Prepare For Pullback In Gold Then Relaunch – Just Like 2008

Gold Has Skyrocketed Since May. Why? We have experienced a lot of dis-inflationary headwinds from the synchronized global slowdown and ultra loose monetary policies in the US, Europe and Asia specifically but globally in general. What could change these...

Market Thoughts: Lowest Volume Day of the Year on SPY

Market Thoughts Today witnessed The Lowest Volume Day of the Year on $SPY. With that, there is not a lot of breakout conviction and given the Debt Ceiling Showdown – as talked about earlier in week in detail – it’s probable the market starts to...

Market Thoughts: “Crosscurrents”

Market Thoughts In a prepared statement, Fed Chair Jerome Powell signaled a rate cut citing “crosscurrents” that are weighing on the economy. Initially, dollar dumped and acted as a catalyst for S&P futures to shoot up. The bullish statement is the salve markets...

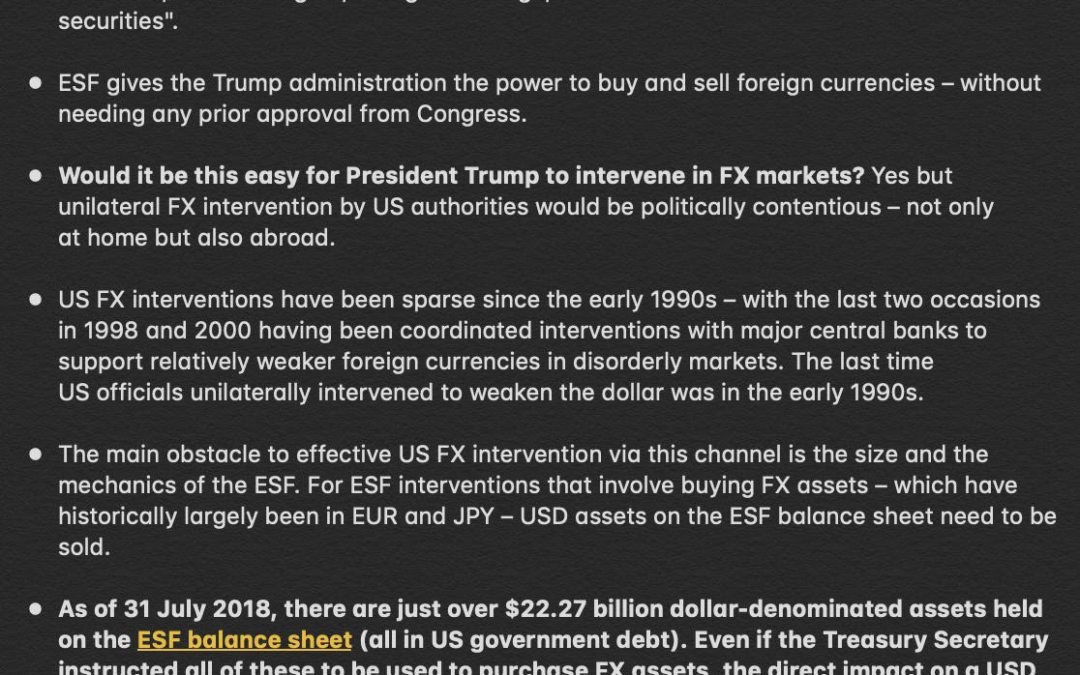

Market Thoughts: Rate Cuts and Dollar Devaluation

Market Thoughts The US 10-year yield is chugging higher while the S&P drips lower to its 8D support – with Powell’s speech released 90 mins before the open Wednesday (i.e. 8:30 Eastern). USD bulls will argue that any rate cut would be “one and...

My Benzinga Presentation June 20 in NYC

After FIVE FULL days in NYC, I am back home and back to my trading desk. My feet+wallet hurt in equal proportions as I secured an Apartment for my daughter’s internship on Wednesday and spent the Weekend walking, drinking and dining with my girlfriend who flew in from...

