(Meant to hit Publish on this post Monday – apologies – I was working on a big piece: Indices are Hanging Out Not Breaking Out, which is going out next!)

Market Thoughts

Generally, I am expecting markets to trade lower but recent snake-like action has been chopping me and others up as we expected Fall trading volumes and direction to resume. As of Monday it hadn’t! SPY volumes were the lowest on Monday for the year!

Here’s my thinking in one chart from last week and why I shorted Small Caps IWM: Above is Bullish, Below is Not

You can follow my actual trades here:

Brokerage-Triggered Trade Alerts!

On the main geo-political stage coming up:

President Trump will meet with Japanese Prime Minister Shinzo Abe in the week ahead at the annual United Nations General Assembly amid high expectations that a trade deal will be finalized. Heading into the meeting, Tokyo reportedly wants written assurances from Washington that it will not impose hefty tariffs on its auto exports before a finalized deal on farm goods and digital trade is inked. Seeking Alpha

Earnings Calendar

#earnings for the week$MU $NIO $AZO $KMX $NKE $BB $RAD $CMD $ACN $UXIN $JBL $INFO $CAG $DAVA $MANU $SNX $FDS $KBH $UEPS $ATU $CTAS $MTN $AGTC $WOR $PIR $ISR $DLNG $CAMP $AIR $FUL $PRGS $CMTL $DYNT $RBZ https://t.co/lObOE0dgsr pic.twitter.com/aesScOoFQd

— Earnings Whispers (@eWhispers) September 21, 2019

AMZN hosts its Hardware Media Event on September 25. A refresh of the Amazon Echo family and some Amazon Fire hardware announcements are anticipated.

Analyst/investor day events: BABA, BBY, DELL, GPK…

FDA and drug updates: A FDA action date arrives for Johnson & Johnson’s (NYSE:JNJ) Darzalex combo for certain multiple myeloma patients. A FDA Advisory Committee meeting is also scheduled on Merck’s (NYSE:MRK) montelukast allergy treatment. At the World Sleep Congress in Vancouver, Jazz Pharmaceutical (NASDAQ:JAZZ) and Avadel (NASDAQ:AVDL) are due to present trial data.

Barrons Mentions: The impact of the opioid crisis for investors is broken down in the cover story. In a sobering appraisal, liability from opioid lawsuits is estimated to range from the hundreds of millions to double-digit billions for Johnson & Johnson (JNJ), Teva Pharmaceutical Industries (NYSE:TEVA), Endo International (NASDAQ:ENDP), Mallinckrodt (NYSE:MNK), Abbott Laboratories (NYSE:ABT), Amneal Pharmaceuticals (NYSE:AMRX), Mylan (NASDAQ:MYL), McKesson (NYSE:MCK), Cardinal Health (NYSE:CAH), AmerisourceBergen (NYSE:ABC),Walgreens Boots Alliance (NASDAQ:WBA) and CVS Health (NYSE:CVS).

Economic Calendar

Macro Matters

Negative Interest Rates are just plain negative. This, just in:

Danish and Swiss Banks to Charge Customers 0.75% Interest on Large Deposits.

This means 1) deposit flight 2) less money in circulation to finance the economy 3) real economy weakens.

Economy stagnates.

@MishGEA https://t.co/akUWf4M0cM

— Daniel Lacalle (@dlacalle_IA) September 22, 2019

And my repeated warnings past few weeks about holding Unicorns – specifically companies as part of IGV + FFTY sectors:

WeWork Business Model Is Systemic Risk To Economy, Fed’s Rosengren

If you own Unicorns – in $IGV $FFTY – because you figured “Well if WeWTF can do it then these other Unicorns are surely better ‘value’”…

you might be in for some turbulence coming up 😬#GrowthValueRotation#CreditLeadsEquities https://t.co/UzsMLNBQC8— Samantha LaDuc (@SamanthaLaDuc) September 22, 2019

