Market Catch July 10-14

Check out the highlights from the week that have got us hooked, and what else is down the line!

Theme of the Week – Reaction vs. Reality

From volatility in China ADRs to credit channel graphs and the recent disinflationary wave, the market challenges us to decipher between sentiment and fact. Here is your guide to trade on the moment’s swing and also anticipate market conditions down the line.

Trade of the Week

China ADRs are back in the spotlight, showcasing incredible volatility. Whether you are interested in long trends, swings, or even day-contained Morning Star reversals, stocks like $KWEB and $BABA present phenomenal exit opportunities. At the same time, keep watch of macro-scale US-China news for potential market effects.

Chart of the Week

Macro into Micro: Disinflation

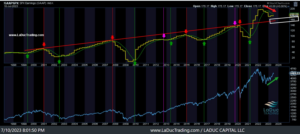

This past week, Samantha released two videos detailing the chase on $SPX and $SPY. The two stocks showed incredible positive gamma. Samantha tagged $4488 as the upper threshold and call-limit for the rise of $SPX, but explained that as long as the stock remained above $4200, positioning would stay strong. In reality, $SPX broke all the way up to $4524 on July 14, and it remains quite bullish.

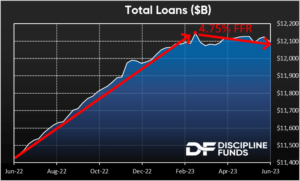

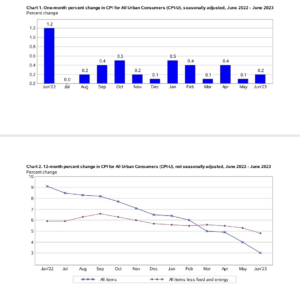

The sentiment behind the chase on $SPX and $SPY stems from a newfound sense of disinflation and pause on a hawkish FOMC. The Wednesday release of the CPI, an instrument that measures inflation based on the cost of products consumed by households, showed that inflation had eased to its slowest pace in more than two years (See image below). Specifically, inflation climbed 3% in June, less than estimates for the month and significantly less compared to the peak of 9.1% in June 2022. Combined with a healthy labor market (Jobless Claims released on Thursday), the market perceived less rate hikes, and much less hawkish FOMC policy to come.

Even so, inflation remains extremely sticky; it is above trend. Rent, services, and food inflation, for example, all remain quite elevated even as they rolled over into this ‘disinflationary descent.’ From one view, the only reason the CPI fell so much is because of the high base effect of 9.1% last June; we may be recovering from the surge, but we are not in the clear. While this pause might sway the Fed’s mind on a July hike, inflation risk still remains and, as Samantha claims, will be back as a “Q4 Problem.”

On Twitter last week, Macro Advisor Craig referenced the UMich mean LT 5-10 year inflation expectations, which point back to the highs at 4.5%. He noted that there is a gap between where the market believes inflation is going and what the Fed believes. While the micro showcases activated, reactionary behavior (driving up assets such as $SPX and $SPY), only the macro and the Intermarket will shed light on what to expect down the line.

Samantha’s Market Thoughts UNLOCKED: Positioning Before the Move PUBLISHED July 11

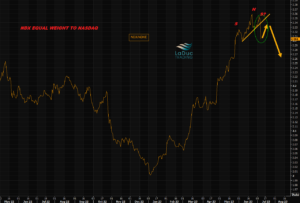

Nasdaq 100 “Special Rebalancing

As discussed Mon am live with clients, the Nasdaq 100 “special” rebalancing not only gives my growth-to-value rotation thesis mega legs, it also caused the worst trading day for Hedge Funds in the past 10 yrs, as Mega Cap Tech came under distribution and non profitable tech (read: highly shorted names) rallied Monday!

As it turned out, according to GS, those VIP Nasdaq8 names underperformed shorts by -387bps! Specifically, Monday, July 10, I rec’d swing short XLK and the main mega cap players, given MSFT $AAPL $NVDA $AMZN + $TSLA will have a combined REDUCED weighting from 43.85% to 38.5%. Luckily, we were already chase short AAPL + TSLA from last week.

The announcement led the equal-weighted version of the Nasdaq 100 to outperform the capitalization-weighted version on Tuesday as well.

