Table of Contents

The following is a summary of trade ideas plus Samantha’s market thoughts and Macro-to-Micro analysis presented from her live trading room. Not every trade set-up Samantha discusses will be captured in her trade alerts. Her focus for clients is on scanning and synthesizing market moving news, money flow, volatility and risk:reward for highest probability trading set ups across multiple asset classes and time-frames using stocks, options and futures. Samantha will make best efforts to offer up custom analysis for clients inside her trading room while also setting up risk-defined trades via her trade alert service.

Reminder: To activate/switch portfolios for any of the offered Brokerage-Triggered Trade Alerts, go to Manage Trade Alert Categories under your Membership Dashboard and update your preferences. Trade Alerts are sent via email and SMS (if opted in) as well as posted under the Trade Alerts page. To access the open and closed trades, go to Live Portfolios. Enjoy the review and please let us know how we are doing: Live Trading Room Trade Of The Day Feedback.

The Upside Catalyst for Equity Market’s Advance

Inspired in part by Charlie McElligott of Nomura with my own ‘spin’:

- Sentiment has turned higher as death rates have slowed – even as cases counted has increased in the US.

- Speculative vaccines have driven headline risk – for bears (MRNA after hours yesterday for example).

- Optimistic interpretations of COVID data and vaccine candidates (120 of them) underlie rationale for fund positioning.

- Price shock-down in March reversed with velocity in March back up and momentum continues.

- Volatility strategy players were taken out to the woodshed in March, so there’s that removed ‘suppression’ of VIX.

- US Monetary and Fiscal policies reign supreme even if it’s a case of Emperor With No Clothes.

- Worldwide Monetary and Fiscal policies are not letting up.

- Asset purchases of corporate bonds to stave off credit tightening is the new “Fed put”.

- US Dollar cash swap flows to stave off USD spike from EM shortage risk worked.

- Less bad economic data coming out of COVID lockdown continues to surprise positively.

- Trump is adamant about not returning to lock-down which is economic disabling to put it mildly.

- Fiscal stimulus needed to juice inflation expectations is kinda working and pulling US out of deflationary spiral.

- Velocity of ‘beats on reopening’ is causing shock-up impulse on future inflation.

- Crude has stabilized.

- Bonds could reprice lower if mortality doesn’t spike or better virus data comes in, fueling rotation into stocks.

- Less bad behavior in fixed income market will produce yields up; so will better economic data.

- Value over growth (cheap over expensive) wins when the above happens; expect yields to spike soon.

- High Tech crowded trades are bond proxies – low yields to justify their valuations. When that turns, look out.

- Pure momentum portfolio is long growth, short value. So when yields are agitated, cross assets shifts. Like this week.

- Rotation into left for dead value (economically sensitive, cyclical stuff over secular tech) is signal we are trying to make the turn.

- Gamma is largest force in the market and CTAs are neutral to long after covering shorts past 3 months.

- Implied notional equities still have room to cover shorts and have ton of room to add equities

- As Vol goes lower, position size can go higher. And vice versa (gross down on Vol spike)

- We can get some shock-downs but dips look to be buying opportunities into election.

- Desperate Trump likely to move to $3T fiscal policy (from $1T), with permanent fiscal stimulus from global trade break-down, monetary expansion WW, credit creation from companies drawing down revolving lines of credit… This is when investors realize they need to take down bond exposure.

- Big jobs beat, growth better than expected, core CPI beats – can create big moves in equity prices.

- A Democrats sweep in November election – even with higher corporate tax rates – will likely cause Fed to step in again.

But there’s always a “what-if”:

“Print too little money and we cascade off the waterfall like the Great Depression of the 1930s… print too much and we burn like the Weimar Republic Germany in the 1920s… fail to harness the trade winds and we sink like Japan in the 1990s” Chris Cole, Artemis Capital

