Inflation = Sticky

I made the bold claim last year in August that deflation ended with Covid and so many inflationary themes would be ‘sticky’; translation: systemic not transitory.

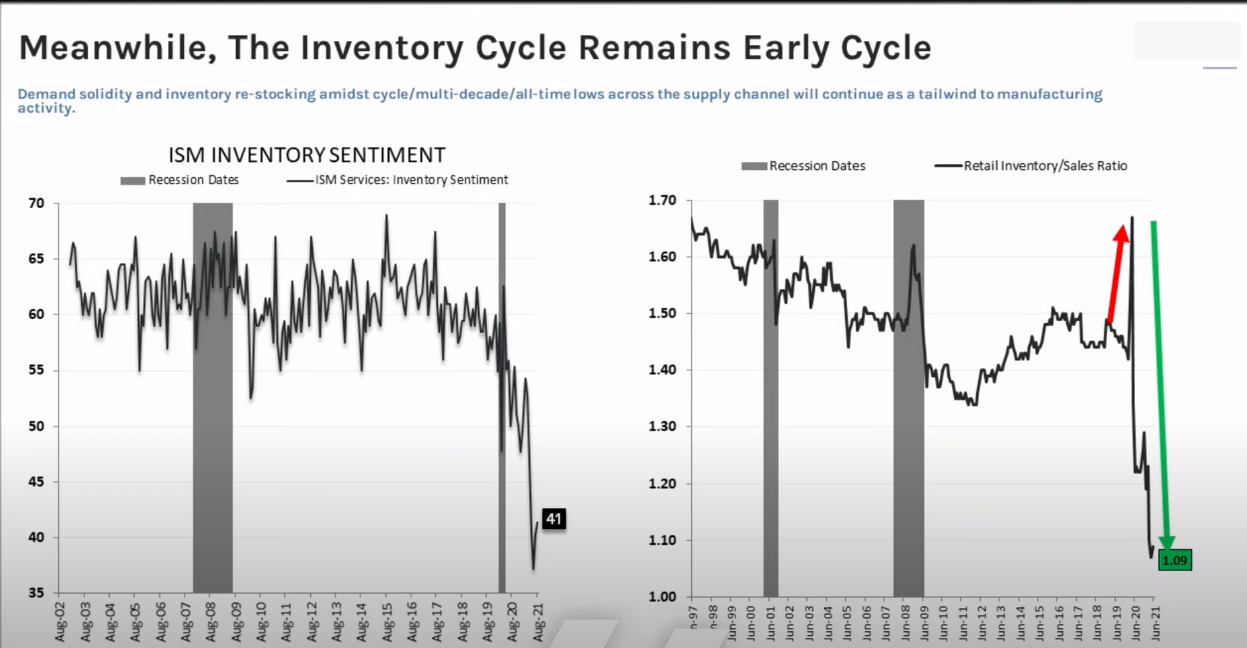

Covid was the trigger but deglobalization as a trend is likely to continue if for no other reason than where we are in the inventory cycle, which is at all time lows [see 1st chart]. Given supply chain problems and stress [see 2nd chart], we are also likely to see a reversal in the under-investment in US resources, production, transportation and labor. All of this has been chased in full view given inflationary pricing spikes in housing, cars, food, energy, and especially bond yields.

