Current Outlook

The services economy has been the strength for the US so this December reading is very concerning, and suggesting a serious loss of economic momentum to end the year, with very sizable drops in employment and new orders. However, prices paid remains quite elevated as inflation remains sticky. We saw wage data re-accelerate in December as well, back above 4%, and we know Fed govt employment is up 5.2% this year, COLA adjustments are +3.2% and tax brackets/standard deduction increases of 4-5% will support consumer spending as well. All this positive momentum on consumer balance sheets can make it more difficult for the Fed to believe we are rapidly approaching the 2% target. This will mean they are going to be slow to add accommodation.

We have evidence of a stagflation environment setting in where the Fed’s reaction function will remain slower than the market wants/needs to keep moving higher. If we are not going to get much in the way of multiple expansion from here on falling rates (since too much accommodation is likely already priced in), then we need to have earnings growth momentum pick up the slack. Early evidence on the earnings trajectory does not look that great as we have seen some crappy results in December (FDX, NKE, ORCL) and to start this year (MBLY, WBA).

Double digit earnings growth is expected in 2024 but that assumption seems very aggressive considering this deterioration in the services economy (note manufacturing has been in recession in the US for over a year).

So, if we cannot really expect to get much from earnings growth surprising to the upside here, and we aren’t likely to see assistance from multiple expansion that comes from lower rates, what exactly is the rationale behind plowing into risk assets, particularly equities in here?

The last argument would be flows which we know are typically supportive to start the year and there is a lot of ITM single stock calls for January opex which may keep us pinned however, we have lost the stock buyback support for now as we are in blackout and we know that systematic flows are very long after the rally we saw in Nov/Dec (both CTAs and vol control). So, we do not really have the support from flows either in the coming weeks.

If what we have here really is no multiple expansion, limited potential for positive earnings surprise and flows that can start to go the other way, exacerbated by dealers currently in negative gamma position and realized volatility starting to move higher which can act as a “throttle” on further selling.

I must admit: The equity outlook here is grim. Caution is warranted.

Asset Class Positioning

Upcoming Macro Catalysts

- US Data / Fed Speak

- 1/08 – NY Fed 1-Year Inflation Expectations, Consumer Credit, Fed Bostic (voter)

- 1/09 – NFIB Survey, Trade Balance, Fed Barr (voter)

- 1/10 – MBA Mortgage Apps, Wholesale Inventories, Wholesale Trade, Fed Williams (voter)

- 1/11 – CPI, Initial Jobless Claims, Continuing Claims, Monthly Budget Statement

- 1/12 – PPI, Fed Kashkari

- International Data / Central Banks

- 1/08 – German Factory Orders, EU Consumer Confidence, Tokyo CPI

- 1/09 – ECB Villeroy

- 1/10 – China Money Supply Data, China New Loans, ECB Guindos/Schnabel

- 1/11 – China CPI/PPI, ECB Vujcic

- 1/12 – China Trade Data, ECB Lane

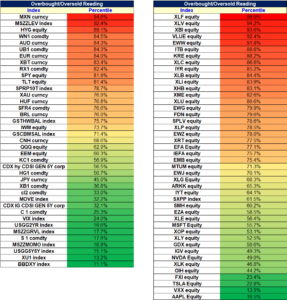

Overbought / Oversold Indicator

————————————————————————————————————————————————————————————–

Any questions on anything contained in this report? Send me a DM in Slack @Craig Shapiro

EDGE MEMBERS ONLY | NOT FOR DISTRIBUTION