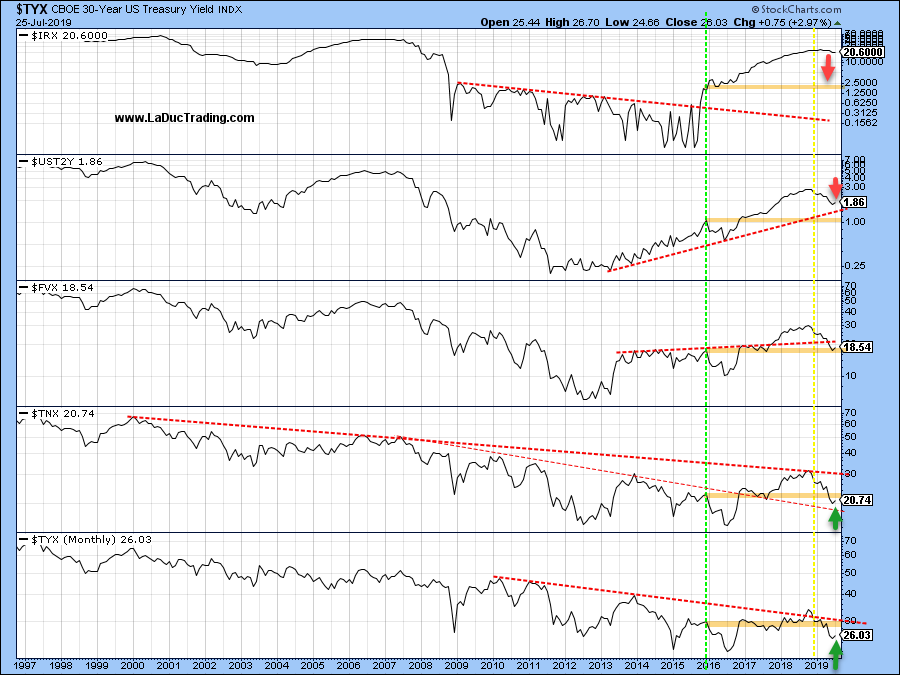

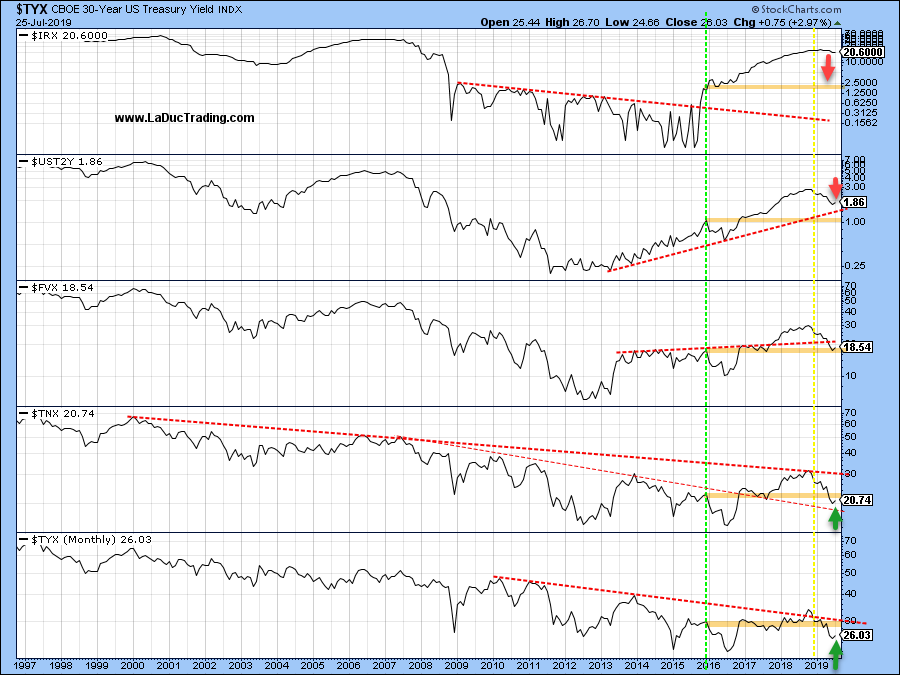

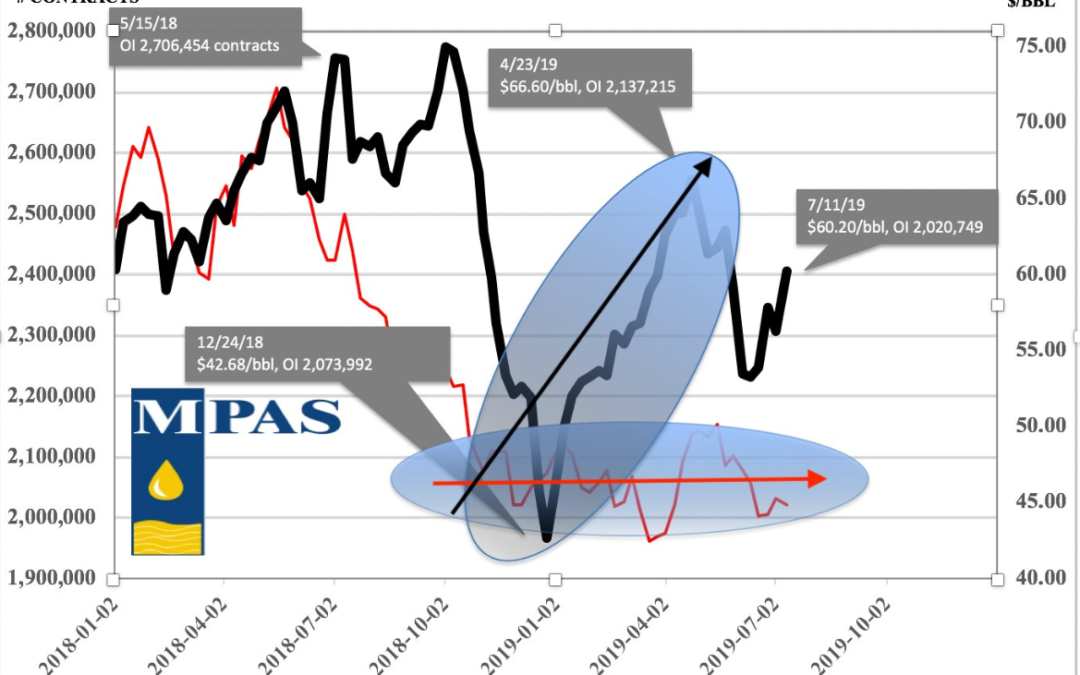

The Divergence of USD to Treasury Yields is Dangerous

In lieu of a big market sell off on global economic growth slowdown and trade jitters, the market seems to still be expecting the “Art of the Deal” from Trump on China and/or the Fed cutting 75 basis points worth this year – which ever comes first....

