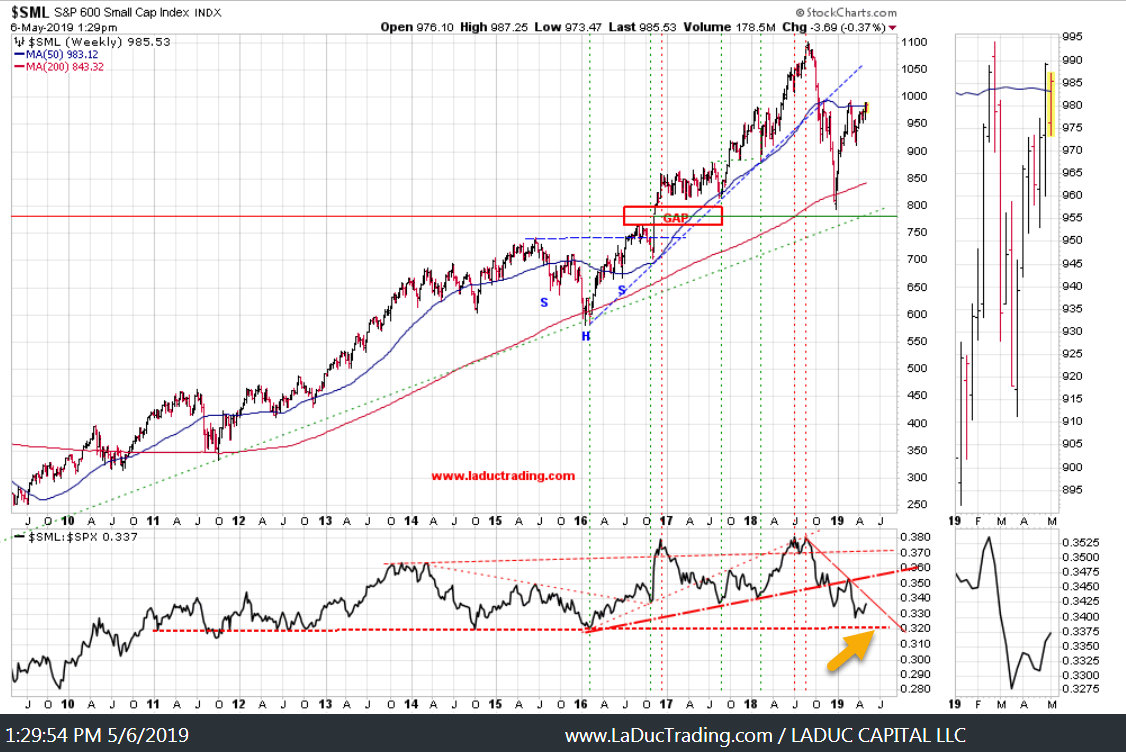

There are two sectors that could change my Bearish thesis to Bullish: Small Caps and Transports.

Small caps have lagged SPX, Nasdaq and Dow, which in and of itself represents risk of further pullback into the yellow arrow (bottom panel) and gap fill (upper panel). Correcting in time not price, is another take, but speculation in small caps is needed to keep the rally running and right now the momentum has more than slowed. I would be more bullish this sector if it actually moved higher, breaking out above the red trend-line (lower panel).

Transports relative to SPY are also more than weak. Should the below pattern turn out to be an inverse Head & Shoulders, then I would be uber bullish the market – especially if this ratio breaks above the dark blue trend-line. Having said that, I am not expecting it.

Emerging Market Stress

Markets around the globe were stressed today after Trump’s tweet of impending China Tariffs. Given the following two charts I grabbed last week for this post, I’m not surprised Shanghai dropped 6% last night. Not only did the charts intonate lower but last week we had other signs:

- Copper took out 3 mos of gains in one day last week

- $HYG/JNK/WTIC all spiked down hard last week

- Trump/Kudlow pushed Fed to drop rates 1% immediately following a 3.2% GDP print

- A $2T Infrastructure Bill was touted loudly in the media which is a fiscal policy best kept for when the market goes South – not at all time highs

China margin trading – spurred by PBOC easing and fiscal policy – had a look of rolling over just as my read on Chinese equities looked ready to drop below double trend-lione support (2nd chart).

This is the chart I showed in my Live Trading Room last week. After Trump’s Tweet, China closed at $2,906.46 −171.87

A record high number of Chinese listed companies made losses in 2018 and the situation didn’t improve much in Q1.

