Table of Contents

Summary

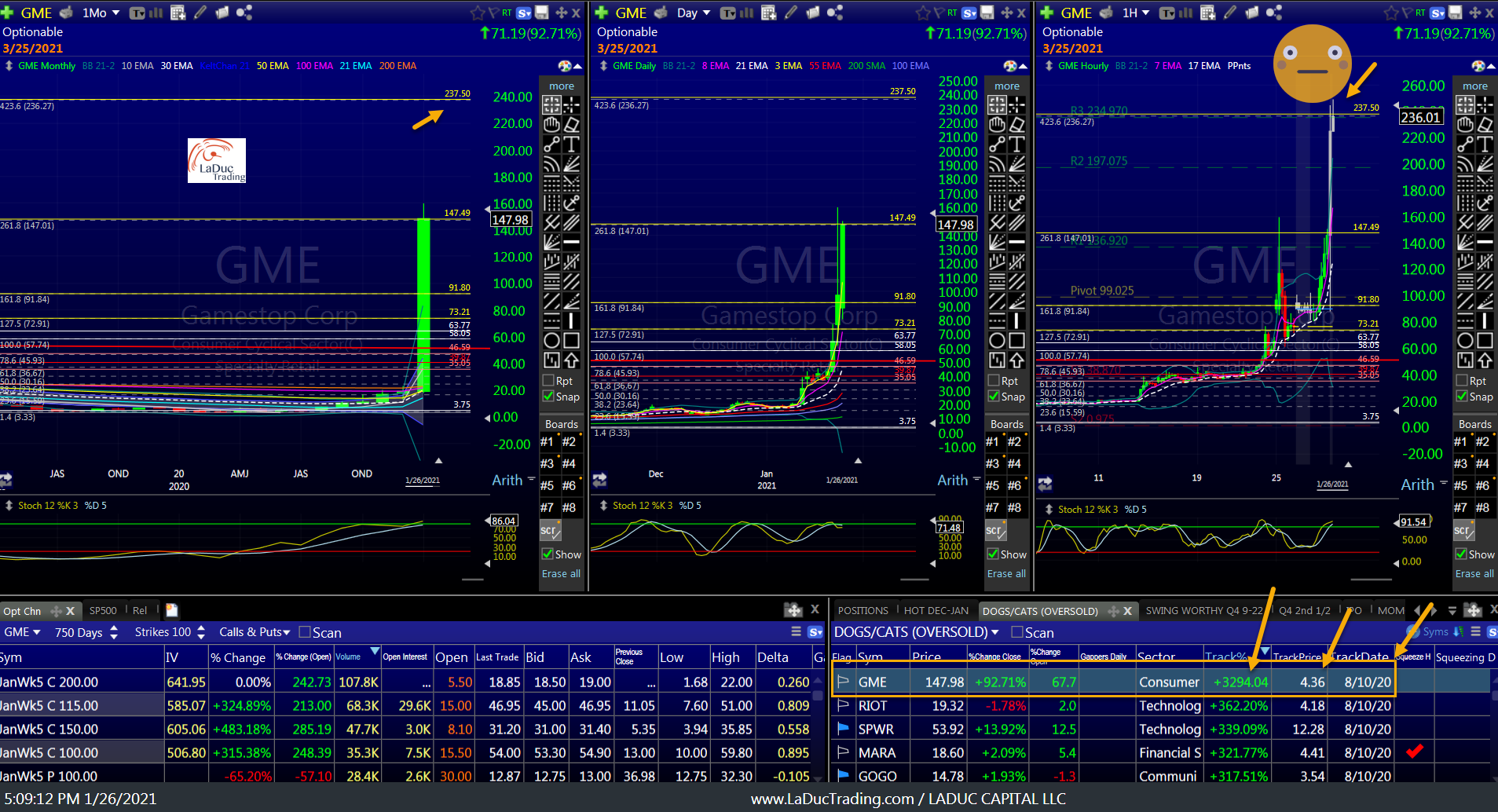

I recommended GameStop to clients of LaDucTrading as high conviction trade on August 10th at $4.36. I called it my $4 to $40 stock by end of year. It tagged $40 January 14th. Given sentiment and structure, I continued to recommended it long to clients in our SLACK workspace and in my live trading room as I saw it bullish to $60 at least. I referenced this $60 call when the stock was $40 on my youtube channel.

Each day I have given my thoughts and price targets to clients who have continued to trust my analysis and I thank them.

Tonight, Gamestop tagged $249 after-hours and I thought it worth-while to summarize how we got here. Plus, a warning.

GameStop Bear Case

- Over 5000 stores in malls lightly visited since Covid outbreak.

- Bears like to remind bulls that Gamestop reported net income of $408 million on revenue of $9.5 billion in 2012 but in the last 12 months had a net loss of $275 million on revenue of $5.2 billion. Not a good fundamental case…

- GameStop’s stock traded as high as $62.11 per share in 2007; it got as low as $3.50 in March 2020.

The Bull Case Charges Forward

- Ryan Cohen, former CEO of CHWY took an activist role = 12.9%, believing GME could make a turnaround.

- Jan. 11, GameStop announced that Cohen and two of his friends from Chewy would be joining GameStop’s board.

Bloomberg’s Matt Levine: So GameStop, which was bad, is becoming good. It was a money-losing mall retailer in a dying business during a pandemic, and traded like it, but now it will be a dynamic e-commerce leader in the rapidly growing gaming segment, and should trade like it.

And Here Come The Flows

- Between Friday and Monday, Gamestop closed Friday at $65.01, opened Monday at $96.73, got as high as $159.18 and as low as $61.13 before closing at $76.79.

- For Monday alone, almost 178 million shares were traded, worth almost $17 billion.