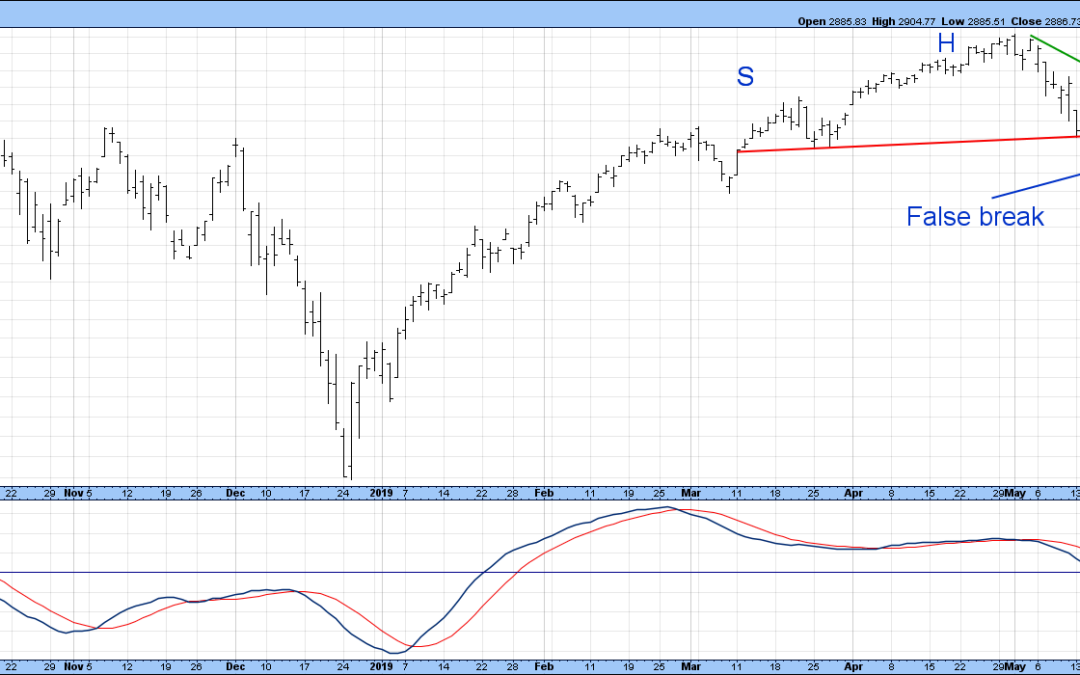

Market Thoughts: 5 Day Rule

Market Thoughts 5 Day Rule in play – Basically I have a play in my playbook that says, After a bottoming candle and 5 green bars/candles straight up, “on the 6th day, it should rest and reverse”. (This logic also applies to timing reversals at tops...

