**The following oil analysis was posted by Samantha for LaDucTrading FishingClub and BigIdeas clients in their Slack workspace under #macro-to-micro channel. It was published on Wednesday November 24th during market hours to support her oil short thesis she had been tracking past month and reviewing daily in her live trading room.

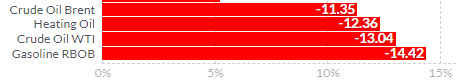

Prior to the oil crash on Friday November 26th, which triggered the 4th largest one-day VIX gain in history, Samantha had suggested it was time to fade oil on October 30th. Then on November 20th after crude had already fallen from $85/bbl to $77/bbl, she updated her oil fade call:

“So is the pullback done? I don’t think so. My XLE overlay on IEF:HYG chart also intonates an inverse H&S pattern that says the oil pullback is #NotDone.

And then you have my recent short call on IWM/Russell which is heavy on energy plays (with banks and materials contributing).

Plus you have the benefit of Bob MacMinn’s fundamental take on lack of open interest in the commercial trading side of oil…

PLUS the “Oil as Public Utility” narrative to lower oil + gas prices with Biden going so far as coordinating with other nations (China and India) to release oil from respective strategic petroleum reserves (SPR).

Cherry on top is the new wave of Covid fears driving sentiment to be bearish oil demand.”

Samantha LaDuc #Intermarket-tells slack channel for clients November 20th.

WTI Crude oil closed Friday at $68.15 dropping over $10/bbl from Wednesday’s close. Brent oil lost $9.50 to close at $72.72.

Not only did Samantha warn clients in advance of the “air pocket of risk to the downside” in oil, she also warned VIX was coiled, recommending it long on November 22nd. VIX closed up 54% – again, its 4th largest one-day move in history!

BLACK FRIDAY DEAL

Oil as Public Utility

The Biden Administration clearly wants a transition to ESG (environmental, social, corporate governance) sooner rather than later or they wouldn’t be attacking so openly with so many on so many fronts to try and get oil and gasoline prices down. That said, many politicians in the past have worked to tap pump prices lower ahead of elections. With gasoline and heating oil up 80-90% YoY, it’s no wonder democrats are getting nervous heading into the mid-term election cycle. But there is an added kicker to this play that makes the progressive democrat’s agenda more in line with seeing oil as a public utility and oil independence/dependence as a political football.

Fire and Fury

It’s not likely lost on many that the Biden Administration has sounded with much fire and fury about higher oil and gas prices, blaming many in the process.

First, they picked a fight with OPEC+, calling them ‘bad guys’ – actually calling them out as “cartel” (which they are) at every chance they get on national media – so as to paint a picture of US oil dependency. Biden went so far as to threaten unspecific “retribution” at the Saudis and OPEC including a coordinated SPR release with other allied nations’ reserves.

First, they picked a fight with OPEC+, calling them ‘bad guys’ – actually calling them out as “cartel” (which they are) at every chance they get on national media – so as to paint a picture of US oil dependency. Biden went so far as to threaten unspecific “retribution” at the Saudis and OPEC including a coordinated SPR release with other allied nations’ reserves.

Ah, but they didn’t stop there. They have also gone on the offensive from the start with select policies to limit US production at the same time accuse the US Oil and Gas industry of price fixing (implied cartel but it isn’t). The latest has been to rail publicly on US Oil + Gas companies as being ‘bad guys’ because they dare to make a profit.

Okay, so I thought it helpful to zoom out before predicting what is a very tricky road ahead for oil traders, starting with some arguments to details Washington may not be sharing and why.

Blame-Game Ignores The Facts

The Biden Administration’s blame-game ignores supply-demand fundamentals from covid and resulting supply chain disruptions, not to mentions selectively lacks mention of the inflationary affects on price of oil from the many inputs to the oil process (like Methane that has skyrocketed 10 fold) to the labor and equipment shortages felt acutely in the industry. It also ignores the policies they enacted first of year to restrict pipeline leases thus limiting supply. Oh, and it totally forgets my thesis of “Oil as an Inflation Hedge“!

