EARNINGS AND GDP

Earnings last quarter 2017 saw double-digit earnings growth but stocks fell on great earnings – the opposite of late 2016 when the earnings trough showed companies with negative earnings had stopped falling after they reported. So here we are in Q1 2018 and FactSet has the estimated earnings growth rate for the S&P 500 coming in at 17.2%. For Q1, all sectors are expected to show growth in earnings. And companies have been ratcheting up EPS guidance at the highest rate on record.

Analysts have basically given companies a pass in 2018, thanks to tax cuts, so beating isn’t the question – as of Friday, 80% of the S&P 500 companies that have reported have beaten earnings estimates and 72% have beaten revenue estimates – it’s guidance and what happens when they don’t guide higher than expected that matters (aka TSM, largest AAPL supplier, dropped 10% in breathtaking fashion last week on weak guidance).

So all eyes will be on US GDP print this Friday. And at a 2% consensus, we’re setting up for a positive surprise on US GDP Friday but….Recently, GDP was revised down by Morgan Stanley for Emerging Markets and China – by as much as half for 2019. Why it matters: slowing growth around the world will hurt U.S. multinationals, and China is a major source of U.S. multinational sales growth.

Chinese yield slide may pose greatest danger to emerging markets: Morgan Stanley cut its estimates for emerging-market earnings in a separate note earlier this month, and is now expecting growth of 10 percent in 2018 and 5 percent in 2019. That compares with consensus estimates of 23 percent and 11 percent respectively, according to data compiled by Bloomberg.

That’s the theme it seems: any firm that doesn’t have stellar 2019 guidance likely gets hit. And when is the last time they had to reach THAT far out to impress? Color me skeptical, but I liked buying into that Earnings trough in 2016, and as such, I am less excited about buying the earnings peak now, even after a 10% pullback – twice. I will trade it, however, after the risk premium is out with the economic growth for Q1 on April 27th. That’s the bull’s hope for a better read on how tax cuts have impacted growth and the growth number will likely beat, in comparison to last year’s soft quarter. And my guess, market participants know that, just like they ‘knew’ banks would beat and still bank sold off anyway. Is Tech next?

BANKS AND RATES

Combined Q1 earnings of GS WFC JPM BAC and C rose bigly thanks to lower corporate tax rates BUT Wells Fargo would have seen earnings decline from a year ago, and Citi and BofA would have seen no growth, if tax cuts were stripped away. Without banks participating however, the current rally will likely fail. Even with commodities screaming higher. Especially with commodities screaming higher as they foretell higher rates, inflation, costs that will squeeze debt servicing and profits. And a continued climb in market interest rates could slow this bounce in stocks – at least until we get a better read on GDP growth data, where we can weigh the evidence for higher or lower.

FANG FUMBLES

Amazon and Netflix are stocks with little or no profit but terrific growth – rallying in a parabolic fashion. Apple and Facebook, on the other hand, post solid earnings and have to date pulled back dramatically. GOOG/GOOGL announced strong growth last night but hasn’t held the AH move, selling off perhaps as $3.40 of the EPS beat was due to accounting changes.

There is the bullish argument … that hotter earnings triggers hotter economic growth. But let’s face it, this post-correction period has been very choppy – not V-shaped – and I expect more headline risk and policy mis-steps and guidance disappointments as we migrate from monetary to fiscal stimulus. We just need Q1 earnings and economic data to confirm and right now they look to be getting ahead of themselves.

P/E MULTIPLES AND REAL GROWTH

It is assumed companies will use little of their tax cut/repatriation money on wage growth or capex and more on stock buy-backs and dividends. And with P/E multiples dropping of late, exciting some bulls, what is appropriate multiple to pay for post tax-cut earnings almost 9 years into this economic expansion? Does it make a lot of sense to forecast aggressive future growth as the FED raises rates and rebalances its portfolio taking liquidity out of the market? Does it make sense to pay peak multiples for stocks when real growth is slowing, globally? Can real growth exceed expectations?