Growth-To-Value Rotation

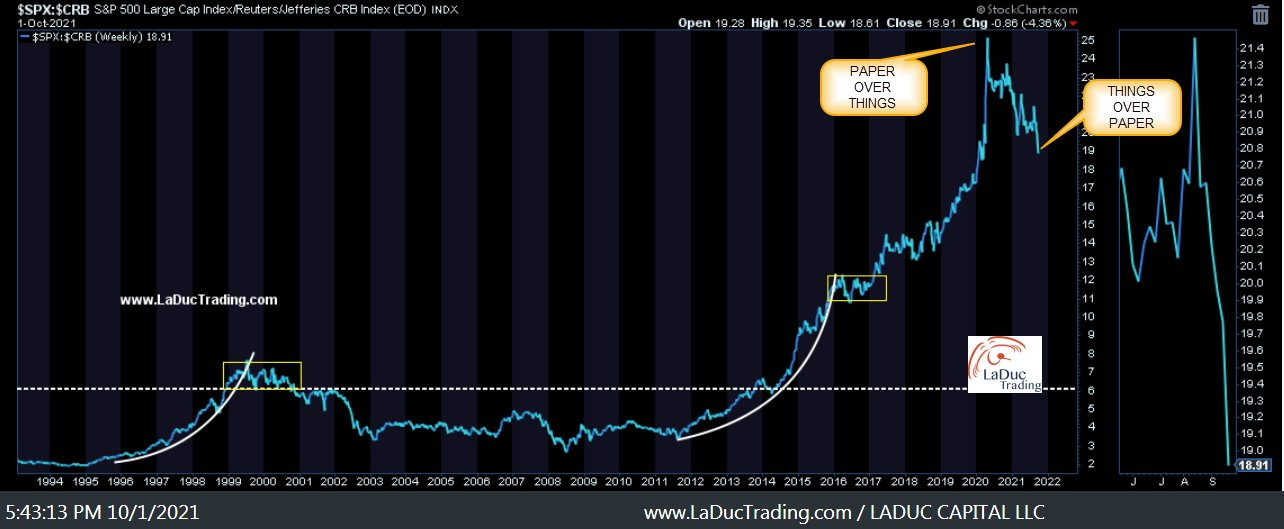

My emphasis on growth-to-value as an investment theme since last summer was based on my call for asset allocation into THINGS OVER PAPER. This wan’t nostalgia to bring back US manufacturing as much as it was/is a market call that recent supply-chain stress would trigger reinvestment in US productivity which is akin to reinvestment in US labor and with it wage inflation. I even did a podcast about this back in April entitled: “1970s Style Hyper Inflation” – long before current headlines debating this theme.

Everything inflationary that was in play earlier in the year is still in play:

- Shipping delays and spiking container/transportation costs with rising fuel expenses, triggered by Covid lock-downs and continued by labor shortages, are still in need of time to normalize, while substitutes and solutions are found. This dynamic will further support the move for nationalization/deglobalization.

- Rising raw material costs from shipping delays, labor shortages, re-opening demand and the self-fulfilling nature of inflation expectations will need time to normalize, while higher costs get passed to and absorbed by consumers.

- Housing and related cost-of-living increases from lack of inventory and rising producer prices are outpacing wages. Wages are near record lows versus corporate profits which is a social and economic policy initiative the Biden administration is working to reverse.

- Energy and food pricing can trigger panic buying with government price controls further inciting panic buying, which is why I also believed the best path for investors last year was to stick with THINGS OVER PAPER keeping in mind INFLATION = STICKY.