But the attack on oil and gas companies making a profit? That was the latest progressive democratic attack and one that is widely misunderstood. As if it wasn’t enough for investors, already staying on the sidelines of an industry under attack from ESG initiatives, now to have their administration position the oil industry as more a ‘public utility’ than profit center. Officials may selectively fail to remember the $66B in oil industry destruction between 2014-2016 let alone the negative effects of negative oil prices last year. And after pushing through their climate agenda and policies that further deter industry investment, companies still turning a profit in this challenging environment are on my list of worthy investments! It all goes to show, the oil markets are politicized and going to get even more so moving into the mid-term elections.

Supply-Demand Matters

Global consumption of all refined products (gasoline, diesel, heating oil but not jet fuel), is effectively back to pre-pandemic levels. So demand – other than air travel – is back and inventories are too. This supply discipline has been displayed here and abroad. OPEC+ has kept a tight grip on supply since it agreed to its production cut deal in May 2020. It has not only sought to balance supply with demand as the world emerges from the pandemic but it also has sought to restore petroleum inventories to normal levels post covid lockdowns. So supply – from OPEC – has stayed disciplined.

US upstream players have also remained disciplined. Shale companies are printing higher growth, and yes, profits. Higher prices have helped of course. And given the very heavy losses shale companies experienced during the 2014-2104 oil industry recession, they have had added incentive to maintain supply discipline as well. In fact, US production remains below pre-pandemic levels of 13M/bbl/day at 11M/bbl/day (from 10M/bbl/day during covid lockdown). Production should keep rising into 12M/bbl/day in 2002, but this is still below pre-covid levels.

Recently OPEC+ has begun the process of easing supply cuts by adding 400,000 barrels a day each month. Even though global inventories are now close to “normal” pre-pandemic levels, OPEC+ has remained hesitant to add more supply despite US, Japan and India urging them to do so. Why doesn’t OPEC+ add more supply despite prices over $85 a barrel upon which their profit margins are based? Because they remain concerned about demand in the coming months and 2022. Sure enough, fresh global covid outbreaks have brought about new lockdowns or mobility restrictions. They have a point.

Also, higher oil prices have also been caused by a global spike in natural gas prices, as the switch from gas to oil products boosts oil demand. But increasing inventories that then have to be reduced in the Spring is yet another balancing act for OPEC+. Summer months typically drive demand of gasoline and jet fuel, but in the case of China’s lockdowns last year, it didn’t.

Don Quixote Fixes

The current administration seemingly wants to blame anyone – OPEC, Russia, US Upstream producers – for higher prices at the pump. Instead of importing more oil or removing regulations on refiners – or gasp, removing gas taxes – they are quick to reach outside borders for help. Most have heard they are working to coordinate a SPR (strategic petroleum reserve) release among the biggest four consuming oil countries in the world: US, China, India, Japan. Sadly, for them, it lacked the shock and awe they were hoping for. Instead, OPEC could respond (retailiate) with a coordinated production restraint, something that can have a long-lasting effect on oil prices – to the upside. So Biden needs to be careful.