Notably, the number of companies that attributed the losses to good-will write-offs also hit a record high last year. @YuanTalks

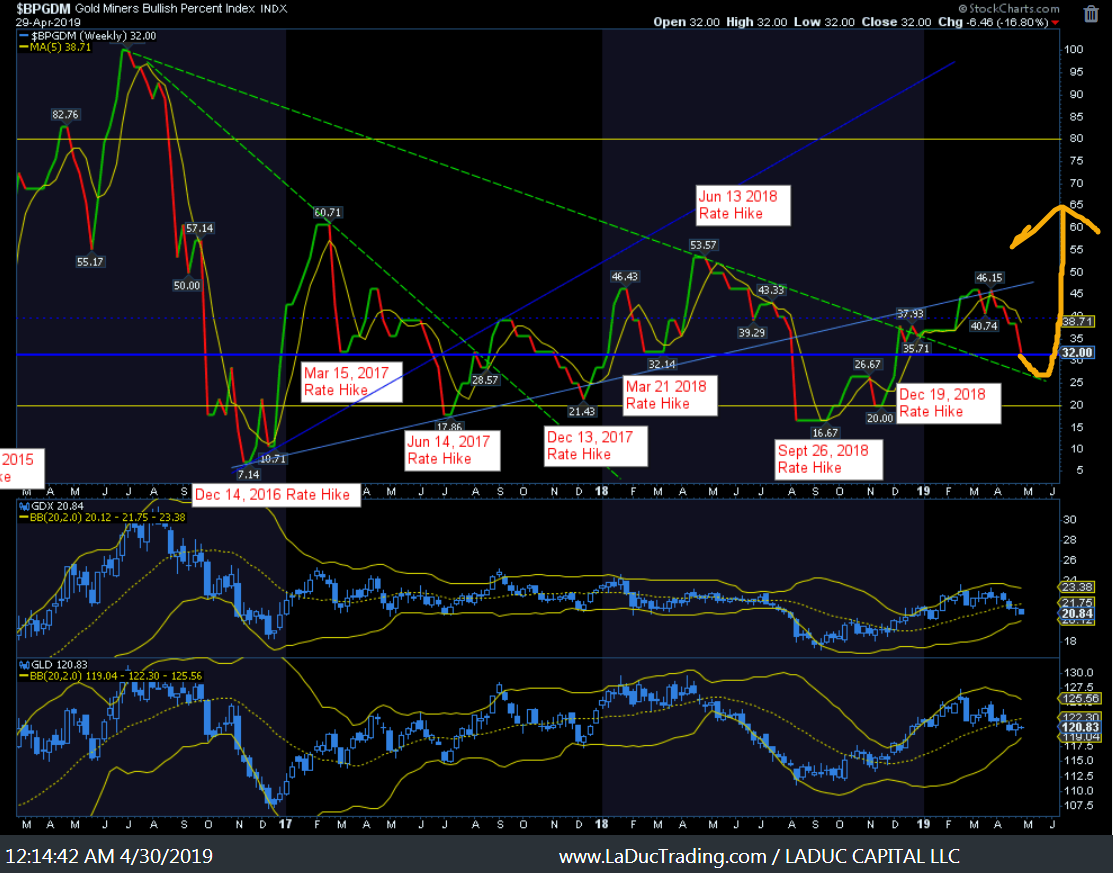

Gold Lost Some of its Luster

I am not expecting a big down move but softening into the June FOCM meeting, where I would expect Seasonality and potential proposed lower rates would help give Gold and Miners a boost – maybe a turbo charged one.

Oil WAS a Tailwind

Two weeks ago, Crude ran into its 61.8% Fib and pulled back. Then last week HYG and JNK dumped hard on Tuesday. They were the Tell that Oil would fall when inventories showed a huge build. Oil + Gas plays clearly followed and XLE is currently below $64 support.

