Market Catch July 24 – 28

Check out the highlights from the week that have got us hooked, and what else is down the line!

Theme of the Week – Priced to Perfection

The market is currently “Priced to Perfection” and nearing key inflection points. Wisdom from Samantha and Craig included below will orient your outlook on market moves to come.

Trade of the Week

China plays are back in the game following signals from Chinese officials that more stimulus will hit the market per revised economic policy. While China stocks showed lazy activity last week, $BABA, $KEWB, and $USDCNH are now bullish across the board. Keep watch to see how China stocks follow through.

Chart of the Week

Samantha on Spotgamma; Growth-to-Value Review

Last week, Spotgamma interviewed Samantha to learn more about LaDuc trading and Samantha’s individual trading style: namely, using Intermarket and Macro analysis to follow the money flow and position herself within sectors before rotation occurs.

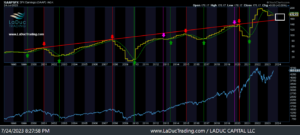

In the interview, Samantha stated that “we are priced to perfection.” This stance harps on SPX’s current position. Right now, $SPX is trading for 20x future earnings, even as estimates decline and many sell-side analysts expect an EPS trough. Because Samantha’s SPX Earnings chart continues to go down (pictured below), expectations for a trough cannot yet be confirmed. The takeaway: SPX’s current position is price-perfect!

While “priced to perfection,” the market is nearing an inflection period that will put it to trial.

The Growth-to-Value chart below features annotations marking Samantha’s value rotation in play since June 1. For extra context, the spikes leading up to June 1 on the graph were caused by the Bank bailouts in March and the AI rallies in May.

In the highlighted rotation portion from June 1 on, growth:value has been leveled off and protected. As Samantha explained in her Growth-to-Value Review video, the indicator has been trying to outperform tech for a while, and we are finally seeing some red following the recent Nasdaq sell-off. Accordingly, mega cap concentration is absolutely at risk, and once growth:value finally breaks down, there will be a pristine backdrop to go long on value. Market performance during the current testing period will determine whether or not growth:value indeed breaks down.

Another signal comes from the Nasdaq Composite, which has tagged its resistance of 14500; a classic inflection point example wherein the index’s next move is variable.

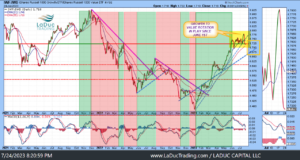

The crucial kicker of predicting the money rotation: Samantha identified transports/transportation as the next sector to watch. As her analysis points out, the IYT:SPY Index was extremely oversold post-Covid (read: Fedex, UPS, airlines), but signals are now firing that a bullish turn will materialize. While $IYT remains in rotation, both $MATX and $JBHT, for example, are spiking ballistically.

Macro Down the Line: Post-FOMC Power Hour

News that has likely reached your ears already: the Fed approved another 25 basis point hike this past week, as expected. Press conference takeaways did not excite either, only re-confirming that the FOMC will continue to use a data-dependent approach.

As Macro Advisor Craig explains in the Post-FOMC Macro to Micro Power Hour, the questions that remain are, ‘what will the next market catalyst be,’ and, ‘is current buying real, or just contained within short squeezes?’

Our eyes should go to coming Macro data that will drive a transition out of the current period of micro earnings (some names up, some names down). Payroll will be released imminently, and we can also expect the Inflation Print on August 10. These data will determine whether or not to expect another rate hike in September. Craig mentioned that, although consumers are feeling more at ease given headline inflation’s ‘soft landing,’ we might enter situations of inflation re-acceleration soon.

Craig also noted that China stimulus talk, however legitimate, has already boosted Chinese assets; remain on the lookout at commodities and pricing.

Check out the Power Hour, provided below, to learn more.

Never miss a trade

Learn more