Market Catch September 25 – 29

Check out the highlights from the week that have got us hooked, and what else is down the line!

Over the last two months, the dollar and yields have surged higher, putting pressure on the markets. Will volatility persist into Q4?

Trade of the Year

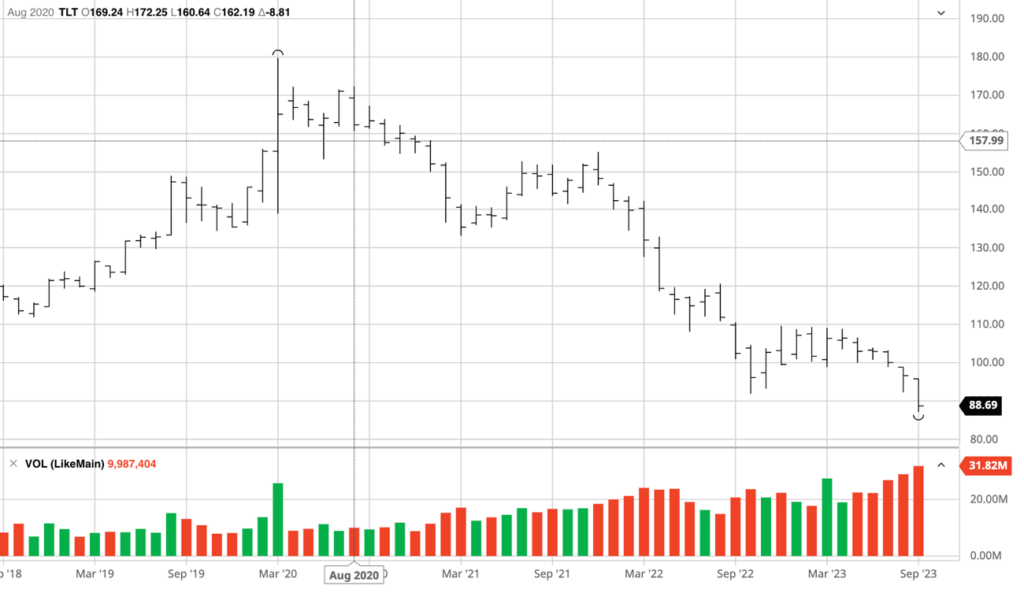

In August 2020 Samantha warned clients that she thought bonds were done going up and shared her thesis publicly on Twitter in early 2022. She predicted that this would be, in time, the biggest bond selloff in history. TLT has slid over 46% since then. Through her daily analysis, Samantha not only helps traders and investors navigate a challenging market environment, but also provides impressive trade ideas.

Samantha on Bloomberg TV: September 25, 2023

Samantha returned for another engaging conversation with Abigail Doolittle on Bloomberg TV, where she shared her fresh insights on market volatility, the US dollar, bond sales, and her prediction for the SPX reaching the $4210 range by quarter-end. Samantha reiterated that the dollar and yields play a crucial role in market dynamics, emphasizing that if the 10-year yield and DXY index surpass 4.5% and 106 respectively, it could fuel even more market turbulence. Since her last appearance on Bloomberg on August 1st, Samantha’s timing has been impeccable once again, accurately predicting both the recent bond and equity sell-offs. The 10-year yield has surged by 14% while the SPX has declined by 8%, hitting a low of $4240 as of this past Wednesday. Samantha’s call has truly been remarkable!

Macro Rundown

Net Liquidity

In Macro-to-Micro Power Hour last week, Craig accurately pointed out that markets would continue to be under pressure. He noted a significant drop in bank reserves due to the TGA increase and quarter-ending window dressing, leading funds to stay in high-yielding RRP. He shares his take on this upcoming week: Net liquidity has hit a year-low, erasing gains from SVB additions. Funds will exit RRP as usual, but with significant tax payments due on October 15th, TGA will rise above $750 billion, further depleting liquidity. Expect risk markets to face higher risk premiums and ongoing pressure.

Collective Bargaining Movement

All eyes have been on the United Auto Workers (UAW) ‘Stand Up Strike’ as it is set to potentially become one of the largest in the industry’s history, targeting the country’s three largest automotive manufacturers – Ford, General Motors, and Stellantis. As of this Friday, UAW has ramped up the pressure on GM and Ford to create a new contract deal, adding two additional assembly plants – Ford’s Chicago Assembly Plant and GM’s Lansing-Delta Assembly Plant. That brings the total UAW workers on strike to 25,000 people. Their four key demands are reinstating cost of living protections, 40% pay raise, ending the two-tier system for wages and benefits, and job security in the electric vehicle transition. The automakers argue that the union’s wage and benefits demands would harm their competitiveness, particularly during the shift to EVs.

The Las Vegas Culinary Union hospitality workers could be next. Members have authorized a potential strike at nearly two dozen Las Vegas Strip properties. While not an immediate threat, this empowers the unions to call for a strike if agreements with employers aren’t reached. This coincides with Las Vegas gearing up for major tourism events, including a Formula 1 race in November and Super Bowl LVIII in February. Representing 60,000 Nevada workers, mostly in Las Vegas, the unions have varied demands, including higher wages, better working conditions, safety measures, tech protections, healthcare, and recall rights in crises.

Craig shares his insights on the growing labor market power movement. He says the Fed’s assumption that wages are a lagging indicator, not a driver, of future inflation hinges on the absence of collective bargaining trends in the US since the 1980s. However, this notion is now being challenged. As inflation persists above target, the labor movement is gaining momentum and demanding more, fueled by robust corporate profits and a history of prioritizing buybacks and dividends over wage increases. This trend is likely to continue into the 2024 election year, particularly in key union-heavy swing states, with President Biden’s support potentially fostering more unions and increased union membership. This growing labor market power poses a challenge to the Fed’s goal of returning to a 2% inflation target. Achieving this will require the Fed to maintain higher interest rates for an extended period, potentially leading to layoffs as corporations adjust. A risk-off environment may become necessary in this scenario.

Never miss a trade

Learn more