Are Banks a Trade or Investment?

Big banks reported double digit gains from Q3 earnings this past Friday. Then they sold off. It’s not a good sign when stocks fall on good news.

However, they fell ‘into’ strong support, technically speaking. As a result I went long JPM on Friday after they reported – near $106.70/share using options. I sold half today at $4 higher (60% gain). It would be bullish if JPM can get/stay above $112 which happens to be its 200 day moving average. If successful, I would not rule out a retest of their prior highs around $119…but I’m not betting on it.

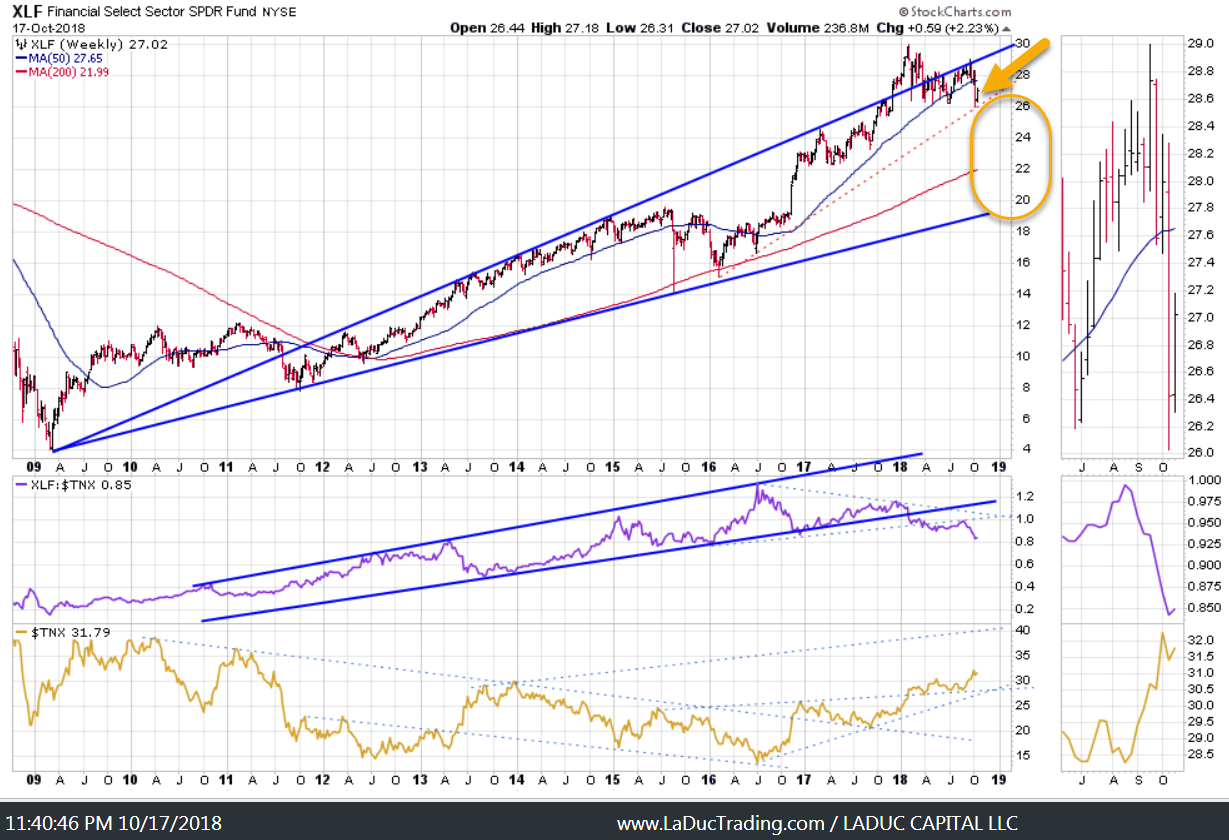

I see banks as a trading opportunity not an investment theme at this time given bank lending is slowing – a reflection of economic slow down and higher rates to come.

In the Q3, for example, “the combined loans of JPMorgan Chase, Citigroup, Wells Fargo and PNC Financial Services increased just 2 percent from a year earlier, in line with the second-quarter rate. Last year, loans at the four banks grew 2.9 percent, and in 2016 and 2015 the rate was well above 4 percent.”

The Credit Stress in the market, as witnessed by the bond sell-off with banks, has not relieved itself. Banks sold off strongly past two weeks and as of today have only recovered half of these losses – likely as a reaction to some very short-term, very-oversold technical levels. There is more work to do to get and stay above its 50D again. The alternative – trading down to its 200D – would be a significant event and one which would return the banking index back to 2015 levels – before the repeal of the Volker rule, deregulation, tax cuts and Trump.

Still, it pays to keep an open mind – especially with a divergence of this size heading into a year where many economists and fund managers are predicting a recession starts.

Thanks for reading and please consider joining me in the LIVE Trading Room where we work through Value and Momentum trade ideas and set ups every trading day.

At LaDucTrading, Samantha LaDuc leads the analysis, education and trading services. She analyzes price patterns and inter-market relationships across stocks, commodities, currencies and interest rates; develops macro investment themes to identify tactical trading opportunities; and employs strategic technical analysis to deliver high conviction stock, sector and market calls. Through LIVE portfolio-tracking, across multiple time-frames, we offer real-time Trade Alerts via SMS/email that frame the Thesis, Triggers, Time Frames, Trade Set-ups and Option Tactics. Samantha excels in chart pattern recognition, volatility insight with some big-picture macro perspective thrown in.

More Macro: @SamanthaLaDuc Macro-to-Micro: @LaDucTrading