Table of Contents

“Losing an illusion makes you wiser than finding a truth.” – Ludwig Borne

I hate drama, let alone being at the inception of an idea that is triggering both notoriety and attacks. I consider myself an analyst for analysts, and that my clients are savvy enough to do their own due diligence and not follow blindly. Because I am independent – both in affiliation and thoughts – I am not deeply invested in any siloed groupthink or agenda. I simply really love to lawyer a trade by looking at both the bullish and bearish takes. This has served me well over the years in timing macro trends, sector rotations and stock selection.

Running into the most recent Nvidia earnings August 23, 2023, I had a loosely-held opinion that they were “priced for perfection” and was positioning to clients that it was a better short than a long. It was a lovely fade on the day, and had a very profitable follow-through to the drawdown of -18% in one month. That was really what I expected to get out of it: a well-conceived swing short for myself and clients. The end.

But X (new Twitter), had other ideas, and my original question – “Is end demand real?” – took on a life of its own. Many apparently shared my concerns, and subsequent revelations have surfaced revealing cracks in the façade that is Nvidia demand and the questionable company they keep. None of my analysis took away from Nvidia’s clear technological prowess or positioning as leader. I get they are at the forefront of producing top-tier GPUs and that Artificial Intelligence (AI) is perceived game changer that can ensure a high degree of demand.

But that doesn’t mean that the hype surrounding AI justifies Nvidia’s valuation, or that they haven’t engaged in numerous questionable activities that appears to not only pull forward and exaggerate demand, but that Nvidia is tied to some very questionable characters within a fraud-riddled industry of crypto who are well-versed in manipulating investor schemes, including but not limiting to potential artificial orders while promoting fake demand for Nvidia GPUs.

Was I looking for any of that before Nvidia’s latest earnings? Absolutely not. But now given the collective investigative research and analysis offered up by the village that is X (new Twitter), I can’t un-see it. So I offer up the follow-up analysis on the matter, and then leave it up to each investor to make up their own minds.

Background Reading / Viewing

Please watch the 3-part series that Jack Gamble produced, which was inspired by my original tweet shining light on the suspicious nature of Nvidia’s earnings beat.

It is also helpful to view another’s analysis from a sector and macro lens posted by the anonymous blogger Mad King:

- NVIDIA – THE RED FLAGS: No Smoke without a Fire – followed by:

- NVIDIA – DON’T BELIEVE THE HYPE: This time is different…not

If you are my client, you can see my recent client post on “Why NVDA Really Matters to Market Returns” and the trades I structured to benefit from the stock pullback.

Now for a big pet-peeve: SO many YouTubers have jumped on the bandwagon to pronounce Nvidia a fraud, simply ripping off our original and very independent thoughts as their own – clearly just doing it for monetization. The shameless shrills just look for scandals and clicks for that is how they generate large revenue streams. I do not. My LaDucTrading YouTube channel is not monetized. I make my living on analysis, education and trading for serious investors. That’s my wheelhouse and that’s where I’m staying.

Questioning CoreWeave

CoreWeave, being at the center of my original tweet, generated the most valuable engagement in my X direct messages. From anonymous accounts, I was sent CoreWeave’s pitchdeck pushing their 1900% valuation, investor presentation of big promises, insights on their full roster of employees, physical offices and state filing delinquencies, not to mention what was not found: a solid list of big clients. Clearly, I was fed this intel as a way to promote the argument that something was fishy.

I very much valued a thoughtful exchange with an anonymous account who shared both my intellectual curiosity with and transaction analysis supporting that Nvidia is either being played or part of the play. This individual was more-than a seasoned investor and provided the CoreWeave financing details (we’ll get to that). He has actually been tracking the correlation and coincidences between semiconductors in general and crypto-GPU-leader Nvidia and it’s connection to the crypto space for over two years. I was fascinated. I had no idea there are professionals who have long-held beliefs that Nvidia is much more complicit in a much bigger ponzi-like system. They were eager to help me connect many of the useful patterns needed to understand how interwoven this whole thing is with Bitcoin in general and the crypto ecosystem and/or underworld in particular.

With that, it appears CoreWeave could be very much at the center.