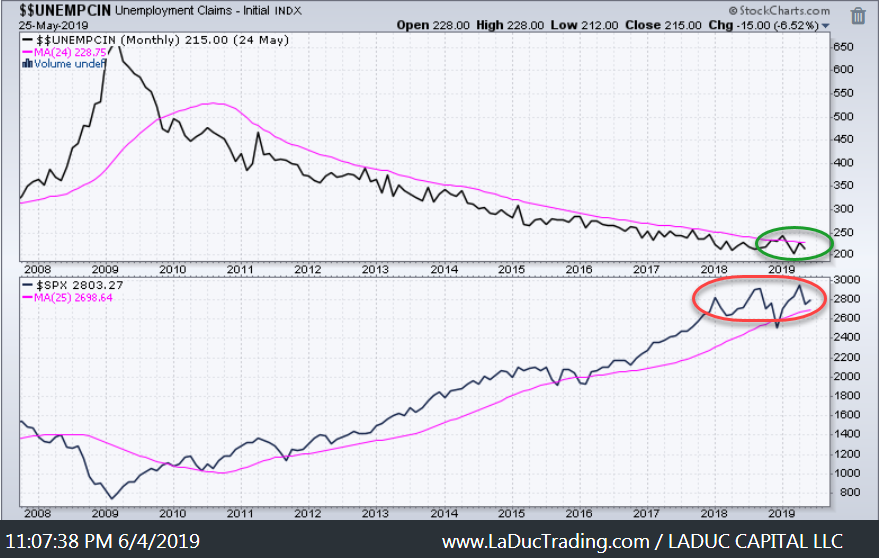

Goldilocks and the Three Bears of “Layoffs, Unemployment Claims and Payrolls”

What to Expect from NFP and the R-Word Non Farm Payrolls (NFP) are released Friday morning. Markets have had the mighty tailwind of ever decreasing employment rates and strong job gains during this past long cycle post Great Financial Crisis. Given all of the...

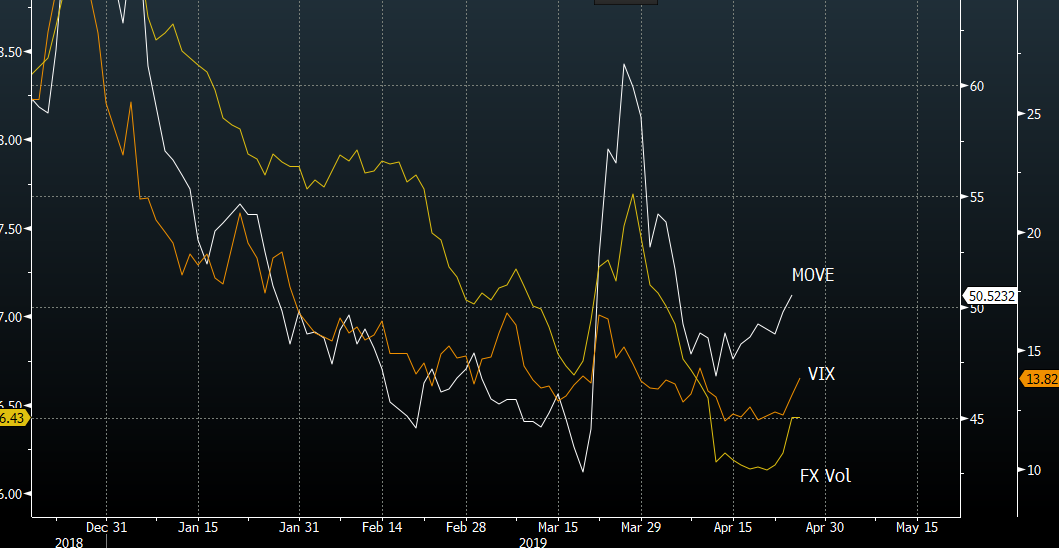

Notes for DailyFX Podcast – June 6

Market Thoughts The rally in safe haven assets such as Treasuries and the US Dollar, while equities have sold off sequentially week-to-week, is raising worries that the economy is in trouble but stocks don’t know how badly yet. Will we sell off in a more pronounced...

The Week Ahead: April 28-May 3

Market Thoughts: Anything can happen For the week, the S&P 500 gained 1.2% and the NASDAQ 1.9% – that is the 5th straight up week for the NASDAQ. Despite this continued move higher, macro data continues to deteriorate. The U.S. economy grew at an annual rate of 3.2% in the first quarter, well above the 2.3% estimated […]

Gone Fishing Newsletter: Cautiously Complacent

Reflections and Inflections This has been one of the strongest V-shaped market recoveries in history. The equity market’s move off its Christmas Eve low now ranks fourth by order of magnitude (+23%) among all bear market recovery rallies since 1950: Nov’08- Jan’09 (+27.4%), Sep’01-Jan’02 (+24.6%), and Jul-Aug’02 (+24.4%) were stronger. But this rally is longest […]

Market Huddle Notes

Current Events Healthcare sector went to the emergency room. IF… If it was more than an excuse from fear of a policy change – “Medicare for All” – the speed of selling could happen to other sectors – one by one. And that brought to mind...The Week Ahead: April 15-19

Market Thoughts The question on everyone’s minds – bears and bulls – will the SPY march straight up to ATH at $2940? With Big Banks out of the way Monday, and Old Tech (IBM) plus New Tech (NFLX) out of the way tonight, we are now a stone’s throw from my SPX $2920 Turn Target […]