Market Catch May 8-12

Check out highlights from the week that have got us hooked, and what else is down the line!

Theme of the Week – Hurry Up and Go Slow

From bankruptcy predictions to the AI Rally on $GOOGL to the threat of reaching the Fed Debt Ceiling, we just have to hurry up and go slow.

Trade of the Week

Bullish behavior on $PLTR, $ZS, and $CRSP! A chase-continuation play, huge volume and massive buy-ins. Expecting behavior to continue as volume is digested.

Chart of the Week

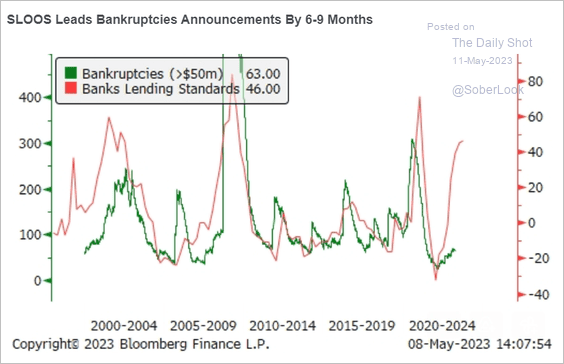

SLOOS Data shows that bankruptices might surge soon. Leads by 6-9 months, bankruptcy follows lending standards.

From @SamanthaLaDuc

Thoughts for the Week: Tech

Google I/O Conference this week: Google showcased its long-term competitive position across AI powered search, responding to competitors (ie the New Bing) and Bard’s recent botched release.

- AI Rally – Last 5D: GOOGL +11.29%

- Risk On? or Risk Averse?

- Net Selling is picking up underneath the surface

- Approach AI with caution

Tradability “makes complacency very dangerous” – Samantha

Down the Line: The Debt Ceiling

The Fed Debt Ceiling is on the watch list for the rest of May. Based on the government spending trajectory/tax receipts, there is a growing chance that the Treasury will run out of money by early June. Other than risk aversion in T-bills around the start of June, there does not seem to be much market concern. Yet, political leaders will have to convene and decide on spending cuts, and Macro Advisor Craig surmises that political action will likely be spurred by market panic… Bond market Concern? A June cut? Learn more at Samantha and Craig’s Macro-to-Micro Power Hour here:

Never miss a trade

Join the action today with a LaDucTrading membership for prescient market timing calls across all assets and timeframes.

Learn more

Learn more