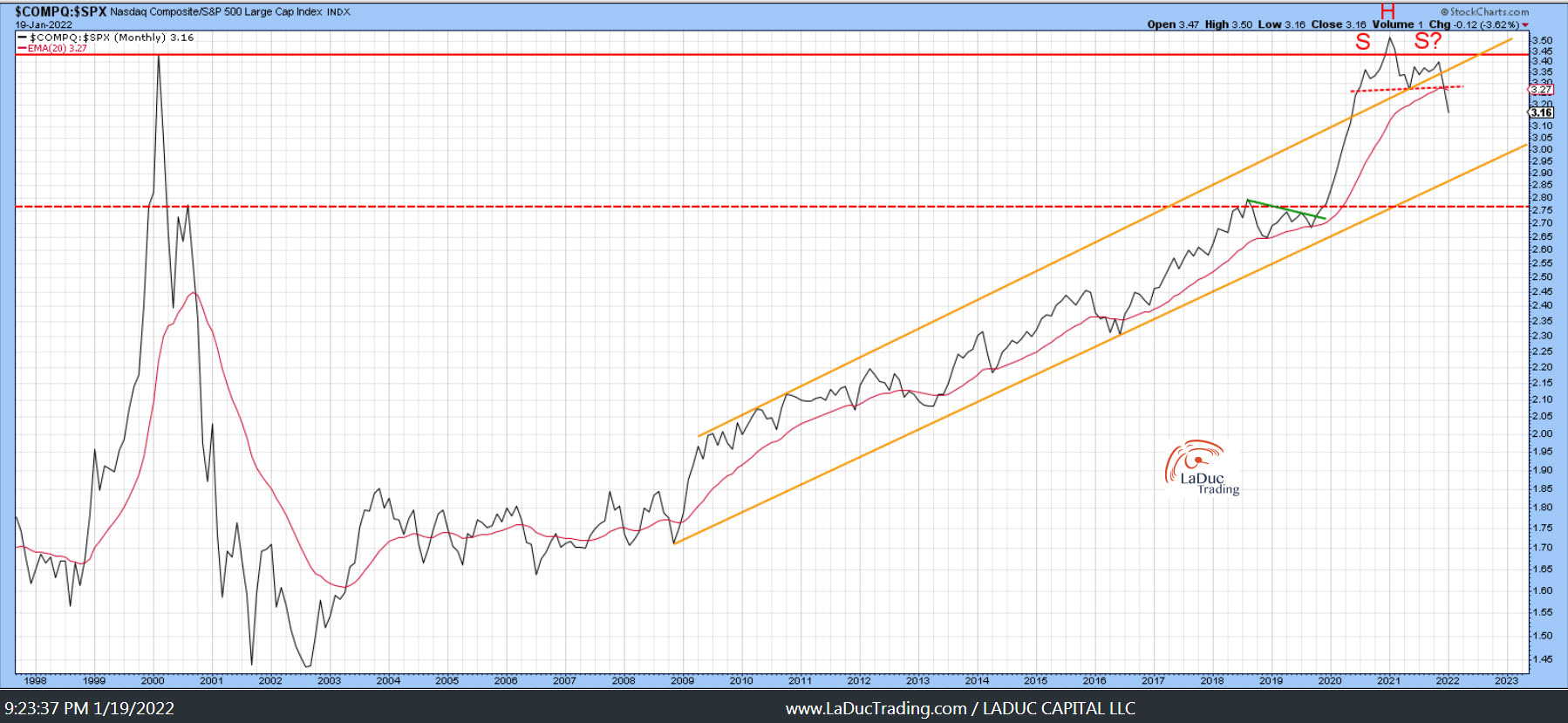

2022 TOP PREDICTION: Growth To Value Rotation Continues

From Samantha’s StockChartsTV Interview January 6th: One of my favorite rotations to time is from Value to Growth and vice versa. As a Macro-to-Micro analyst, educator and trader, I work to find durable trends to trade with and around for my clients. One such...TESTING YOUTUBE AUTO POST JF. – All Things ARKK – Top Ten Holdings

