by Samantha LaDuc | Dec 2, 2016

Much attention of late has been focused, with good reason, on rising yields, falling bond prices and the collapse in the Japanese Yen and Gold. So many assets are correlated that as a strategic technical analyst I look for macro themes to show themselves in...

by Samantha LaDuc | Dec 1, 2016

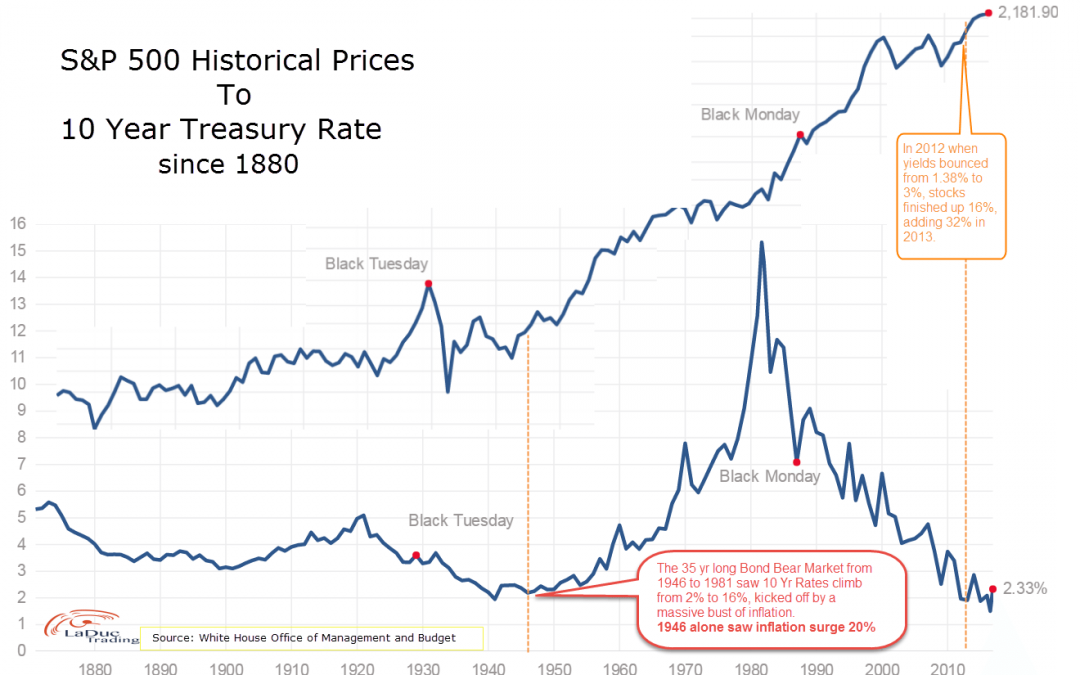

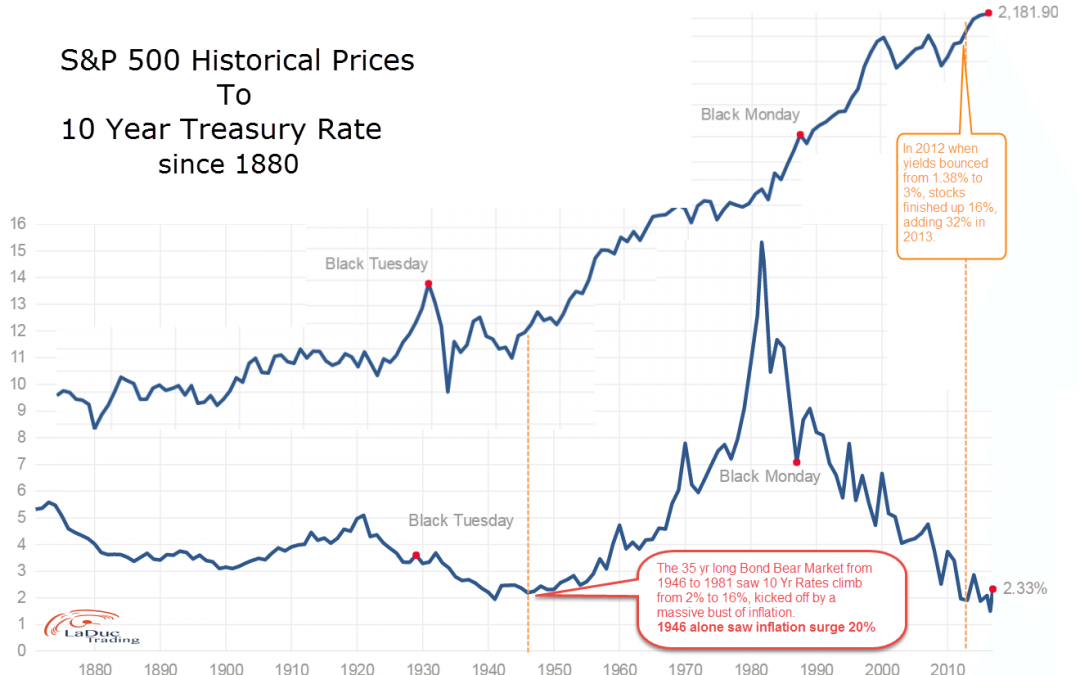

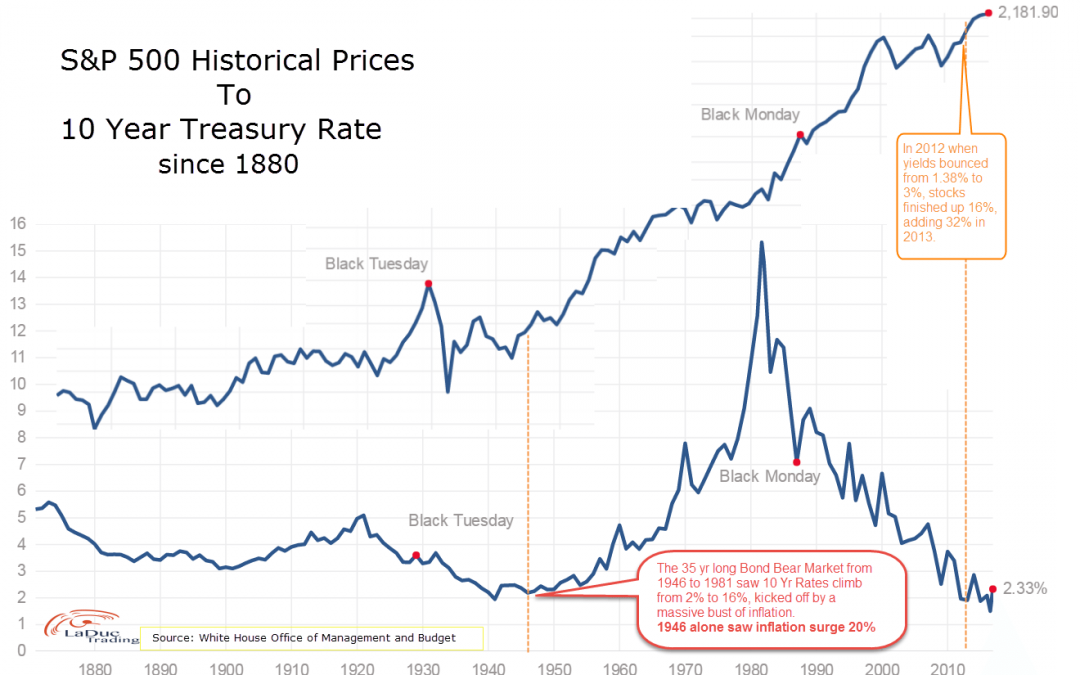

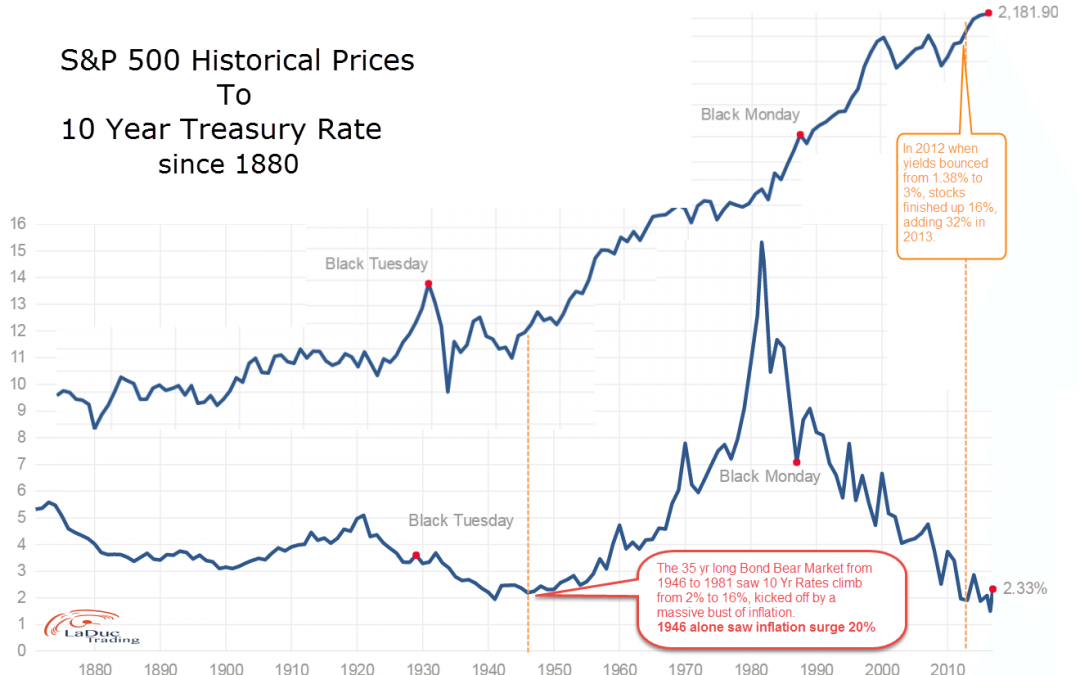

Higher Rates Can Be Bullish Interest rates follow very long term cycles. Above highlights a 35 year (1946-1981) bond market, but unlike our most recent 35 year (1981-2016) bond market, they were in a rising rate environment (for more than a blip on a chart). From a...

by Samantha LaDuc | Nov 28, 2016

S&P Bulls and Bond Bears Pin Hopes to 1946 Interest rates follow very long term cycles. Above highlights a 35 year (1946-1981) bond market–but unlike our most recent 35 year (1981-2016) bond market, they were in a rising rate environment (for more than a...

by Samantha LaDuc | Nov 22, 2016

There are lots of ideas out there on what to trade. The trick is synthesizing news-you-can use from the noise. Choosing ideas from veterans doesn’t make it a sure thing. But listening to ol’ timers…well, there is so much to be learned from...

by Samantha LaDuc | Nov 22, 2016

Every month I write a swing trading newsletter for those who can’t join me in my LIVE Fishing Daily Trading Room but want my macro take on the month ahead, or just my trade ideas they can set and forget. The daily room is for active traders where we mostly chase...

![Pre-Election Results: Oversold Support But Not Really]()

by Samantha LaDuc | Nov 5, 2016

The entire world awaits the results of the U.S. Presidential Election. Unprecedented angst and uncertainty. And risk. As of Nov 5th, SPX was pricing in a 68% chance for a 33 point move by Nov 9th, the day after the election. That’s a ~$66 expected move in either...