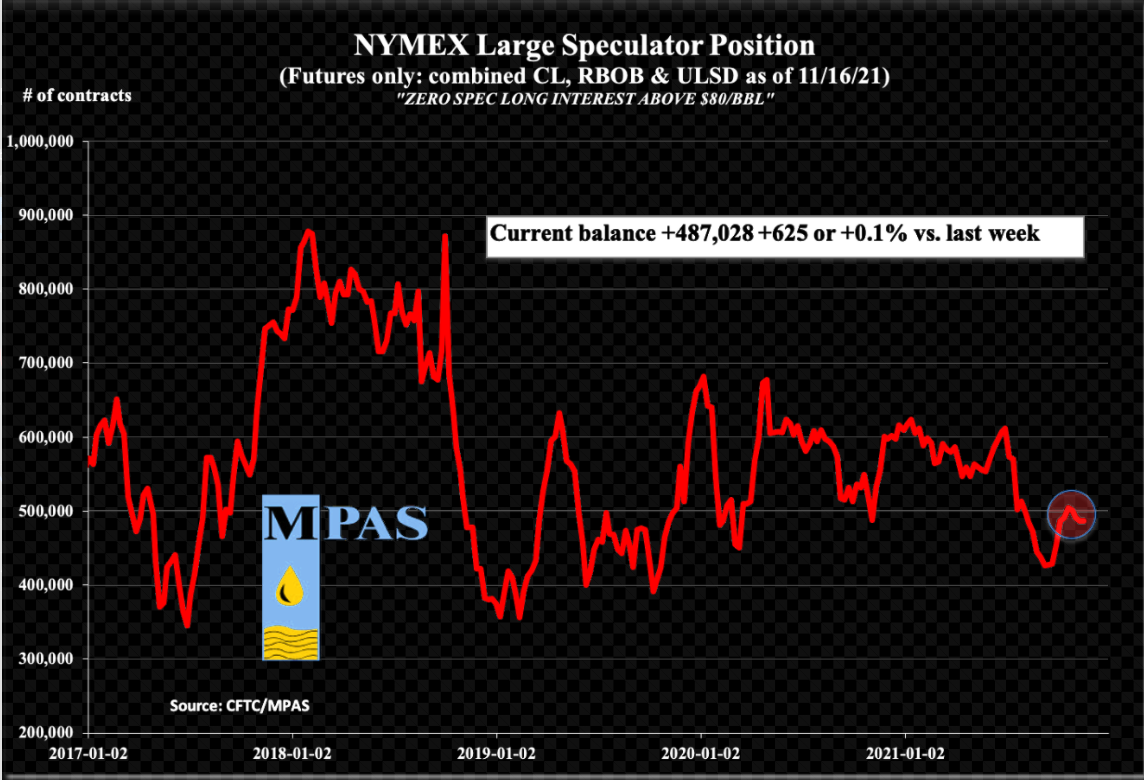

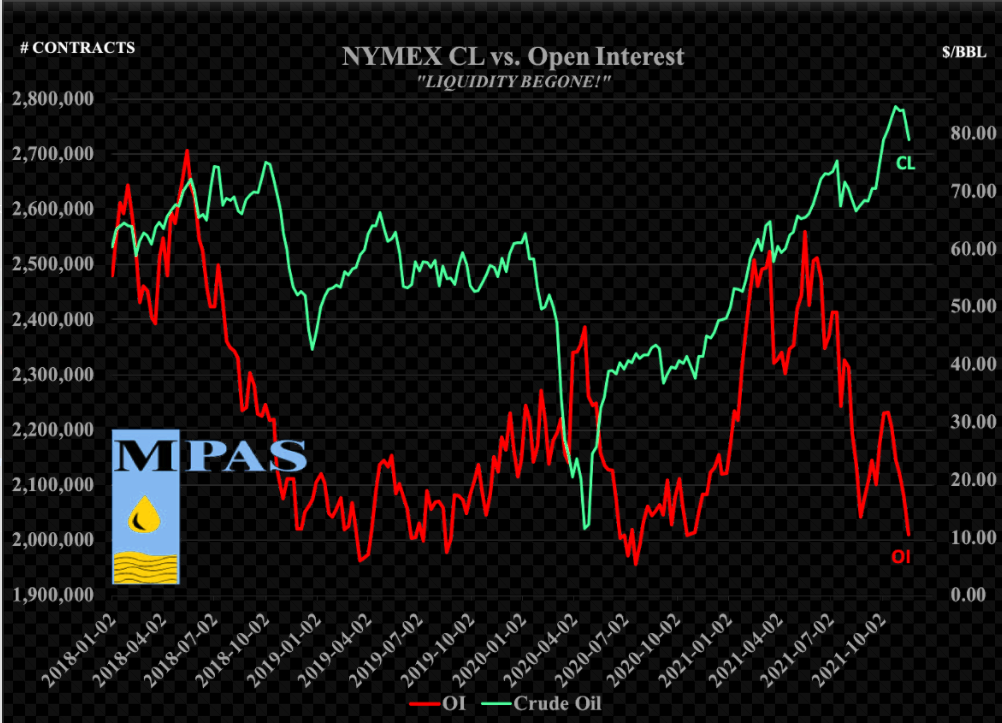

Saudi Arabia has already said that it sees no demand in the physical market for additional barrels. My oil trader, Bob MacMinn, has warned of this for past few months adding that the R.O.O.F (running out of fuel) narrative is false. There is no shortage of oil or surplus of oil, in his opinion; there is underinvestment in the oil patch and an air pocket of risk to the downside with political intervention and commercial hedgers on the sidelines waiting the political intervention out. Bob further contends that this underinvestment in oil and gas infrastructure, because of political attacks and ESG policies, will create a strong undercurrent of support for Republicans to position for US oil independence and energy as mission-critical investment thesis into the mid-term elections next year.

If the administration wants oil and gas prices to come down, they need to import more oil and/or remove restrictions that disincentivizes US producers from producing more. Biden Administration’s climate policies send a strong message to producers and investors that they care more about transitioning to ESG then remaining a top world oil and gas producer. This was evident first part of the year with Biden’s policies including the termination of Keystone XL, the attempt to halt federal oil and gas lease sales, and aggressive efforts to regulate methane emissions.

The Unspoken End Game

So Biden is between rock and hard place. Gasoline pump prices are now up over $1 a gallon during his administration to a seven-year high but he remains steadfast on his climate change for the progressive democrat’s agenda. That’s why he is pushing OPEC for more supply NOW because OPEC is sitting on over 6 million barrels a day of spare production capacity that can be brought on quickly. In stark contrast, the US oil sector is highly fragmented with hundreds of companies not all of which are aligned. It’s clearly a process for the US oil industry to mobilize and increase production, and in light of the current ESG push by Washington, why would they?

