Table of Contents

The following is a summary of trade ideas plus Samantha’s market thoughts and Macro-to-Micro analysis presented from her live trading room. Not every trade set-up Samantha discusses will be captured in her trade alerts. Her focus for clients is on scanning and synthesizing market moving news, money flow, volatility and risk:reward for highest probability trading set ups across multiple asset classes and time-frames using stocks, options and futures. Samantha will make best efforts to offer up custom analysis for clients inside her trading room while also setting up risk-defined trades via her trade alert service.

Reminder: To activate/switch portfolios for any of the offered Brokerage-Triggered Trade Alerts, go to Manage Trade Alert Categories under your Membership Dashboard and update your preferences. Trade Alerts are sent via email and SMS (if opted in) as well as posted under the Trade Alerts page. To access the open and closed trades, go to Live Portfolios. Enjoy the review and please let us know how we are doing: Live Trading Room Trade Of The Day Feedback.

What Just Happened

The Nasdaq 100 traded up by 2%, making all-time highs, then dropped precipitously to close down 2%. TSLA gave up its entire 16% gain today and then some.

- SPY was sold today -0.87%

- QQQ was sold hard today -2.10%

- IWM was sold today -1.23%

- SMH was sold hard today -1.44%

- FAANGs – Every One Red

- Bonds (TLT) – Green

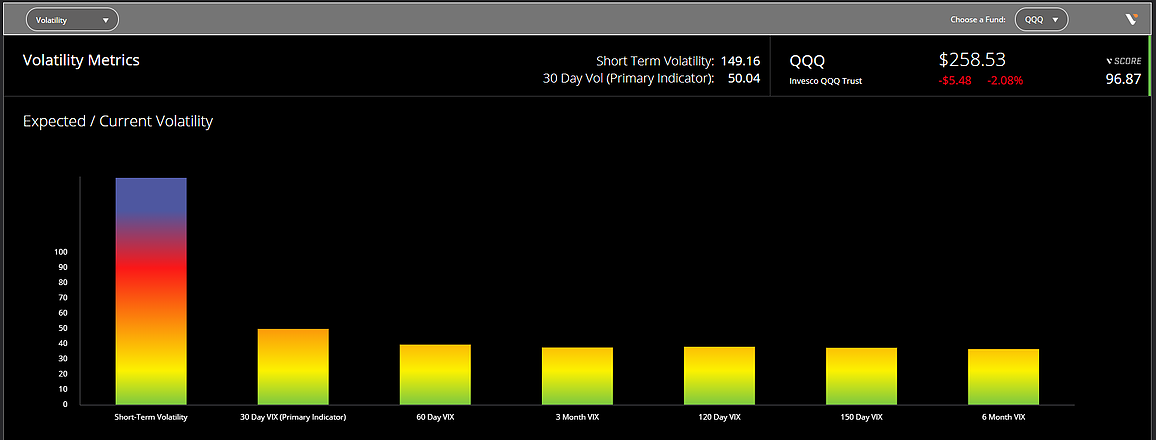

- VIX – 10% move in 120 minutes

- VOLS (especially 60+ days out) – FIRE

The QQQ 9 day VOL hit 149.16! h/t @voliswell

Prior to today, QQQ was close to having its best performance of the last 17 years.

Speaking of Gamma…

Top Headlines Before Reversal

Escalation with China, California schools not re-opening, or TSLA new margin requirements – take your pick!

WASHINGTON (AP) — Officials: In new escalation, Trump administration to reject nearly all Chinese maritime claims in South China Sea.

