Market Thoughts – Last Week

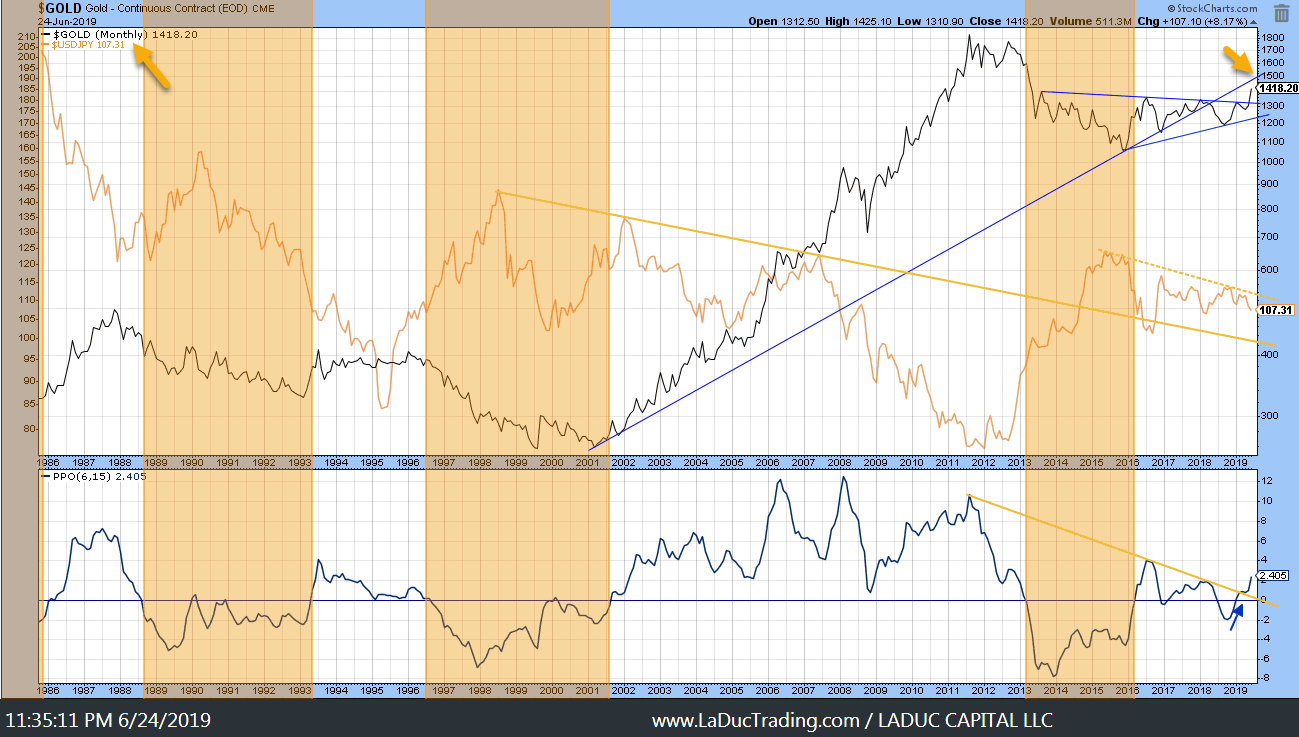

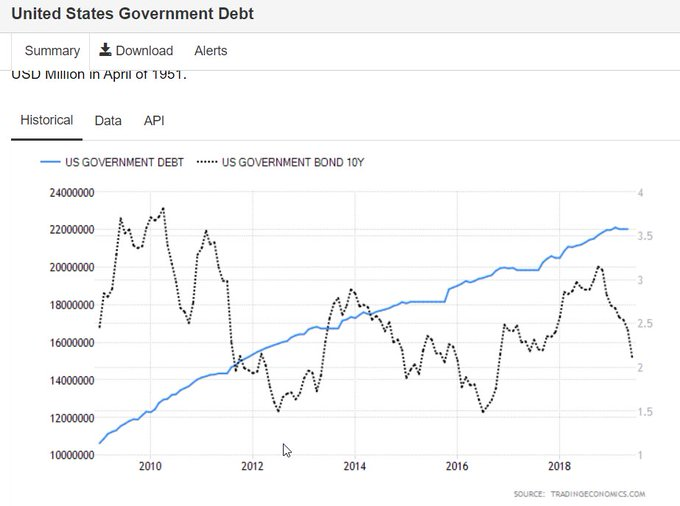

While away from my trading desk last week, the Fed confirmed a stronger case for rate cuts and SPX ran to new all-time highs. This is not a surprise given it was Quad Witching Expiration and 26 out of the 29 last quad witching cycles saw a run-up into the date of expiry and weakness after – average .73 SPX pullback so not really alarming drop but a pause nonetheless. Also notably, Oil popped +10% (posting its best week since 2016), Gold touched $1,400 (a level not seen for five years), and US 10-year yields briefly fell below 2% (a level not seen since before the Trump election).

Highlights

“The FOMC will closely monitor the implications of incoming information for the economic outlook and will act as appropriate to sustain the expansion,” the Fed said in a statement, dropping its recent buzzword about being “patient.”

“The case for somewhat more accommodative policy has strengthened,” Powell said at a news conference to discuss the rate-setting Federal Open Market Committee’s highly anticipated decision.

“My initial thoughts are that the Fed did what the market thought they would do today, and offered to give them what they really want in the near future. That could be as early as July, and that could be as much as 50 basis points,” said Kevin Giddis, head of fixed-income capital markets at Raymond James.

Europe added to the party atmosphere when ECB President Mario Draghi at the annual central bank conference in Sintra, Portugal Tuesday said policy makers would consider “in the coming weeks” how to adapt its policy tools “commensurate to the severity of the risk” to the economic outlook, a signal that the central bank may be willing to lower rates.

And that drove Gold aggressively higher

Coming debt ceiling+potential federal gov shutdown triggers…

1. Slowing Gov Spending =

2. No New Treasury Creation

3. Treasury Shortage = Lower Federal Funds Rate (FFR)

4. Excess bank reserves depresses interbank rate which causes the yield curve to invert