- On Friday, 194 million shares were traded, over 12 times its average trading volume.

- Between Friday and Monday, 372 million shares of GME were traded. The float is 47 million.

Bloomber’s Tracy Alloway: “Flows before pros.” The market will be driven by a flow of capital rather than fundamentals. …

Pros Are In Trouble

- Andrew Left of Citron Research is very bearish and issued a $20 price target when GME was trading near $40 last week.

- GameStop short interest is still about 139% of available shares after last Thursday having 141% short even though GameStop shares surged 162% in two days alone.

- (We will find out the new short interest amount on Wednesday when the data is updated.)

- Stock borrow fee of 23.6% and margin calls have forced short sellers to “buy-in”.

- CITADEL & POINT72 BAILING OUT MELVIN $GME SHORT

-

*Citadel, Its Partners and Point72 Asset Management Investing $2.75 Billion Into Melvin Capital Management *Melvin Capital Down Nearly 30% for 2021 Through Friday, Sources Say *Citadel, Its Partners and Point72 Taking Revenue Share in Melvin. 2:54 PM · Jan 25, 2021

-

- As of Monday morning, mark-to-market losses of over $6 billion year-to-date were estimated for short sellers by a from financial analytics firm S3 Partners.

- WallStreetBets subreddit chat encourages followers to jump on a stock all at once.

- Chamath is a buyer of Feb $115C

How Many Standard Deviation Moves Is That?

- Gamestop moved 15 standard deviation move. Monday… well just look at a chart to know this is a freak-of-nature move.

- Here is why: technical story is based on just two factors—a short squeeze and a gamma trap

- Gamestop hit a high of $159.18 Monday (also 261.8 Fib level area on a monthly chart) before reversing in half.

- Gamestop is the most tweeted and talked about stock in the universe of stocks right now.

Matt Levine writes of the “boredom markets hypothesis,” the notion that stocks these days are driven not by rational calculations about their expected future cash flows but by the fact that people are bored at home due to the pandemic and have nothing better to do but trade stocks with their buddies on Reddit.

Parabolas Equal Trapped Buyers

- Monday saw Gamestop trigger at least nine trading halts.

- Between 10:45 and 11:15 yesterday, GameStop fell from $159.18 to $88.09, with four trading halts along the way.

- Tuesday was off to a similar start.

- The short squeeze is clearly in play but what may not be as evident is the gamma squeeze. Gamma squeeze is the delta hedging of purchased call options by market makers needing to hedge the other side of the trade.

- For every call bought there is a call seller that will likely hedge the exposure risk by buying other calls or stock.

- One reason I suggested $60 as price target for clients early Friday morning was because I saw it was the highest strike. It exploded past $60 but since all the all the short-term options were in-the-money (100 Delta) then there was not a lot more gamma pressure so it fell from $76.76 to a close of $65.

- I posted to clients Friday that I expected higher price targets as long as price stayed above $55 close, which it did:

And A Warning

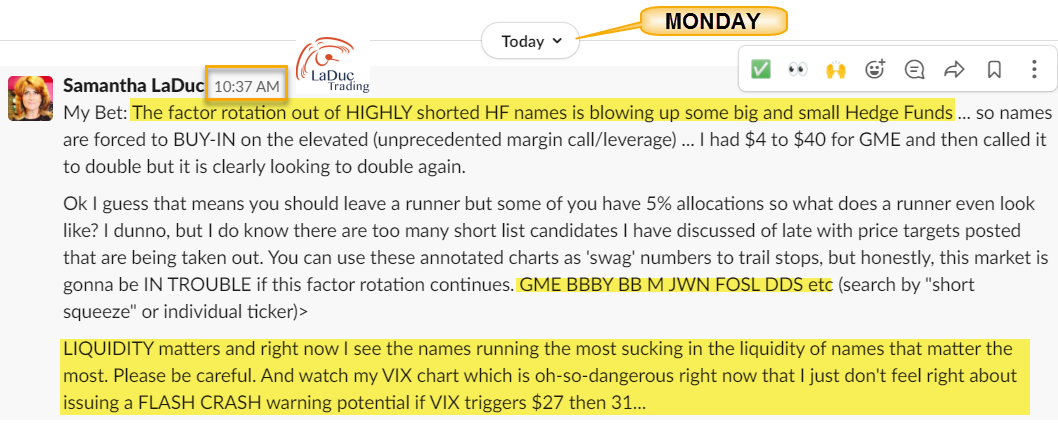

- Monday saw Gamestop tag both of my higher price targets for clients: $91.80 and $147 just before I saw volatility enter and warned clients to protect their winnings:

- The stock quickly imploded by half when I warned in my trading room that volatility was entering the factor rotation space. (see trading room archive recording under Live Trading Room).

- Between 10:45 and 11:15 yesterday, GameStop fell from $159.18 to $88.09, with four trading halts along the way.

- Tuesday had yet another crazy chase move in Gamestop that I called out in my live trading room. GME staying above recommended $76.76 level could see $147 PT again – as posted Sunday for clients. And it did.

- But nothing like doing a LIVE Macro-to-Micro Power Hour Tuesday at the close, discussing Gamestop with Jonathan of Vigtec.io with the theme of PARABOLAS EQUAL TRAPPED LONGS, when Gamestop began moving violently higher to it’s next Fib Retracement level of $237.50!

So that’s my warning: “Outliers Revert With Velocity”, as I like to say, and Gamestop is one of the biggest if not biggest outliers I have ever seen.

To clients I say, TAKE CARE, and consider what happened during Feb 5th, 2018 with XIV after-hours. Volmagedden resulted in XIV getting ‘rebalanced’ and opening up down 90% next day. I am not saying that will happen but I am saying the risk is rising.