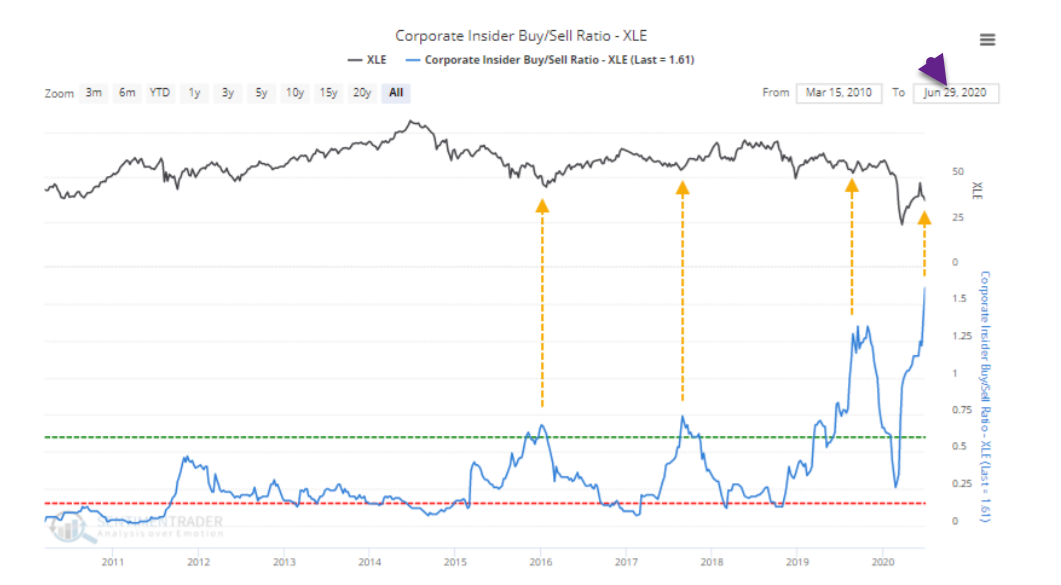

Insider Buying Where It Matters

My expectation is that Tech won’t “crash” but will start to give up some of its relative strength – just enough to help money managers look in earnest at “value” and other themed “reflation-plays.”

What Inflation Looks Like

The next trend that is emerging will favor things or hard assets. This is what the gold markets are telegraphing now. This trend will be inflationary driven by resource shortages and a tsunami of money printing. There are two things the markets aren’t ready for right now which are the return of high oil prices and inflation.

One of my intermarket tells for clients back in early May for higher. #lumber

$328.50 to $583.00 💃 pic.twitter.com/Qc3GoRvyiu

— Samantha LaDuc (@SamanthaLaDuc) July 14, 2020

Oil Shock Yet To Come

The markets have bought into the idea that we have reached peak oil demand as a result of COVID-19 and that we are entering a new green economy where electric cars will replace the gasoline combustion engine. This is utter nonsense and wishful thinking. Electric cars make up only 0.3% of the global car fleet. Green driven cars are heavily subsidized by the government. Without those subsidies, they wouldn’t be able to stand on their own. We will be driving combustion driven cars or hybrids for decades to come.

The End of Money: From Paper to Things, Jim Puplava

And what would further help the commodity and value plays moving forward? Yes, infrastructure bill and fiscal policy boost, but so would a lower US dollar.

USD Makes The Weather

Here’s my cheeky, broad stroke thinking on USD direction:

USD Weather Forecast

BoJ balance sheet is similar in size to US 🤯 despite Japan only having 1/4 of the GDP 🥺