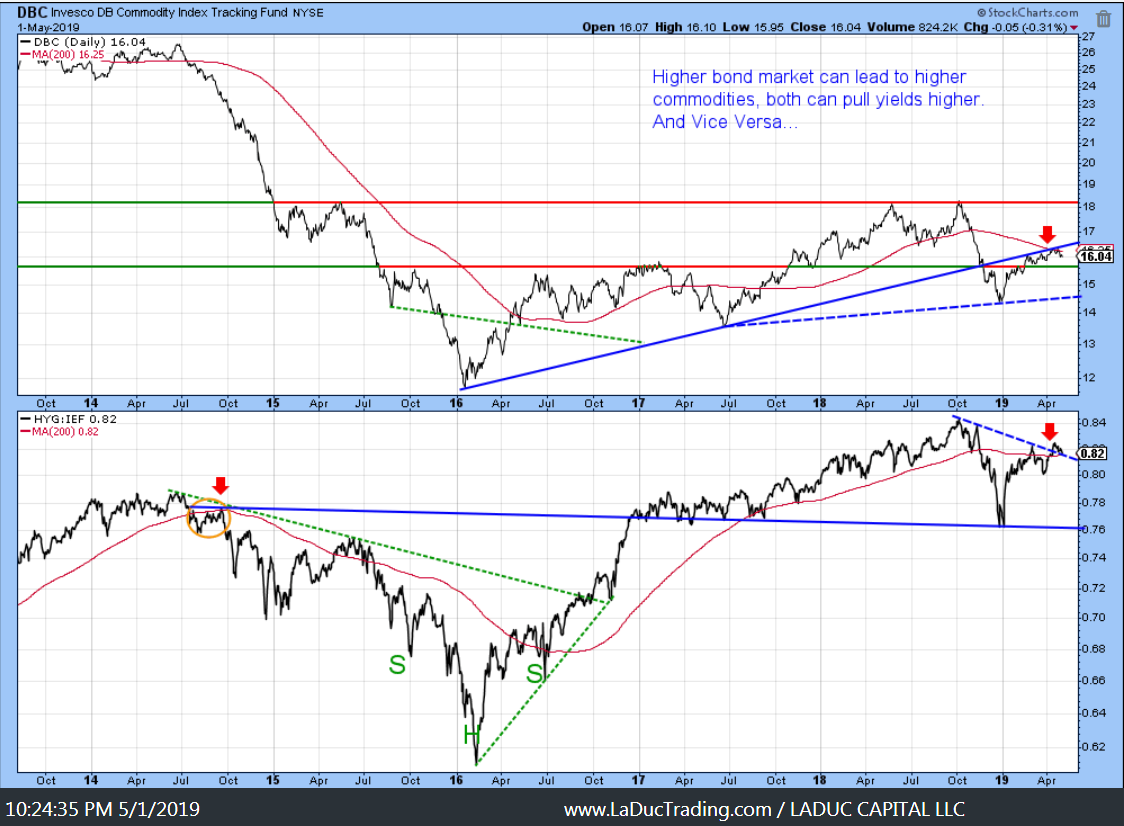

Commodities Are In A Tight Spot

I will keep showing this chart as proof that Commodities are under pressure until these resistance levels (red arrows) can be overcome.

Speaking of commodities under pressure, Copper was a Tell that US-China Trade Talks might not be going so well…Copper basically took out 3 months of gains in one day last week.

