Market Catch August 7-11

Check out the highlights from the week that have got us hooked, and what else is down the line!

Theme of the Week – LaDucTrading Team Roundup

Featuring Archna’s trading strategies, Samantha’s derivatives philosophy, and Craig’s Macro analysis, check out this week’s Market Catch for a roundup of what the LaDucTrading team can do for you.

Trade of the Week

Join Archna in the trading room as she provides a derivatives analysis of potential chases for this week. Archna provides expected levels on $VFC and $LEVI, and with $PGNY, she explains how to buy long when activity is generally low.

Chart of the Week

Options Trading with Samantha LaDuc

Recently presented at the Synergy Derivatives Conference, check out Samantha’s thoughts on how she uses options to read markets and establish risk.

Samantha’s market framework begins with intermarket analysis based on a macro backdrop, tracking sector rotation and timing volatility. Samantha then studies options structure with the goal of visualizing aggregate demand. Charts of interest include CTA/Quant/Gamma levels, interest rates (STIRs market), oil, speculators, and Big Money Flow across assets. Finally, Samantha identifies the best momentum stocks and provides clients with profit targets and stops.

In her presentation, Samantha details her options framework as well. She explains her outlook on strike prices given what is achievable within the specified time frame (read: understanding the market conditions), keeping the Deltas and the Destiny (P/L) in mind. She then shares her personal approach to risk management, nodding to her central mantra, “don’t risk more than you are willing to lose.”

Learn more about how Samantha reads the market and what LaDuc Trading can do for you through the presentation, included below.

Macro Roundup

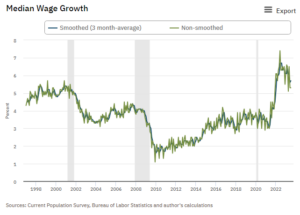

Inflation Expectations:

With the release of the Michigan Year-Ahead Inflation Expectations this past week, Craig shared his thoughts on the potential for headline inflation re-accelerating, in line with the recent ascent of gasoline.

Although the median data point went from 3.4% last month to 3.3% this month, the mean data point climbed from 5% to 5.7%, and the expected change in prices for the 75%-tile of respondents jumped from 5.4% to 6.3%.

With strong gasoline continuing and a final revision of the data coming in two weeks, Craig expects that we are not free from inflation woes.

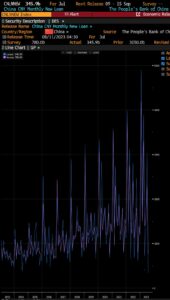

China Credit:

Last week, Craig pointed out on Twitter that China new loans hit an all time low in July, an even worse position than in 2015 when China one-time devalued. See the chart below for reference. While Craig does not expect another devaluation, he emphasizes that he would not be long anything China-related at the moment. Given how ineffective China stimulus decisions have been, keep watch of further monetary policy.

Treasuries Review:

On Thursday 8/10, the Treasury released its official budget deficit numbers for the month of July. Ultimately, Craig summarized on Twitter that deficits have been rising rapidly, and UST issuance must follow suit. Easing the deficit currently represents even more of a challenge, given that China and Japan are trying to defend their currencies and stimulate their own economies: we will have to rely on domestic private buyers, who are more price sensitive (read: yields higher).

Combined with UMich expectations, Craig explains on Twitter that a choppy bond market and sticky inflation lies in sight.

Never miss a trade

Learn more