— *Walter Bloomberg (@DeItaone) July 13, 2020

LOS ANGELES PUBLIC SCHOOLS WON'T OPEN IN FALL AMID WORSENING COVID-19 CRISIS, SUPERINTENDENT SAYS

— *Walter Bloomberg (@DeItaone) July 13, 2020

https://twitter.com/VlanciPictures/status/1282760512212803584?s=20

Does anyone else find the timing of today’s dramatic pullback curious with the TSLA margin requirements? Only half kidding…

Momentum De-Risked

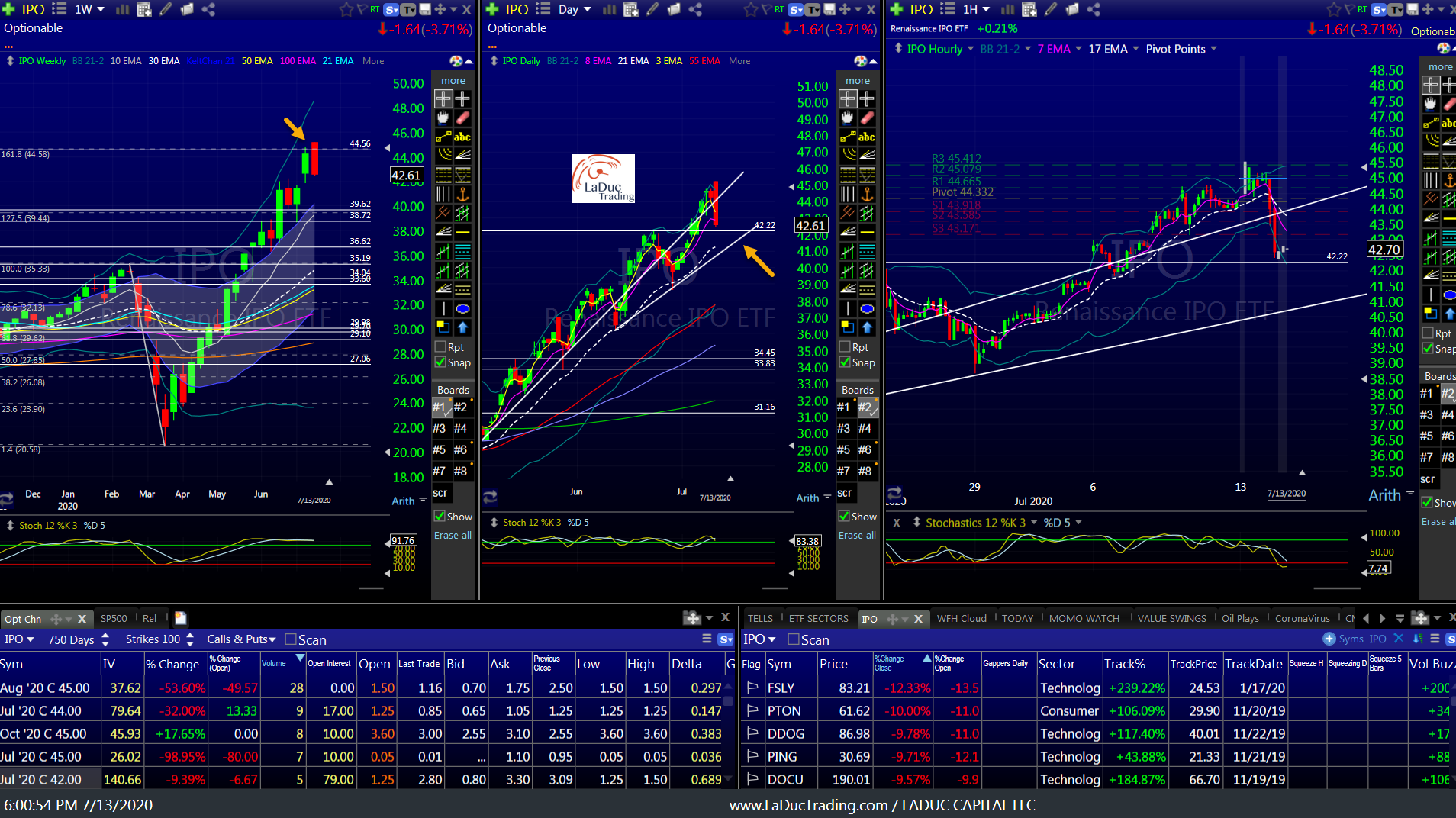

Anyway, given today’s dramatic reversal, look at where these key Momentum charts got rejected – hint, weekly Fib retracement levels: NYFANG, IGV, IPO, QQQ

Clients in my trading room today: Remember the SPX levels I gave at the open: 3236 – 3150? Yup, we stopped at 3235.32 and reversed down to 3149.43.THIS IS QUANT DRIVEN ON AUTOPILOT I TELL YOU.

