At LaDucTrading, I analyze price patterns and intermarket relationships across stocks, commodities, currencies and interest rates. I develop macro investment themes to identify tactical trading opportunities and employ strategic technical analysis to deliver high conviction stock, sector and market calls. My annotated Charts are meant to do most of the talking and illustrate my Thesis, Trigger, Time Frames, Trade Set-ups and Option Tactics. When applicable, I note Unusual Option Activity (UOA) and Deal Flow. I also keep a Tally and follow a Trade Plan, both of which are made available to members. No proprietary indicators are used, just solid chart pattern recognition, volatility insight and some big-picture perspective thrown in. Don’t hesitate to contact me with questions or comments: [email protected].

The LaDucTrading Gone Fishing Newsletter is divided into basically three parts:

- Reflections and Inflections

- Events This Week and How I’m Trading It

- Macro Considerations

Reflections and Inflections

Despite a negative week for rates (TNX -3.33% and with that XLU +2.5%), banks (BKX -1.6%), transports/airlines/rails (TRAN -2.8%, XAL -2.7%), crude (-1.9%), and USD (-1.3%) last week, the FAANG names saw the NDX gain 1.4%, mostly thanks to Netflix. The Euro Stoxx 50 and DAX Index however made 4 month lows. As I mentioned last week, emerging market debt chart was clearly showing a negative divergence with EEM, and EWG was a bullish chart with a bearish MACD divergence. Another case where Credit leads Equities! Stoxx lost 2.1%, DAX lost 3.1% for the week. This coming week may see stabilization in Europe, or not, with first meetings between UK and US officials to explore post-Brexit trade deals and German/UK inflation reports. If European markets don’t stabilize, some of that weakness could spill over to the US.

I want to be short oil, both technically and fundamentally (among other reasons CSX reported in their earnings conference call that crude oil trains have dropped to zero) but I do not dare get in front of the OPEC meeting Monday in Russia where it is likely they get production cuts from Nigeria and Libya at the very least. A bigger move would be Putin conspiring to help Saudi Arabia with production cuts in order to drive up the price of oil prior to their 2018 Armaco IPO. Then it was reported this week that the House & Senate negotiators reached a deal on a Russian sanctions bill including the ability to block the White House from easing penalties. Trump was not happy based on his tweet dissing the GOP. I’m more interested in Putin’s reaction. He didn’t turn more diplomatic when Obama had sanctions levied. Since Putin has amassed power over Trump, it feels we are about to enter a new level of gamesmanship and game theory and the battleground will be oil. Should Putin push back, he could collude with the Saudi’s to drive oil prices lower first, which would put US shale companies, and their banks, on shaky ground. So many possibilities to trade against!

