Market Thoughts

Gold Skyrocketed. Why?

We have experienced a lot of dis-inflationary headwinds from the synchronized global slowdown and ultra loose monetary policies in the US, Europe and Asia specifically but globally in general. What could change these dis inflationary headwinds into inflationary tailwinds as a result of or separate from the geopolitical events like US-China Trade Deal collapse and hard Brexit? The biggest one: the collapse of the US dollar as the global reserve currency. Am I expecting that any time soon? No. Given the whole wide world is awash in debt, we won’t likely see the World’s Reserve Currency of the USD debase until other countries start to liquidate their US Treasury holdings. And given the size of US market buyers – Blackrock et al – that supply would likely be absorbed. At least, we need to hope it will be. If not, there is NO safety in stocks or bonds. Everyone will buy Gold and every penny-stock gold mining shop will rise 1000 fold.

With that, any recent USD pullback (it’s been range-bound for months) did not cause the recent violent move higher in Gold. It was just added fuel. Last month (June 6) for DailyFX I was interviewed for their podcast wherein I made my pitch for Gold:

- Gold price divergence: price was stable/outperforming “industrial metals” like platinum and silver – this was bullish

- Both realized and implied volatility were at record lows.

- Macro backdrop distrusts Central Bank actions – or maybe more specifically their ability to act when they need to next.

- My BPGDX Index (presented to clients) was extremely oversold.

- Gold usually trades down into an FOMC meeting, but as soon as market priced in rate cuts, Gold soared as USD pulled back and yields dropped hard.

Gold is a sometime currency, sometime hedge, sometime commodity and sometime store of value when other assets don’t seem to hold much value. When equities roll over, the safe haven of Gold (and Yen – we’ll talk about this next), take on renewed energy! And in this case, it was as simple as perceived rate cuts (lower real interest rates) are bullish for precious metals.

I also presented in that podcast my thesis for higher Yen in 2nd Half of 2019:

Yen Next?

I have a thesis – way early – that the currency market is going to have a surprise this year … with a break out in JPY. Not only is Yen at its strongest in two years, but my Intermarket DXJ:XYJ ratio work has broken a 3 year-long pattern – to the upside. In Forex land, that looks ominous for USDJPY breaking $108 and revisiting that flash-crash price near $105.

VIC: Very Important Chart of Gold

That was then (June 6th). This is now (July 18th).

Now, overbought is a relative term, so here’s a picture to demonstrate my position that Gold (and Silver and Miners) are OVERBOUGHT right now and should pull back.

Note the times GLD was outside the Monthly Bollinger Bands… And in the 2nd Month, GLD reversed, strongly.

Except 07-08…

My View:

Jul. 19th, 7:45 am The very dramatic fall yesterday in the US dollar, on Clarida’s comments of potential QE tools ready to deploy, is being sharply reversed this morning. Williams came out to talk it back and I suspect it will be talked all the way back. With that, gold and silver were also at extremes yesterday (charts in Daily) and I fully expect for them to reverse. SLV below $15.15 is a swing short in my book. GLD may back and fill up here into FOMC week before falling dramatically on a disappointing rate cut.

Brokerage-Triggered Trade Alerts!