5. Gold Rallies with Treasuries (and Yen)!

**So when Treasuries are available again, rates will rise again!!

Macro Matters

Urgent UBS Report – Expect 20% Drop in Global Markets

Will the showdown in Osaka result in a takedown by the American administration? Stakes are sky high as we approach the most important meeting between America and China in a generation as tariff man comes back to the table. After the Hong Kong protests, America is in a strong position to heap more pressure on Chairman Xi to agree on a deal on U.S. President Trump’s terms. The Hong Kong mess has revealed that China has little wiggle room to maneuver and if they do play the long game and stall, UBS has signaled a violent drop of American GDP of 1.2% over the next 6 quarters to the US economy. Pencil in a 20% drop to equity markets as disappointment to this standoff could bring newfound contagion to the markets. Even though base case projections expect some modicum of coming together between the two countries, UBS has warned that economic numbers will go through the grinder if hostilities increase. A no deal would result in another wave of offshoring to South East Asia from China and now the Hong Kong economy is going through the gauntlet with newfound whispers telegraphing capital redistribution to Singapore. CNBC

Economic Calendar

Monday June 24

Tuesday June 25

US Consumer Confidence/

Wednesday June 26

WTI EIA Oil Stock

JPY Japan Retail Sales

Thursday June 27

US Jobless Claims

12:30 USD US 19Q1 GDP (final) (e3.1% p3.1%)

US PCE QoQ

US Pending Home Sales (MoM)

JPY Tokyo CPI (e0.9% p1.1%)

Friday June 28

EUR Eurozone CPI (prelim) (Core YoY e1.0% p0.8%)

US Personal Spending/PCE MoM & YoY

CAD Canada GDP (MoM)

US Chicago PMI

US Michigan CSI

Looking Ahead – Calendar Risk*

Earnings Calendar

#earnings for the week $MU $BB $FDX $NKE $GIS $WBA $STZ $LEN $FDS $PAYX $SOL $CAG $ACN $RAD $INFO $SNX $KBH $AVAV $JKS $UNF $SCHN $MKC $ATU $PIR $MLHR $SJR $AITB $SKIS $SGH $GMS $APOG $FUL $NG $PDCO $WOR $ACST $FC $CAMP $PRGS https://t.co/lObOE0dgsr pic.twitter.com/9HBogJf1i8

