by Samantha LaDuc | Feb 19, 2020

Market Thoughts Investors are selling off the Yen on horrific economic data and the result is a SPY QQQ melt-up, risk-on market. It most likely stops when the Yen selling stops! This is a 3-standard deviation move so it’s a Big Deal that looks risk off but it’s actually JUST the opposite! Soon ? Higher […]

by Samantha LaDuc | Jan 21, 2020

While waiting for a rug pull (next 30 days I suspect), here are the strongest looking charts – both Intermarket and Sector. McClellan Summation is still pointing upwards with MACD now cooperating. This is bullish SPY until it reverses. Nasdaq McClellan Summation Index is also pointing upwards, although RSI is strongly overbought. This is still […]

by Samantha LaDuc | Jun 26, 2017

More Summer Treats: Premium Member Video update for nonmembers–again! In follow up to Friday’s LIVE Trading Room action (and Free Video), I sold the gap up this morning and turned around to short it. I’m staying short Tech despite end-of-quarter...

by Samantha LaDuc | Dec 2, 2016

Much attention of late has been focused, with good reason, on rising yields, falling bond prices and the collapse in the Japanese Yen and Gold. So many assets are correlated that as a strategic technical analyst I look for macro themes to show themselves in...

by Samantha LaDuc | Dec 1, 2016

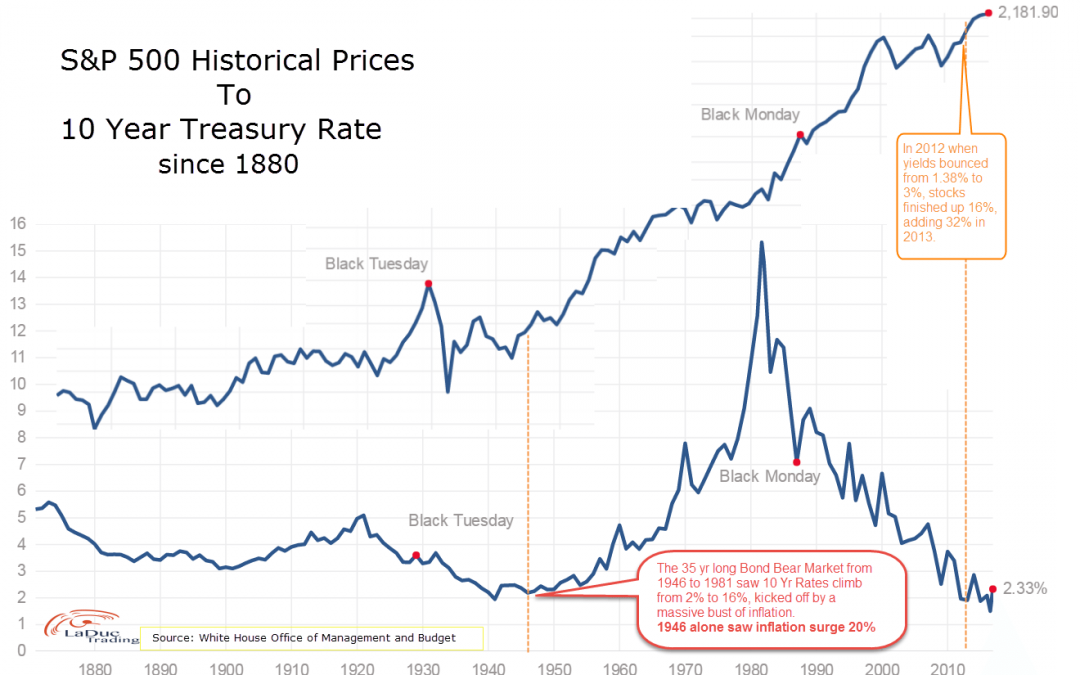

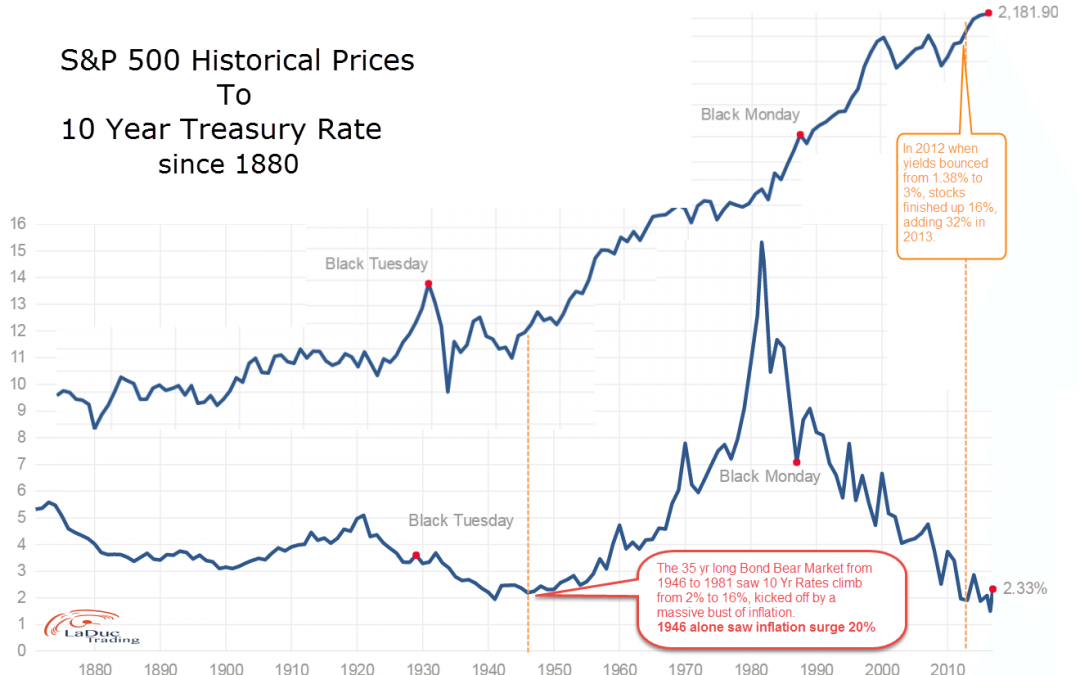

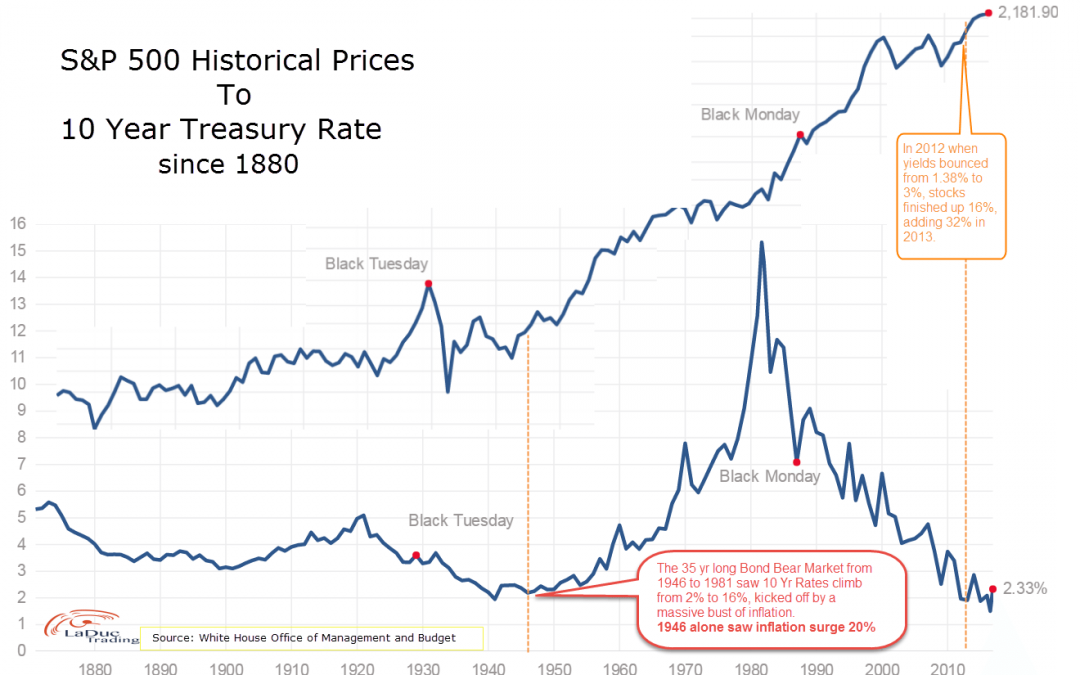

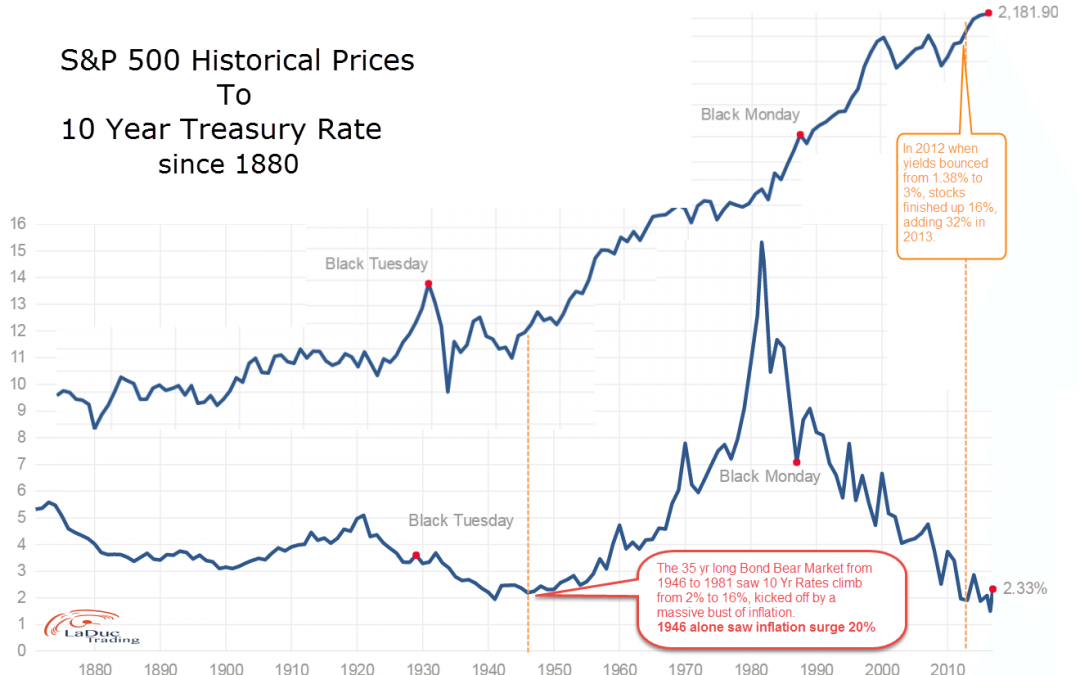

Higher Rates Can Be Bullish Interest rates follow very long term cycles. Above highlights a 35 year (1946-1981) bond market, but unlike our most recent 35 year (1981-2016) bond market, they were in a rising rate environment (for more than a blip on a chart). From a...

by Samantha LaDuc | Nov 28, 2016

S&P Bulls and Bond Bears Pin Hopes to 1946 Interest rates follow very long term cycles. Above highlights a 35 year (1946-1981) bond market–but unlike our most recent 35 year (1981-2016) bond market, they were in a rising rate environment (for more than a...

by Samantha LaDuc | Nov 22, 2016

There are lots of ideas out there on what to trade. The trick is synthesizing news-you-can use from the noise. Choosing ideas from veterans doesn’t make it a sure thing. But listening to ol’ timers…well, there is so much to be learned from...

by Samantha LaDuc | Nov 22, 2016

Every month I write a swing trading newsletter for those who can’t join me in my LIVE Fishing Daily Trading Room but want my macro take on the month ahead, or just my trade ideas they can set and forget. The daily room is for active traders where we mostly chase...

![Pre-Election Results: Oversold Support But Not Really]()

by Samantha LaDuc | Nov 5, 2016

The entire world awaits the results of the U.S. Presidential Election. Unprecedented angst and uncertainty. And risk. As of Nov 5th, SPX was pricing in a 68% chance for a 33 point move by Nov 9th, the day after the election. That’s a ~$66 expected move in either...