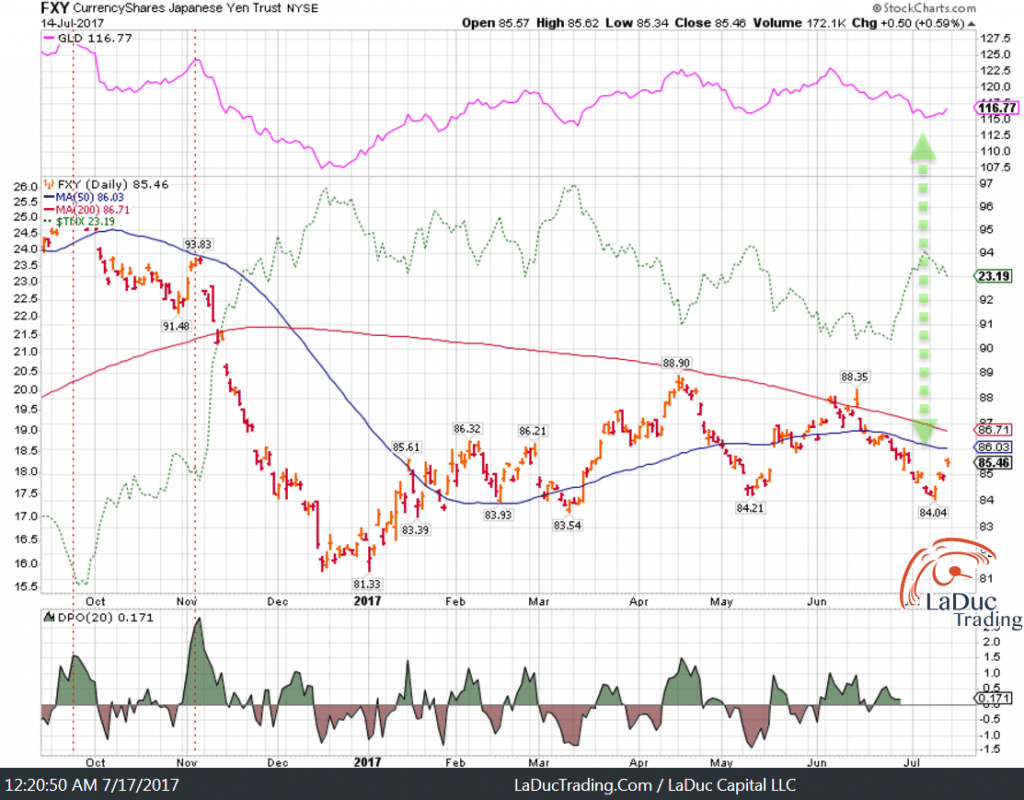

As mentioned last week, long Gold, Silver and Miners showed a strong technical reversal signal with a falling USD/JPY. GLD finished up 2.2% last week and with it FXY is back up to its 200D. Commitment of Trader (COT) data shows Large Specs at their shortest JPY since Dec’13 which was a huge inflection point then for higher. Despite all the earnings and economic reports this week, the falling USD/JPY should result in higher precious and industrial metals. Similarly, open interest and positions held by both Large Specs and Commercials are the smallest in DXY as when it was $93 before rising to $104. So USD likely bounces soon ($92.50 is strong support) and with it a pullback in FXC FXA FXE. Another words, lots to trade that may be more predictable than earnings plays.

Last Week’s GLD, FXY, TNX correlation worked well and looks to continue after a small tussle with sellers at 200D as some investors are still exiting GLD to the tune of -$437M outflows at GDX withdrawing -$199M this past week:

And lastly, a very compelling chart and trade idea:

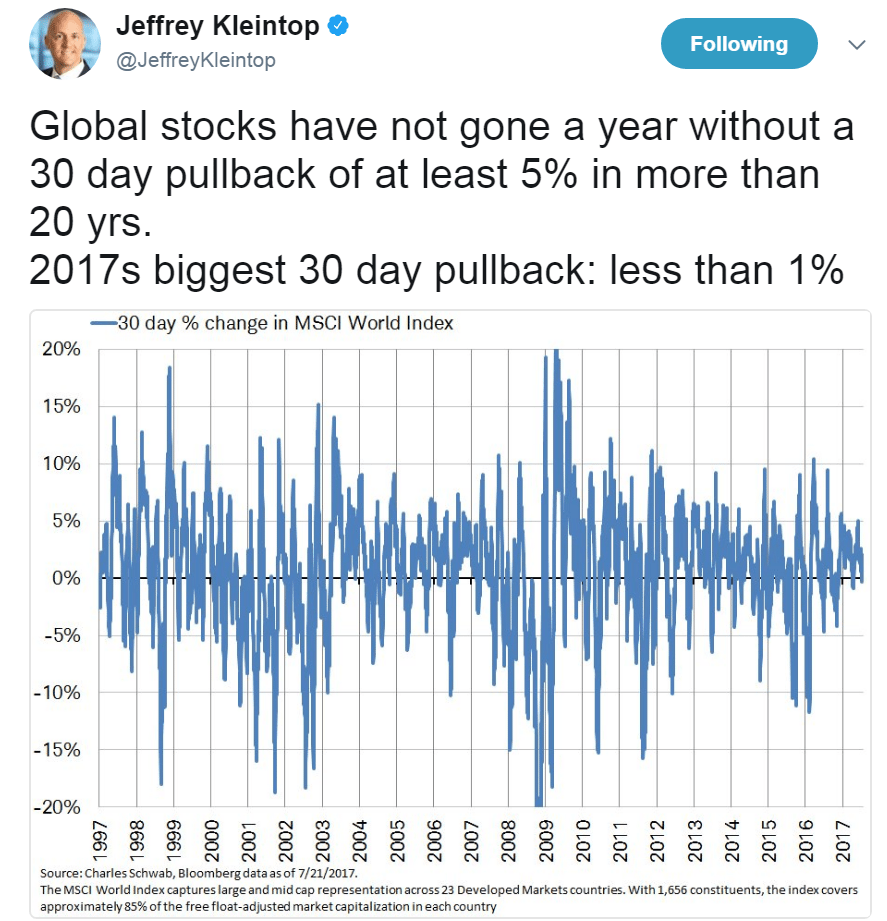

Here is a not-to-be-missed article from Hedge Fund Baupost: Low volatility could be the harbinger of a crisis to come.

And soon after a LARGE VIX trade hit for October, just enough time to cover the Debt Ceiling drama in September.