2018 PREVIEW

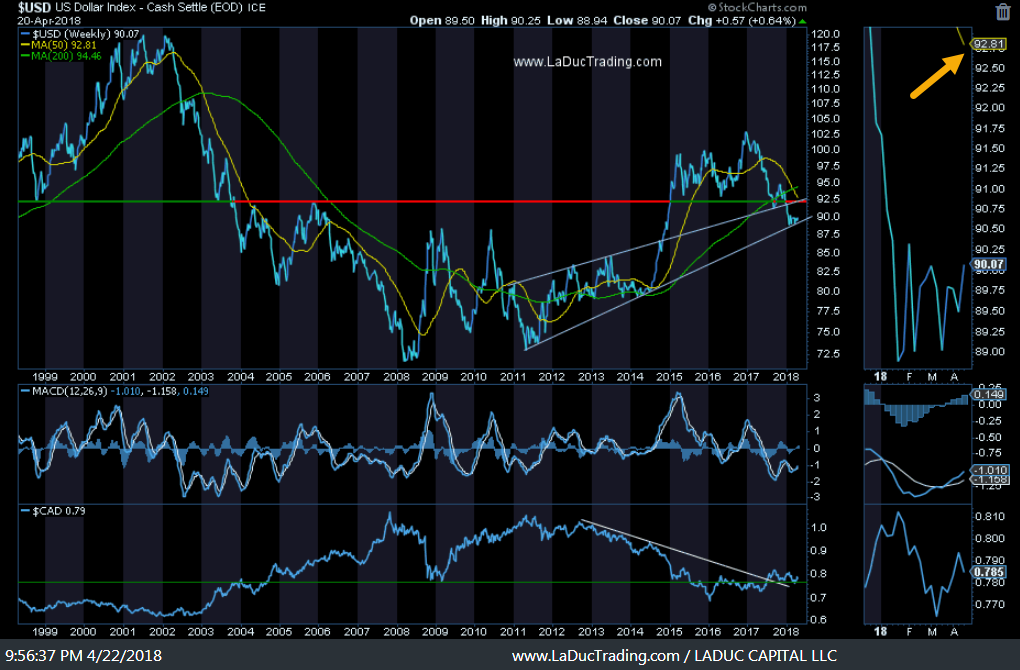

We ran up post Presidential election on the rumor of deregulation, tax cuts and repatriation of USD. Ever since we got the news, we have been selling off, helped by a depreciating US dollar. The Trump Bump turned into the Trump Dump in February, but we are not at price levels last seen at the 2017 US Presidential election. Still, I can’t help but wonder if the earnings season ‘high bar’, helped by Q1 2018 tax cut impact, along with potential tech regulation and political/currency shocks, creates an environment ripe for a revisit to SPX ala Nov 2017 – another 10% lower.

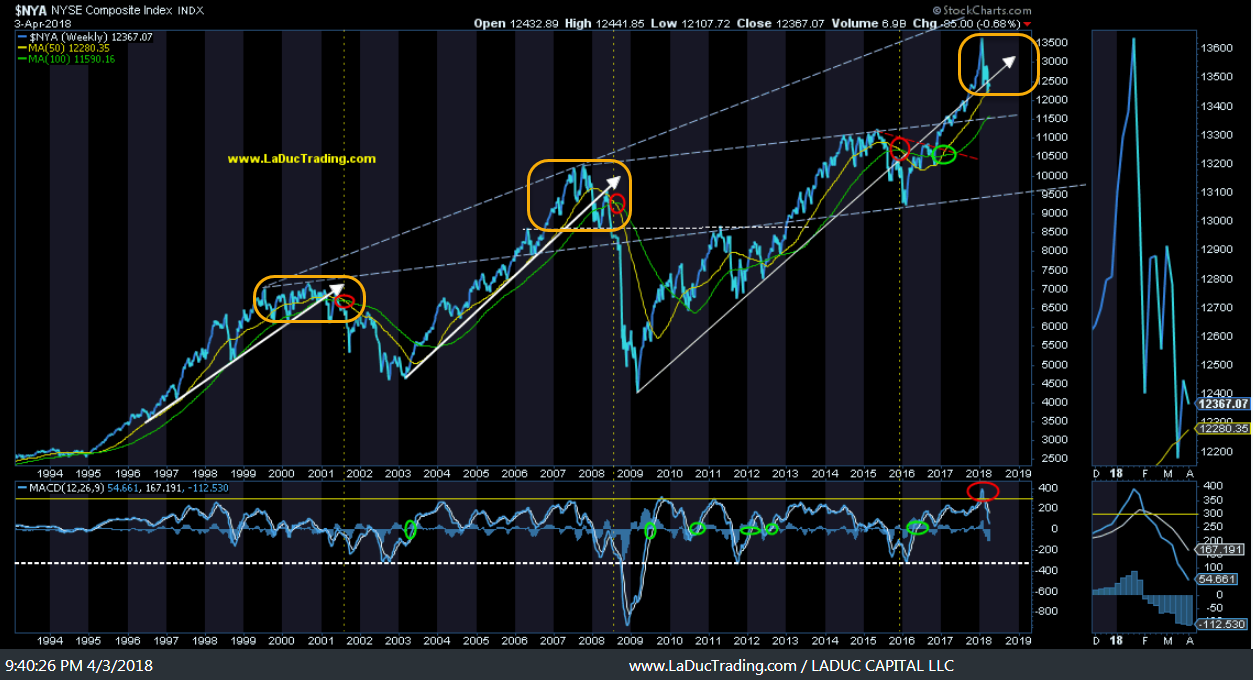

Outliers with Velocity Revert

A distribution top in the making:

Peak COT data in USD shorts, EUR longs…and what will that do to those funds long Crude 15:1 should US dollar move higher?

Stocks of Interest

NFLX short, DIS long

HBI and select retail as bottom fishing plays

GE, maybe

At LaDucTrading, I analyze price patterns and intermarket relationships across stocks, commodities, currencies and interest rates. I develop macro investment themes to identify tactical trading opportunities and employ strategic technical analysis to deliver high conviction stock, sector and market calls. Through LIVE portfolio-tracking, across multiple time-frames, my real-time Trade Alerts via SMS/email frame my Thesis, Triggers, Time Frames, Trade Set-ups and Option Tactics. I selectively use Unusual Option Activity (UOA) and Deal Flow but no proprietary indicators – just solid chart pattern recognition, volatility insight and some big-picture perspective thrown in. Twitter: @SamanthaLaDuc