US-QE-COVID has added 75% to the BS with room to go 🤮

Eurozone + Japan have less room to maneuver AND Less inflation than US ⚠️

A stronger euro + yen = USD ⬇️$DXY pic.twitter.com/ZtRiyidzyE

— Samantha LaDuc (@SamanthaLaDuc) July 14, 2020

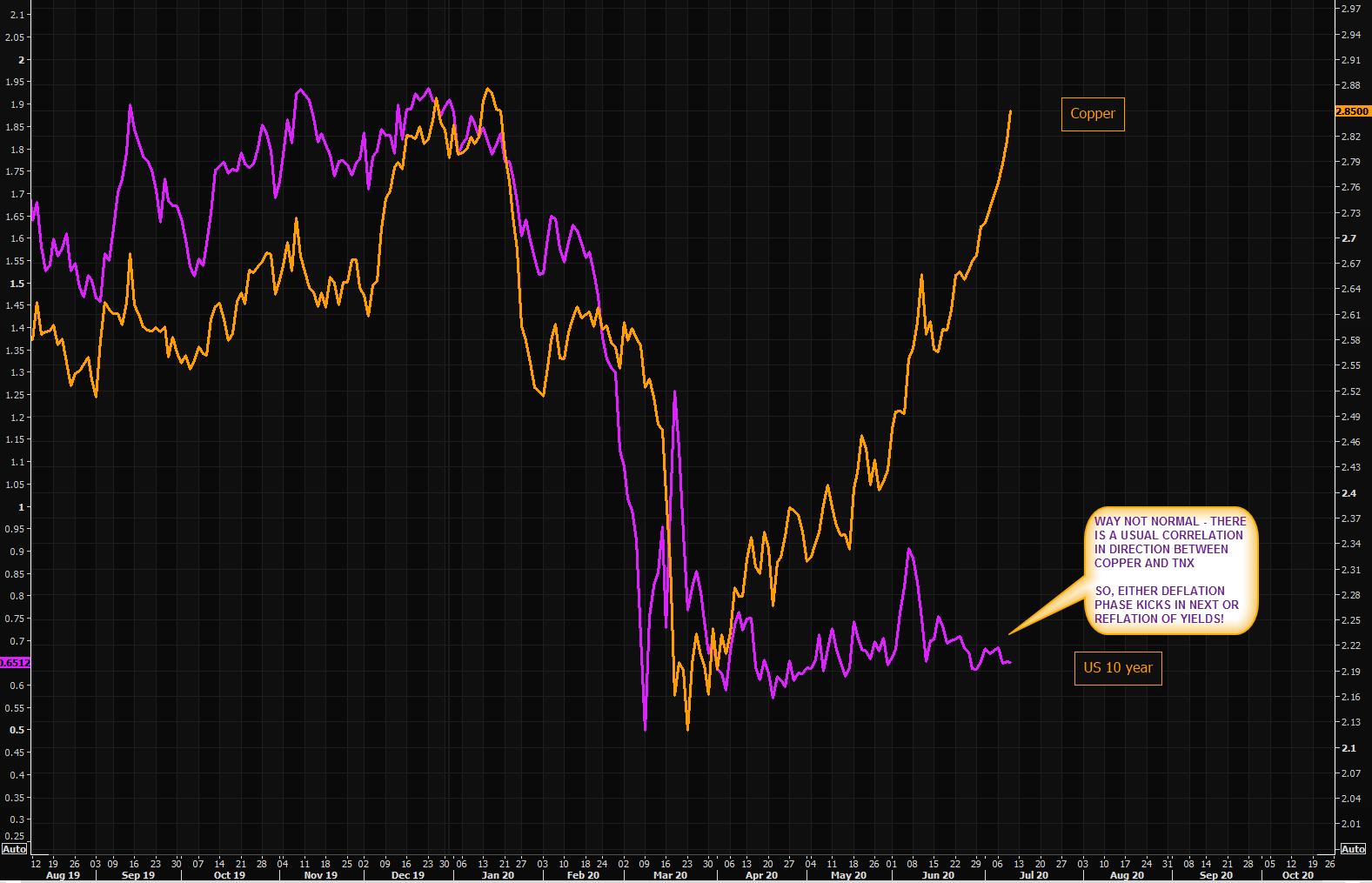

Rate Spike Coming

More than anything else to support my reflation theme… we ‘need’ yields to pop.

Curious timing today on the YCC talk AND guidance

…following yesterday's $NYFANG+$QQQ drawdown, $VXN spike and today's YUGE loan loss provisions…

Just sayin' 10y breakevens > US real growth is not market friendly if yields catch up so Fed may be trying to avert your eyes. https://t.co/gYMzwmHzRo

— Samantha LaDuc (@SamanthaLaDuc) July 15, 2020

BEST GUESS RATE SPIKE THESIS FOR TNX:

- Week of July 20th for a quick snap higher in TNX as we approach deadline for unemployment insurance extension.

- Within 3 weeks, we should have a lot of excitement build around inflation breakevens.

- Within 6 weeks, TNX is closer to 1%.

- And with that QQQs stay ‘bid’ through July and then drop into August and September.

- Overall Market likely holds into mid September – with more volatility/less liquidity swings – as November elections draw near.

- Inflation in raw materials, food, industrial metals, drugs and health care.

- Sectors for Growth: Infrastructure, Health care, Home improvement, Home construction, Internet, and Renewable Energy.

- Stocks of Interest: Staples and Household Products (food, cleaning products, personal products, packaging and containers)

- Monetary conditions (Fed and Treasury) suggest limited downside, regardless of which party takes office, until early 2021.

Today’s Action

In one chart: Freaken Bullish under the surface… for the details, see the recording of my live trading room. There was A LOT to cover.

Richard said my trade alerts reminded him of “Pinball Wizard”. Let’s hope so…