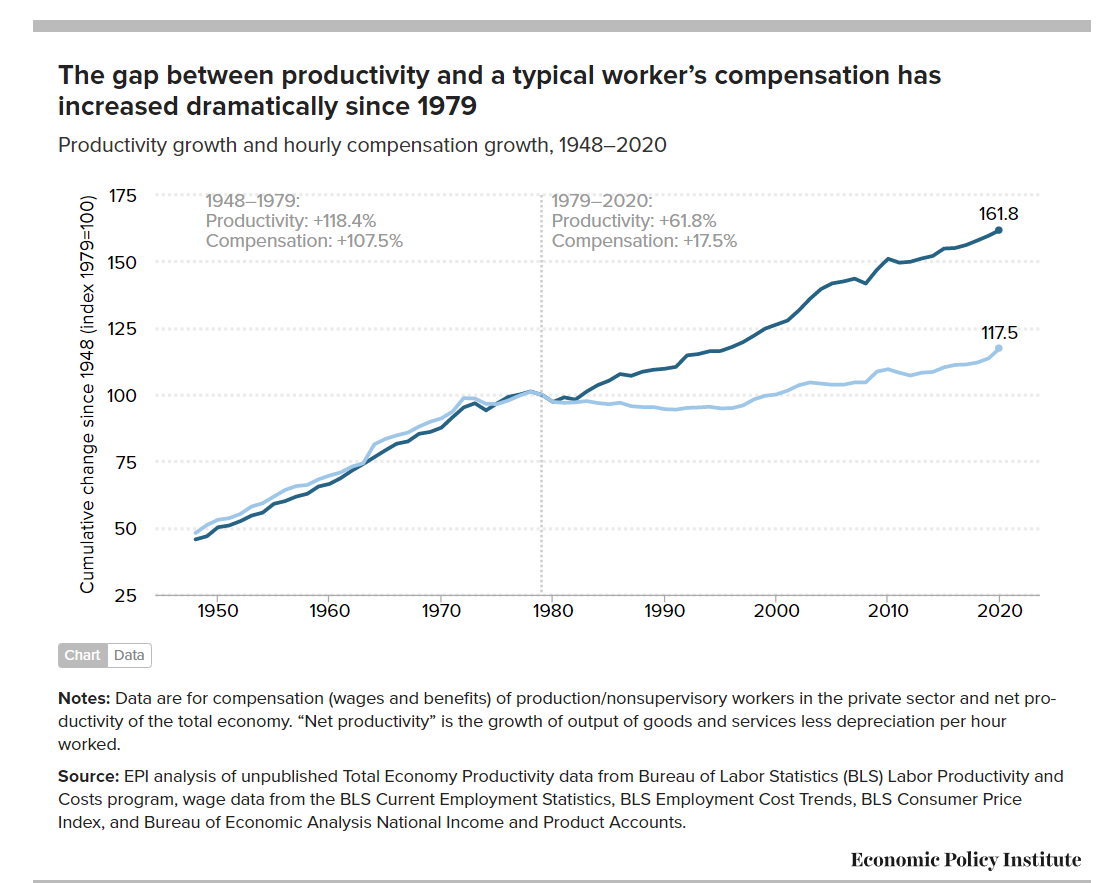

- Labor shortages triggered by Covid and continued from fiscal stimulus replacing incomes will need time to unwind while wage increases will need time to play catch up after decades of productivity outpacing wage gains. Why does productivity and wages matter? Read on…

Productivity and Pay Gap – playing catch up

Productivity growth and hourly compensation tracked closely together 1948 – 1979, but since then has been far apart.

Productivity +61.8% versus Hourly pay +17.5% means that Productivity has grown 3.5x as much as pay. Source: EPI

Starting in the late 1970s, policymakers began dismantling all the policy bulwarks helping to ensure that typical workers’ wages grew with productivity. Excess unemployment was tolerated to keep any chance of inflation in check. Raises in the federal minimum wage became smaller and rarer. Labor law failed to keep pace with growing employer hostility toward unions. Tax rates on top incomes were lowered. And anti-worker deregulatory pushes—from the deregulation of the trucking and airline industries to the retreat of anti-trust policy to the dismantling of financial regulations and more—succeeded again and again.

As I like to say, “Policies drive Economics” and with that policies made to suppress wage growth prevented wages from growing with productivity, and, as a result, economic growth slowed. I also contend, we can’t ‘grow’ our way out of this productivity malaise until this pay gap catches up.

Add to that,

This concentration of wage income at the top (growing wage inequality) and the shift of income from labor overall and toward capital owners (the loss in labor’s share of income) are two of the key drivers of economic inequality overall since the late 1970s.

When the trend ends, it will look like this: rising AHE (Non-Supervisory Average Hourly Earnings). Currently, they are rising at 5.5% – the highest in 40yrs. This is the trend needed to help sustain company pricing power and inflation.

So given that potentiality of ‘sticky’ wages and inflation, what’s the trade?

Bonds Are Stocks (without circuit breakers)

The uneven distribution of globalization has been clearly rewarding capital owners not workers. But with new and proposed fiscal policies, regulations and taxes, it seems clear a shift in the redistribution of wealth is expected. Rising inflation will help boost COLA (expected to jump 6% next year) which will help move US wages (and social security) higher. This will be better for the working class, but not for bond holders.

Add to that, the very process of unwinding a foreign manufacturing reliance will import inflation. Fed tapering of bond purchases will also fuel inflation. Together, inflation is the enemy of bond holders and why bonds have been in an uptrend for 40 years – we’ve had deflation not inflation. Covid ‘fixed’ that. Reversing globalization will be highly inflationary to both input costs (materials and labor) as well as consumer prices (housing, energy, food etc). We’ve already seen the market front-run this concern by bidding up inflationary assets – THINGS OVER PAPER.

The question is whether this THINGS OVER PAPER is ‘transitory’ or systemic.

My bet: The answer will be revealed in the bond trade, and I think they smell it already…

This chart of the 30 year treasury bond shows price has stayed in an ascending channel the past 40 years. It’s forming a trend-reversal pattern known as a Head & Shoulders. Once this channel breaks we will know INFLATION is more than transitory or sticky. It will be clear inflation is systemic because bonds will begin their descent. At that point, the rate of change in that bond break will matter – to volatility and to market returns. Bonds, after all, are just equities without circuit breakers. The ‘market tell’ will be when bonds sell off with stocks in the midst of rising energy and commodity prices. This could be very destabilizing to markets and economies worldwide as the risk-parity trade is unwound in favor of cash.