Events This Week and How I’m Trading It

Economic Reports

There are a lot of economic reports (most notably sentiment, housing and PMIs), in addition to the heaviest earnings reports of the month coming at us this week, not to mention the FED rate decision which has a 97% likelihood of a 1.25% rate hold, the testimony related to Russiagate from Trump’s son and son-in-law, and last but not least the biggest market driving event, in time I believe: the OPEC meeting in Russia which starts Monday. OPEC likely forces Libya and Nigeria to comply with production cuts which could cause oil to rise but the real price manipulation may be a few months off as Saudi Arabia prepares its Aramco IPO. German and Eurozone PMI misses could cause EUR to give up some of its recent strong run which aligns technically with USD bounce. BOJ minutes won’t likely add much as they already announced their rate hold and last month’s CPI of 0.4% is well below the BOJ 2% target.

Sunday: Japan Flash Manufacturing PMI

Monday: Eurozone Flash Manafacturing/Services PMI, US Flash Manufacturing PMI, Existing Home Sales

Tuesday: France, Spain, Finland PPI, Germany IFO Business Climate, US Case Shiller Home Price Index, Consumer Confidence, US API Crude Inventories, New Zealand Trade Balance, Australia CPI

Wednesday: Finland, Spain, Denmark Retail Sales, France, Italy Consumer Confidence, UK Prelim GDP, US Flash Services PMI, New Home Sales, DOE Crude Inventories, FOMC Rate Decision

Thursday: Germany Consumer Confidence, UK Home Price Index Consumer Confidence, Eurozone M3 Money Supply, US Jobless Claims, Durable Orders, Japan Tokyo CPI, Household Spending, National Core CPI, Japan Unemployment Rate, Retail Sales, Australia PPI

Friday: France GDP, CPI, Consumer Goods Spending, Spain CPI, Austria, Netherlands PPI, Sweden Retail Sales, GDP, Eurozone Sentiment Indicator, Germany CPI, US GDP, Employment Cost Index, Michigan Consumer Sentiment (Final)

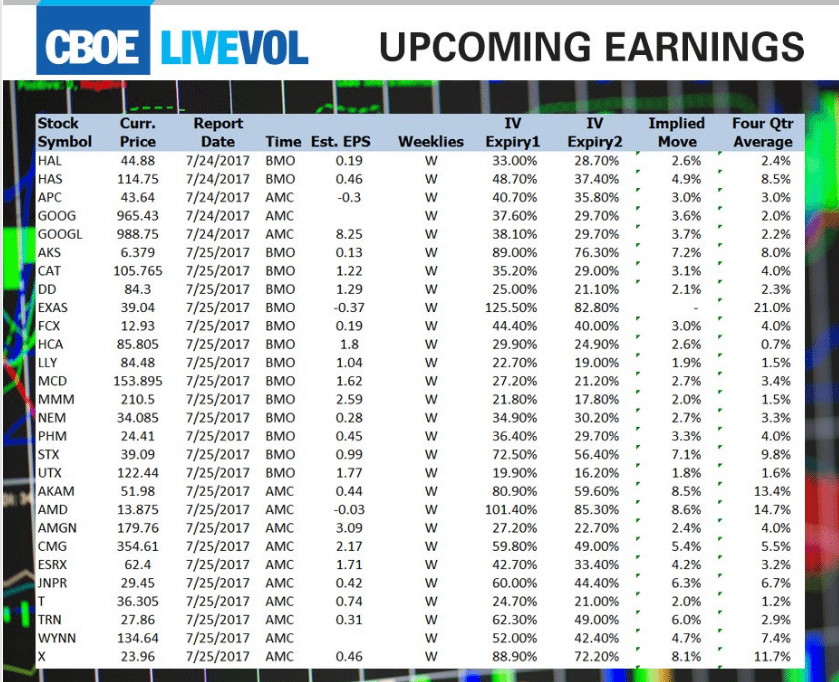

Earnings This Week

Earnings season continues and this week alone comprises 36% of the SP-500 company reports so Big Week. Here are the Majors for just Monday/Tuesday. For a complete list of companies reporting with average expected moves compared to last quarter, Russell Rhoads prepares a great cheat sheet here.

Trend is Strong with These Stocks:

Scan Criteria is based on large volume, optionable stocks where Price as Percent of 52 W High, Volume (90D + 5D), Relative Strength vs SP-500 are all in top 20%.

ALB, CTRP, HAS, WTW, AMZN, RCL, AMTD, MA, AXP, AMP, UNH, ALGN, GD, BA, CMI, MSI, NTAP, NVDA, ASML, FB, WDC, ADBE, MSFT, NRG, XBI.

