Market Catch August 21-25

Check out the highlights from the week that have got us hooked, and what else is down the line!

Theme of the Week – Micro Bounce, Macro Breadth

Last week presented great amounts of activity, from a bounce in $NVDA and $QQQ to a breadth of Macro events. While the Micro tests the market right now, the Macro weighs heavily on conditions to come.

Trade of the Week

NVDA soared last week, following the release of its glowing earnings report. The stock grew bullish on account of its growth and market cap. QQQ pushed past its 21-day, breaking $270. On a broader swing basis, QQQ remains bullish. NVDA digesting after its rally last week will test for the market’s resolve: reasons for sell-off could trigger a flip to negative gamma and trigger volatility.

Chart of the Week

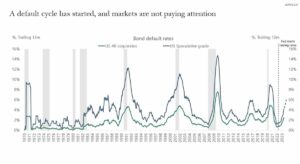

Shared by @MichaelAArouet on Twitter, a default cycle has started that the market has not yet acknowledged. According to the graph, there are currently three times more zombie companies (companies that cannot repay their debt and/or require bailout) than during the 2008 financial crisis. In a climate of high interest rates, companies may need to roll their debt.

Intermarket Analysis: August 23, 2023

In her intermarket reviews this past week, Samantha reviewed multiple key indexes and charts that depicted one major trend: the market continues to roll over, with no sign of basing.

Notably, the NAAIM Exposure Exposure number dropped to 34.36%, its lowest point in 2023. This indicates a starkly poor investment sentiment. Samantha further reviewed McClellan Summation Indexes for SPX, NYSE, and NDX, all of which show no signs of reversal following their peaks at the beginning of August.

Volume and breadth of buying have not triggered stronger or higher, and Advance/Decline for the market overall is still trying to bounce from oversold levels. Accordingly, volume and breadth are at risk of retesting their lower levels.

Both credit stress and volatility have yet to trigger higher as well.

Macro to Micro Power Hour on Twitter Spaces

Catch up with Samantha and Craig at last week’s Macro to Micro Power Hour, hosted on Twitter Spaces. Basking in Nvidia news, Samantha and Craig touched on last week’s rally before centering their conversation on key Macro event risks.

While discussing the Unemployment Claims revision news from last week that announced 300,000 less jobs than expected, Craig explained that we still have a fairly strong labor market, complete with robust wages. Further, the idea that a rate hiking cycle would stifle the economy did not ultimately play out. Considering the slight drop in recent US Services PMI data, Craig commented that we might be lightly responding to the effects of tightening, but not so significantly that inflation would fall to its target of 2%. In retrospect, Craig noted that the market potentially resembles stagflation, wherein growth is slowing but not recessionary and inflation remains sticky.

Samantha and Craig also touched on last week’s drop in USDJPY, which caused a bounce in bonds and golf/silver/miners. Samantha explained why this bounce was highly expected, and Craig added that he expects yields to continue marching higher.

Last week’s United Auto Workers strike-positive vote led Samantha and Craig to revisit the wage spiral narrative. Check out Samantha’s thesis on how Wage Inflation Delayed Recession.

Later touching on the BRICS de-dollarization debate and the threat of a US ‘debt bomb,’ the US Debt ceiling, the potential for a devaluation in China, and waning liquidity into EOQ, Samantha and Craig concluded that we remain in a position of protection as VIX may soon pop up and SPX may drop into the the September quarter end.

Check out the Power Hour to learn more about key Macro considerations on the horizon.

Jackson Hole Summary

A highlight from last week’s Macro scene, Powell spoke at the Jackson Hole conference, shedding insight on Fed policy to come. He mainly noted that the Fed is prepared to hike further but will proceed cautiously, that the 2% inflation target will not move, and that lowering inflation will require softer labor markets.

Craig remarked on Twitter that, if the Fed needs to be so careful amidst market uncertainty, then risk premiums should rise.

Never miss a trade

Learn more