Ironically, I had not looked into CoreWeave until Jack Gamble of Nobody Special Finance exposed them in his video series, referenced above. Here’s a quick overview:

- Michael Novogratz led all the offerings between CoreWeave and Magnetar Capital – both of which have been embroiled in well-documented scams.

- As a reminder: Magnetar helped design CDOs pre-2008 GFC which was the focus of The Big Short movie.

- CoreWeave is trying to raise capital at a $5–8 billion valuation, with a “96% “VC Exit Predictor” (according to the company’s pitchdeck as of Sept 14th).

- Both of the CoreWeave founders are from the hedge fund industry, not deep technology let alone AI guys. But they have worked together in their prop trading firm, running a Natural Gas futures shop, an Ethereum mining crypto outfit and operated near 20-60 carbon-credit shell companies in the Caymans linked to ESG schemes. None of which has connotations of legitimate enterprises let alone the street cred to command such lofty company valuations let alone the expertise to run sophisticated AI data center operations.

- Oh yeah, and Geoffrey Fouvre of @GraphFinancials discovered that CoreWeave has a history of offloading GPUs at a loss.

I knew none of this when I first asked the question: “Is end demand real?” What I did know was that CoreWeave was using likely deflationary assets as collateral (Nvidia GPUs), to justify a $2.3 billion line of credit (which was more than the company’s valuation), for which Nvidia was one of the investors ($400M), and all this despite NOT having any of their own Intellectual Property or major clients.

CoreWeave Financing

I am no forensic accounting expert. I am however very lucky to be contacted by one.

With that, here is the CoreWeave “H100 as collateral” private transaction details I was provided. These are the CoreWeave financing details that were sent to clients from one of the megafunds in the consortium that lent to Coreweave, as analyzed by my contact:

-

For NVIDIA contract, instead of leasing the chips to Coreweave, NVIDIA has done a sale leaseback to generate revenue. Given accounting reasons, the sale leaseback must be a true sale and only 66% of sold chips can be leased back. The leases must be market rate. In order for Coreweave to service these contracts, the company needs to purchase ~ $2.9bn worth of chips from NVIDIA upfront.

-

The senior asset backed financing of $2.3bn, remaining source of capital ~ $746m of equity is from the ParentCo (received primarily via upfront payments from NVIDIA)

-

For the private credit syndicate, the underwritten return for the H100 financing of the transaction is ~ 14.6% (S+8.75% @98.250 ID)

First, let me translate the shorthand:

- S is for SOFR (Secured Overnight Financing Rate), a reference for the floating debt rate.

- OID is the upfront fee discount, so for example the basis is 98.25 but they need to repay 100 principal.

His point:

There are so many red flags here, but especially that the equity is completely contributed by NVIDIA.

For emphasis, the “ParentCo” here is CoreWeave, and the $746mm equity in this capital structure is just from CoreWeave, but CoreWeave received this portion of cash as part of prepayment from NVidia’s “sale and lease back arrangement”.

My source sums up thusly:

So essentially, NVDA worked with this shell company Coreweave, signed a “sale n leaseback” of H100 contract with them, supplied them with cash and locked in expenses from “renting” their own H100, and provided 700mm equity, with this equity, Coreweave secured 3bn worth of H100 from NVIDIA, using these H100 as collateral, took on 2.3bn debt from Wall Street private credit investors.

And these debts are at staggering cost of over 14%. 2.3bn of them.

It is highly likely that CW will bankrupt later on, but NVDA is seemingly safe from it cuz CW is kinda like a SPV outside of NVDA’s balance sheet

Side-note on Famous Frauds and SPVs

To clarify, SPV stands for “Special Purpose Vehicle” and was used famously in the Valeant – Philidor fraud case – with short-form highlights here:

If you are really into the official SEC findings:

“the order finds that, for five consecutive quarters, Valeant, former CEO J. Michael Pearson, former CFO Howard B. Schiller, and former controller Tanya R. Carro, touted double-digit same store organic growth, a non-GAAP financial measure that represented growth rates for businesses owned for one year or more. Much of that growth came from sales to Philidor, a mail order pharmacy Valeant helped establish, fund and subsidize. The orders find that Valeant improperly recognized revenue relating to Philidor sales and did not disclose its unique relationship with or risks related to Philidor in SEC filings and earnings and investor presentations. Valeant ended its ties to Philidor in October 2015 and restated its 2014 financial statements in April 2016, reducing the revenue that was improperly recognized.”

