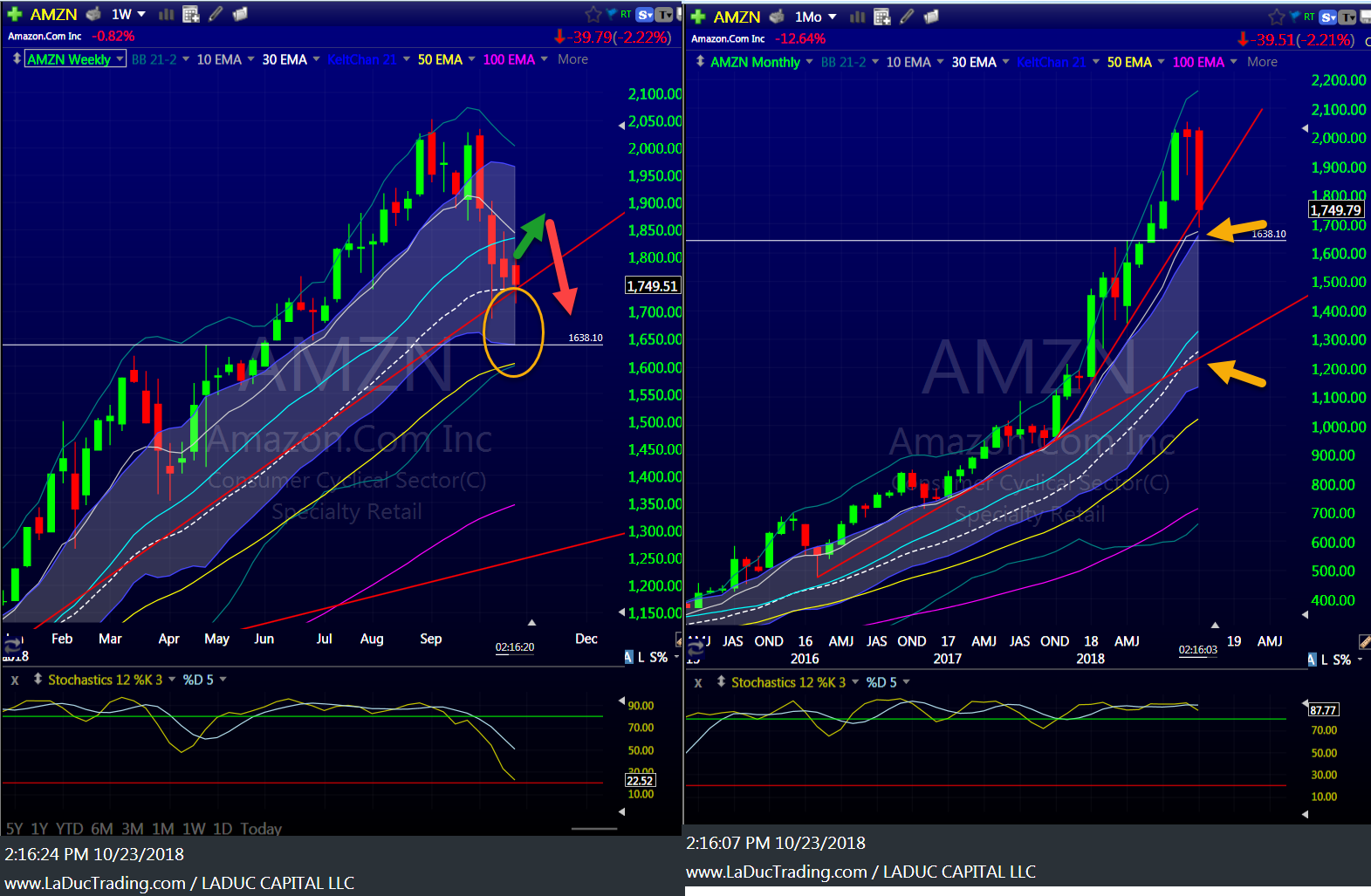

On October 8th I went about analyzing Monthly “FANGMIA” and Index charts to project out Price Targets based on Patterns and potential Volatility. My thesis was short after calling for a Market Pullback on October 3rd. To better identify intermediate-term price targets, I like to wait one full week after a New Month starts to better size up price patterns and from there create a trade strategy and option tactics to take advantage of what the Monthly Chart ‘tells’ me.