— Earnings Whispers (@eWhispers) June 22, 2019

Inflection Points

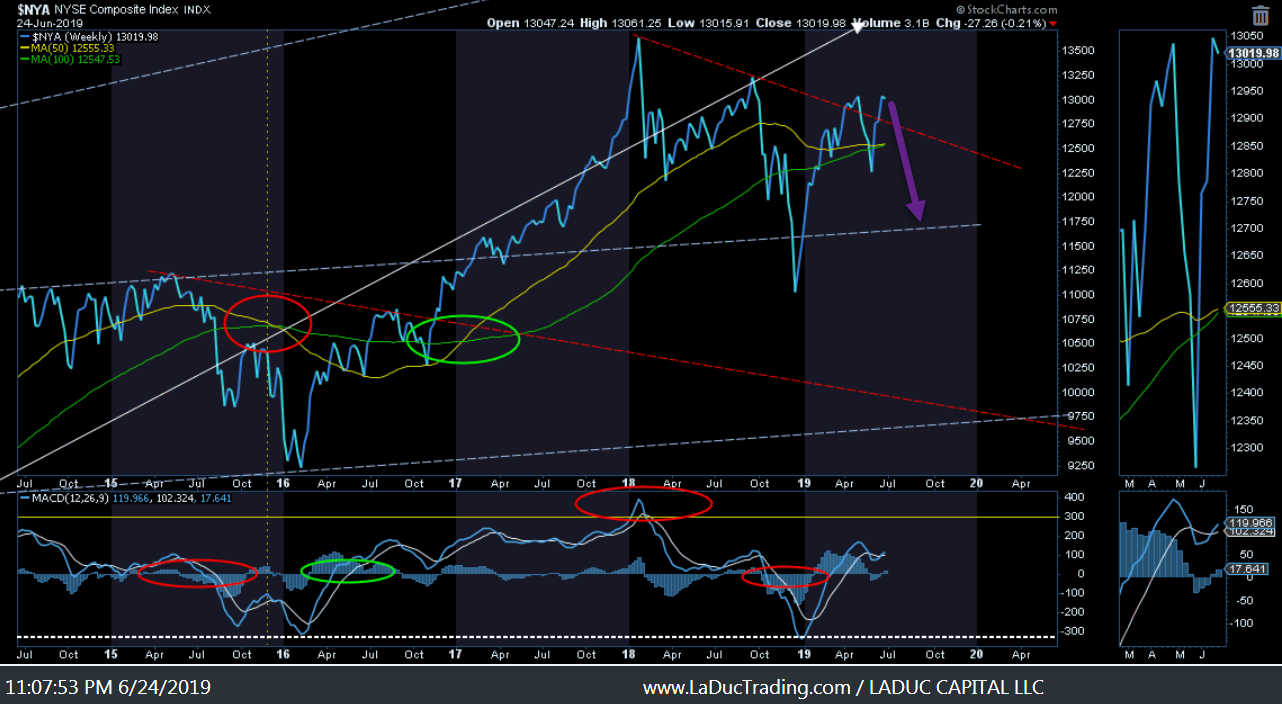

My Fave Indicator -NYA is still a short at $13,000 until it can get AND stay above it.

Every prior Fed-induced recession happened because the Fed withdrew reserves from the system, pushing up interest rates. It was the lack of money – the squeeze on reserves – that pushed interest rates higher and caused the recession. Rates themselves don’t cause recessions, it’s the reason rates move that really matters.Brian Westbury, Chief Economist, First Trust Portfolios LP

Volatility is just a blip but can quickly grow

$VIX weekly volume.. first green candle since late September..investors bought vol during all the last week. pic.twitter.com/KV8CYGWE9e

— 🅰🅻🅴🆂🆂🅸🅾 (@AlessioUrban) June 24, 2019