Table of Contents

Intraday Call to Protect Lumber Profits and/or Short

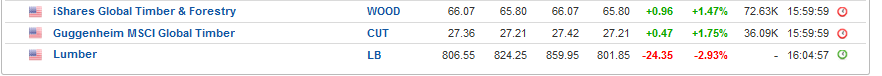

The above prices are from Monday August 24th closing prices of Lumber – with high of $859.95 – and two popular ETFs WOOD and CUT. I bring this up as I suggested Monday in my live trading room that I believed it was time to tightly trail stops for those long lumber and related plays. Lumber was a Trend Reversal theme first posted to clients back in May.

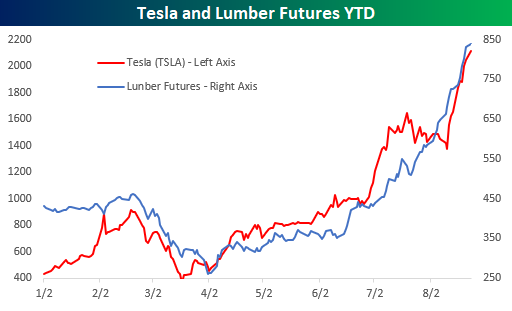

From my client post May 5th to today, Lumber has risen 162% – from $328 to $859..

Then Monday morning, I mentioned in my trading room that I suspected a reversal in Lumber on profit-taking – although I am still bullish the theme as a Trend play for reasons I discussed and detail below.

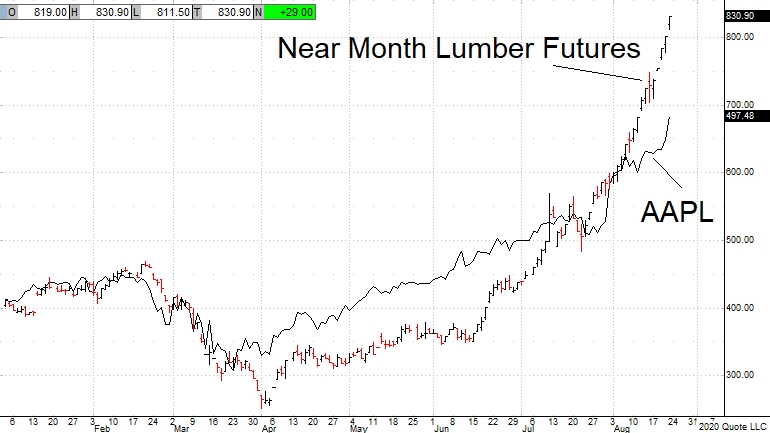

Late Monday, Lumber sharply reversed:

Timing A Lumber Pullback

Ironically, I had been discussing Lumber with a Lumber expert/trader over the weekend. Here are his thoughts in a worthwhile thread on why lumber went parabolic and what could lie ahead. Then just Monday morning I tweeted Lumber could reverse on news Lumber Tariffs might be cancelled. Just a few hours later there was news announced that Canada wins trade battle; WTO says U.S.-imposed tariffs break rules.

Lumber & Labor rates rising for new home construction = home price inflation, assuming folks can afford homes in light of growing permanent job losses.

If Trump cancels Lumber tariffs, it would make Lumber a good short. Otherwise… https://t.co/z4DWOY0q4Q

— Samantha LaDuc (@SamanthaLaDuc) August 24, 2020

Speculation Begets Speculation

Longer-Term Lumber Thesis

My whole thesis can be summarized in one sentence: Demand In-elasticity Meets Supply In-elasticity.

Here is an article I retweeted back in March 2018 about the perfect storm for lumber markets:

Housing growth, Canadian tariffs, insect infestations, and Chinese imports all pushing lumber to record prices.

A Bloomberg article refers to the tree devastation as a potential threat to global emissions. They bury the lede for traders but I will unpack it for you.

When major supply disruption from natural disasters (beetles, fires) meets diminished mill operators and operations (from 2005 GFC fall out and 2020 pandemic) at a time of heightened demand in lumber (from trend in work-from-home improvements to surge in home buying due to millennials and migration), we have the very real threat of asset price inflation – not only in lumber itself but also in homes. And this is in addition to Tariffs on Canadian lumber imports into the U.S. averaging more than 20%.

NAHB: Average new home price $16,000 higher due to lumber.

The housing sector is one of the most important and dynamic parts of our economy. According to the National Association of Home Builders, the housing sector directly accounts for roughly 17% to 18% of national gross domestic product. And that’s why when Homebuilder sentiment rises, so too do prices.

U.S. housing starts surge 22.6% in July and Homebuilder Optimism Hits All-Time High

Thanks to record-low mortgage rates, the fair value of houses in America today has actually gone up faster than house prices have gone up. The typical home in America is underpriced by about $75,000! Steve Sjuggerud

Inelasticity

‘Demand Inelasticity’ connotes the price-insensitivity to higher input costs. Mortgage rates are at all-time-lows, demographics of Millenial buyers support demand, lack of inventory drives scarcity…. This would normally be tempered by Permanent Job Losses post Covid and global economic contraction BUT, we have lumber ‘Supply Ineslasticity’ wherein replacement and substitutes are very limited and not time-sensitive, while new mill investment is capital intensive and labor-intensive.

