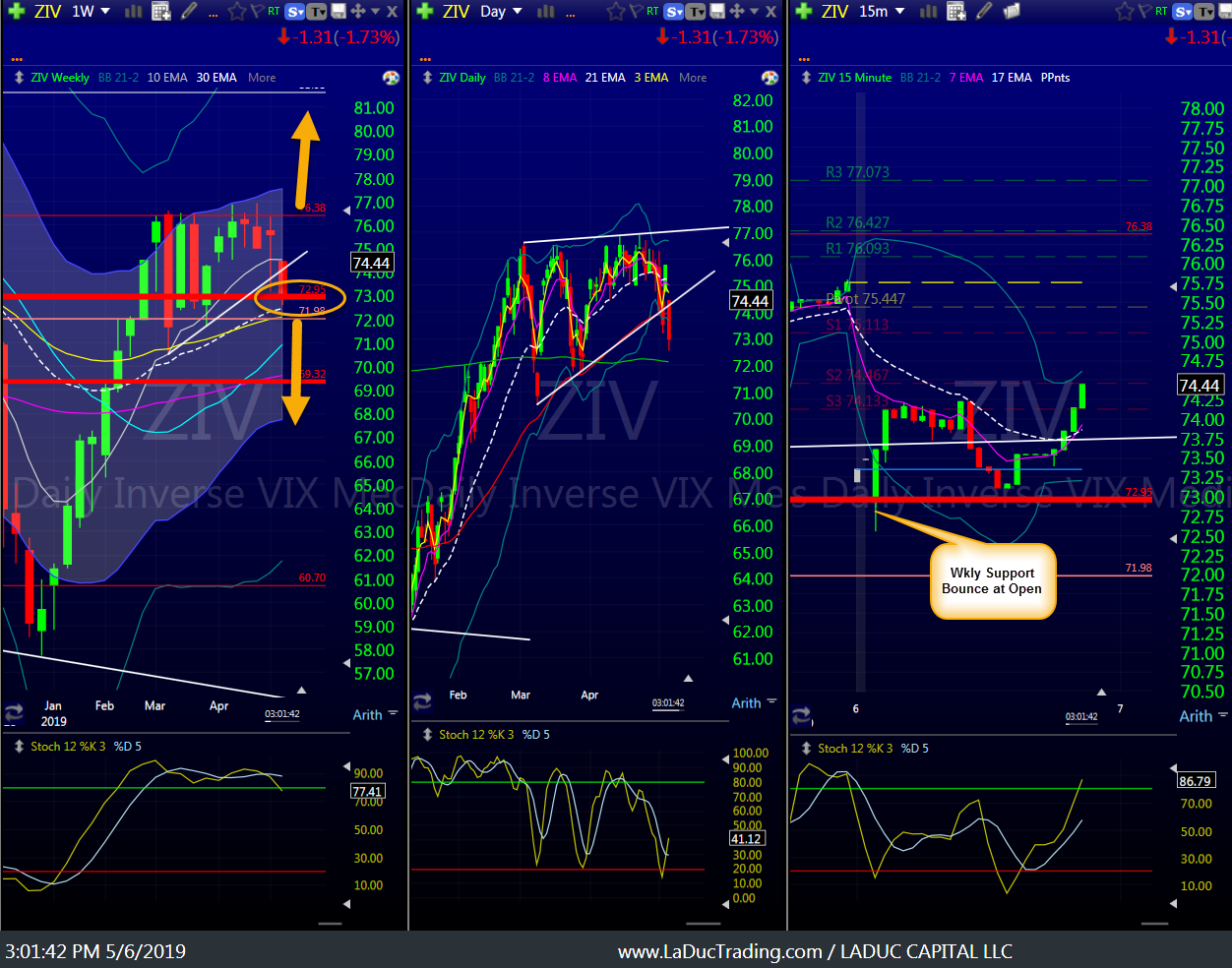

A 25% Tariff on $200 BILLION more of Chinese imports is a 25% tax hit to consumers. Trump is trying to obscure this fact in his tweets but Chinese tariffs is a tax on US and the market is smart enough to know the affect it would have on the eocnomy in the form of lower earnings and GDP … IF … the deal was really in danger of falling through and IF the Tariffs were implemented for real. The market doesn’t believe this is any more than Trump bully posturing to force China into a ‘deal’. As such, the gap down was bought. Straight off the open. My Tell was ZIV on MAJOR $72.95 support:

One sign market was still hungry for more upside was the early rotation into US growth-centric areas – Software (IGV) and Biotech were strongest sectors while KWEB and Emerging Markets were most weak. For the most part, Tech + Semis along with Industrials (CAT, BA, etc) reversed half their losses by 2PM ET. Volatility stayed elevated however…