Republicans will make a stand to increase independence from OPEC+ and imports which increases US gas emissions. Democrats want to increase dependence on OPEC+ and imports which increases offshore gas emissions. Neither approach fixes greenhouse gas emissions globally. In fact, moving these emission offshore where there is less regulation makes it worse. “Not in my backyard” seems to be the political mantra of the day, so political intervention to tap down oil and gas prices may help short-term, in an election year, but a better approach would be to incentivize the increase of US oil production AND increase emission regulations at same time. Why aren’t they beating that drum instead of the one that rallies their opponents and causes price of oil and gas to increase after the initial smack-down?

Technically Speaking

It was a great fade in crude oil from $85 to $77 while it lasted, and the bounce first part of this week in energy timed with precision to the tech sell-off. This is textbook and follows my mantra perfectly – “in lieu of sector rotation, we will have volatility”. In a nutshell, we had rotation from ‘interest-rate sensitive, high-valuation, mid-cap growth-tech in Nasdaq to ‘cyclical’ plays of energy, financials and materials. Today we have the opposite. That’s sector rotation in full view.

There is an open gap on crude at at $80.76. Normally I would say: “above is bullish and below is not.” In this special case, I believe first sign of print above this open gap and Biden will unleash the dogs. Put simply: Oil may “not be allowed to go up”. For now, the risk to oil is to the downside. Seeing how the administrations’ SPR release didn’t move the price needle very much, it wouldn’t surprise me to see Washington announce a ban on exporting oil. I’ve written about this likelihood before.

Another disincentive for producers and traders alike is in the oil futures markets themselves. It’s in “backwardation” — where prices months and years down the line are lower than current prices. That shows that investors are expecting ‘lower for longer’ in oil prices, making it riskier to drill and frack if $85 oil isn’t sustainable.

But big picture, unless there is more oil production state-side – and the current administration doesn’t look like they are about to green-light that anytime soon – I’m still betting we can have a bigger upside move once tech starts selling off with vigor 1st of the year. Until then, there is little interest (see Bob’s chart) and oil is tracking pretty well as a fractal with RSX (h/t @themarketear). I think Bob summed it up best:

Commercial hedgers have been on the sidelines. With open interest falling, it won’t take too much commercial selling to pressure a market already on the defensive.

CL OI off -549k or -21.4% since 5/18, when you have poor liquidity, silly stuff happens, BOTH directions.