Aug 2nd: America’s Saw Mills Didn’t See This Building Boom Coming

Lumber prices soar as saw mills struggle to meet demand

Add to that those damn beetles invading the world:

A plague of tiny mountain pine beetles, no bigger than a grain of rice, has already destroyed 15 years of log supplies in British Columbia, enough trees to build 9 million single-family homes, and are chewing through forests in Alberta and the Pacific Northwest. Now, an outbreak of spruce beetles is threatening to devour even more trees in North America just as similar pests are decimating supplies in parts of Europe, creating a glut of dead and dying logs. Bloomberg

Key article take-away points:

- This beetle infestation has erased more than a decade of lumber supplies and modeling indicates about 55% of B.C.’s marketable pine trees will be dead by 2020.

- These pests have affected 5.4 million acres and the outbreak is unlikely to subside for another five or six years.

- Climate change is to blame.

- It takes 80 years to grow back these pine trees in B.C.

- About a dozen European countries have outbreaks that could surpass damage felt in British Columbia.

- Reduction in sawmills post GFC from the collapse of the US housing market has led to a massive destruction of mill capacity to process the felled lumber.

- Reduction in sawmill operations during (closed) and post Covid (no overtime) have led to a massive disruption in mill processing to meet orders.

No wonder lumber went parabolic! Supply inelasticity met Demand inelasticity:

Aug 7th: *Lumber Touches Record With Lockdowns Spurring Home Renovation Revival*

‘Inventory levels are at an extreme low, which should fuel even higher prices ahead’ – Bloomberg News

Aug 18th:: U.S. Housing Starts Surge by Most Since 2016 As Permits Climb*

‘A big jump in permits points to a sustained advance in new home construction’ – Bloomberg

But now that lumber prices have intonated a pullback, is it the end of the trend? I don’t think so for all of the above reasons and quant positioning:

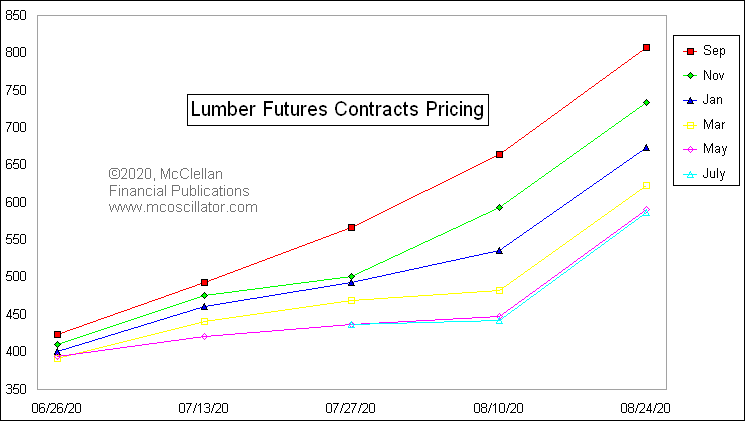

Earlier this summer, the lumber futures price rally was mostly confined to the September contract, indicating a near-term supply squeeze. But the last two weeks have seen the other contracts rising at the same pace. Not quite catching up yet, but matching the rise.

@McClellanOsc

Again, Lumber hit ATHs in May 2018 ($648) with a median price prior to that around $200. Fast forward two years and Lumber is in the mid-$800s and likely ‘settles’ around the prior highs in the $600.

Stocks of Interest: RFP

Canada’s Lumber Stocks will benefit from the lumber shortage, boom in home renovations and housing, and Fed-induced low interest rates, but there are few to play and they are not easily accessible to US traders let alone optionable: CFPZF, IFSPF, WFTBF

My US-based bet is on RFP – a deep value play that I have called out in my trading room the last week. Resolute Forest Products is the largest producer of Paper and Paper Products East of the Rockies.

Divide market cap by capacity: ~$160/mfbm, which is 2 to 4x cheaper than peers & a discount of 4x to building new milling capacity.

This ignores the other 3 biz areas they have (pulp, etc).

Prices like this imply it’s possible to double 2018 highs.

Earnings for sawmillers won’t be linear though – they might have hit 60% margins in ‘18 but ‘21 could be 230%.

@bryandav1z

When I say Deep Value, I mean RFP is 70% below its 2018 highs when lumber hit $643 all-time-highs. Today lumber is in the mid $800s and RFP is trading around $4.50.

August 20th – two upgrades on RFP are what prompted my attention on it again.

*Resolute Forest Products Upgraded To Outperform at RBC Cap*

RBC says record lumber prices will more than offset decline in Co newsprint/paper biz.

Sees strong free cash flow from soaring lumber prices, which RFP can use to reduce its leverage.

I also like it because of its growth potential. With just a $293 million marketcap, it represents 4.7% of the $6.2 billion paper and products industry.

Another idea: $IFP $IFP.TO

Interfor is a Canadian-based pure-play lumber producer with 70% capacity in the US South, so tariff exempt but they get to report in CAD which is an advantage. Both are possible takeout candidates. At $18 it is 33% below it’s 2018 high.