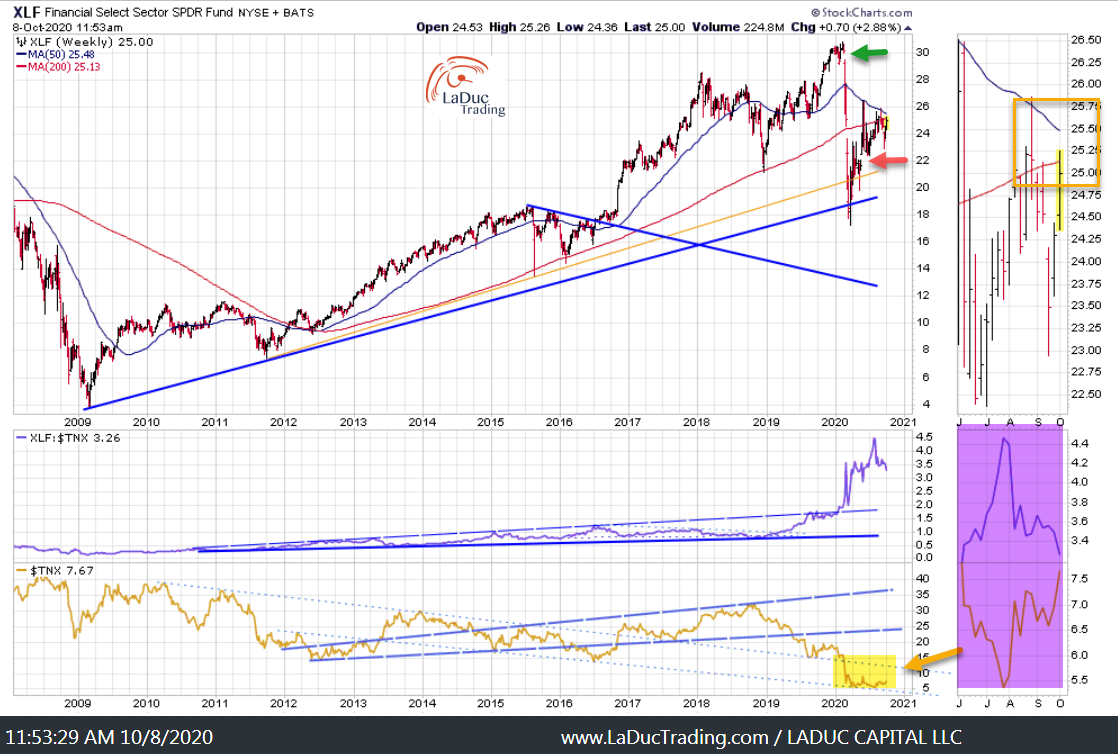

Financials needs to get above 25.50 on weekly close to convince me. And wouldn’t you know there is a gap fill just above and just below. Place your bets!

October 12th is first week of Q3 earnings season and big banks and financials start to report. We shall see shortly how the consumer and the banks are doing!

Market Thoughts

Intermarket Summary – a near cliff-dive was averted last week, but the very nature that I had many-a-chart indicating risk-off, makes it all the more curious that the hard market rally might have been for show. For example, bond inflows – $25.9bn just recorded (BofA) – were the second biggest on record – and this despite yields rising.

Technical Summary – My “Biden Rally Into Resistance” video post to clients is working and the 2nd half stock pics are still banging out new highs.

Quant Summary – Well, I still see intermarket divergences under the surface that suggest sudden volatility at the same time folks are hedging via heavy SPX put accumulation in December (October (1.2mm), Nov (640k) and Dec (2.3mm)). Next few months should be very choppy with all the stimulus-on-off headline risk, but I contend this makes January a better positioning bet. And my prior client recommendation to Sell Nov (Election) Volatility and Buy Jan (Inauguration) Volatility is working!

Sentiment Summary – Seems market is pricing in a Democratic sweep scenario, so long-end yields “should” rise on the prospect of additional fiscal stimulus and higher spending which will can simulate stagflation thereby giving life to stocks and gold and bitcoin. But if fiscal talks break-down, so too will stocks and gold and bitcoin.