Enron also employed a number of special purpose vehicles that helped the company escape mark-to-market losses.

In the former case, Valeant was losing its organic growth, so it schemed to inflate revenue to disguise this while insiders sold and/or positioned short. In the latter case, Enron was clearly a ponzi from the beginning. Literally, everything at Enron was made up: liabilities became assets, credits were presented as income, and all profits were inflated.

Fun Fact: Did you know Nvidia (NVDA) replaced Enron (ENRN) on the S&P in 2003 when it was delisted?

But I digress.

Back to Nvidia’s Connection with CoreWeave and Crypto

Nvidia’s dealings in CoreWeave and Crypto Mining go back to at least 2018. Before its stint as a crypto miner, CoreWeave also played a lucrative part in natural gas trading and before that carbon capture credits – as detailed above. Basically, in every hyped market we’ve had the past few years, you will find CoreWeave more than active.

So is it a wonder they are now deep into GPU peddling? And I am not the only one questioning how much of the artificial intelligence-fueled rally this year is real.

“It turns out every scammer in America is trying to buy H100 chips right now so that they can say they own them… In 2021, scam companies put Bitcoin on their balance sheets — now the scams have shifted over to putting $40,000 H100s on the balance sheet.” Koppikar of Institutional Investor August 29th

Geoffrey Fouvry – former portfolio manager of 15 years at York Asset Management, a US and UK based firm specialized in Risk Arbitrage & Special Situations, and now current CEO of DocuTalk, a NY-based software company that pioneered a new visual format to interactively present documents in video format – connected Sysorex to CoreWeave when CoreWeave was a crypto miner.

Coreweave has a history of dumping GPU at a loss to the investing public by contributing GPUs to TTM co, then reversed merged into Sysorex. Then dumping shares of Sysorex (crypto mining Etherum).

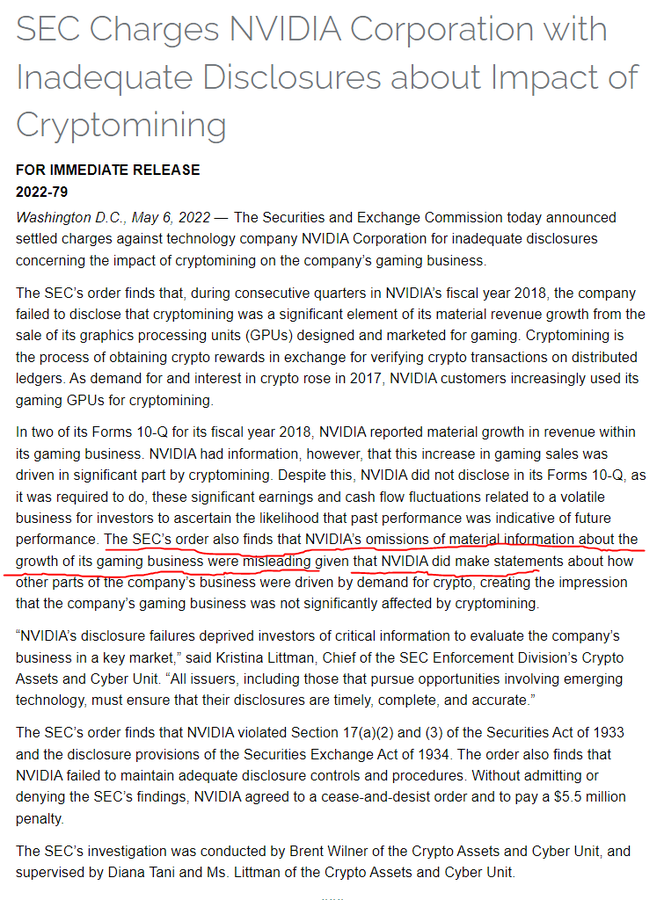

You can watch his augmented video findings on the spider web of interconnections here. In short, Geoffrey highlights CoreWeave’s habit of dumping GPUs on the unsuspecting market. (Curiously, Sysorex collapsed same time (May 2022) that SEC charged/fined Nvidia for improper disclosure of misrepresenting its crypto related revenues.)