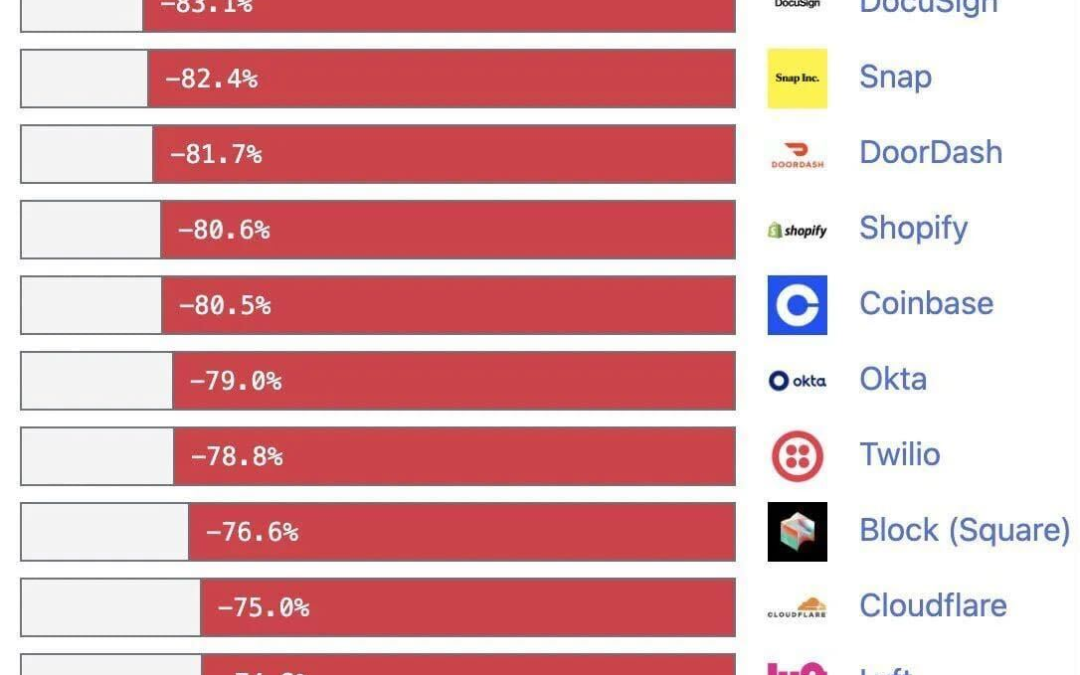

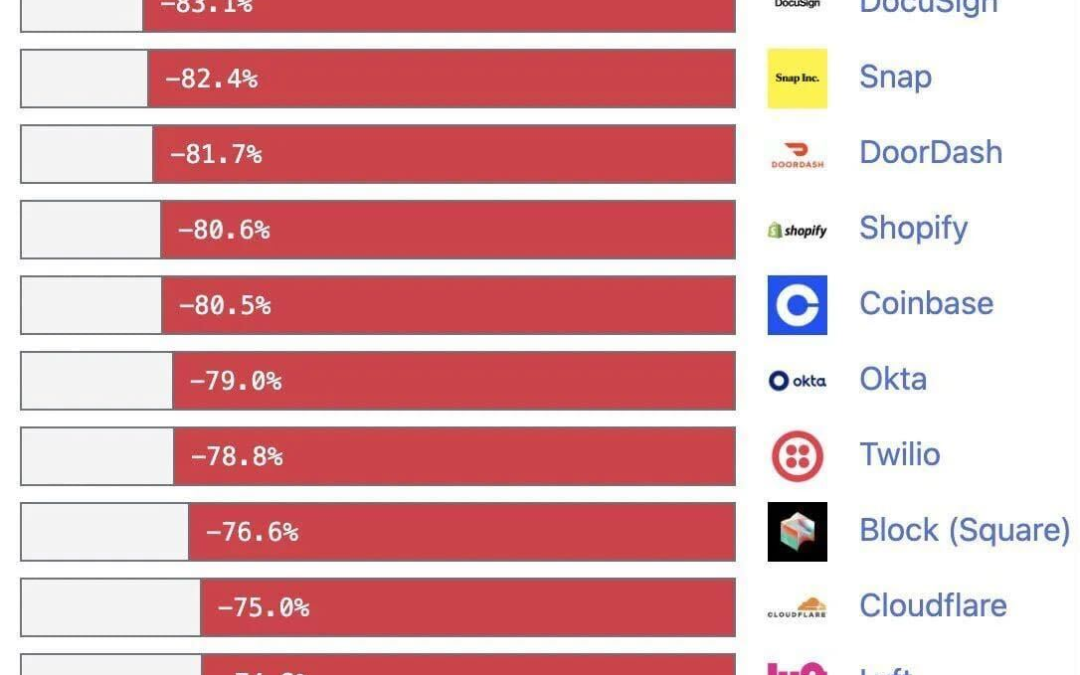

In follow up to Samantha’s YT video last week… https://youtu.be/wjd4Asuf3zw “Everyone into the ARKK – Nasdaq Rotation” Here’s an update on ALL THINGS $ARKK Top Ten Holdings: $ROKU, $Z, $SHOP, $TLWO, $TSLA, $SPOT, $TDOC, $ZM…...TESTING AC INTEGRATION JF 1/28

StockChartsTV 2021 Predictions

Samantha was recently asked to present her 2021 “Look Ahead” for StockChartsTV CHARTING FORWARD 2021, “a yearly market outlook special featuring technical analysis icons Tony Dwyer, Rick Bensignor, Samantha LaDuc, Mary Ellen McGonagle, Craig Johnson...

Meritocracy in Finance and Trading Needs the Voice of Women

I trade for a living and support those who do the same. I love what I do and why I actively work to attract, inspire and elevate the voice of women in trading and finance. This is not only a great career, but empowered women make for powerful traders and investors. In...

Value Remains In Flight

Last Tuesday, I penned a post for clients entitled, Violent Rotation. It was to highlight a trading theme I spied for the coming week to support my market timing calls to trade long ‘value’ plays – those highly-shorted, ‘high risk, bad-balance...

Residential Mortgage Market: Mortgage Meltdown Perspective

Clients know I see mortgage stress in the Commercial but also Residential mortgage market to be 1 of the top 5 risks lurking under the market’s price action. I have written about the stress in mortgages: Mortgage Companies Pricing In Calamity Small Business and Mortgage Bailouts Make Banks Nervous And late last week there was […]

Fed’s Precautionary Measures Equate To A Coming Crisis

The stock market has a 100% success rate of getting what it predicts from the Fed. But while it is easier to trust the market’s predictive powers, the Fed’s own forward guidance leaves much to be desired. As a reminder, the FOMC’s summary of economic projections in...

The Fed’s Hawkish Hold with Dovish Intention Won’t Save Markets From Liquidity Panic

That Was Predictable It was a boring reaction to the October 30th FOMC rate decision, because the Fed did 100% exactly what was priced in. 84 FOMC meetings since expansion began… 72 meetings: mkt priced in no rate change & no change. 9 meetings: mkt priced in 25...

Recession or Reflation? How About Reflation Then Recession

Julian, I hate gmail. It does terrible things to flow of images when trying to create context. This is a private link – only you get it FYI. As for your question of whether I think this Momentum-to-Value rotation call I made in early September will continue...

