Market Catch June 12 – 16

Check out highlights from the week that have got us hooked, and what else is down the line!

Theme of the Week – Bull Politics

This week’s conversation of Bullish squeezes extends into the geo-political realm: China ADRs and foreign affairs. We also continue to wrestle with the politics of the current Bull-run itself; namely, what to expect from Bullish markets as the TGA fills.

Trade of the Week

In her video tracing $TSLA’s bullish behavior over the past week, Samantha proved that $TSLA tagging up was a “not if, just when” case. Keep watch as $TSLA’s bullish squeeze continues, riding the wave of this month’s hallmark EV deal.

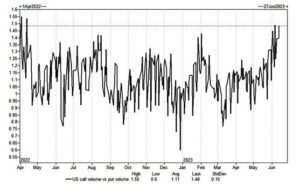

Chart of the Week

Business-Politics Spotlight: China

In a LaDuc Youtube release this week (included below), Samantha walked through the China ADRs that are ‘back in play.’ $BABA, for example, showed healthy options accumulation and promising upward momentum. On the whole, the ADR chase remains unconfirmed. For a full chase to break out, $BABA and other stocks, including $KWEB and $BIDU, will need to maintain the upward momentum above channel thresholds.

The US-listed Chinese stocks did not rally by coincidence. Last week, China’s central bank cut its Seven Day Repurchase Rate rate by 10 basis points, injecting stimulus into the market. The effect of the rate-cut is mirrored in the USD/CNH currency chart (pictured below), which depicts the ‘shake and bake’ of the US Dollar in terms of Chinese Yuan.

This much-anticipated policy decision stems from China’s slowing, post-Covid economy. China’s currently faces a property slowdown (“property investment contracted 7.2% in the first five months of the year from the same period in 2022“) and record youth unemployment (“the jobless rate for young people between the ages of 16 and 24 rose slightly to 20.8%“). More stimulus decisions can be expected as China works to lift its markets.

In related news, US Secretary of State Antony Blinken was finally able to meet with China’s Foreign Minister Qin Gang in Beijing last week. The US and China have been stuck in a tense freeze for quite some time, aggravated by misleading communication between both parties and potential security threats on either side. This meeting, while primarily aimed to address tensions and discuss topics such as Taiwan, Military, and Ukraine-Russia, also weighs heavily in matters of Chinese economic rebound.

According to Zhao Minghao, professor at the Institute of International Studies at Fudan University in Shanghai and spokesperson to the Washington Post, “China hopes the relationship between China and the United States can be improved in part to help its economic recovery and other economic challenges.”

A lot lies beneath the surface of China ADRs’ promising performance; the US and China both seem to have worries of recession on their hands. We will have to wait and see how US-China relations develop following this meeting, and what market phenomena, if any, arise.

Macro Roundup

The refilling of the TGA continues to be a large presence on the Macro watchlist at the moment. According to Macro Advisor Craig on Twitter, the Fed aims to have the TGA at $400-420bn by Thursday 6/22, based on the current bonds/bills auction schedule and other cashflow dynamics. For reference, the TGA closed at $135bn last Wednesday. Brace yourself for this tightening period.

We have also entered the last two weeks of the quarter (OpEx occurred on Friday). The portfolio adjustments and market corrections to follow during this post-OpEx period will compound with TGA filling, creating choppy Macro seas.

Learn more from Craig on Twitter, @ces921.

Never miss a trade

Learn more