This article was first published 16th July 2023 as a Slack post for our CLUB members.

Deflation of Wages Ended with Covid

I’ve been very focused and consistent on this message since

my client post October 2021:

Deflation of Wages Ended with Covid.Fast forward, and this has proven to be a durable theme for 2022 and 2023 – even as core CPI (consumer price index) has decelerated from 9.1% in June 2022 to 4.8% in June 2023.

To be clear, wage inflation is a lagging indicator, but one that can support inflation in becoming entrenched. That was my bet when I warned clients in October 2021 that bonds were at risk.

“It will be clear inflation is systemic because bonds will begin their descent. At that point, the rate of change in that bond break will matter – to volatility and to market returns. Bonds, after all, are just equities without circuit breakers. The ‘market tell’ will be when bonds sell off with stocks in the midst of rising energy and commodity prices. This could be very destabilizing to markets and economies worldwide as the risk-parity trade is unwound in favor of cash.” Me, October 2021 (last paragraph)

As it turned out, 2022 was the worst year for bonds on record, and further, many went to cash not only to avoid market volatility – as the Nasdaq sold off 35% – but also to capture higher yields from risk-free, short-duration treasury bills and money market rates paying 3-4% then (5+% now).

In short, my bet paid off that “higher wages relative to productivity would be the enemy of bonds”.

Ironically, many macro-focused fund managers got the equity and bond sell-off, in the midst of the fastest Fed hiking regime and poor economic data, wrong as a call for US recession hitting in Q1 2023. We had none, as my theme of ‘sticky and rising wages’ served to underpin a main macro driver in helping to delay recession.

So the big risk now is how higher prices from rising inflation, notably wage inflation, can trigger and stay steadfast even during a coming recession.

And is the basis for why bonds will not be safe for sometime.

Part 1: Inflation is Entrenched and Fed Hikes are Inflationary

My mantra since summer 2020 is that yields were done going down and inflation would be more than sticky.

Three years later and we can see that inflation is above the 10-year trend, and I would contend has become entrenched.

Here are my top 15 charts that demonstrate this point as inflation jumped above trend post-Covid as inflation was accelerated from massive QE and Fed rate hikes.

And yes, I firmly believe Fed rate hikes are inflationary:

Part 2: Wage Inflation Delayed Recession

Premised on my assessment that inflation is entrenched and Fed rate hikes are inflationary, let’s revisit how wages impact inflation and rate hikes.

Juliette DeClercq, a macro analyst/prognosticator, highlighted recent evidence why higher wages delayed recession. She quoted Bank of England’s Silvana Tenreyro, and explained the paradox of weaker manufacturing and headline disinflation as reflationary:

“If workers try to resist a fall in their real income by making higher nominal pay demands, and firms try to defend their real profits by raising domestically set prices, real-income resistance can lead to nominal inertia and delay the return of inflation to target.”

It seems counter-intuitive, but global manufacturing weakness and headline disinflation is reflationary because lower goods and resource prices have helped developed market services sectors support aggregate personal real income gains.

Juliette continues:

While I was right on the initial COVID price shock vanishing, price pressures persist due to the classic lagged second run effects on services pricing and wages. In other words, companies are resisting lower profits and workers are resisting lower real wages. And because of continued strong aggregate final demand, they both succeeded.

Juliette goes so far as to say how real income gains caused a tremendous global economic rebound which was compounded by easing financial conditions and together helped to price out immediate recession risks.

Part 3: Wage Inflation Begets Wage Inflation

Wage pressures are clearly growing

as I pitched on Twitter recently.

From city-mandated increases in Living Wages, to state-mandated increases in Prevailing Wages, the trend is higher.

From services industry competing for workers with manufacturing industry, the trend is higher.

From construction labor deficit and its impact on all-things housing inflation, the trend is higher.

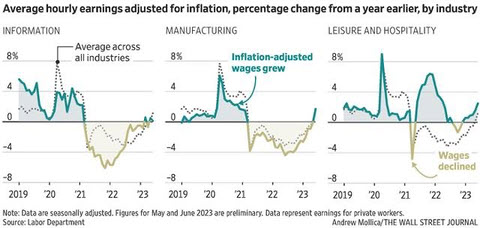

Pay Raises Are Finally Beating Inflation After Two Years of Falling Behind

Wages rise more than 4% while consumer prices increase 3%

Inflation-adjusted average hourly wages rose 1.2% in June from a year earlier. That marked the second straight month of seasonally adjusted gains after two years when workers’ historically elevated raises were erased by price increases.

As I detail below: We are firmly in Stage 2 of Wage Inflation where Wages catch up to and beat Inflation rate.

