Courage doesn’t always roar. Sometimes courage is the quiet voice at the end of the day whispering, ‘I will try again tomorrow.’ Mary Anne Radmacher

This was my sentiment on the last day of the month of August after a week of chop – both in the indices as well as in my account. Only one week prior (Friday the 23rd) I had posted that I was ahead of the crowd and had returns to prove it. But I went against my gut when I pressed shorts Friday expecting CTA deleveraging and TGA liquidity draw Monday. I wasn’t the only one in thinking the Aug 5th Globex low would be retested last week, but I was wrong nonetheless.

Market often tests climactic lows 3-4 days afterwards. But was the Sun/Mon low the print low, 2835, or the overnight Globex low, 2810? And was the August 4-5 correction low-to-date the print low, 2822, or the overnight Globex low, 2775? Would only be an issue if 2835 taken out… @WalterDeemer

Well, the ‘Crowd’ had other ideas from mine and the last week of August caught me off-sides and slow to react. I ended the month giving back my hard-earned gains and I realize now the game was to blindly: 👉 Buy End of Month, and likely Beginning of Month too, then Sell mid-Sept and here’s why:

- Q3 Quad Witching Options Expiration

- Buyback Blackout Begins

- FOMC Disappointment Likely

- Gamma Unwind from Quants

- CTA Deleveraging with Volatility

- TGA Liquidity Withdrawal

And so I must try again to better time the market twists and turns, and why I chose the title, Shaken But Not Stirred. If you say that someone has been shaken but not stirred by an experience, it means that they have been slightly disturbed or emotionally affected by it, but not deeply enough to change their behavior or way of thinking. So that’s why I spent a fair amount of time this weekend detailing my Macro views for clients as we move into the last quarter of what I believe to be an eventful Fall.

Gone Fishing Newsletter: New-Not-Normal

In it I Cover: Structural Capital Flows, Global Money Supply, Yield Differentials, Yield Curve Inversions, Trade War Impact, Earnings, Buybacks, Fed Rate Cuts, Unicorns, USD, Yen, Yuan, Global Carry Trade, China and Peak ‘Disposable Money’.

Other Recent Gone Fishing Newsletters for Clients

- Yen Nearing Escape Velocity

- Volatility Reprices Everything

- Market Thoughts: Out Of The Pool

- How The Market Is Like Donkey Kong

- Intermarket Chart Attack: Trading Trend Reversals

- Intermarket Chart Attack: Some Things are Really Broken

- Gold At An Inflection Point

- Intermarket Chart Attack: Something Is Broken

Brokerage-Triggered Trade Alerts!

The Week Ahead: September 2 – 6

Earnings Calendar

Some implied moves↕️ for #earnings next week:

- $COUP 11.1%

- $MDB 13.3%

- $PANW 8.0%

- $WORK 16.9%

- $SMAR 12.1%

- $HOME 29.7%

- $LULU 9.7%

- $PD 18.3%

- $ZM 11.8%

- $CRWD 14.4%

- $DOCU 10.9%

- $SIG 19.4%

- $DOMO 19.5%

- $AVAV 13.4%

- $CIEN 10.3%

- $AEO 9.8%

- $CLDR 14.4%

#earnings for the week $LULU $AEO $CIEN $MDB $COUP $PANW $ZM $CLDR $NAV $CRWD $CONN $MIK $BRC $NSSC $HQY $TUFN $VRA $DOCU $WORK $HOME $SIG $KIRK $GSM $EGAN $SMAR $BITA $ZLAB $DOMO $PVTL $DCI $ZUMZ $LE $GIII $AVAV $SAIC $SCWX $CSTL $PD $GCO $JW.A https://t.co/lObOE0dgsr pic.twitter.com/noXs1PJb8C

— Earnings Whispers (@eWhispers) August 31, 2019

Economic Calendar

The ‘big news’ of course is that on Sunday, the next phase of tariffs hit: 15% added to $131Bn of Chinese imports and about 7% retaliatory tariffs on $45Bn of US exports.

Upon return from not only a 4-day Labor Day weekend, Wall Street returns from ‘summer session’ so trading volumes should pick up. We come back to ISM Manufacturing Tuesday (last month 51.2, anything below 50 = bad), Fed speeches may reveal ‘positioning’ for upcoming September 17th FOMC meeting, but most will be closely watching the employment data Friday (expectation +155K). A little less known data point is that there is a US-Mexico trade meeting also scheduled for Friday.