JPM estimates that passive and quant products represent over 60% of equity AUM in the US!

Big Picture Tech Test

Speaking of suspect…

The Nasdaq 100 rallied more than 2% intraday to set an all-time high, then reversed to close down by more than 1%.

It's done that twice. Today was one.

March 7, 2000 was the other. pic.twitter.com/zEJoOrf6JZ

— SentimenTrader (@sentimentrader) July 13, 2020

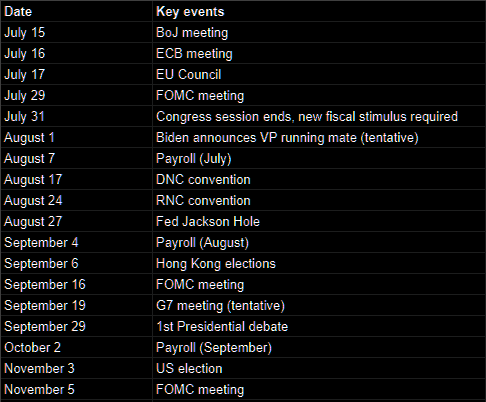

The Week Ahead

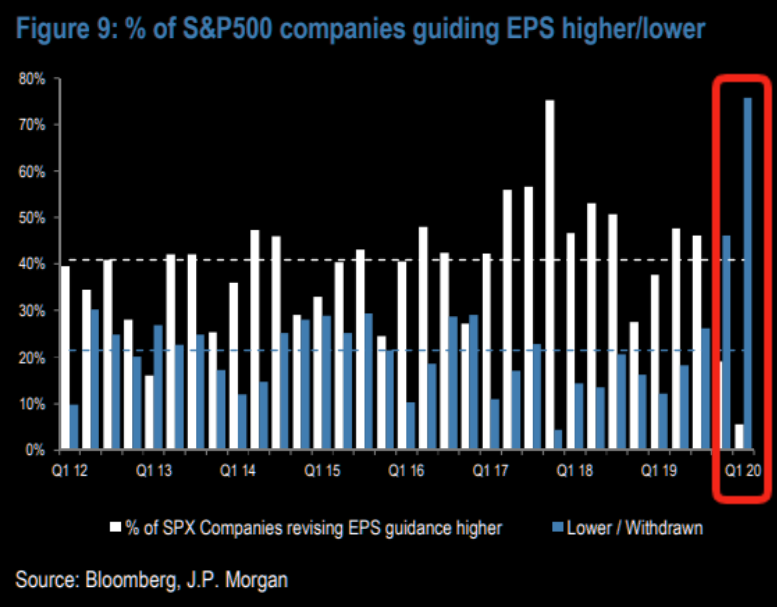

The earnings season fires off next week in a big way with a slew of major banks joining Abbott Labs (NYSE:ABT), PepsiCo (NASDAQ:PEP), Domino’s Pizza (NYSE:DPZ) and Netflix (NASDAQ:NFLX) in the initial crossfire. Analysts expect Q2 profit for S&P 500 companies to be down 44% before improving to -25% in Q3 and -14% in Q4. The biggest question of the season might be if companies will step out with full-year guidance again amid all the COVID-19 uncertainty. Economic reports of interest next week include updates on industrial production, consumer prices jobless claims and consumer sentiment. Retail sales for June will also be reported to expectations for a 4.5% month-to-month increase. The energy sector will be watching the monthly report from OPEC, while Fed speakers on tap include New York Fed President Williams (discussing LIBOR), St. Louis Fed President Bullard (discussing economy and monetary policy) and Philadelphia Fed President Harker (economic outlook). Across the oceans, the leaders of the 27 European states meet in Brussels next week for a summit aimed at agreeing on a €750B euro plan for pandemic recovery and China GDP is due to be reported. Seeking Alpha

