Market Catch June 5 – 9

Check out highlights from the week that have got us hooked, and what else is down the line!

Theme of the Week – Rallies and Rests?

Rallies across the Tech sector continue, this week featuring big names such as $AAPL and $TSLA, while the Fed ‘rests’ into a long-term TGA-refilling state. How much can we really rest, and how will the rallies pan out?

Trade of the Week

“It’s extended, but it’s Apple”

With the release of the Apple Vision Pro, $AAPL has been extremely bullish over the past week. ‘Buy the Rumor, Sell the News’: wait and see how this trading adage aligns with $AAPL as the bull-run continues, but bets (and calls!) are on for even more growth.

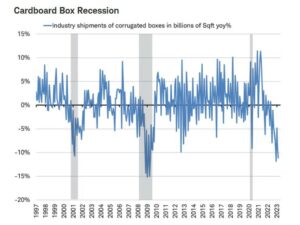

Chart of the Week

While Jobless Claims is one way to predict recession, another interesting proxy is depicted below: Cardboard Boxes. Daily shipments of corrugated boxes indicate economic activity. According to @Halsrethink on Twitter, Alan Greenspan famously relied on this indicator. Based on the graph, recession appears near. Learn more from @SamanthaLaDuc on Twitter.

Micro Spotlight: Tesla

Unlike many of the Tech surges we have been tracking as of late, $TSLA shows convincing follow-through. Tracing back to the evening star reversal last Fall, we saw a partial gap fill at the start of the year, and after a period of steady, sideways digestion, $TSLA’s bullish conditions this week indicate that we are closing in on a complete gap fill. In the videos below, Samantha explains why she believes the stock will rise towards a price target of around $270.

$TSLA’s current bull-run spurs from two main developments: EV credits and a striking partnership.

Regulations regarding EV credits from last year’s Inflation Reduction Act went into effect last month. While reducing the number of eligible EVs on the market, these regulations propped up the Tesla Model 3 as one of the best available options. In California, for example, given additional state-specific rebates and the Model 3’s popularity, a Tesla Model 3 lists at a net cheaper price than a Toyota Camry.

At the end of last month, news outlets raced to announce of a rare partnership between Ford, GM, and Tesla: Ford and GM EV drivers can now use any of Tesla’s supercharging stations around the nation. Since word of this partnership broke out on May 25, $TSLA has risen by 30%. Beyond Tesla’s performance, this event marks a critical point in the EV arms race as a whole.

Keep your eyes peeled as the $TSLA rally continues.

Down the Line: Fed, Phase 2

Never miss a trade

Learn more