Geoffrey makes the point that CoreWeave doing a reverse merger in a company called “TTM” and then reverse-merging into Sysorex to then dump the shares is no amateur move.

We already know Magnetar is expert in keeping the bubble alive long enough to dump assets on the public.

The Magnetar Trade: How One Hedge Fund Helped Keep the Bubble Going

It’s more than possible that CoreWeave is helping Nvidia do the same thing.

Are Nvidia and Bitcoin/Crypto The Same Trade?

So I got to thinking about the company Nvidia keeps and the common thread at the core that weaves this whole saga together: CRYPTO

Then I asked myself: “Are Nvidia and Bitcoin/Crypto The Same Trade?”

Let’s ignore for the moment the “hedge-fund guys” of CoreWeave and their carbon-credit, nat-gas-futures trading, crypto-mining and GPU-peddling shell companies in the Caymans. And let’s turn a blind eye to notoriously-suspect crypto-evangelist Novogratz and his lead for the financing between CoreWeave and Magnetar. Lastly, for now, let’s even ignore (I know it’s hard) the infamous, Great-Financial-Crisis-inducing Magnetar Trade which destroyed trillions in economic value globally.

Wait, I forgot to mention Tether!

I have not properly updated you on the Nvidia-Tether asset-backed financing scheme sent to me that uncovered even more shell companies that mimic the CoreWeave-Nvidia dealings:

Tether purchased 10,000 Nvidia H100 GPUs for US$420 million and will also acquire a 20% stake in the crypto miner Northern Data. Northern Data has acquired 70% of the equity of Tether-related shell company and plans to lease GPUs to AI startups and enter the field of GPU cloud services.

The structure of this transaction is very complex. Tether purchased 20% of Northern Data through the Irish shell company Damoon, (they are trolling us here), and Northern Data acquired 70% of the shares of the shell company through share swap. Northern Data has the option to acquire the remaining shares in the shell company, but the total price remains unclear. Northern Data’s had historically been questioned by regulators. According to an earlier report by Bloomberg, German regulators filed a complaint against Northern Data executives, accusing them of falsely reporting revenue.

Do I have to mention that Tether’s balance sheet is still a black hole? Or how Tether relies on “Attestation” and Resists Calls for Audit?

Or how the entire Tether system for self-sustaining fractional reserve banking for crypto is allowed to continue to exist in full view?