Relative Strength New Highs:

BZUN, NVDA, WTW, SQ, EXEL, ALGN, VRTX, NFLX, WDC, RCL, BA, ADBE, HAS, NTAP, GLW, ETFC, FB, MA, ATHN, V.

Unusual Option Activity with charts that technically look to match:

Bios/Healthcare: CLVS ACAD VRX GILD CELG SRPT HOLX all indicate higher. (THC JNJ ABT GWPH top picks did well last week!)

Bonds: TLT $1.1m in Aug $25 P after last week’s run up pre-FED announcement Wednesday. (Long TLT worked well last week!)

Retail Mixed: Higher GPS M COH DDS; Lower SIG w large Sept $55P (TGT KORS M worked well last week!)

Media: DIS w large Sept $110-115 call spread, which I would finance by selling puts. (January’s $108-110 call spread financed by $106 puts returned 1600%!)

Fave Earnings Strategy:

KMB – Ratio backspread pre earnings with 90D expiry captures potential move from where it sits now on 200D support to prior high of $134 area with stop loss on underlying at $122. Option Tactic: Selling 1X Oct $135C against 2X $130C. May do same with GIS.

Macro Considerations

Last week and in prior newsletters I have reiterated my thesis: Higher commodities drive inflation and with it global yields. Tom McLellan recently theorized that yields are based on the weather and we haven’t had a cold enough spell to incite price inflation in commodities. Interesting. By scanning different theories I gain insights. Economists point to supply and demand. Analysts focus on boom bust cycles. But for myself and many traders, we mostly look for price confirmation.

We’re not there yet. Oil above $55 per barrel would certainly help. Precious metals getting and staying back above 200D would certainly help. Industrial metals like copper and steel are trying to break out but they keep retesting support. We are starting to see strong bounces in food markets (leading the advance was WEAT and SOYB with SGG and JO looking poised) but staying power has been weak. Maybe because we don’t have that cold weather cycle to justify higher prices yet. I don’t know but I can see that precious metals are in a downtrend unless Yen breaks up hard in defiance against kuroda/BOJ rate fixing, pulling industrial metals with it since it would no longer have to contend with the deflationary affects of a falling yen. In short, commodities look to be setting up to reverse higher into year-end, pulling US and global yields higher with it, but they haven’t confirmed.

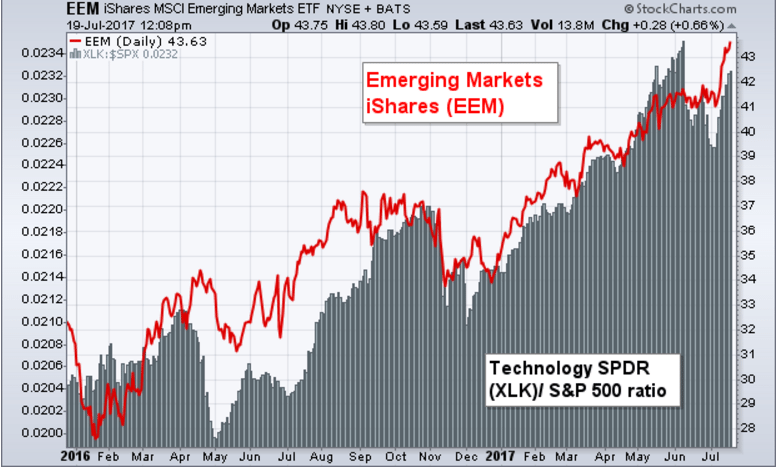

There is one area that has shown confirmation and correlation. A falling dollar is clearly driving global funds into emerging markets. And as mentioned last week, low Treasury yields help support technology stocks which, in turn, propel emerging markets. So my Thesis of the Week is simple: if EEM is to continue, then USD needs to stay down and tech stocks up but neither looks to cooperate in the next few months which should lead to emerging market weakness which will likely result in more US weakness. At least until commodity markets start rising.

