I trade for a living and support those who do the same. I love what I do and why I actively work to attract, inspire and elevate the voice of women in trading and finance. This is not only a great career, but empowered women make for powerful traders and investors. In honor of International Women’s Day, I celebrate the voice of women and call attention to level up the playing field so women can be what they can see!

Why Don’t More Women Trade?

A few years ago I launched my own thing – a woman-owned and operated macro-to-micro research, education and trading service with a live trading room for retail and institutional clients. As a woman in this male-dominated industry, I struggled to find mentors of powerful women in roles of leadership in finance and trading.

Privilege Is Invisible To Those Who Have It

When I took up trading, I knew I would learn to fish much sooner if I learned from the pros. I actively sought out and shadowed very successful, pedigreed money-managers as well as highly-profitable, retail-rogue, super traders. I quickly found out that very few women trade professionally. I have seen very little data to offer up on what percentage of women are professional traders let alone percentage of women who manage their discretionary money in the market. I am not pitchin that women are ‘better traders’ than men – although there is growing evidence, especially as it applies to risk management. My goal is to promote a strong belief that there is NO meritocracy in finance and trading without the voice of women, and therefore we need better representation in finance/trading careers, in managing assets as well as in gaining access to capital to grow fintech and financial services businesses.

‘Separate But Equal’ is Not Equal

Over 100 years ago – women fought and won the right to vote. It involved decades of protest, violence and hunger strikes. But black women, while having suffrage on paper, could not freely exercise it until the passage of Voting Rights Act in 1965. I highlight this fact as a way to bring home the message that women are catching up for a lot of lost time. There are many who feel the same.

“Women belong in all places where decisions are being made. It shouldn’t be that women are the exception”. Justice Ruth Bader Ginsburg“Anybody who doesn’t think about how to bring in more women won’t be able to compete, because they’re just cutting out half the talent from their opportunity set.” Jenny Johnson, Franklin Templeton Investments

“…nine years of research has left me with the unshakable knowledge that the lack of women + minorities in the asset management + investment industries is making everyone, from Wall Street to Main Street, poorer.” Meredith A. Jones – Investment researcher and author of “Women of The Street: Why Female Money Managers Generate Higher Returns (And How You Can Too)” June 25, 2019

“The male-dominated finance industry is missing out on more than $700 billion a year in revenue by failing to listen to or tailor products for women.” Bloomberg

Serious Problem In Our Industry

For young women to learn how women lead, we need more women leaders! For more women to lead, they need to see what they can be!

One who clearly saw a need for change and did something about it in the financial services world was Seema Hingorani (@SeemaHingorani). A former CIO $160B pension fund manager is paying this theme forward by founding @GirlsWhoInvest

“We have a serious problem in our industry, you tell me you can’t find the women, so I will make you a deal: I’ll go find them, and then you hire them.”

For more women to lead, we need more access to career opportunities and capital!

Of 16K active fund managers globally, just 11% are women, up from 10% four years ago. At this rate, it will take 200 yrs for equality. Also, of $15T of assets in Citywire‘s database, just $2.9T is managed by women (whether all female teams or teams of women & men.)

Female Fund Managers Lag Their Male Counterparts by 200 Years

Only 3% of the mutual funds tracked by Goldman have an all-female fund manager team, collectively managing just 2% of total assets. In contrast, 77% are managed by an all-male team, with these funds accounting for 57% of assets. Bloomberg

Diversity Divide

“Altogether, McKinsey [Global Institute]. expects global gross domestic product could be $1 trillion less in 2030 than it would be without a gender unemployment gap,” Bloomberg

More than half of women now control their household finances and are responsible for household savings and investing, according to Alliancz “Women, Money, and Power” study.

