This was my “Macro Focus” in this weekend’s Gone Fishing Newsletter anticipating a US Dollar bounce. See It Market has published this section as well.

After hitting a 14-year high at the end of 2016, the US Dollar has lost 11% in 2017. Whether a reaction to Trump talking it down post inauguration, US real disinflation, Euro melt-up (which comprises 57% of the ‘dollar basket’), falling 10-year yields (despite Fed rate hikes in December ’16 and July ’17), the US Dollar has clearly not reflected the much hyped ‘reflation trade’. Inflation expectations post Trump’s election were suppose to boost the US economy, bond yields and dollar but instead the weak USD helped stoke inflation, economic growth and currencies abroad.

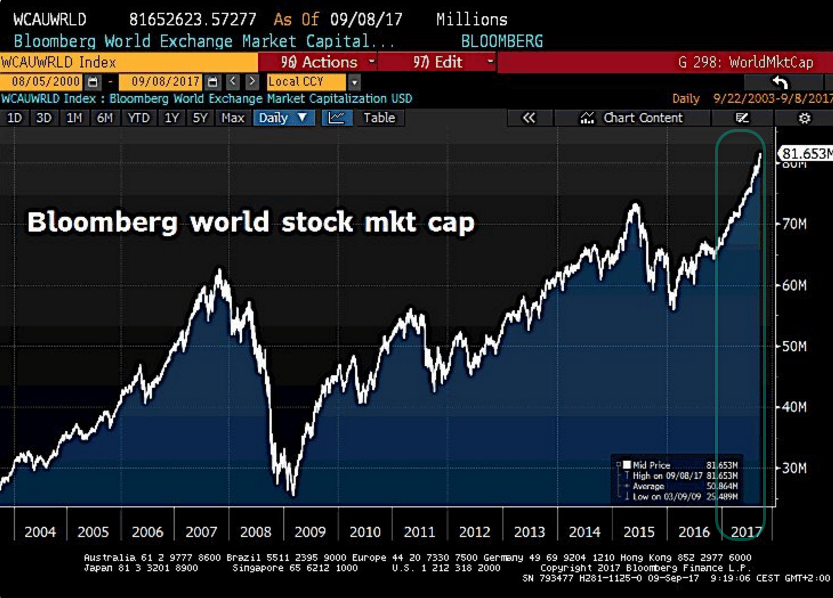

This makes sense. A side-effect of a weak dollar is that it can drive global funds into foreign markets which can contribute to Emerging and Developing Market strength. The Bloomberg World Exchange chart above shows a practical melt-up in world stock market capitalization while the US Dollar has declined without pause and the US stock market has moved mostly sideways this year. Despite strength in the global economy, or because of it, the strength in overseas foreign currencies put pressure on the US Dollar. And the bet is it still will:

More Hedge funds bet on a continuation of the Euro rally. Managers increase their bullish Euro bets by another 11% to highest level since May2011 @Schuldensuehner 9/10/2017

At the same time the USD has fallen, Gold has been on a nice run. Gold is a hedge against currency debasement and speculators are betting it continues.

MS estimates roughly 3.5bn notional added to

#Gold longs between 1,342-48 this wk @LONGCONVEXITY 9/9/2017

The falling USD can also benefit large cap multinationals, especially Tech Stocks, which often derive half of their revenues from foreign markets. It’s been estimated that a 1% drop in the USD translates into a .5% gain in EPS for our large caps. Since the SPX stock market appreciation has been largely driven by its component Tech stocks, both the index and large cap tech plays may come under pressure when the USD bounces/rallies.

The falling USD can also benefit large cap multinationals, especially Tech Stocks, which often derive half of their revenues from foreign markets. It’s been estimated that a 1% drop in the USD translates into a .5% gain in EPS for our large caps. Since the SPX stock market appreciation has been largely driven by its component Tech stocks, both the index and large cap tech plays may come under pressure when the USD bounces/rallies.

