Main Points:

- Stock Buybacks and are most often credited for underpinning the market’s amazing Bull Run since the early 1980s, and especially the past ten years.

- Given our current polarized political arena, buybacks have also been criticized for compounding wealth for the few while crowding out wages for the many.

- This article is not a war on company profits. Of interest is the behavior that is incentivized by US companies using cash flow to reduce share count (value creation) which compounds the risk for investors to buy and hold stocks that engage heavily in stock buybacks.

- And it asks the question: What would price discovery (fair value) look like in the market if companies no longer had the ability to buy back their stock?

Macro Risks – from political mis-steps or monetary tightening or currency/trade war positioning – has not seemed to deter the Buy-The-Dip crowd in US equity markets. So I decided to have a closer look into this US phenomenon of corporate stock buybacks, their affect on price discovery of late and how a potential shift could be on the horizon for this powerful tool of stock appreciation and how it could be masking a potentially large blind spot in the investing public.

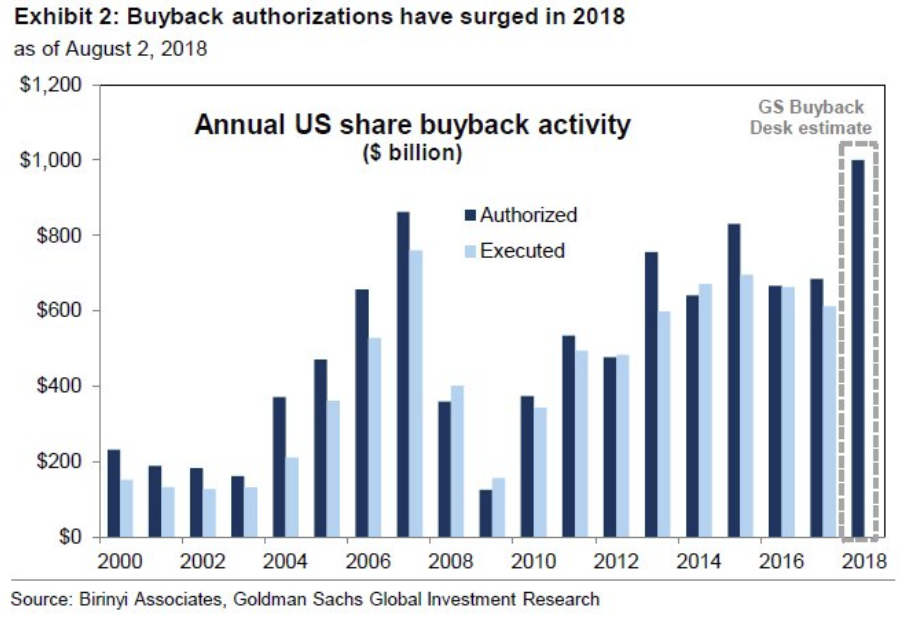

It is common knowledge that companies are increasingly using buybacks as a substitute for dividends. It is less known/understood that management has a proclivity to buy high and not buy low, because buying back overvalued stock boosts EPS and helps management reach their financial objectives faster (and their bonuses that are tied to these objectives). It shouldn’t surprise, then, that buybacks for 2018 are expected to reach a fever pitch – to a record $1 Trillion, a 46% rise from last year – thanks to tax cuts, repatriation and a strong equities market. Add to that, corporate cash is being channeled back into leveraged credit, resulting in five times the equity buybacks. A type of ‘closed loop’ system that requires a major upset to break the loop- say like Regulation.

Buybacks are a byproduct of our markets since 1982, when it became perfectly legal to distribute capital to shareholders without causing them to incur unwanted tax liabilities as with dividends. Their interest would stay inside the asset/stock where it could compound over time. Needless to say, share buybacks have largely outpaced and in many cases replaced dividend income. And with so much available cheap debt and excess cash in US corporations, it makes sense that those companies that can take advantage of buybacks, do! But at what cost?

Buybacks have been essential fuel for the low-volatility regime, enabling steady equity appreciation and in turn, the rules-based strategies pegged to that tranquility. Now, as volatility returns to equity markets, buybacks will likely prove key to understanding and anticipating the threat of a high-volatility crash.

Aside from the risk to Volatility compression and expansion, I ask myself, “It it wasn’t for AAPL buybacks, would they really be a $1T company?” I firmly believe AAPL is a great company albeit with slowing growth. Instinctively I just know it could not be ‘this high’ without the closed loop of Stock Buybacks. And then I found this chart:

Apple's buybacks have spurred about 42% of the stock's gain since 2013, via @TheOneDave pic.twitter.com/uSXjv01Rvh

— Lisa Abramowicz (@lisaabramowicz1) August 1, 2018

Another ‘closed loop’ system is more insidious: A study found that in 2017 and early 2018, the percentage of insiders selling stock more than doubled immediately after buyback announcements. CEOs are cashing out as they announce stock buybacks that buoy the stock price higher.