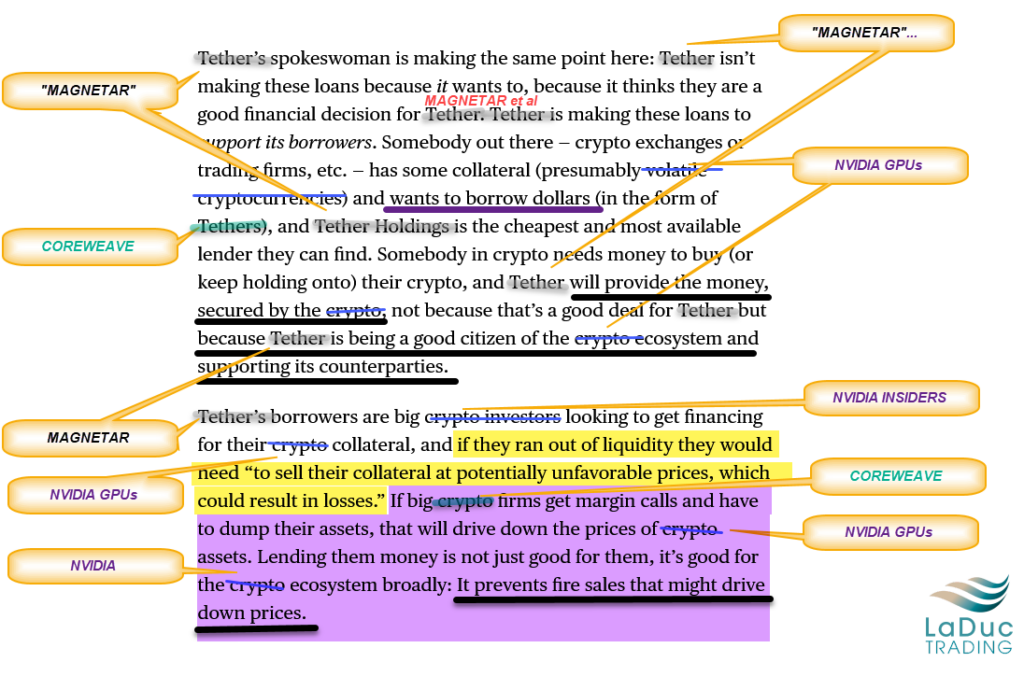

“Tether is a form of self-sustaining fractional reserve banking for crypto, and it dynamically prints Tethers in order to prop up crypto prices. At the margin, cryptocurrencies are not purchased by real people putting new dollars into the crypto system, but by crypto hedge funds buying crypto using freshly printed Tethers.” @matt_levine, Bloomberg

Tether conspiracy theories weren’t conspiracy theories after all! Because Tether’s spokesperson just admitted to them. I took the liberty to cheekily mark-up the Tether Spokeswoman’s circuitous explanations for Tether’s very existence so you can see how I think now.

Bitcoin as Liquidity AND Nvidia GPU Driver

After Nvidia replaced Enron in the S&P in 2003 (when Enron was delisted), Nvidia’s gaming revenues through 2015 made up ~70% of total revenues – and as such, Bitcoin’s massive run from $157 in January 2015 to $69,000 in November 2021 mirror the trajectory of Nvidia’s stock price. In fact, Nvidia is up 1000% in the past 10 years with a CAGR (Compound Annual Growth Rate ) of an unheard of 60% per year! This is bigger than any other stock by a nautical mile.

So I wondered: If Bitcoin’s “Proof of Work” drove the buying power in Nvidia’s GPUs, and Bitcoin’s crash from $64K to $16K roughly in October 2022 timed perfectly with Nvidia’s 66% pullback, why has Nvidia’s 366% advance off the October 2022 lows outshined Bitcoin’s mere 100% gain?

The answer is AI. We have a new narrative in town, “conveniently”, as the explosion of perceived computing power demand to mine more bitcoin has been replaced with the perceived computing demand to process AI requests.

The anonymous blogger summed it up well:

CoreWeave might be only one client, but if their operations were to blow up, they would leave a hole in NVIDIA much bigger than any other clients could cause.

They found a way to create a flywheel of liquidity at a time when liquidity was drying up globally and took advantage of the system – kind of how they did with their ESG-related operations. Watch this video to understand.

The inflated metrics created a deceptive impression of a bull market, just as underlying demand and global liquidity were actually starting to wane.

Nvidia Really Needs Crypto Revenues

Let’s talk about Moore’s Law and what that has to do with Nvidia’s meteoric rise this year.

But first, let’s review a bit about the semi conductor sector backdrop before talking about Nvidia’s exponential growth prospects.

Here is the anonymous blogger again:

As generative AI captivated global attention in late 2022, investors eagerly bought into the narrative, overestimating the short-term impact of this emerging technology – a classic case of Amara’s Law.

In this wave of enthusiasm, NVIDIA, with its unparalleled GPUs, became the face of the AI hype.

However, nine months later, the demand for these GPUs hasn’t generalised across the sector; it seems to be an NVIDIA-specific phenomenon.

Paradoxically, while NVIDIA thrives, the semiconductor industry in South Korea is in decline, Taiwan’s electronics exports are slowing, US inventories are diminishing, and TSM, the main manufacturer of NVIDIA’s high-end GPUs, is experiencing a drop in revenue. These conflicting indicators raise questions about the overall picture.

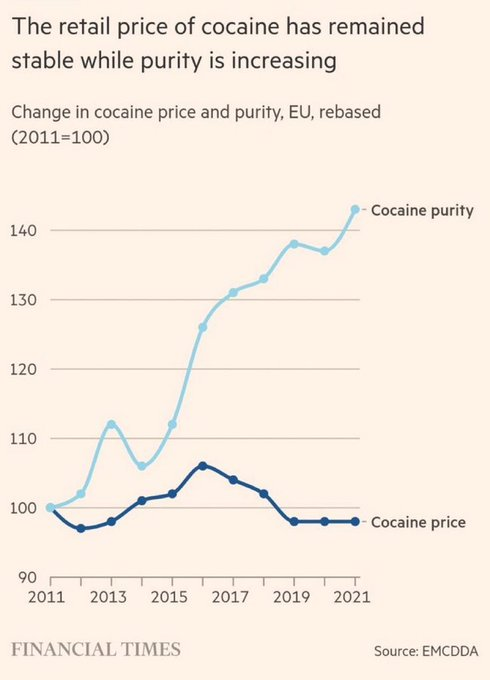

And then there is a Moore’s Law obstacle to this growth rate. Best example: Cocaine. Yes, I’m comparing Nvidia to an illegal drug.

