Last Tuesday, I penned a post for clients entitled, Violent Rotation. It was to highlight a trading theme I spied for the coming week to support my market timing calls to trade long ‘value’ plays – those highly-shorted, ‘high risk, bad-balance sheet’ companies with the most exposure to COVID19 lockdown that many sold in the throes of demand destruction and elevated insolvency risk.

Think: Leisure & Travel, Airlines and Aerospace, Regional and Money Center Banks, Cyclicals and Transportation, Retail and Real Estate. And think Small Caps.

I followed up on this theme in an interview last Thursday with ForexAnalytics to further make the case for my month-long call for Value Over Momentum. Well, the month of May closed Friday and with it, Small Caps actually outperformed Large Caps! Last week alone from within my live trading room and brokerage-triggered trade alerts, we closed option trades in: AAL +308%, FDX +152%, BA +158%, M +133%, MMM +66%. Why was I on this kick all month and why do I think this theme will continue?

Coming out of recessions, small caps have beaten large nine out of the last 10 times and also tend to beat coming out of bear markets.

Small caps and beaten down cyclical sectors appealed to me as they offer great value in their discounted prices and as a sentiment play on the perceived economic recovery of Americans returning to work out of lock-down. In addition, we often have a rotation out of the momentum factor into value plays that coincides with a yield pop. While we may not have seen a spike in the 10-year yield (yet), real rates are in fact rising (as inflation has fallen).

And with that, there are three rotations within Equities that I see as continuing into June options expiration June 19th – at least – before volatility enters to threaten equities in general and this rotation in particular before recovering 2nd half of the year:

