Market Catch August 14-18

Check out the highlights from the week that have got us hooked, and what else is down the line!

Theme of the Week – Bonded to Precaution

From UST issuance to news in Asian markets, big moves that will significantly affect the market remain in flux. Risks continue to surface, reinforcing the need for caution and study.

Trade of the Week

Join Samantha in the trading room as she provides price targets and entry/exit advice with precision. For $GRPN, Samantha cited the significant financed call spread for October in advising an exit. With earnings out of the way, Samantha notes varying actions based on varying risk, given the need for new sources of momentum.

Chart of the Week

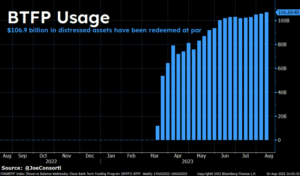

Taken from @Kathleen_Tyson_ on Twitter, BTFP is not rising quickly enough to offset QT and UST issuance draining liquidity. As Fitch noted this past week it may downgrade banks, Kathleen warns of potential credit shock in the US Economy. All eyes on BTFP and the $107bn of distressed assets so far redeemed!

Intermarket News: Asian Markets

The market strongly reacted to Macro news from China and Japan last week. China issued a 10bp drop on its one-year loan prime rate to 3.45%, officially marking the country’s state of economic slowdown. This yuan intervention aims to prevent a potential devaluation event, which would trigger capital flows out of China. Although Samantha does not suggest that a devaluation will occur, its possibility justifies her focus on Asian FX risk, which itself is linked to UST selling, higher yields, and equity repricing. Per the US market’s reaction, the surprise rate cut sparked a rise in Vol.

Japan’s GDP printed stronger than expected last week, with growth in exports leading to 6% expansion over the second quarter. As the USDJPY climbed sharply higher, gold moved inversely and fell to 1900 levels. Strong growth and inflation in Japan, the ‘Buffet Bet,’ remains a point of Intermarket focus.

Adding to Asia news last week, India completed its first crude oil payment to the UAE in rupees, no longer using the US dollar for bilateral trade. This news launched the USDINR out of a steady period of sideways movement in which it has been tightly coiling between support and resistance. USDINR is worth watching, as time will tell how high the rupee will rise and whether or not it will later roll over.

The above news features weigh into market stability, as risk-off remains the play until the bond market can stabilize and sustain a bounce in equities. Given the precarious movement in the 10Y, Samantha calls on the bond bulls to defend here.

Check out the rest of Samantha’s Intermarket analysis from last week for insights on last week’s Semiconductor buying spree, Mega Cap roll-over updates, commodities reviews, and even a new Intermarket tell.

Macro Rundown

10Y

A gloomy history lesson from Craig: in 1987, when the 10Y tested YTD highs in August and ended up surging through to new highs, the equity market hit its low (see chart below). Last week, the 10Y topped a 52-week high, and yields continue to march. All eyes are on how the equity market will sustain itself in this setting.

Volatility

On Twitter last week, Craig shared a chart of realized volatility for SPX (see below). He commented in particular that the 30d vol has made a 1 month high. As realized vol rises, funds will systematically reduce risk, adding selling pressure in an already negative gamma climate. Craig ultimately warns of fireworks that can arise when systematic flows, such as vol-spurred selling, match “fundamental concerns (yield spike, $ higher, sticky inflation, China concerns, etc).”

Read the full tweet here.

Craig on InvestorPlace

Check out Craig’ insights in his InvestorPlace article published last week, “Warning: A Stock Market Crash Seems Increasingly Unavoidable.” CLUB and EDGE members had access to these insights a couple weeks back, wherein Craig explains the gravity of the Treasury’s current deficits. Accounting for dysfunction in D.C, Craig explains why the Fed is nearing a point where they must cut rates to ease the deficit. This could cause a significant devaluation of the USD and reignite inflation, especially if such policies occur before the slaying of the current “inflation dragon.” Craig goes on to outline the scarcity of reasonable options for the Fed, predicting an overall high-risk environment.

Graphcall Macro Education – Precious Metals

Check out LaDucTrading’s newest dimension of financial learning, the GraphCall Macro Education Channel, hosted by Geoffrey Fouvry. This week, Geoffrey focused on Precious Metals, speaking on everything from extraction history, Intermarket correlations, and recent case studies throughout the course of videos.

GraphCall is available to CLUB and EDGE members on Slack. From UST issuance to news in Asian markets, big moves that will significantly affect the market remain in flux. Risks continue to surface, reinforcing the need for caution and study.

Never miss a trade

Learn more