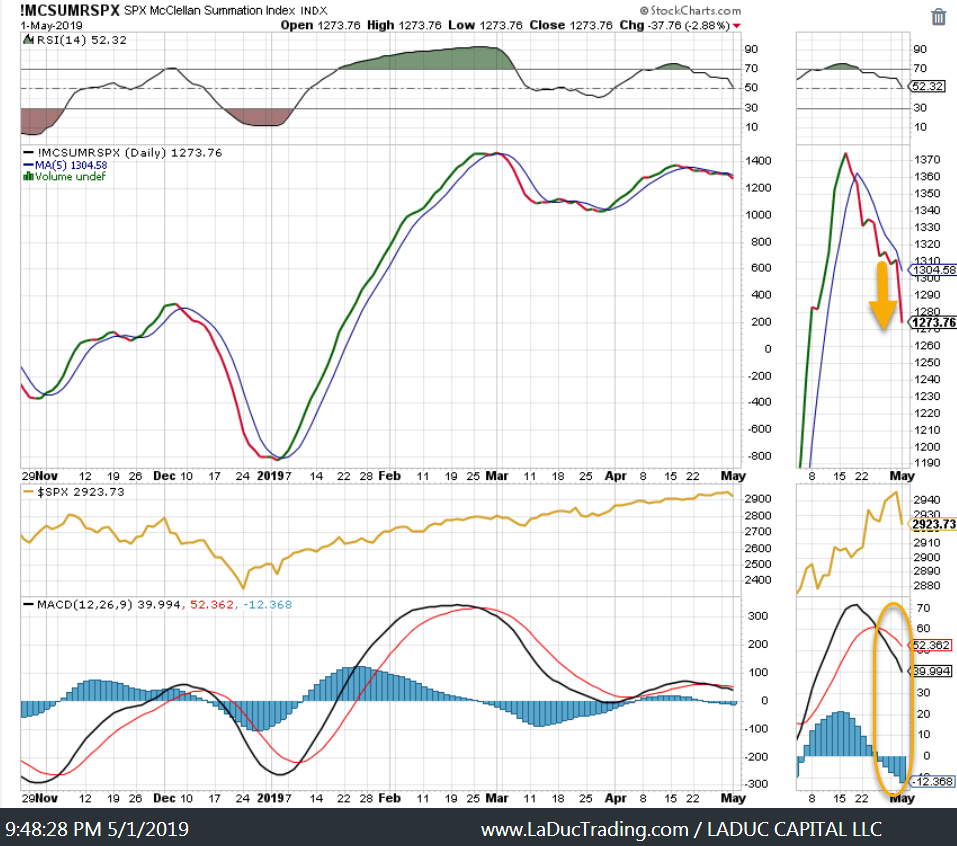

Breadth is Slowing

SPY breadth is weak under the surface as demonstrated by the McClellan Summation roll-over – despite headline news of All Time Highs.

Nasdaq has 50% of its components below their 50D but for a good read on future direction, my fave indicator is the NASI which graphically represents weakening momentum.

Roadmap Reigns

Basically, my roadmap chart for trading is still the NYSE and it is still rising – tagged 13,000 area as predicted – although pausing to digest the V-shaped run which I have talked about since December 12th. I have no Trend Reversal confirmation – yet. I’ll let you know when I do.

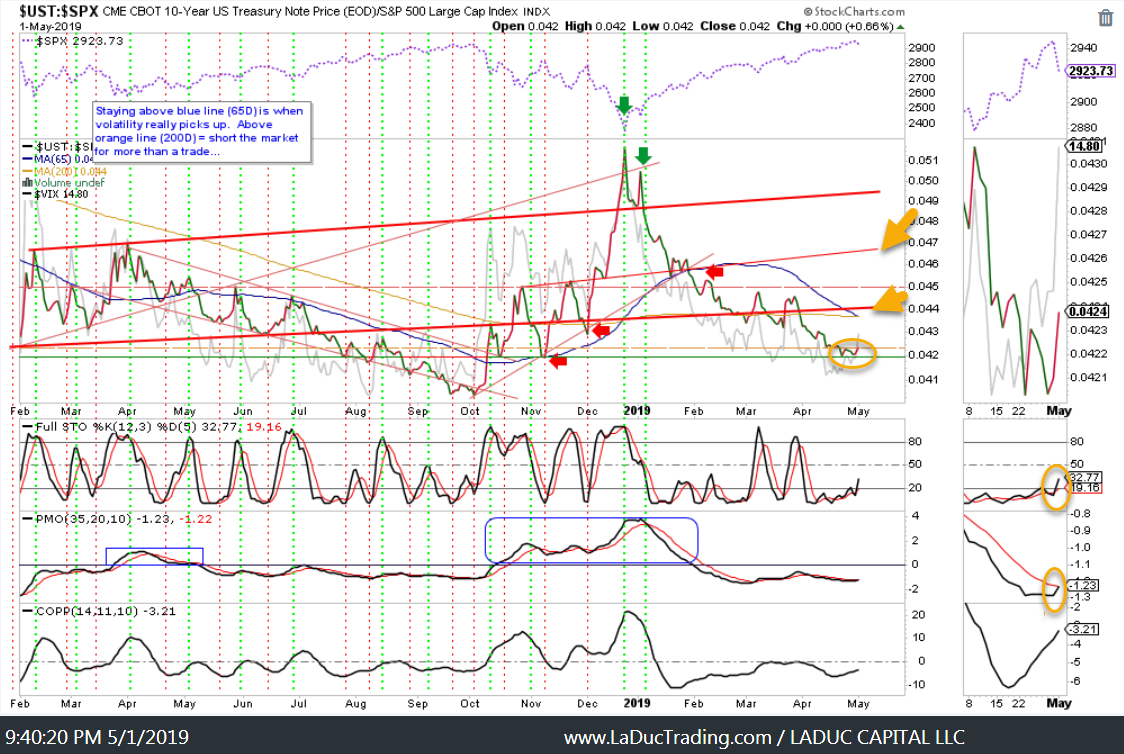

Lastly, my Stock-Bond Volatility Ratio is intonating a bounce is due – which WE JUST HAD LAST NIGHT – so now I will be looking for follow through.

And Bonds will move violently I’m guessing as soon as a Trade Deal or Tariffs are announced – maybe even as soon as this Friday!!

Don’t Forget To Hedge!!

Samantha