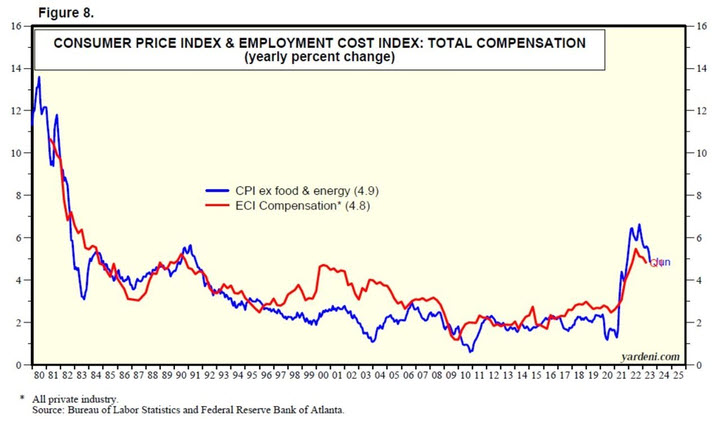

Ed Yardini posted a recent chart that highlights the Employment Cost Index to CPI:

He warns:

“Both price and wage inflation have been moderating so far this year, with the former down more than the latter. As a result, real wages have been rising at a pace consistent with a modest improvement in productivity growth. The risk is that a wave of labor strikes and expensive new contract settlements could cause wage inflation to rebound, forcing companies to raise their prices at a faster clip again. That would trigger a renewed wage-price spiral,”

We will talk about my thesis for a “wage-price spiral” below. First, let’s have a quick look at how demographics can impact wages.

Part 4: Demographics and Tax Receipts

There have been missives written about “tomorrow’s jobs problem” due to pure demographic trends – here and abroad.

I’ll try to summarize the US situation in a few bullets:

- Boomers Retirement Trend – Spurred by Covid, when 2 million workers left the workforce, retirees continues to migrate out of and permanently leave the workforce.

- Millennials – The sector with the greatest labor need is construction, but it is the sector where young people do not gravitate. As long as labor slack in general, but construction jobs in particular, remains tight, wage inflation will be needed to lure workers into the space. With housing supply and related labor tight, inflation in this space will stay sticky supporting wages.

- Immigration – took a big hit under Trump, and still unpopular, not to mention China’s drive to bring Chinese nationals in the US (and their money) back to China.

- Birth Rate – steadily declining since 2008!

Interesting to note:

It may not be popular but: “

Nearly 8 million U.S. jobs are dependent upon illegal immigrant activity.” Same report: “Undocumented immigrants pay around $11.64 billion in taxes per year”.

During a time when US Govt debt and servicing that debt has created a circular loop with fiscal/monetary stimulus supporting higher inflation, all of the above demographic trends point to a negative hit on US tax receipts as labor tightness puts pressure on wage inflation.

So far, I’ve focused on the factors for a declining labor pool as contributor to wage inflation, the trend for higher wage demands from inflation, facts supporting entrenched inflation and my thesis that Fed wants and/or created the inflation and why they are trapped. Let’s now revisit my main theme of Wages > Productivity and how it ties into the bond market.

Part 5: Wages and Productivity

My whole thesis back in that October 2021 report was based on the assumption that Productivity had “outperformed” Wages for 40 yrs – same exact time the bond market had been in its 40 year long trend – and that it was time to reverse. It’s reversed but can the trend continue?

Bob Elliot

suggests and I agree:

The problem for the Fed is nominal wages are growing at 5-6pct which is sustainably financing nominal spending at 5-6% for an economy with productivity growth near zero.

Until there is a decline in wage growth relative to productivity growth, inflation will remain a problem.

Further, I contend that wage demand increases will only increase unless/until productivity picks up in a meaningful way. Many are betting on AI as the trigger to do just that. Color me skeptical.

Bob also seems to agree with Juliette even if they come at it from completely different approaches:

All this points to the likelihood that total nominal spending will continue to grow largely in line with nominal incomes. And those nominal incomes continue to grow at a pace that is well above productivity. That is really important to understand because it then means that while there may be disinflation in one sector or another, *total prices* will likely continue to rise. As one set of prices comes down, it will free up income to be spent on other things.

So that brings us back to my “Wage Inflation Delayed Recession” thesis, and why prices in general but wage inflation in particular remain sticky.

Juliette again:

The point is that in hot labor markets, workers tend to use their strong bargaining power to recoup lost purchasing power…

And that’s a pretty reliable across-the-world lag of nine months between higher inflation expectations and higher wages.

