RISK-ARB: BITCOIN MISPRICING A NON-EVENT (HALVING)

📺 WATCH RISK-ARB: BITCOIN, MISPRICING A NON-EVENT (HALVING)

📺 WATCH BITCOIN EVENT-DRIVEN: MISPRICING A NON EVENT (HALVING)

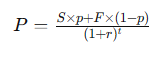

A event driven situation with a binary outcome can be defined in those term P (price today a t=0) is defined in the following mathematical manner.

Where:

P is the expected discounted price.

S is the price in case of success.

F is the price in case of failure.

p is the probability of success.

(1−p) is the probability of failure.

r is the discount rate (r

epresenting the time value of money).

t is the time period.

The bicoiners believe we are facing a situation like so.

Where we will have success and as a result of sucess the price will converge higher due to halving.

Except that it is mathematically very improbable using Bayesian framework of probability, because the higher price is due to new information, except that halving is no new information, it is a sure thing.

The reality is that buyers are front loading TODAY in expectation of the halving, and the pre-IPO guys are taking advantage of this liquidity exit bonanza.

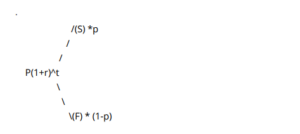

Since p = 1 (certainty) and 1-p =0

A rational market should have this behavior

(1+r)^t ———– (S)*1 no change in price since the havling a is a certainty we already know.

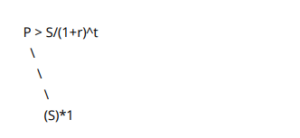

But the marketing push and FOMO means we have that.

P > S/(1+r)^t

All Bitcoiners assume it’s a great secret and that something magic will happen, the demand is front-loaded.

Meaning on the day, nobody will buy because an uncertainty has been removed like say a CFIUS approval on US Steel.

So the demand will actually FALL on the day the halving since all bitcoiners bought in anticipation ALREADY.

And that is why DIMON is expecting a fall Post Halving. He probably talked to some the risk-arb speciality people, speciality acquired from Bear Stearns Desk.

https://www.theblock.co/amp/post/279833/jpmorgan-bitcoin-price-april-halving

The reasoning above is a classic ARB basically..

In the augmented media report all the topic below discussed.

JUST CLICK ON THE LINK AND ALL TOPIC WILL BE DISCUSSED, YOU CAN ALSO DOWNLOAD THE PDF SEPARATELY

📺👉https://link.graphcall.com/bit-coin-pricing-a-non-event

About the author

Geoffrey provides unique insights. As DM and EM start to switch places in fiscal dominance regimes, his experience from a firm that traded EM bonds in the early 2000s will prove crucial. He is also versed in pre-FX as reserve monetary systems ( prior to 1922) and it will prove handy to understand local ccy trading, and its impact in FX, bonds, PM and currencies.

Former portfolio manager of 15 years at York Asset Management, a US and UK based firm specialized in Global Risk Arbitrage & Special Situations, Geoffrey is now CEO of DocuTalk, a NY-based software company that pioneered a new visual format to interactively present documents in video format using patented technology (and featured in the ’30 year anniversary’ edition of the Investor Relations Magazine New York).