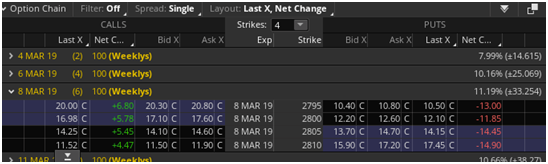

The Reflation Trade may be in the early innings, again, as last week Bonds dropped as Yields (US and German) spiked along with China’s Shanghai index. The USD continued to hold steady while Gold retreated as rates rose. Stocks traded in a tight range with SPX tagging $2800. This week’s price target is $2826 which is well within the expected range. The weekly expected move is $33 – slightly higher than the past week but that makes sense as it is NFP Day Friday!

Economists expect the economy to have added 185K jobs during the month and for the unemployment rate to return to 3.9%. Keep an eye on average hourly earnings, seen rising +3.3% Y/Y and +0.3% M/M. Across the pond, an European Central Bank rate announcement on March 7 is followed by President Mario Draghi’s press conference and another Brexit vote could disrupt U.K. stocks.

President Trump Says the Dollar is Too Strong – Bloomberg

Oil ignored him. Maybe the USD does too, especially with the ECB outlook coming up – expect a little more USD strength.

Some Stocks of Interest

Trend Long Ideas: GEOS, OSTK, SNCR, AVP, CRSP, CLVS, IBM, T, LB, SPOT, ROKU, NVDA, MSFT

Tesla pays off $920M convertible bond in cash – sources

Last Fall I said $TSLA wasn’t shortable until after this news. Now we get to see what $TSLA is really made of.

Airline traffic reports: Monthly traffic releases are due in next week across the airline sector. Along with the February numbers, Q1 guidance updates could be revealed by some companies. The sector sold off on Friday following rating cuts/price target reductions from Deutsche Bank.

Earnings Calendar

#earnings for the week $CRM $NIO $TGT $WB $PLUG $KSS $MGIC $YY $CIEN $IPAR $KR $BZUN $OKTA $BCRX $COST $SINA $SESN $DLTR $LUNA $CTRP $ANF $MEET $ACRX $GDP $SPKE $ADMS $URBN $GNC $GMS $BURL $LJPC $BJ $ADUS $THO $VNET $MRVL $GSKY $GAIA $ROST $AEO $TPBhttps://t.co/lObOE0dgsr pic.twitter.com/TUhymBD3O1

— Earnings Whispers (@eWhispers) March 2, 2019

Implied moves for #earnings next week:

$CRM 6.6%

$WB 9.7%

$SINA 8.8%

$MEET 11.8%

$YY 8.6%

$NIO 26.4%

$TGT 6.4%

$KSS 7.5%

$ROST 6.7%

$BZUN 14.9%

$YEXT 13.0%

$SSYS 9.8%

$OKTA 12.4%

$COST 3.6%

$CIEN 7.8%

$ROST 6.7%

$KR 7.0%

$THO 9.3%

Economic Calendar

Highlights this week leading into next week’s FOMC meeting March 19-20: the ECB meeting and the US employment report.

This week’s ECB meeting is key. Two outcomes are likely, and although no change in rates can be expected, both will support the characterization of a dovish hold. First, the ECB will likely commit itself to a new long-term lending facility. A targeted long-term refinancing operation (TLTRO) would allow banks to refinance before the old operation complicates their management of short-term liquidity ratios. This is no economic or financial panacea. It simply avoids a potential strain. The ECB may not provide much detail about the new facility, but the announcement effect could produce favorable price action.

The sobering forecasts will require a policy response. It could come in the form of an adjustment to its forward guidance. Currently, the position is that rates will not be raised before the end of summer. The economic weakness and sub-par price pressures suggest a hike is unlikely this year. The issue is how far out does the ECB want to pre-commit, especially given the change at the helm with Draghi’s term ending in October.

- Rate decisions in EUR, CAD and AUD

- Non-farm payrolls in US and Canada

- Australian and Eurozone Q4 GDP

- China’s main political conference

Monday – China economic releases/rhetoric/trade talks

Tuesday – The 13th National People’s Congress in China is expected to produce economic growth targets going forward, and review intellectual property and technology transfers, key areas in the trade dispute. The key scheduled event is the RBA rate decision. Fed Rosengren (hawk, 2019 voter) speaks at 1230, followed two hours later by Kashkari (dove, 2020 voter). Barkin (hawk, non-voter) is also on. Brazil and Argentina remain closed.