Earnings nuggets: When banks start to report Q2 earnings on Tuesday, July 14, all eyes will be on credit loss estimates to see if they are larger than Q1’s reserves. On Wall Street, Wells Fargo analyst Mike Mayo taps Goldman Sachs (GS) as the top investment into the earnings parade due in part to the great risk managers at the bank, while JPMorgan sees Bank of America and Citigroup outperforming in the near term. Other bank stocks seen riding out the earning blitz in decent shape include Truist Financial (NYSE:TFC), Citigroup (C), KeyCorp (NYSE:KEY), Signature Bank (NASDAQ:SBNY) and Western Alliance (NYSE:WAL). Meanwhile, Goldman Sachs expects Netflix to post a blowout net subscriber addition tally of 12.5M for Q2.The firm assigned a Street-high price target of $670 to back up its bullish thesis, which is centered on that the COVID-19 crisis is accelerating the shift from traditional content consumption (linear TV, theaters, live events) to streaming services. In the consumer sector, UBS expects Domino’s Pizza to blast past consensus estimates for U.S. same-store sales growth of 16%, while Morgan Stanley tips that PepsiCo will post a weak Q2 (-3% organic sales, -19% EPS growth), but recommends snapping up shares for the long term on any weakness.

Caterpillar (NYSE:CAT) is due to post its monthly machine sales update sometime next week. Machine retail sales were down 21% in April and were 23% lower in May for the company.

The European Union’s second-highest court will rule On July 15 on an appeal by Apple (AAPL) and Ireland against a European Union ruling for the tech giant to pay 13 $16 billion.The decision is expected to be appealed one way or the other, but a win for Apple could help other multinationals breathe easier

The CASS trucking index report is due out next week for June after the freight index showed a 23.6% decline in May and 15.1% drop in April.

In the banking sector, charge-off and delinquency reports could arrive with earnings even though the full impact of COVID-19 won’t be known with some customers in forbearance.

Economic Releases

- Monday – federal budget is due out with a few Fed speakers.

- Tuesday – CPI report noting consumer prices have fallen for the last three months.

- Wednesday – industrial production which has fallen last three months. We also get a read on 12 regional Fed districts when the Beige Book data comes out

- Thursday – jobless-claims, housing data and retail sales.

- Friday – consumer sentiment.

Also this week:

Central Bank Rate Decisions – The ECB and the BOC will announce interest rate decisions, and both are expected to leave rates unchanged as a continuation of the “wait and see” trend we’ve seen from policy makers.

Key Events Rest of Year

Earnings Reports

And it begins…

#earnings season begins https://t.co/lObOE0dgsr $JPM $PEP $NFLX $WFC $DAL $DPZ $C $BAC $UNH $JNJ $FAST $GS $ABT $FRC $TSM $PNC $ASML $USB $BK $BLK $MS $ERIC $WIT $ALLY $SON $INFY $AA $SCHW $TFC $ANGO $CFG $BMI $HOMB $ALV $RF $PGR $SNBR $STT $KSU $JBHT $WNS $KRUS $AMRB $MRTN pic.twitter.com/iqPrlXbA3Z

— Earnings Whispers (@eWhispers) July 11, 2020

Bar is low to beat …

GAAPSPX as Timing Tool

See my Highlights client post from June 26th where I updated the following with Apr 1 data for $GAAPSPX.

Reminder: it’s trailing 12 mos earnings from period starting 18 months ago, ending 6 mos ago. So by this measure, we topped in January 2018?! Trend Reversal Timing Tool – worked great 8/10 times since 1999!!