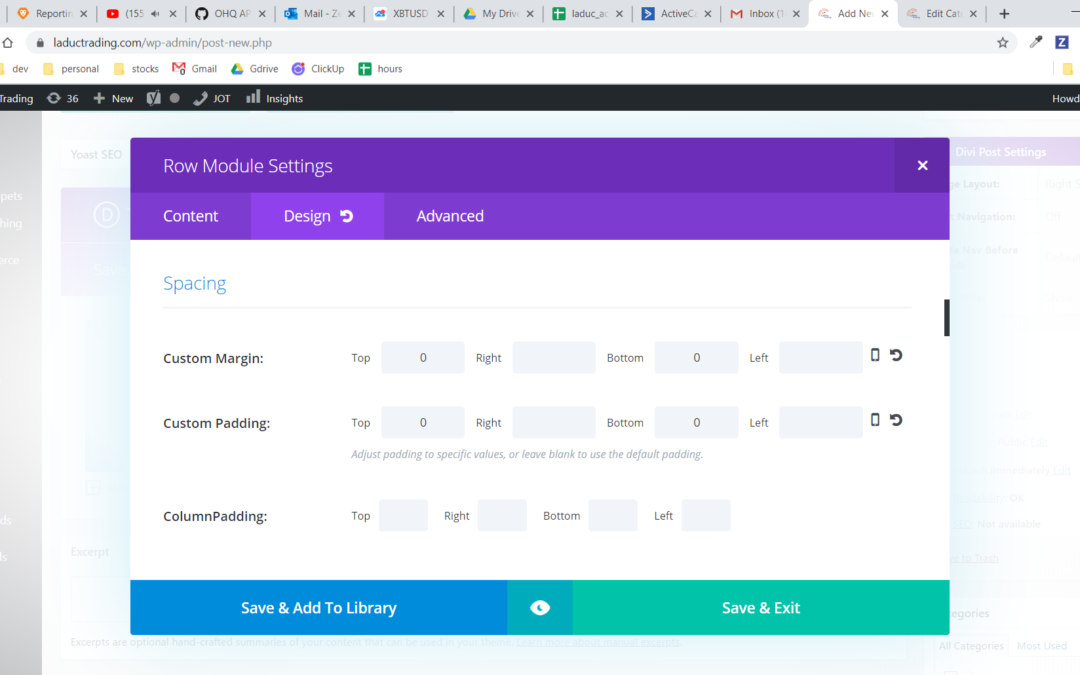

Line Spacing Control Guide

This is Heading 1 This is paragraph 1 – There’s a little space above because I’ve got h1 tags for the heading. This is paragraph 2 – There’s no space because I’ve removed the line between this and p1 in the “Text” view....

How to display blog as complete newsletter in email not clickable abstract?

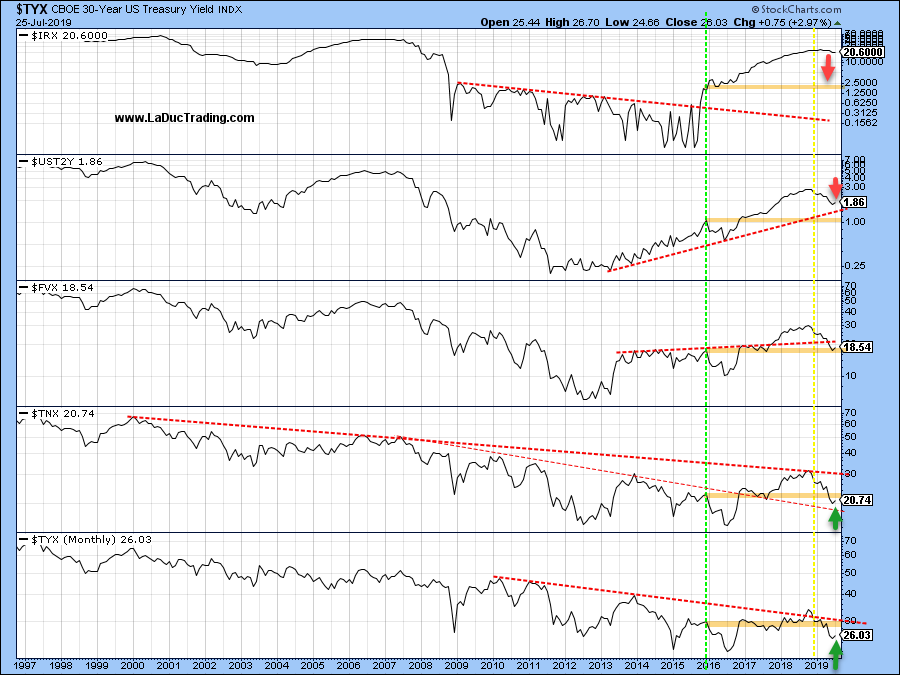

Market Thoughts: Can Fed Cuts Save US From Economic Recession? by Samantha LaDuc | Oct 2, 2019 | Daily Weather Report, Fishing Lessons, Market Thoughts I couldn’t make my Market Timing Calls for Clients without the Intermarket Analysis work that I do – which is beyond...

Internmarket Chart Attack: Market Bullish Into FOMC

Here are charts I showed in my live trading room. I am not convicted with this market call but I am making it nonetheless. The following charts I can interpret as bullish leading into FOMC September 17th. SPX is more bullish when/if MACD crosses above 0 line. Ditto: NASI > 0 = Bullish Hedge funds […]