I have no idea what’s going on with these vicious swings, both to the downside then upside then downside, except to say end of month/quarter rebalancing is more eventful than usual. Seriously, the selling is very intense and very concentrated to Tech and it was a true Tech Wreck Tuesday.

$TWTR -12%

$NVDA -10%

$TSLA -9%

$NFLX -7%

$SHOP -6%

$FB -5%

$GOOGL -5%

$BABA -5%

$AMZN -4%

We discussed many of these in the trading room yesterday. We understood the TWTR carnage due to Citron short with $25PT – caught that in the trading room before the Citron hit piece even. We know TSLA was a slow bleed through $320 then even $287 100W support but after hours Moody’s downgraded TSLA so it dropped another $10. At least NVDA was news-driven in that they would suspend autonomous-driving testing after the Uber-related death. And we understand the FB price pressure even though Zuckerberg is supposedly testifying before Congress April 12th. SHOP is collateral damage to FB. And I guess you could say so is TWTR, although they defend their data as public not private. How will GOOGL fare, as they sell more user data than the rest of these internet plays put together?

My take: The selling seemed more calculated than machines. Perhaps the Market is pricing in tighter regulation and scrutiny of these high-fliers, not to mention the risk to these monopolies from threats of tariffs and taxes – not only outside the US where China and EU can increase their costs of doing business, but also the sentiment of user and buyer remorse that is sweeping the media outlets and dinner table discussions and may reflect a possible change in their positions of power. In short, the SPX 200D looks more than vulnerable across the spectrum of Tech and Semi selling. Yes, Semis are softer now that Treasury dept is proposing to ban China from investments in US semiconductor and 5G wireless companies. Today could add further color as we get the final Q4 GDP number from the Department of Commerce at 8:30AM ET.

Regardless, I expect more violent swings in stocks through end of week/month/quarter, and really into earnings season (which kicks off April 13), which will continue to test the resolve of both bulls and bears.

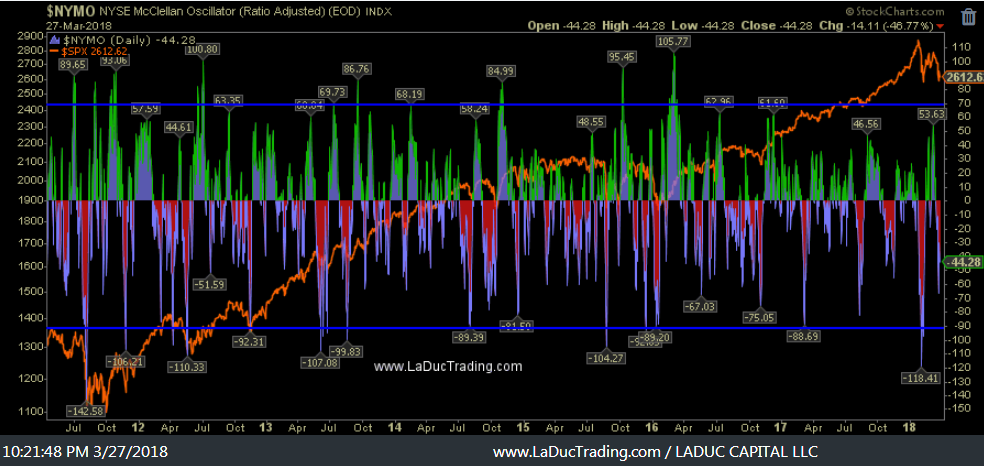

NYSE is not as oversold as February downdraft:

Nasdaq is almost as oversold as February correction:

And yet the NASI is still on a sell signal:

Market Moving News

The US Commerce Department releases its final estimate of fourth-quarter GDP. Last month, it revised growth down to 2.5% (paywall). Economists believe the tweak today will show GDP in fact grew at a 2.7% annual pace in the last three months of the year.

China will soon announce a list of retaliatory tariffs on a large number of major U.S. imports to China, according to the Global Times, which said the Trump administration’s tariffs, involving more than 1,000 products, would likely come by Tuesday

Stocks of Interest in the News

BlackBerry’s resurgence continues. BlackBerry, which has evolved into a software company, has seen its shares rise 15% so far this year, with recent deals including an agreement with Jaguar Land Rover to install infotainment and security software in its cars. Shareholders will find out how profitable these new partnerships are when BlackBerry reports fiscal-year earnings before the market opens.

Shares in Shire Plc jumped more than 20 percent in London trading this morning after Japan’s Takeda Pharmaceutical Co. said it’s considering an approach for the company.

Moody’s has downgraded Tesla’s (NASDAQ:TSLA) credit ratings and changed its outlook to negative from stable, citing a “significant shortfall” in Model 3 production and a tight financial situation.

Must read thread on $TSLA https://t.co/jmS5PaVNBq

— Samantha LaDuc (@SamanthaLaDuc) March 28, 2018

$AAPL – #Swing short idea: Goldman Sachs lowering June qtr iPhone units 6% below Street consensus to reflect ‘demand deterioration’; cuts PT to $159

$OLED – #Swing long idea: hearing Gabelli saying Samsung to return to OLED TV market, according to various sources.

$TNDM – #Swing long idea: Tiny insulin pump maker Tandem Diabetes Care (TNDM) scores an upgrade to Outperform. $30 stock a yr ago.

$LULU – #Chase long idea: +6.2%AH amid strong comp sales growth.

Today’s Markets

In Asia, Japan -1.3%. Hong Kong -2.5%. China -1.4%. India -0.6%.

In Europe, at midday, London -0.3%. Paris -1%. Frankfurt -1%.

Futures at 6:20, Dow -0.1%. S&P -0.1%. Nasdaq -0.5%. Crude -0.9% to $64.63. Gold +0.2% to $1344. Bitcoin +3.2% to $8037.

Ten-year Treasury Yield -3 bps to 2.75%

Events Calendar for Today

- 7:00 AM EST MBA Mortgage Applications Data

- 8:30 AM EST Gross Domestic Product (Annualized) for Q4…est. 2.7%

- 8:30 AM EST Personal Consumption for Q4…est. 3.8%

- 8:30 AM EST GDP Price Index for Q4…est. 2.3%

- 8:30 AM EST Core PCE QoQ, for Q4…est. 1.9%

- 8:30 AM EST Advance Goods Trade Balance for February…est. (-$74.4B)

- 10:00 AM EST Pending Home Sales MoM for February…est. up 2%

- 10:30 AM EST Weekly DOE Inventory Data

- 12:00 PM EST Fed’s Bostic speaks to financial professionals in Atlanta

Stay Safe out There,

Samantha