However, the usual nine months lag between the former and the latter means that automatically and mathematically 2023 is seeing a strong payback for the 2021 COVID supply shock hungover in the US.

And 2022 energy supply shock hangover in Europe. With the original inflation shocks in the rearview mirror and short term inflation expectations normalizing what we’re actually seeing is the recent wage gains are lifting real incomes, and fueling hopes for increasing purchasing power, which overall is supporting global consumption.

Income growth could slow when/if labor markets soften, but when that happens, we need to be on watch for recession.

Part 6: The 3 Stages of Wage Inflation

Stage 1 (2020-2021): Inflation growth beats wage growth.

Stage 2: (2022-2023): Wage gains catch up to inflation.

Stage 3. (2024-2025): Wage price spiral fears trigger more Fed tightening + credit stress.

We passed stage 1. We are well into stage 2 when real wage inflation bases, rises and then trends higher than inflation when you run out of spare workers.

That’s when companies have to compete to lure workers. That’s the stage we are/have been in.

In short, the labor supply shock post Covid is/has turned permanent for the labor market.

From that, wages will continue to march higher, all of which is reflationary, as tight labor markets support higher real income for workers which keeps aggregate demand/spending bid.

When does stage 3 – “wage spiral that leads to recession watch” kick in?

Let’s review before we look for when recession risks get pulled forward:

- The labor tightness is here, today; recession is not. It has been delayed.

- The services sector recovery in 2023 not only defied weak (domestic and weak) manufacturing but contributed to higher wages, helping to delay recession (and helping to support equity prices).

- Wages still outperform productivity which is inflationary. So are the Fed rate hikes.

- Housing recovered in large part from extremely low inventories, rising real incomes, durable demand as THINGS (houses, cars) proved to be a good hedge against inflation over PAPER.

- Corporations were able to pass on their higher prices with higher prices. This allowed them to rebuild profits even after the Covid lockdown supply shock as higher material input prices declined.

- Wages increased and with it incomes and spending.

- Equity markets were supported by Fed liquidity and coordinated Central Bank intervention in October 2022, followed by Fed backstopping banks in March 2023 post Silicon Valley Bank failure, and offering to ‘make whole’ ALL banks holding treasury losses.

- As long as Wall Street (stock market) and Main Street (economy) continue to be supported by Fed/Treasury intervention and White House/Congress fiscal stimulus, wages should continue to grow.

Part 7: Recession Watch

Good news: 2022-2023 has indeed seen decelerating CPI and stabilizing prices, as continued strong wage gains triggered the transition from nominal to real activity growth. This can continue into 2024 as higher nominal wages translate to higher real income gains – unless inflation spikes higher than wage gains.

Time will tell if that translates to higher demand and higher equity prices. But there is only so long that demand can save the credit markets and I expect 2025 will form the potential for a threatened wage price spiral triggering Fed rate hikes AND recession, as the lagged affects of tight monetary policy hits demand along with credit conditions.

This is why I track these recession tells closely:

- Productivity falling further relative to wages as economic growth materially slows.

- “Wage price spiral” narrative fears trigger more Fed hikes/tightening.

- Treasuries underperform, bank NIMs shrink, and credit tightens.

- USD falls relative to ROW as growing US Govt debt and interest costs erode confidence in US hegemony and US treasuries as ‘risk-free’ collateral.

- Yields getting and staying >4.3% in the 10Y is a tell that bond holders demand a higher yield for the risk of holding US treasuries.

- Unemployment moves higher and with it jobless claims.

Other measures of employment data I track closely as signs we are pulling forward recession:

- Sahm Rule trigger of .5% rate of change increase in the unemployment rate.

- Jobless claims getting and staying above 267K.

- Real hourly earnings getting/staying above 2%

I’ve written about the former two points in detail. Real hourly earnings are still below 2% – consistent with Fed’s 2% – but once above, Fed will likely be back with more hikes. Market has yet to price any of this in.

More Rate Hikes = Higher wages = Higher incomes/demand = Higher Inflation = Waves of Inflation Peaks and Equity Bottoms.

For now, this increased wage activity and demand has surely contributed to why equities accelerated in 2023 and why recession has been delayed, despite the fact that US has had

negative growth prints past few quarters. And until there is a decline in wage growth relative to productivity growth, inflation will remain a problem and bonds will stay under pressure.

Fed hikes only make inflation and bond returns worse. Market just doesn’t know it yet.

===========

We serve Active Traders, Investors & Institutions

Join our community of active traders with a Club subscription for just $350 /mo or get two months free with an annual subscription.

You will get immediate access to all of Samantha LaDuc’s current market analysis across sectors and timeframes – Chase, Swing and Trend.

Learn about all our memberships here.