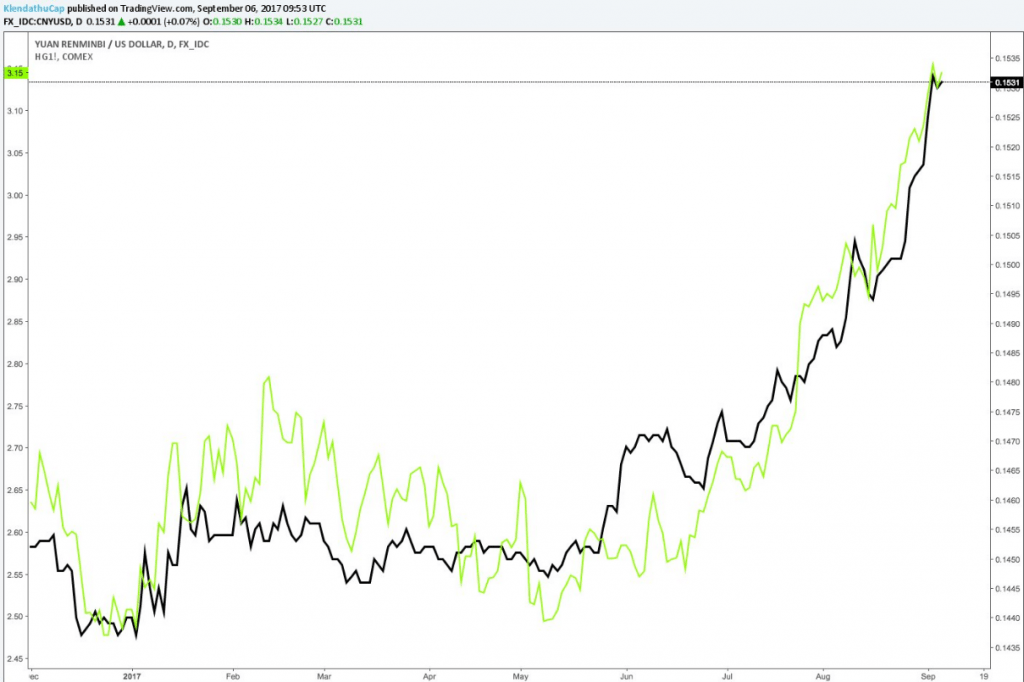

The continued slide in the USD has also driven speculation into commodities, both industrial and precious metals, which can lead to higher inflation, eventually. So far this ‘inflation’ has been largely seen in China’s Yuan/Copper simultaneous advance. (chart @KlendathuCap)

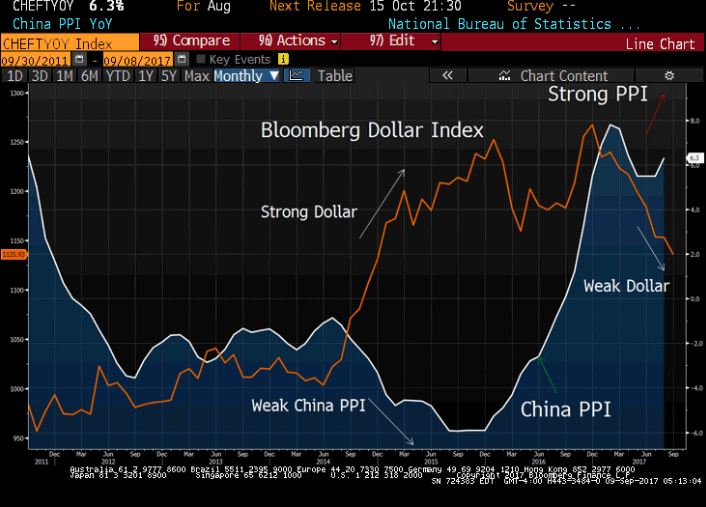

Meanwhile, China’s Producer Price Index resulted in import growth up 11% this year (chart @convertbond).

