Intermarket Chart Attack: Recession Watch Time

Recent Newsletters for Then vs Now Reference: March 2nd: Intermarket Chart Attack: A Bottom But Not The Bottom February 26th: Intermarket Chart Attack: Is It Safe? February 17: Intermarket Chart Attack: Key Charts I’m Watching Right Now A Gun Without Ammo So, the ‘surprise’ anticipated 50bp emergency cut by the Fed last Wednesday wasn’t enough! Market now […]

Gone Fishing Newsletter: Waiting On A Bounce

Market Thoughts – Short Term We just got through the worst week in the markets since 2008. Literally, Nasdaq futures briefly exceeded the worst 1-week loss since October 2008. And this past week… had the fastest correction in S&P history – with the speed of the decline even beating Black Monday episode in Oct 1987. […]

Intermarket Chart Attack: A Bottom But Not The Bottom

Big Picture Tells Many “bottoms” lead to immediate and violent oversold rallies only to retest the lows as part of a bottoming pattern – sometimes with higher prices, sometimes slightly lower, and in some case with no retest at all. But in most cases, UNLESS THIS IS 2008, the probability for a bounce is high. […]

Gone Fishing Newsletter: Waiting On A Bounce

Market Thoughts – Short Term We just got through the worst week in the markets since 2008. Literally, Nasdaq futures briefly exceeded the worst 1-week loss since October 2008. And this past week… had the fastest correction in S&P history – with the speed of the decline even beating Black Monday episode in Oct 1987. […]

Intermarket Chart Attack: Is It Safe?

Here are my updated charts – from my live trading room, from my Daily Fishing Plans and from my last Intermarket Chart Attack. Then Vs. Now VIX THEN: VIX NOW: I said $28 in my trading room Tuesday but I fully expect higher in coming day/days. Volatility… NYSE Warned: There are still some shorts left […]

Intermarket Chart Attack: Key Charts I’m Watching Right Now

Key Charts from the Week: Growth to Value Rates US Dollar Gold/Miners Germany China Oil XLE SPX Momentum Sector Spotlight: Retail NASDAQ Momentum Divergence Global Money Supply in USD Growth to Value Rotation – Someday. All things being equal… well, they...

Gone Fishing Newsletter: Higher US Dollar Emboldens US Dollar Bulls

USD Has Strongest Start in Five Years The US Dollar is having its fastest start to a new year in half a decade. Here are my Top 5 Reasons why: Safe Haven status as COVID-19 spreads both fear and economic slowdown Stable U.S. economic data in comparison to China,...

Gone Fishing Newsletter: Cowbell > COVID-19

Repo and Federal Deficit Recently I tweeted: Totally unrelated but curious how Repo infusions => Treasury Department’s budget deficit which is $389B in the first four months of fiscal 2020. That’s a 25% gain over the same period last year and already about 40%...

Market Thoughts: Size Matters

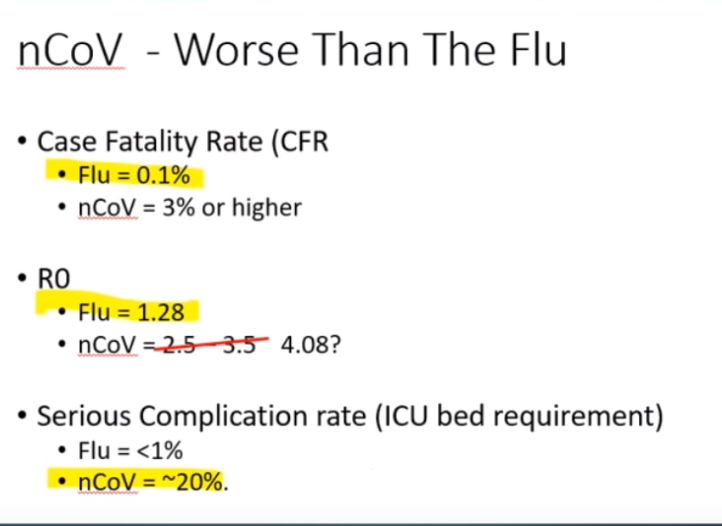

Getting Sicker The world is freaking out over CoronaVirus – inside Wuhan, China especailly. but also in every corner of the world where access to social media is easy to find both latest information and misinformation. On my twitter feed, I was sent videos that have gone viral: Chinese citizens smashing through barricades to escape […]

Intermarket Chart Attack: We Got Our A Rug Pull

This is in follow up to my Jan 21st Client posts: Intermarket Chart Attack: While Waiting For A Rug Pull Gone Fishing Newsletter: US Dollar Edition Let’s go back before we go forward. Macro Matters Timing this recent (January) Commodity pullback was triggered by my TIP:TLT intermarket analysis work which I shared with clients as […]

Gone Fishing Newsletter: The Inflation Edition

Spoiler Alert: We have no inflation in commodities. Healthcare, Education, Concert Tickets … absolutely. But what about the stuff we consume and use every day? CRB Commodities is made up of the following weighting: Softs (Coffee, Sugar, Orange Juice) 23.5%...

All Alone With My Higher Yield Thesis

My 2020 Treasury Yield Expectation See yellow arrows (green arrows are when Powell came on board and Fed began hiking): By the way, the above is most definitely NOT consensus! Neither is this chart crime: I see Value reversing higher and Growth/Momentum plays reversing lower into 2020. This happens when rates turn higher and vice […]

Gone Fishing Newsletter: US Dollar Edition

My Bet: US Dollar heads higher and here are some general Macro reasons why to support my chart read: Whether as risk off trade or bet on best global market (dubbed the “Smile Trade”), the USD typically outperforms. USDCNH reversal (as discussed in trading room past week and here, USDCNH should continue higher and with […]

Intermarket Chart Attack: While Waiting For A Rug Pull

While waiting for a rug pull (next 30 days I suspect), here are the strongest looking charts – both Intermarket and Sector. McClellan Summation is still pointing upwards with MACD now cooperating. This is bullish SPY until it reverses. Nasdaq McClellan Summation Index is also pointing upwards, although RSI is strongly overbought. This is still […]