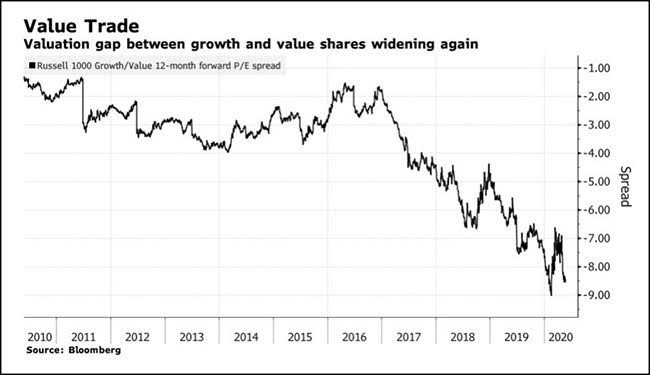

- Growth to Value

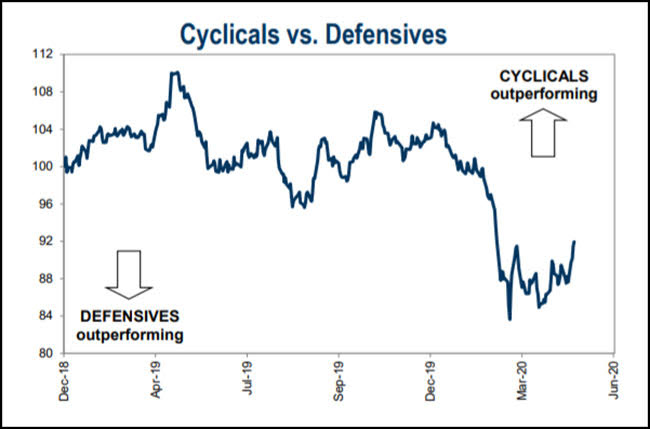

- Defensives to Cyclicals

- US to some non-US markets

Outliers Revert

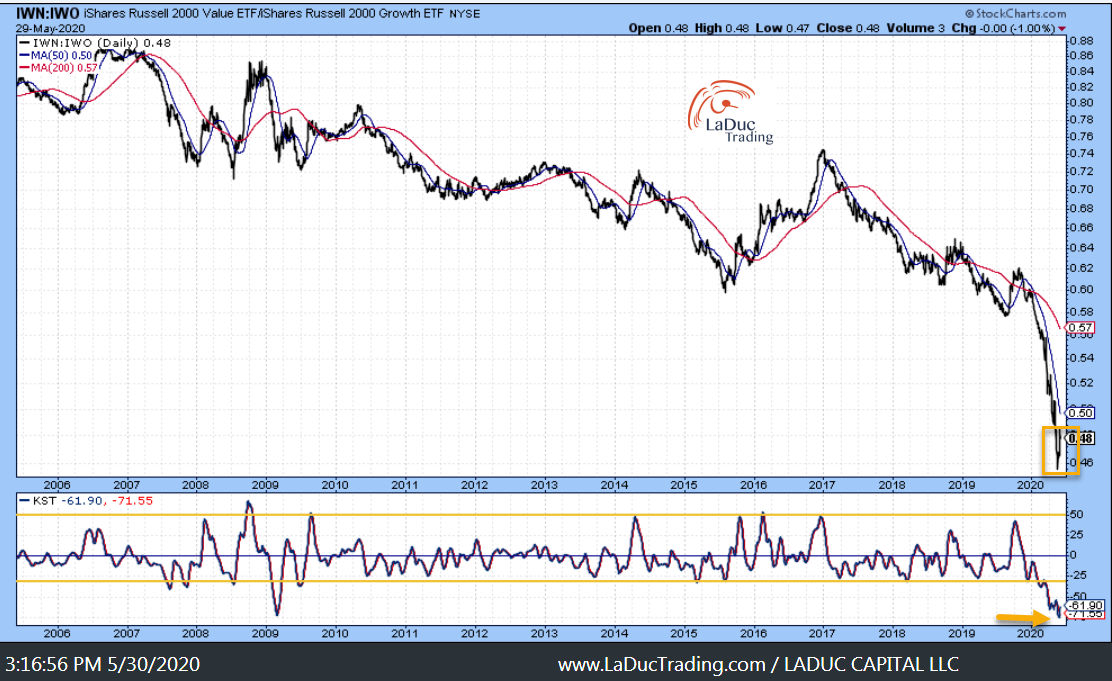

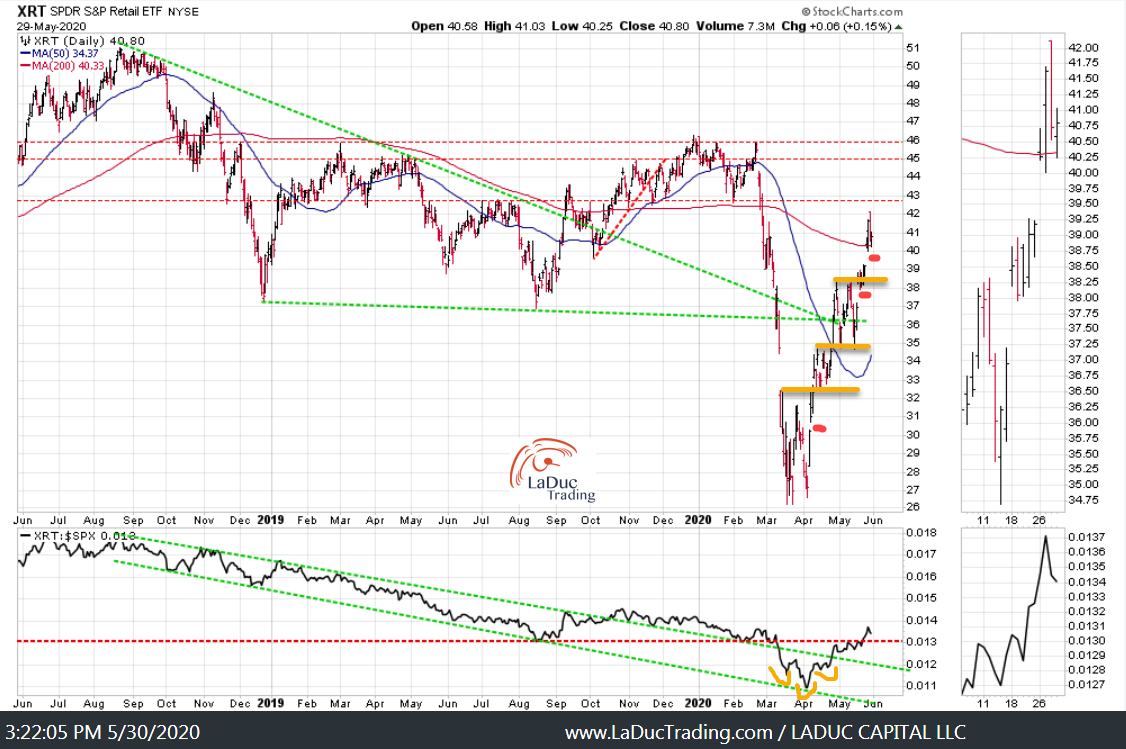

Here’s a look at the extreme of this outlier – extremely oversold value plays – and as I like to say, “Outliers Revert With Velocity”.

Transports – stretched after a waterfall cascade that took this ratio of IYT:SPY past 2004 lows:

Small caps – are just really trying as relative strength to SPX continues to consolidate after taking out 2009 lows.

Retail – working higher, level-by-level, with relative strength very supportive.

Other sectors are similarly positioned: Materials, Mining, Energy and, yes, even Bitcoin/GBTC.

Value Trade or Trap

This rotation from Momentum to Value is an outlier that needs to revert – whether from perceived economic recovery OR just time for a significant correction in valuations (too high for momentum and too low for value).

It’s clear that market participants crowded into the ‘safety’ plays of outperforming Technology/IPO, Healthcare/Biotech and Work-From-Home/COVID stocks this year. But it’s also clear that Cyclical stocks can outperform Defensives as a rotation play:

The time for a significant correction in valuations could be here.

“The P/E spread between the top quintile of historical growth and traditional value stocks is extreme,” DeBusschere wrote. “Investors need to be prepared for a violent move toward value if there is better-than-expected economic news or development of a vaccine.”

This also helps the thesis that stocks with lower credit ratings can outperform near-term:

“What is the price to book of the top third of expensive stocks divided by the price to book of the bottom one-third of cheap stocks? So the median is about 5.5 — [meaning] throughout history, the median is that expensive stocks sell for 5.5 times more in terms of price-to-book than the cheapest stocks. The current figure is rounding to 12: that’s the highest we’ve ever seen,” said Asness.