Basically, the sector rotation play of growth-to-value should gain strength as long as market anticipates a Biden win, and/or Trump keeps touting that a vaccine is “momentarily” coming out, and all can be confirmed by a 10 year yield staying above .666%.

Reflation Trade Above 10YR 0.666%

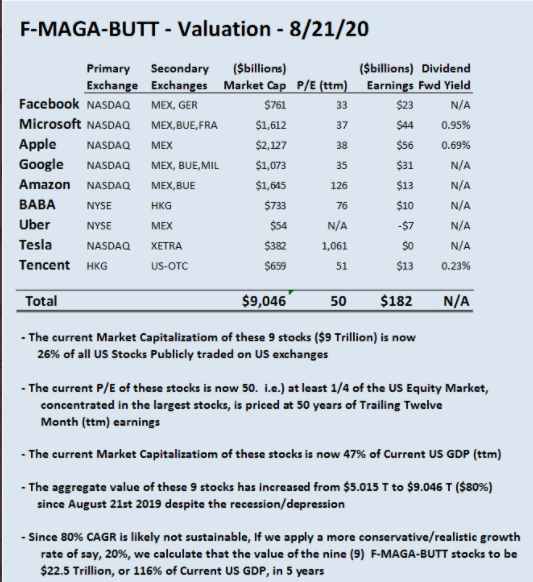

If all the company’s value is found in the projected, long-term (5-10 year) future cash flows, and the probability of inflation rises 3-5 years out, those FUTURE cash flows are WORTH far LESS! Larry McDonald

Big Tech plays already have Big Valuations on top of Big Weightings in indices:

In my Lindzanity podcast with Howard Lindzon August 6th, I told him that my #1 Tell for a Tech repricing would be higher inflation expectations, USD stability/strength culminating in a rate spike. We have met all three criteria but Tech is still holding firm after it’s drop last month..

So where would big money most likely go with a Biden win that represents 2018 corporate tax cut rollbacks, anti-trust investigations and higher interest rates?

Judging from the past two weeks, I would say, market is already thinking higher-yielding value plays – financials, energy, US small caps, transports, etc. On lookout are the economically-sensitive companies hit hard by Covid, such as airlines, restaurants and hotels. These will get and hold attention on a vaccine-driven cyclical upgrade. Also in play: building materials and infrastructure companies as potential of a Fiscal policy is directed at job creation.

Rising rates would go far alongside inflation expectations to support this pro-cyclical trend. Time will tell if we sustainably pivot from Paper to Things again: Beverages, Tobacco, Toilet Paper, etc, but the dividend yield spread for these sectors over bonds has never been greater. So in the most basic terms, I am thinking Bond Proxies Out; Toilet Paper In.

Rates Matters

There is a dynamic at play for higher nominal and real rates.

For a refresher on the relationship between real and nominal interest rates on the economy: Janney Podcast

For perspective, real interest rates have been falling for 700 years, but most of the “heavy lifting” has been due to nominal yields falling. When that reverses, gold falls hard.

Should nominal rates sell off (US breakevens widen), real rates can actually cause tightening in US financial conditions, causing equity weakness especially in growth sectors if real rates are dragged higher by higher nominal rates. And with the market currently ‘pricing in’ a Dem sweep, and likely unwind of the 2018 corporate Trump tax cuts, there is real risk of higher nominal and real rates. Here are some contributing factors:

- higher inflation is good for small caps and cyclicals at this part of the cycle as inflation signals growth.

- but inflation at the top of a cycle is not bullish like at the bottom of a cycle going into a recovery.

- inflation equals higher yields so the rotation from bonds and bond proxies (cloud/tech/QQQ) into value, cyclicals, emerging markets and higher-yielding junk assets will rise, but the selling of Big Tech will weigh on indices.

So here we are – gaming the direction of rates and fiscal deals as monetary policy and presidential personalities matter less.