Dash-For-Trash Well-Timed.

As CLUB + EDGE clients know if you attended the July 11 session, chasing crap (what I have referred to as DASH-FOR-TRASH plays past month) extended bigtime on July 11 – again.

Performance since May: (Refinitiv)

- MEME up 34%

- Most shorted up 30%

- NASDAQ up 15%

But I already helped position you for this rotation with MANY #swing-ideas LONGS that triggered two months ago, which has led to the HF Factor Rotation/short covering extravaganza that is now playing out. It’s been a fabulous two months of positioning and chasing oversold plays:

- Jr Tech rally in May

- Value rotation June 1st

- Short covering Crap + Bitcoin proxies into July…

So we are WAY ahead of the crowd in positioning for these outsized moves. CONGRATS!

There is no substitute for the Live Trading Room.

My 30 min #chase-ideas squeeze indicator is off the charts. From existing swing long squeezes in COIN, UPST + ZS to new dash-for-trash stuff like: FUBO LYFT + NVAX etc.

Just remember: this move isn’t about fundamentals. But every Swing/Trend reversal STARTS with short covering. The trick is in knowing which is which.

It was also my pre-market rant June 1st that was captured in a video for my: “Stalking Value Rotation” theme – 2 days before the largest 1 day outperformance of $IWM vs $QQQ in over 2 years. Since then, IWM has run up nearly 10%.

From my macro premise that falling YoY inflation tends to be a great backdrop for small caps, to the sizing up of the micro positioning before value exploded higher….THIS is why I run a live trading room.

Macro Trades Worked/Working

For those not in my live trading room or tracking #trading-room-chat with my calls or following #swing-ideas for multi-week equities, bonds and currency trades…

- USDJPY was rejected at 145 exactly

- JPY (FXY) bounced on cue

- TLT (ZB Tbond futures) hit price targets short precisely

- GOLD rose into 1938 perfectly

- and Crude oil is working into 75.65

Q3 Macro Trend Thoughts:

USDJPY has strong daily support at 139.39 – so bounce there means the advance in yen, bonds and golds fades, and market overall softens. Should 139.39 get/close below, then the USDJPY 200D is back in play near 135. Equities can advance as DXY declines.

All eyes on USD. As it falls, it’s a tailwind for equities and oil, but DXY 100 matters. Below would be bullish oil but I think it’s too soon for that. A reversal higher of USD off 100 *should* be a headwind for equities, oil, gold and bonds.

Combined, this would give follow through higher in the 10Y which would be equity bearish; otherwise, we continue to chop until we have a trigger for volatility such as spiking higher jobless claims and/or Fed announced pause in June FOMC which is not priced in.

Cumulative earnings disappointment (see GAAPSPX chart) and continued reduced Fed bank reserves (read: market liquidity) are serious contenders for a pullback, but in general, it is the derivatives market that will alert to major directional moves.

I only expect a solid trend short when/if SPX closely below 4218 with 4287 a CTA sell trigger. I continue to see 4545/4660 SPX capping the upside this year. If we close below 4218 weekly close, I fully expect to tag $4000 at some point before EOQ.

Volatility Revisited

Recently, I warned to position for a VIX spike (July 3rd: I fully expect the 10Y to tag my 3.9 level this wk if not next, and with that, a quick volatility shake-n-bake). VIX moved 21% Wed into Thursday and we caught all of it. Yes, it has retraced nicely back to breakout, so now is the time to size up its next move.

Given my VALUE ROTATION (June 1st) meets HF FACTOR SHORT COVERING on MEGA CAP TECH WEAKNESS, I wouldn’t be surprised if it doesn’t give us another spike soon, and here’s why.

As warned a month ago, a dash-for-trash rotation of size (especially where Factor Rotation follows Value Rotation), is almost always proceeded by extended VIX.

Macro Event Risk Events into EOM

This week, CPI, Jobless Claims, and PCE were released. Coming soon: June monthly OpEx on July 21st, Nasdaq 100 special rebalancing into the 24th, and FOMC on the 26th. But none are likely to move the volatility needle like the 10Y moving higher.

Never miss a trade

Learn more