Market Catch July 3-7

Check out the highlights from the week that have got us hooked, and what else is down the line!

Theme of the Week – Intermarket Moves

From $SPX reversals and Nasdaq rebalancing to debt insights, this past week brought together many key market events that altogether reinforce the importance of an Intermarket perspective.

Trade of the Week

After hitting resistance last week, $SPX began a steep downward reversal, at one point opening beneath the previous gap-up. Although by the end of last week the gap fill resolved, no signs of monetization are in sight. Keep watch as the short continues.

Chart of the Week

Intermarket Wisdon: $VIX

This past week, Samantha called the 21% jump in VIX. The key to her wisdom and understanding market movements lies in Intermarket analysis.

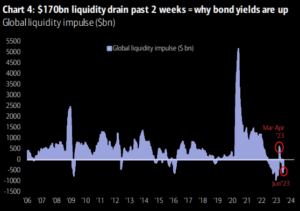

On Thursday, USDJPY climbed from 140.80 to 145. This strengthening of the US Dollar paralleled bids on the 10Y. As the graph below explains (taken from @SamanthaLaDuc on Twitter), the liquidity drain throughout the past two weeks led to bond yields increasing, and hence the overall bond move. The spike in VIX does not exist in isolation, but as a result of all these movements. The strengthening of the USD stemmed from the movements towards bonds, a response to liquidity policy, which in sum comments on market volatility.

As liquidity draining continues throughout the next couple of months, remember to employ an Intermarket perspective.

Macro News Roundup

On Friday, the Nasdaq announced that the index will undergo a special rebalancing before markets open on Monday, July 24. This special rebalancing addresses the recent over-concentration of the index, read: Tech MegaCaps. Be on the lookout for option positioning and re-weightings lower in $AAPL, $MSFT, and $GOOGL

In geopolitical news, China imposed restrictions on the export of gallium and germanium, metals essential for the manufacturing of semiconductors and computer chips, etc. Although the Chinese Commerce Ministry claimed these restrictions are intended to “safeguard national security,” they ultimately feed into the tense technology standoff between China and the US/Europe.

Learn more from Macro Advisor Craig on Twitter, @ces921.

Never miss a trade

Learn more