Macro Charts of the Week:

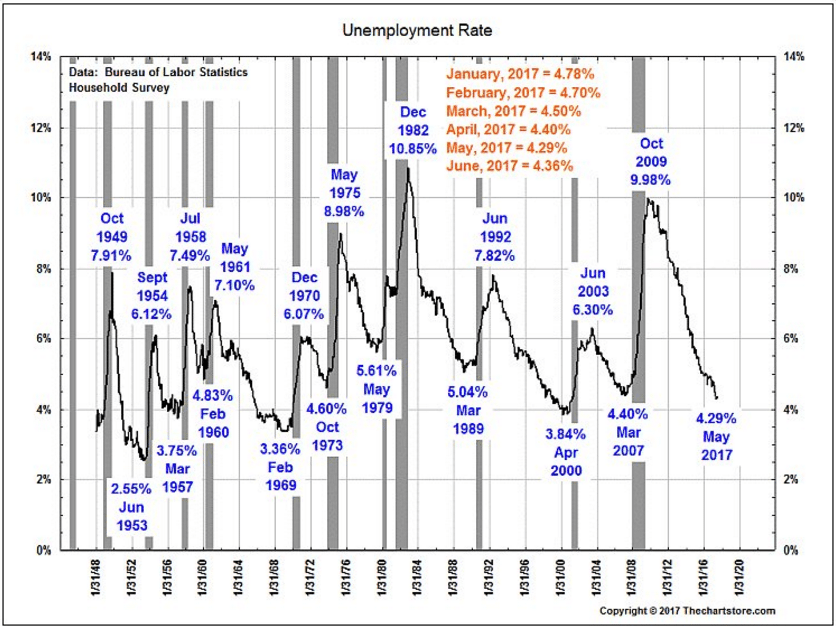

Low Unemployment Rates are good, until they bottom and turn!

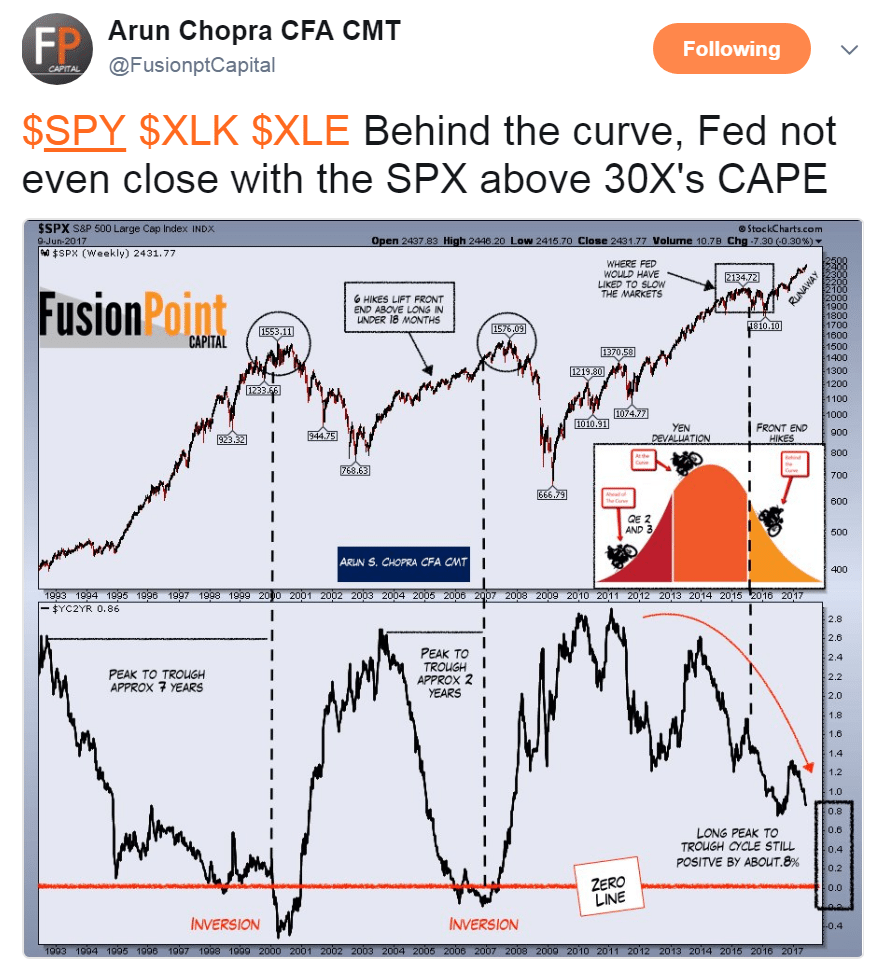

Ditto with Yield Curves!

Air Pocket Stocks

Arun Chopra, the author of the above chart, and I will be jointly working on a project to research those companies who have taken on debt to buy back shares of their stock with the primary goal/result of appreciating their stock prices. Think Central Banks like BOJ but on a Micro stage. We hope to better identify the “air pockets” that we believe exists between current market capital valuation and ‘fair value’. In the case of CMG and AZO, once real buyers stepped away, lower prices came quickly. We want to identify these possible strong shorting candidates as we prepare a shopping list in preparation of the next correction. Stay Tuned!