This is just another version of my “Sold To You” mantra of late with companies like FB: Insider Selling.

The later stages of the 2009–2017 bull market are a valuation illusion built on share buyback alchemy… Share buybacks are a major contributor to the low volatility regime because a large price insensitive buyer is always ready to purchase the market on weakness… Rising corporate debt levels and higher interest rates are a catalyst for slowing down the $500-$800 billion in annual share buybacks artificially supporting markets and suppressing volatility.

Artemis Capital

I am reminded of the last few chapters of Reminiscences of a Stock Operator wherein Jesse Livermore’s character details the the difference between stock Speculation and Manipulation – both of which he was privy to. His last chapter is a call to ban/remove stock buybacks from The Exchanges. Color me skeptical but I am connecting these analytical touch points – like the 90 yr insights by a master trader – with the foreboding macro backdrop which is seemingly interpreted as bullish (as evidenced by incessant buying of any dip) and the growing body of evidence to link income inequality to monetary and fiscal policies.

Add to this the fact that the richest 10% of Americans own about 80% of all shares of stock (the top 1% owns about 40%), and you get a broader picture of how and why inequality has widened so dramatically. Robert Reich

Then my mind wonders further. If we didn’t have pervasive financial engineering in the form of corporate buybacks, would profits actually find their way into wages as a way to help resolve the glaring inequality gaps? Yes, it would cause the ubiquitous wage inflation that so many analysts and economists have predicted, but it would also lift up the standard of living that could in turn spur more sustainable consumption and real economic growth.

How much might workers have benefited if companies had devoted their financial resources to them rather than to shareholders? Lowe’s, CVS, and Home Depot could have provided each of their workers a raise of $18,000 a year, the report found. Starbucks could have given each of its employees $7,000 a year, and McDonald’s could have given $4,000 to each of its nearly 2 million employees. National Employment Law Project and the Roosevelt Institute

The report is careful not to draw a causal relationship between stagnant worker pay and rising buybacks. I’m calling that out. The report examines the period just before President Donald Trump’s $1.5 trillion tax cut came into effect and the tax legislation that cut both the top marginal corporate tax rate from 35 to 21 percent—dropping the estimated effective tax rate on profitable businesses to just 9 percent. I’ll leave it to a future report to update the effects on income equality with tax cut figures fully baked in but it’s likely Yuge.

So here we are: Big Picture 1st Half 2018 Review time. We have market strength, as evidenced by year-to-date positive returns in the indices despite Macro Risks, and Corporate Earnings have been a smashing success – breaking records! But there are cracks: Wage growth has been slowing. Construction has been slowing. Jobs added has been slowing. Auto sales have been slowing. Home sales have been slowing. Home prices have been declining. And all against a backdrop of rising Inflation, Deficits and Buybacks. So I came to ponder: maybe the market only cares about Buybacks!?

And if the market really only cares about Buybacks, what if politics shift to challenge stock buybacks. If I was a betting woman, I would say the current holders of power are invested in taking credit for the market advance and invested in the market’s returns = no change. The next-in-line, however, may have other ideas – like not allowing members of Congress to own individual stocks and other conflicts of interest. Elizabeth Warren has even proposed partially banning stock buybacks…

So that keeps bringing me back to the same Serious Question: What would happen if stock buybacks – $1 T slated for the Top Ten stocks in 2018, out of a $23 T stock market capitalization for 2000 equities in the NYSE – were removed? What would price discovery for our markets look like then? Well, if we go back to the Apple example, they are 42% higher since 2013 due to straight share reduction from buy-backs. So if you’re a bull, you definitely don’t want companies or government regulation to interfere with this gravy train. If you are not in the Top 10% of Americans, your quality of life is clearly much different from the Top 10% and would likely benefit from a little help to level the playing field.

Political and Corporate power are currently aligned on this issue of maintaining and vigorously defending the right to buyback stock, and the Citizenry is not really aware how Income Equality and Price Discovery are collateral damage to Stock Buybacks. Until this changes, the market has few event risks that challenge its structural advance – or at least until the structure of stock buybacks is changed.

Thanks for reading and please consider joining me in the LIVE Trading Room where we work through Value and Momentum trade ideas and set ups every trading day.

At LaDucTrading, Samantha LaDuc leads the analysis, education and trading services. She analyzes price patterns and inter-market relationships across stocks, commodities, currencies and interest rates; develops macro investment themes to identify tactical trading opportunities; and employs strategic technical analysis to deliver high conviction stock, sector and market calls. Through LIVE portfolio-tracking, across multiple time-frames, we offer real-time Trade Alerts via SMS/email that frame the Thesis, Triggers, Time Frames, Trade Set-ups and Option Tactics. Samantha excels in chart pattern recognition, volatility insight with some big-picture macro perspective thrown in.

More Macro: @SamanthaLaDuc Macro-to-Micro: @LaDucTrading