Market Catch July 31 – August 4

Check out the highlights from the week that have got us hooked, and what else is down the line!

Theme of the Week – Time to Protect

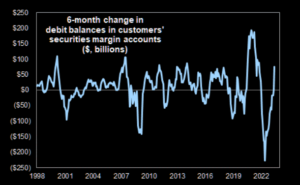

We have entered a market of protection. From record leverage to hedge fund short covering to the August chop-season, this past week’s content warns of volatility-to-come from all sides.

Trade of the Week

While reviewing $AMZN this past week, Samantha wisely noted that we must consider not just how the earnings report, but how the earnings are received. After clearing the inside-week engulfing while waiting for earnings, $AMZN will likely climb to 146 and change before bouncing. Stay tuned for more chase long insights.

Chart of the Week

Samantha on Bloomberg Options Insight, August 1: Risk-Off

Bloomberg TV featured Samantha on its Options Insight segment earlier this week to hear her insights on coming volatility.

Samantha reviewed BOJ’s yield curve adjustment, the ‘Buffett Bet,’ which she has been watchful of since early this year. Samantha sensed that BOJ policy would have a profound effect on the market, and indeed it did.

With US Yields rising higher, Samantha confirmed that she expects volatility. Factoring in vast hedge fund short covering and Tech mega cap softening, now is the time to buy protection.

Samantha on MarketWatch: $YELL and $TUP

Yellow, the trucking company reportedly facing bankruptcy, and Tupperware, the household favorite that is also nearing bust, delivered an absolute market sensation last week. $YELL quadrupled in two days, and $TUP gained 434% throughout July.

MarketWatch’s James Rogers covered these stocks in an article last week, featuring insight from Samantha. Rogers wrote that this radical stock performance seemed to correlate with the meme-stock phenomenon, the idea that social media buzz alone can send stocks flying. Meme-stock benefactors include AMC and Gamestop.

Explaining the reality behind $YELL and $TUP’s surge, Samantha cited the vast short covering in the market and junk unwinding. Speaking about $YELL, she stated that “low priced, low-float stocks are VERY easy to push around,” and while likely a result of Wall Street manipulation, they can also represent the culture of FOMO in an already leveraged market. Samantha separately anticipated $TUP’s parabolic performance following its initial spike, noting that “parabolas are trapped longs that can trigger volatility” and, ultimately, a liquidation event.

All in all, $YELL and $TUP serve as further signals of coming volatility.

Macro Down the Line: Commodities Review

Last week, Anthony Crudele’s Futures Radio Show released an informative podcast featuring Samantha. Throughout their conversation, Samantha dove into her Intermarket analysis strategy that allows her to spot inflection points and follow bulk money flow, she shared her philosophies on risk as well as her general market views, and she explained the importance of the derivatives market in knowing how long to stay in a trade. Her closing advice: all macro managers must study gamma levels!

Within the podcast, Anthony asked Samantha about her thoughts on oil’s recent rise following SPR releases and whether not the rise is solely momentum or a mark of inflation. Samantha explained that we should not get too excited about oil because it wears an ‘intervention collar’: the government will want to make sure oil stays repressed given that it drives inflation expectations. Although we are entrenched in an inflationary regime (wage inflation, bulk liquidity, etc.), oil is special: the Administration will try its best to keep oil animal spirits at bay, especially leading into an election. Samantha concluded that the current rise in oil is a temporary inflationary/reflationary move. Ultimately, big-money oil speculators have yet to bet on the asset, and oil will have to surpass some key levels before it can take off.

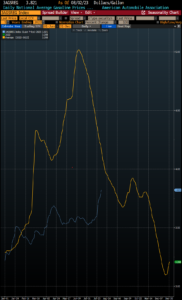

Speaking on Gasoline (blue line in graph below), Craig posted to Twitter that it is about to go positive YoY, driving up headline inflation forecasts for July and August and inflation expectations (USGG5y5y near 2.5%). Although the Fed may be focused on core inflation, the consumer experiences headline inflation regardless. To quote Craig, “Yields up, $ up, stocks down is coming.”

Keep track of Samantha and Craig’s insights to anticipate Macro down the line.

Never miss a trade

Learn more