Market Catch June 26 – 30

Happy July 4th! Here’s a recap of some key events from the past week, and some highlights of what else is down the line!

Theme of the Week – Fireworks, Celebratory and Cautionary

Some sectors of the market enjoyed exciting firework shows this past week, notably EV stocks and Crypto. At the same time, inflationary firework signals blared behind the scenes.

Trade of the Week

The market, oversold yet stubbornly on fire, is stupefying at first glance. In her video, Samantha shared some nuance behind the climb in EV stocks, attributing it to a combination of factors: small-cap ‘dash for trash’ plays, the 10 and 21 crossover, and continued volume input.

Chart of the Week

Market Spotlight: Crypto

This July 4th season, you can expect some ‘fireworks’ from Bit Coin proxies.

As Samantha explained in a Youtube release this past week, off-ramp RRP and market softness are channeling liquidity into crypto. The point to remember: market liquidity is bullish! Although market volatility persists and ‘dash for trash’ plays continue, Bit Coin proxies are showing all the signs for a chase play.

Specific stocks to watch are $COIN, $RIOT, and $MARA, which are at resistance and preparing to take off.

In other crypto news:

This past week, Fidelity joined the club of firms pushing for Bit Coin ETFs, alongside Blackrock and ARK Invest. Since the beginning of the year, $BTC has risen 80%, ETF optimism filling its sails. Although the SEC reported that BTC ETF filings were inadequate last week, BTC investors seem as confident as ever. According to brokerage firm Bernstein, the probability for US approval of a Spot Bitcoin ETF is quite high as its absence promotes products such as the Grayscale Bitcoin Trust, which are more expensive, illiquid, and inefficient.

Looking ahead:

After articulating a creative opening response, Coinbase secured an early court hearing against the SEC: July 13. This hearing will resolve the SEC’s lawsuit filed against Coinbase on June 6, claiming that Coinbase operated its crypto asset trading platform as an unregistered national securities exchange and broker.

Keep watch of crypto!

Macro Roundup

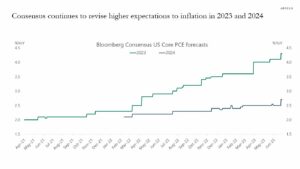

Macro Advisor Craig tweeted at the end of last week that people will have to “rip the Band-Aid off” when realizing how drastically rates will have to be cut. Especially given quarter-end dynamics, we are far from reaching an inflation rate of 2%. Learn more from Craig on Twitter, @ces921, re: Treasury/RRP updates and notes on window dressing.

Adding to the inflation challenge, last week saw worrying reports of potential rising food costs due to droughts, and Saudi Arabia and Russia are restricting oil production in bids to raise prices.

Never miss a trade

Learn more