Moore’s law asserts that the cost (read: GPUs) will maintain stable in nominal terms even as computing demand increases. I use a chart of Cocaine’s “purity to price”, but it is the same concept as the evolution of computing power costs: outlay in computer price relative to the increased power of the tablet. Same for TVs. Over 20 years ago my Sony Trinitron cost $2000 where my replacement cost today for a similar-sized smart TV is not much more than $200.

Similarly, as the global network of Bitcoin and AI computer power improves, the competition becomes much more aggressive. The difficulty of mining goes up. Maintaining a stable output (mining) for Bitcoins is much harder.

Moore’s Law is why Nvidia REALLY NEEDS crypto revenues, or did, as there was no better artificial demand of computing power source boosting Nvidia’s revenues.

Until AI.

As the crypto market stagnated post November 2021 peak – SAME AS EQUITY MARKETS I MIGHT REMIND – the Artificial Intelligence hype took on a whole new meaning.

The AI hype for Nvidia serves like rain in a desert.

Desperate Times Call for Desperate Measures

Putting this all together.

Nvidia tries to disconnect and conceal its revenues with crypto mining, but in reality a major portion of it’s revenues are connected and highly correlated with crypto pricing.

So Maybe “Is end demand (for Nvidia GPUs) real?”, isn’t the question to ask!

And “Is end demand (for AI computing power) real?”, is really just other side of the same coin!

So let’s assume the end demand is real for both!!

Fine, but Nvidia and all other AI-hype accomplices are trying to paint a picture where end demand and Nvidia’s revenue curve relationship are linear. This is where myself and others with whom I have discussed this phenomenon take much issue.

And this is the problem, lie, and fraud they want you to believe.

Thinking out loud: Given the realities of Moore’s law and competition affecting the marginal profits of crypto miners, not to mention the falling price of Bitcoin leading into its April 2024 “halving event” where breakeven price (I am told) needs to trade above ($32K)… is it possible Nvidia might be undertaking some rather risky exposure to manipulation schemes so as to carefully orchestrate a ponzi-like play to boost up its market cap using CoreWeave and associates?

Not only does Nvidia need the PERCEIVED crypto/bitcoin proof of work to fend off the REALITY of Moore’s Law, but I would also contend that Nvidia needs the PERCEIVED AI hype to fend off the REALITY of Amara’s Law!

I’m not sure what they need to fend off French authorities:

Nvidia’s French Offices Raided in Cloud-Computing Antitrust Inquiry

Regardless of everything I have shared above – and the posts I have shared on X (new Twitter) regarding Nvidia insider selling, supply chain discrepancies and irregular accounting – know that I didn’t give any of this a minute’s thought before their last earnings report, and I bet there are a whole bunch of investors who didn’t either.

Further, I wasn’t on a path to “find dirt” on the players intertwined with Nvidia – CoreWeave, Magnetar, Novogratz, Tether et al – or their potentially fraudulent connections. There are analysts who publicly and privately presented that. Nor did I have any idea my August 24th tweet would go viral with several million views, sending me into a maelstrom of media pushback including MorningStar and MarketWatch running a story calling me some “twitter rando“!?!

I simply asked the question August 24th: “Is NVDA end-demand real?”

And then, given my curious nature and desire to serve and protect my clients, I have seriously considered what I believe is a very logical follow-up question:

“Why would Nvidia risk associating with these questionable characters to boost market cap … if they didn’t know end-demand isn’t as robust as they would like investors to think?”

___________________________________________________________________________________________________________________________________________________________________________________________

Disclaimer: I may or may not currently have any open positions in NVDA because I actively trade long/short and on multiple timeframes. I do not have any vested interests in any of the companies mentioned above. My views and opinions are solely my own and should not be considered financial or investment advice! And it goes without saying, but I have to anyway: Always do your own research before making investment decisions!