Here’s the Roadmap post I put together from Monthly Charts – over two weeks ago – and from my Trading Room the better part of the past month.

What follows are the Results of these travels thus far and some updated Price Targets, just in case Earnings (AMZN MSFT GOOGL) don’t go so well this week…

https://laductrading.com/2018/why-i-love-monthly-charts-short-price-targets-found-here/

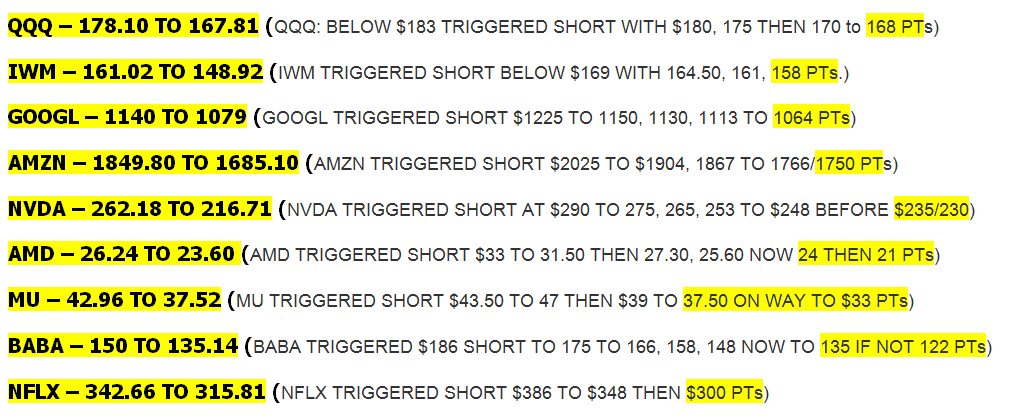

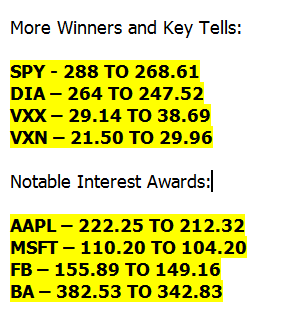

The Winning Results (with the projected price targets from 10/8/18):

Not Done

|

|

What If?

There are three conditions under which I can imagine that short price targets are no longer relevant:

- Trump declares Globalization is good for American and drops his Trade War with China OR (equally unlikely) China concedes to opening it’s market without restrictions.

- Saudi Arabia apologizes for murdering Khashoggi and replaces the money it likely withdrew from US equities and bonds the past few weeks (Vegas odds anyone?).

- Bank of Japan steps in to lower its 10-year yield like they did when they introduced its negative rate policy in January 2016, reversing our market sell-off. (Not seeing it but who knows.)

Short of that, I think it’s clear that Q1 marked #EarningsPeak (which I smelled and wrote about often since April); #EurozonePeaked along with US Housing, Banks and Autos – all in Q1…Big picture, we continue to see synchronized global Growth contraction, PE contraction, Margin contraction from higher costs/wages and general and genuine fears about higher interest rates straining debt refinancing on top of YUGE twin deficits and real inflation that could trigger both stocks and bonds to sell off TOGETHER sparking an unwinding of the very dangerous and oh-so coordinated “Risk Parity Trade” which is way overcrowded . . .

Well, I may have talked myself out of “The Turn”! But ultimately, price action will lead me and I can envision “A Turn” into year end – trading this correction sideways through Mid-Term Election into the ‘Santa Clause Rally” – but with every bullish trade, I will expect to be wrong.

Don’t forget to hedge!

Samantha

Thanks for reading and please consider joining me in the LIVE Trading Room where we work through Value and Momentum trade ideas and set ups every trading day.

At LaDucTrading, Samantha LaDuc leads the analysis, education and trading services. She analyzes price patterns and inter-market relationships across stocks, commodities, currencies and interest rates; develops macro investment themes to identify tactical trading opportunities; and employs strategic technical analysis to deliver high conviction stock, sector and market calls. Through LIVE portfolio-tracking, across multiple time-frames, we offer real-time Trade Alerts via SMS/email that frame the Thesis, Triggers, Time Frames, Trade Set-ups and Option Tactics. Samantha excels in chart pattern recognition, volatility insight with some big-picture macro perspective thrown in.

More Macro: @SamanthaLaDuc Macro-to-Micro: @LaDucTrading