Repo and Federal Deficit

Recently I tweeted:

Totally unrelated but curious how Repo infusions => Treasury Department’s budget deficit which is $389B in the first four months of fiscal 2020. That’s a 25% gain over the same period last year and already about 40% of the total deficit for fiscal 2019.

Aaaaand, Today’s Repo was The Most Oversubscribed Since Repo Crisis …

So why does this matter?

There are simply too many bonds (or, in the language of the repo market, “collateral”) sloshing around in the financial system and not enough cash on the other side of the trade. America’s budget deficits are being financed domestically and leading to a relentless drain on reserves – Bloomberg

With that, our Fed is the backstop. They issued massive treasuries in 2019 and needed to backstop with CASH so they are truly the ‘put’ or floor on market selling as they flood liquidity into the money markets which then finds its way into equity and credit markets. By swapping reserves for short term bonds, it is supposed to prevent a shortage of reserves – which would spike interest rates – but it has instead been used as a source of stimulus.

And herein lies the rub: The Fed Balance Sheet must then never go down again, or we’ll have a shortage of reserves again, and if we have a shortage of reserves again, we have REPO MADNESS and rates spike. That would be disastrous to the plumbing of the money markets at the same time funds that use the collateral as leverage for their trading activities would need to stop, unwind, cover, close.

Therefore, it is assumed in the markets that the REPO window will stay open – until, at the least, they start up QE4 – and this artificially suppresses interest rates.