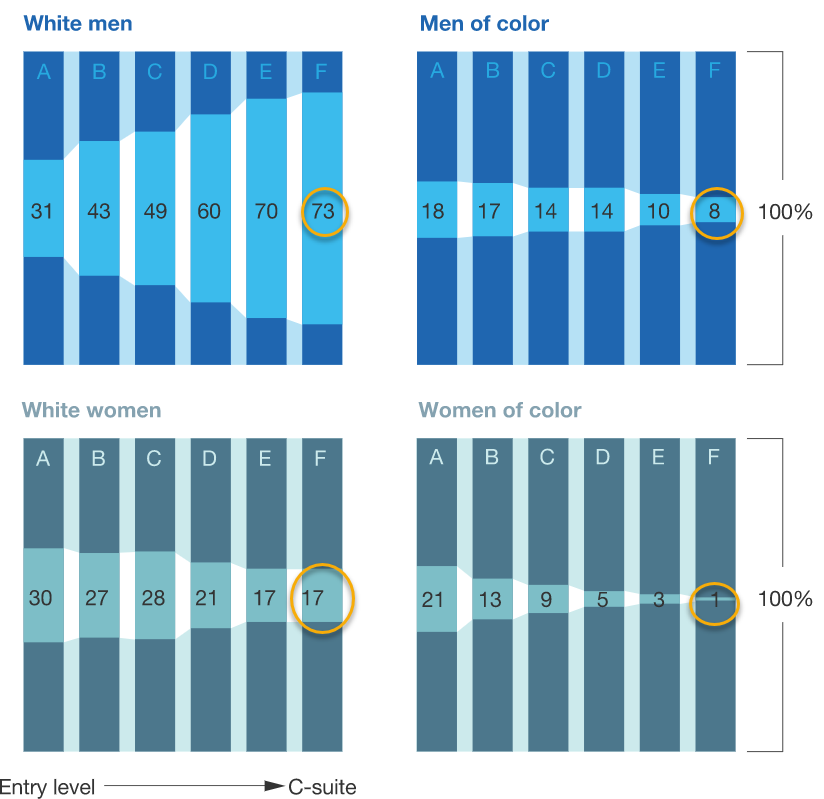

- White men make up 30% of US population with 73% of C-level roles in FS.

- Woman make up 50% of US population but only 20% of C-level roles in FS.

- Women of color make up 20% of US population but only 1% of C-level roles in FS.

Enter The She-Cession

The First Female Recession Threatens to Wipe Out Decades of Progress for U.S. Women

I am the daughter of a single mother who made $13K a year as a school teacher. This news of a Female Recession is disturbing on so many levels. Since women work 2/3 of ALL minimum wage jobs, women (and by association, their children) were hardest hit during the Covid lockdowns.

The pandemic is disproportionately affecting women and threatening to wipe out decades of their economic progress. As the crisis drags on, some of the biggest pain points are among women of color and those with young children…. The jobs, income and promotions that women lose as a result of the coronavirus could hold back economic growth and sideline an entire generation of women. Bloomberg

This reminded me of my frustration in college when I wanted to be both mother and boss, but clearly in America, production is valued more than reproduction, and without a willing and able partner, it is “The Mommy Track” all over again.

Women between the ages of 25 and 54 — also known as prime-age — are increasingly dropping out of the workforce, often to care for children. The participation gap between men and women in this age group is now widening after shrinking to the narrowest ever right before the virus.

As many as tens of millions of women may never return to the labor force, even after a vaccine is found, said Center for American Progress

Nearly 7 million Americans aren’t employed because they have to take care of children, according to a Census survey earlier this month.

Retail Trading Explodes

We have seen the parabolic charts of new traders opening accounts at brokerage accounts the past year since lock-downs, lay-offs and stimulus checks due to Covid. I do not have the break-down based on gender or ethnicity, but I can surmise there are many new women traders balancing work-family priorities as the mommy track is revisited.

Actually, that is how I got into trading actively back in 2008. I tabled my career for my son’s 2007 medical emergency wherein I sold my company of 10 years, took a year-and-a-half off and then began trading full-time post Lehman collapse. As a provider of analysis, education and trading services, I am benefiting from this work-from-home trend that triggered retail traders into the market. I am inspired to support more women in the trading space as they do not respond well to male mentors in their man-caves who exclude, ignore or dismiss the voice of women – their most frequent complaint.

Whether mentoring or professionally managing money, men have a responsibility to be part of the solution of leveling up the playing field. It benefits their interests long-term, especially for their daughters, and serves society as a whole. If the choice is between short-term greedy and long-term greedy, then let’s work together to be part of the bigger solution – stronger economic growth through female representation and advancement including access to capital and capital markets, narrowing the gender and wealth divide.

Let’s start with welcoming the new women to the trading and finance space. Since the numbers of women-owned and managed funds is grossly anemic, we need more not less representation. Given the recent cultural/political backlash to themes of inequality, my sense is that this new crop of entrants to trading and investing will drive a new generation of careers for women in trading and finance. I’m confident they will insist that meritocracy in finance and trading needs a leveling up that includes, strongly, the voice of women.