Wednesday – The Canadian rate decision is expected to be a hold, but watch out for Gov Poloz remarks. It’s Australia’s turn to report Q4 GDP, which we have seen has moved markets in other countries. The ADP ‘sneak preview’ jobs estimate is 190k, 10k more than the NFP estimate for Friday. Fed Williams (hawkish, 2019 voter) and Mester (hawk, 2019 voter) both speak at 1700. There are also rate decisions on TRY and PLN. Brazil and Argentina reopen.

Thursday – Another day, another rate decision, this time the key Eurozone figure. A hold is virtually certain, but as always it’s the report and press conference 45 minutes later which will be examined. The third day of Fed speeches as well, this time Brainard (was dovish, now centrist, 2019 and 2020 voter) is on at 1715. BoE Tenreyro speaks at 0930.

Friday – Simultaneous US and Canadian NFPs offer strong volatility for USDCAD today. As usual, the AHE figure may be more important than the jobs print itself. This is the final day before the US/Europe summer time disconnect. For the next three weeks, for Europeans, US markets will appear to open an hour earlier (1330 GMT), and for Americans, Europe will appear to run an hour later, closing at 1230 EDT. ECB Mersch (hawkish) speaks at 1630. Fed Chair Powell may also speak. Japanese Q4 GDP and January trade

Macro Matters

Expect further monetary stimulus in the near future from China:

The People’s Bank of China’s quarterly report last week crystallized a more relaxed stance, with the word “neutral” disappearing from its policy description for the first time in a decade. We predict another 100bps to 200bps in reserve requirement ratio (RRR) cuts, with each 100bps releasing around CNY 15tn of liquidity into the financial system. Additional tax cuts and fiscal policies have yet to roll out, and may be announced in early March.

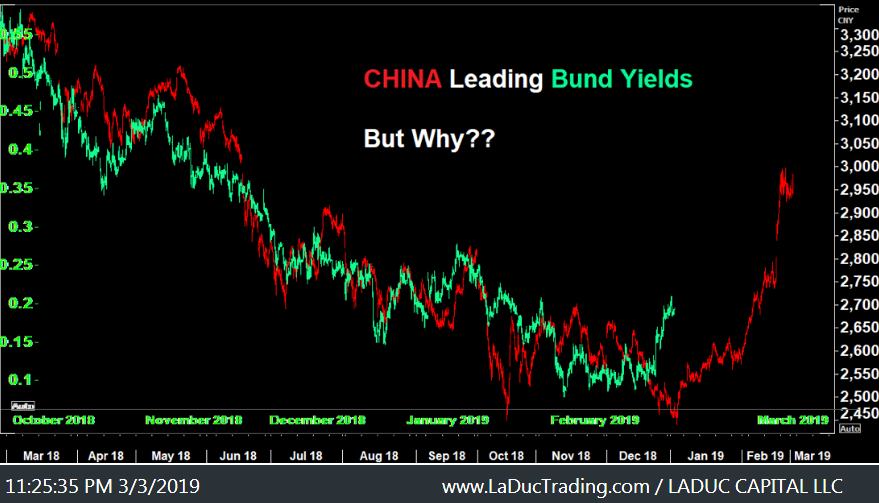

With that, the Yuan is likely pushed down which buoys the USD. At the same time, expectations of global inflationary growth associated with the outcome of Trade War negotiations, are helping rates rise. Even German Bunds seem to follow China higher (h/t Ed Matts, Matrix):

Great Read

Everything you really needed to know about MMT

Thanks for reading and please consider joining me in the LaDucTrading LIVE Trading Room where I take macro and market-moving news, give it context, and recommend trade ideas from it. For additional education, I provide my LIVE Trade Alerts from Interactive Broker to clients interested in my Value and Momentum stock and option plays.

At LaDucTrading, Samantha LaDuc leads the analysis, education and trading services. She analyzes price patterns and inter-market relationships across stocks, commodities, currencies and interest rates; develops macro investment themes to identify tactical trading opportunities; and employs strategic technical analysis to deliver high conviction stock, sector and market calls. Through LIVE portfolio-tracking, across multiple time-frames, we offer real-time Trade Alerts via SMS/email that frame the Thesis, Triggers, Time Frames, Trade Set-ups and Option Tactics. Samantha excels in chart pattern recognition, volatility insight with some big-picture macro perspective thrown in.

More Macro: @SamanthaLaDuc Macro-to-Micro: @LaDucTrading