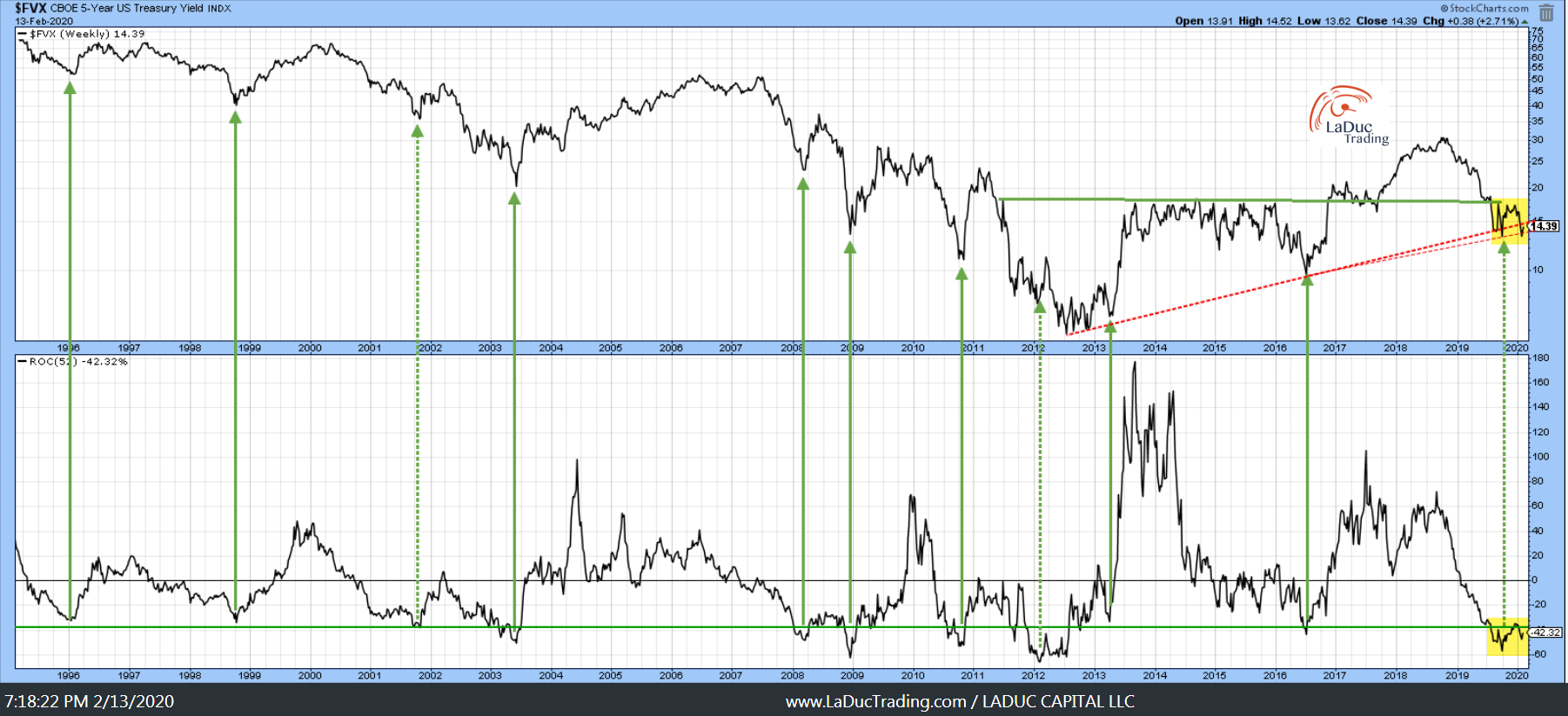

Rate Inflection Point

And as clients know, I’m still bullish yields– it just needs time.

And we may have just had the macro trigger to spike rates.

BREAKING: Fed to beat a faster retreat from repo market.

The New York arm of the Fed announced on Thursday that it will further cut the size of its interventions in the repo market, where investors exchange high-quality collateral such as Treasuries for cash. It is the latest step in its attempt to wean investors off the funding it has provided since short-term borrowing costs spiked in September.

Further, as discussed in prior posts, and as explained extremely well in this RealVision interview (minutes 50:40-54:40), when the Fed weans money away from market participants, rates will rise! And then what?

Will this be the start of the trend reversal in interest-sensitive, debt-financed Tech darlings?

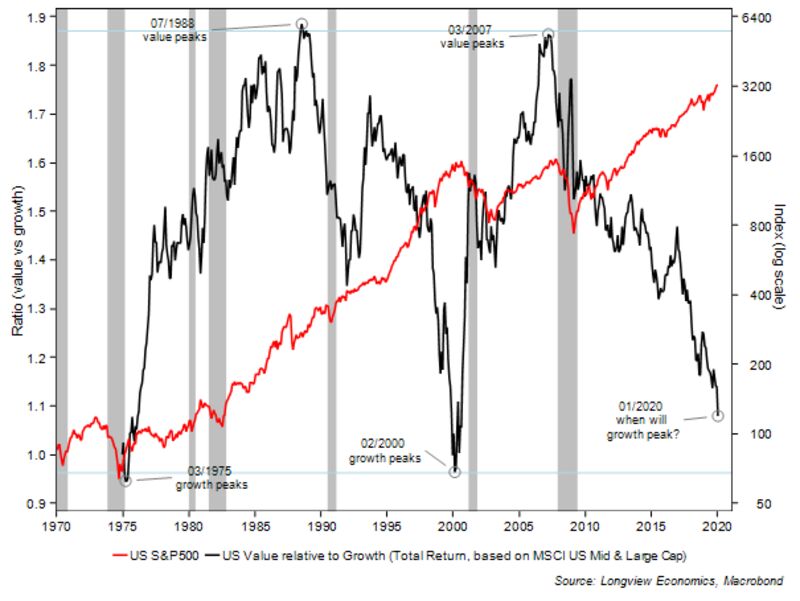

Value: Time to Shine?

Value stocks are almost as cheap as at the peak of the dot-com bubble! @johnauthers

Big Picture, Value stocks hit a low in February 2000 before peaking in March 2007. Its under-performance since then has been severe but not as bad as the troughs of 1975 and 2000. Are we soon approaching the “end of a cycle” when Value typically takes over?

Another way to look at it is from this ratio of Tech to Energy. The only way this ratio goes up is if Tech stocks go down so money rotates into oversold Energy and Commodities.