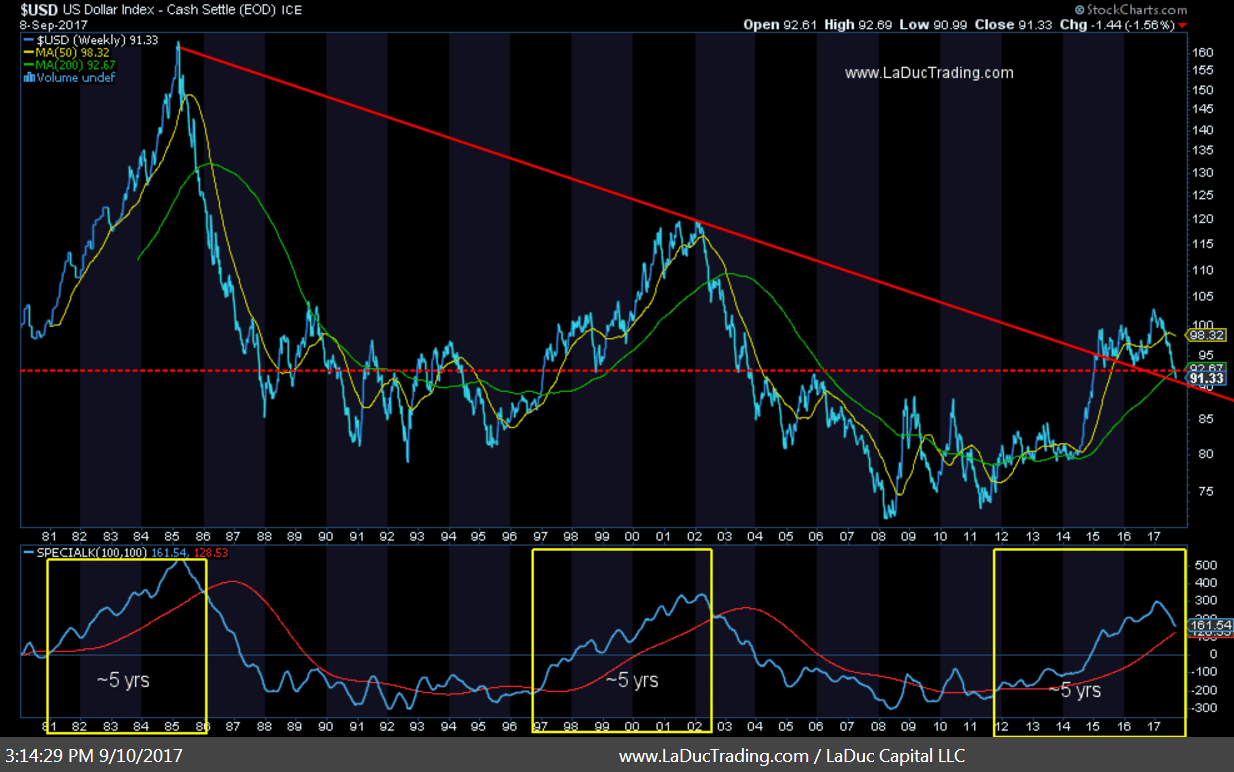

In short, a weak US dollar can induce global inflation (and economic growth/demand), in time circling back to the US. While this Reflation Trade builds energy, I expect the USD to bounce/rally off that red/green support level shown below. And judging from how technically oversold this sell-off appears, it will likely be soon. With that, large caps, especially Tech, can come under pressure.

There’s a lot riding on the direction of the US dollar–especially as it relates to inflation in the intermediate-term and selling pressure in our seemingly-unsinkable indices and tech plays in the short-term. Big Picture, the massive devaluation in the USD may bring about a shift in the USD as no longer being the world reserve currency of choice, further putting pressure on its descent. China has already turned its Renminbi into a gold-backed currency, not dependent on USD. Will Russia follow in-kind with its currency? Point is: there are structural weaknesses with the USD so the likelihood that it continues its downtrend is high.

Continued selling pressure on the USD can also bring US exporting industries back home, which would in turn drive wage inflation higher as well. Both of these (intended or unintended) consequences need some time to play out; time that may rhyme with the recurring 5-year cycle in the US Dollar seeming to have peaked and rolled over this year.

In summary, this continued devaluation of the USD, in time, can further drive the commodity cycle both globally and at home. As a result, another (intended or unintended) consequence from a lower USD that drives resource prices higher which drives inflation higher is that both can incite the FED to hike rates sooner rather than later. And that would make for a perfect storm for a market correction in stocks and bonds.

Come join me… I made it super easy for you to pop into my LIVE Trading Room for custom analysis and interaction–any time! You choose when to fish: Trade the Open or the Close, make a day of it or stay for the whole month.

At LaDucTrading, I analyze price patterns and intermarket relationships across stocks, commodities, currencies and interest rates. I develop macro investment themes to identify tactical trading opportunities and employ strategic technical analysis to deliver high conviction stock, sector and market calls. My annotated Charts are meant to do most of the talking and illustrate my Thesis, Trigger, Time Frames, Trade Set-ups and Option Tactics. When applicable, I note Unusual Option Activity (UOA) and Deal Flow. I also keep a Tally and follow a Trade Plan, both of which are made available to members. No proprietary indicators are used, just solid chart pattern recognition, volatility insight and some big-picture perspective thrown in.