Keep in mind: …a 16% implied volatility is pricing approximately a 1% daily move of the asset… so it’s tough to chase these big gaps. But I don’t mind adding some shorts up here tomorrow if these bounces into resistance are met with… resistance. To have more of a Trend Reversal to the short side, I want to see the following:

- VXXB > $26.53

- USDJPY < $110.68

- ZIV < $72.95

- NYSE <$12854

- AAPL < $207.50

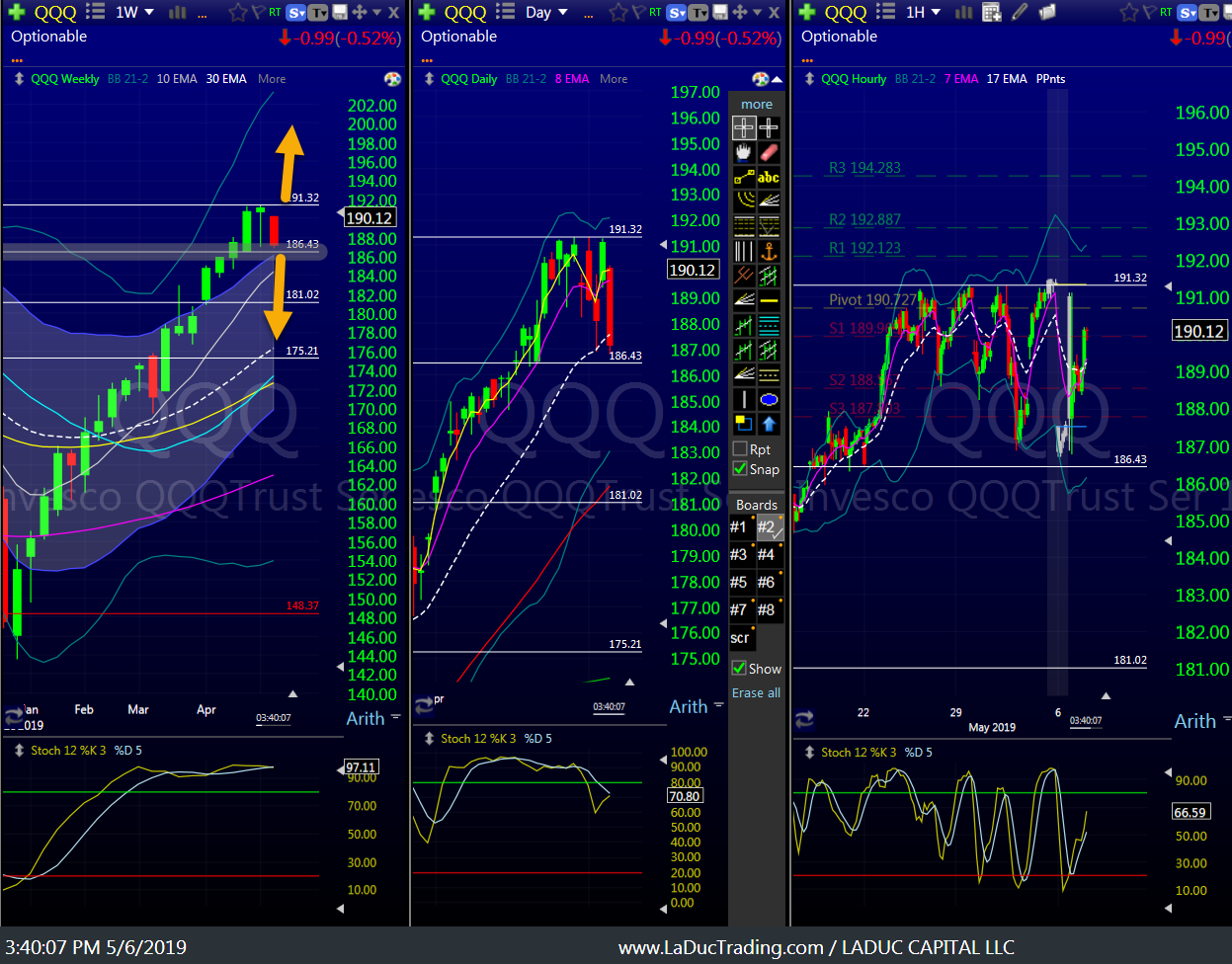

- QQQ < $186

- SPX < $2893

I am not chasing much given I see this as a Bull Trap with Friday’s Tariff deadline and UBERs IPO… I just see more risk than reward and rather go on vacation tomorrow night without the stress of managing many open positions. Having said that, here is a Bull-Bear Maginot lines in case my Bear thesis – and Trump’s Trade Deal – doesn’t play out right away:

I do have a bunch of earnings plays and a few shorts but mostly waiting for confirmation of the above before positioning for a deeper correction. Hope it helps.

Samantha