The Month Ahead: September

This is not a hard sentence to write or believe: Political uncertainty dominates the markets and risks a further slowing of economic growth worldwide.

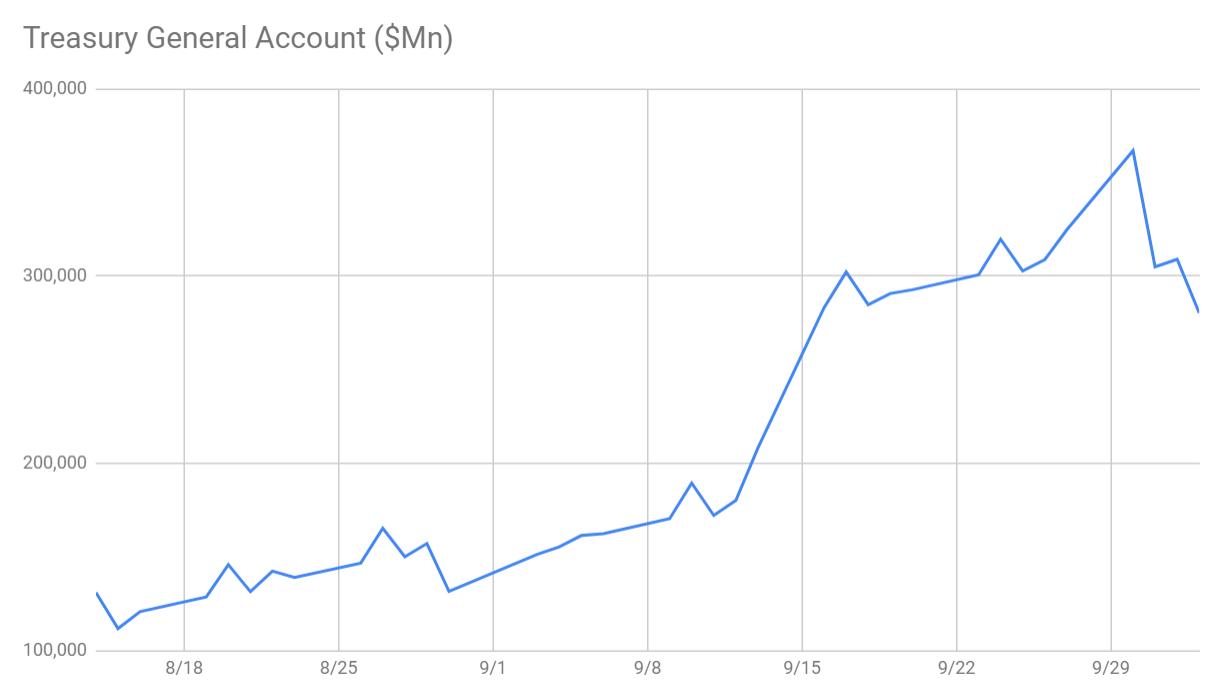

TGA Calendar

US treasury is sucking in $35Bn dollar liquidity each week (to be increased to $150bn on sept opex week) so that means the US treasury is going to do 6-month worth of QT in 1 month. H/t @Barton_options

Translation: liquidity is flowing out of the markets in September versus into it.

FOMC September 17th

What the market wants is clear language that the Fed plans to move away from the ‘midcycle adjustment’ commentary and transition toward an easing cycle, so anything less will disappoint. Again.

What’s Next for US Equities?

- * Underfunded Pensions

- * Stock Buybacks

- * Private Equity Investment

- * Yield Differentials (US Bonds>EM Bonds; US Equities>Global Bonds)

- * TINA with CBs promising QE

People are selling on recession fears but the lower the stock market goes, the more dovish the Fed can get to support it. If it fails to go down then the short squeeze takes US markets to new highs. However, the inverse situation is also true. The higher the markets go the more out of place rate cuts look and the Fed is likely to pare back the aggressive dovish stance. When new highs fail, longs square and push the markets lower. @EdMatts

This looks like a plausible template for how it’s going to unfold. Once USD funding tightens sufficiently this autumn (rising issuance), skeletons will be uncovered in many more closets. And many of these are on the IG-HY cusp. We’ll have a wave of “fallen-angels” downgrades. @GauravSaroliya