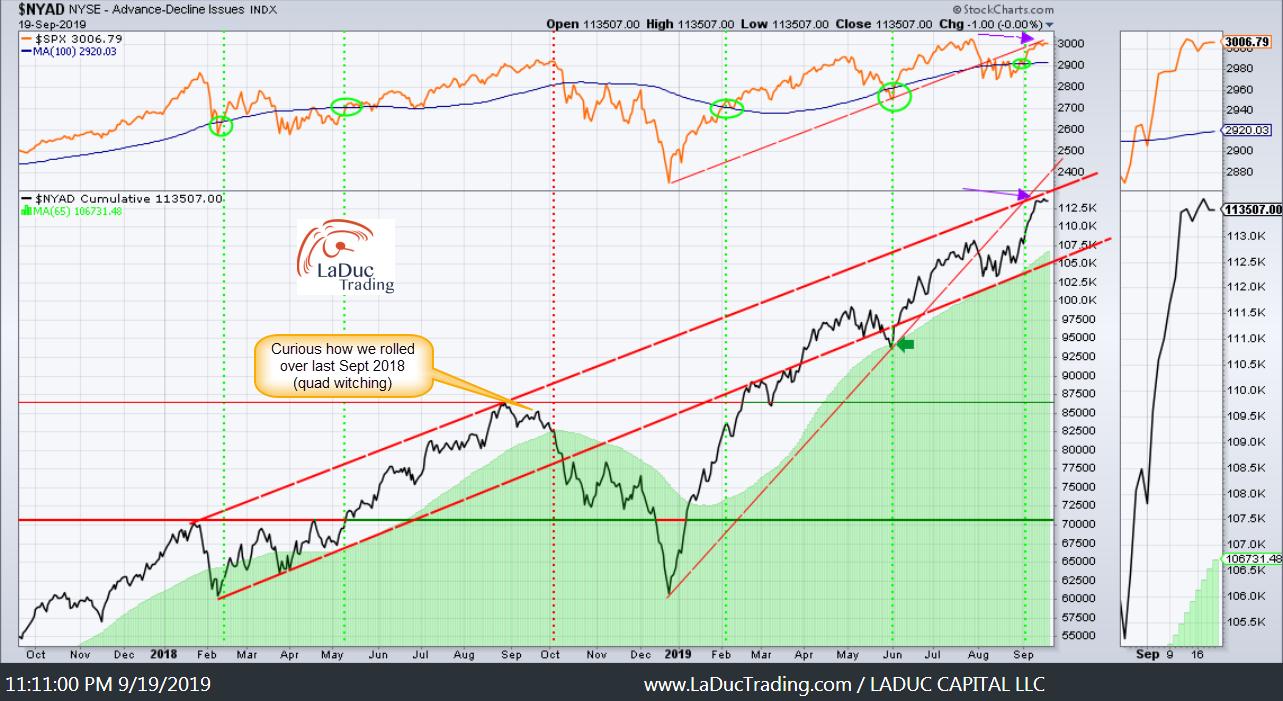

And why I published this chart Friday to show how post-September Quad Witching had some rather ominous history lessons for us:

Remember, I run a LIVE Trading Room and offer Day or Week Passes so set sail any day!

Looking Ahead: BOJ

I will be interviewed by DailyFX on Wednesday so I wanted to update my Yen call that I made last time I was interview June 6.

I can say I am still spying a Yen Nearing Escape Velocity, so naturally, I’m watching the USDJPY. And with that, these two articles caught my attention last week.

while the BOJ may have succeeded in keeping yen bulls at bay for now, it also has to prevent markets from pricing in an October easing too heavily and cornering it into action.”

😉 Good Luck With That!$USDJPY https://t.co/rXtxiqQ2oT

— Samantha LaDuc (@SamanthaLaDuc) September 20, 2019

DOLLAR-YEN

CARRY-TRADE

SIDE-EFFECTSFrankenstein – on steroids:

*800K active forex accts

*Japanese RETAIL Trader

*10X LeverageA Japanese Dilemma the BOJ house built – currency speculation! $USDJPY

“We don’t know what will happen to our pensions.” https://t.co/lo8zPXjL5r

— Samantha LaDuc (@SamanthaLaDuc) September 19, 2019

Along that theme, I grabbed these insights from Twitter:

The JPY has huge money offshore which repatriates and that pushes the yen higher. @RaoulPal

There’s been a large surge in FX unhedged outflows from Japan in recent months with estimates suggesting 25-40% foreign bond exposures unhedged. A rise in hedging will push USDJPY significantly lower. 100 beckons! @GauravSaroliya

My Interpretation: Right now we have a strong US Dollar. When this trend reverses, it will be negative for Bond holders. The result will also be bad for JGB as investors unwind their long JGBs & Bunds, forcing UST yields higher. We shall see!

Don’t Miss: Macro-To-Micro Power Hour

Where Jerremy Newsome and I talk active trading and answer your questions live!