Macro Matters

Economic Data

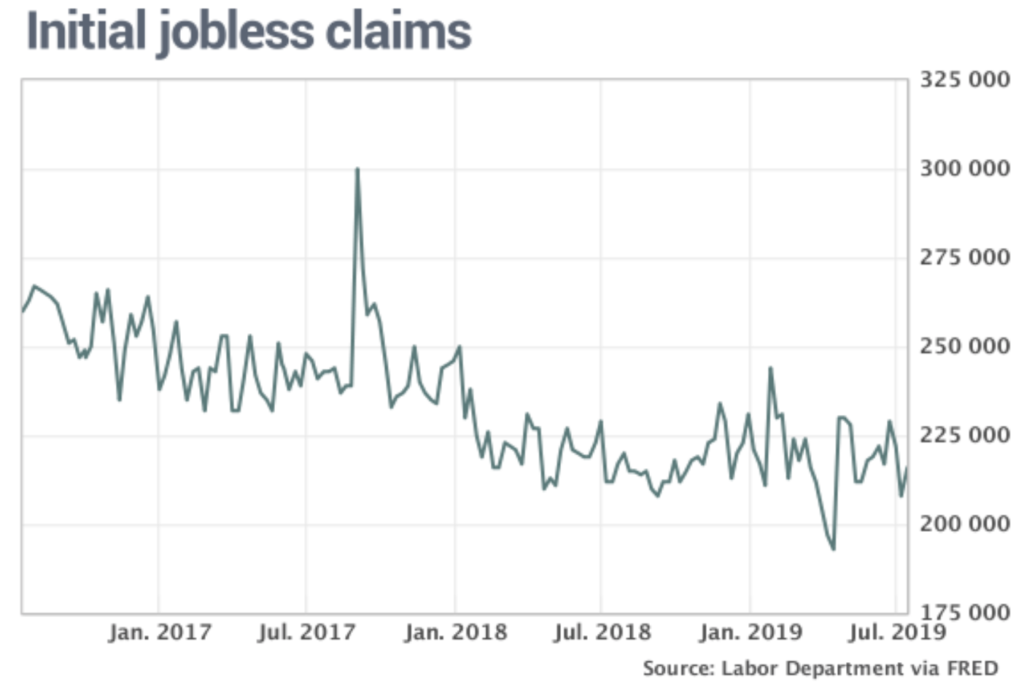

Weekly Jobless Claims: Applications for unemployment benefits remain near 50-year low

Applications for unemployment benefits rose slightly in mid-July, but the rate of layoffs clung to exceedingly low levels that show the U.S. labor market is still going strong more than a decade after the last recession.

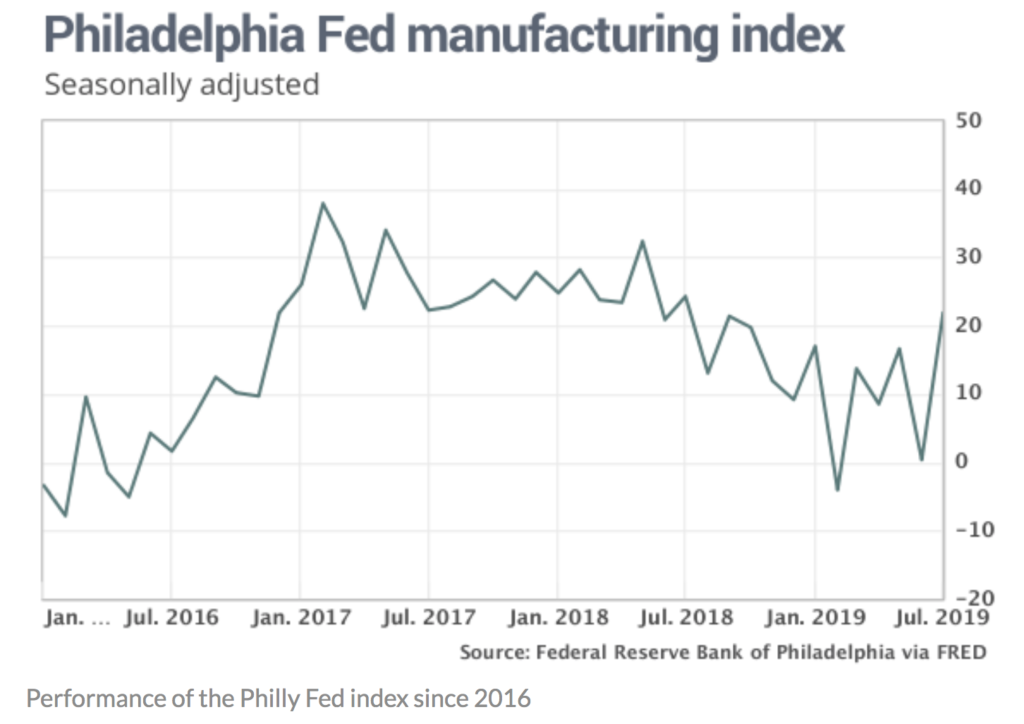

Philadelphia Fed Manufacturing Gauge

The Philadelphia Fed said Thursday its gauge of business activity in its region rebounded strongly in July after hitting its lowest level in four months in June.

The regional Fed bank’s index rose to 21.8 in July from 0.3 in June. The July level is the highest in a year. The index was 16.6 in May.

Any reading above zero indicates improving conditions. Economists polled by Econoday expected a 4.5 reading.

Trade Wars and More

Trump Says U.S. Warship Downed Iran Drone Near Strait of Hormuz

President Donald Trump said the U.S. “immediately destroyed” an Iranian drone that approached the USS Boxer near the Strait of Hormuz, the latest sign of escalating military tensions around the critical oil chokepoint.

The drone was a threat to the ship and its crew, Trump said at the White House on Thursday. The president said he’s calling “on other nations to protect their ships as they go through the Strait.” The Boxer is an amphibious assault ship.

“The Boxer took defensive action against an Iranian drone which had closed into a very, very near distance — approximately 1,000 yards, ignoring multiple calls to stand down and was threatening the safety of the ship and the ship’s crew,” Trump said.

Trump’s tariffs trip up the all-American RV industry

Carrie Gray points to a stack of unwelcome mail on a conference table at the offices of Renegade RV, one of the leading U.S. manufacturers of high-end recreational vehicles. She’s buried in bad news from most of her about 350 suppliers.

“We got letters from 75 percent of them demanding tariff-related price increases,” explains Gray, Renegade’s materials manager.

About 85% of the recreational vehicles sold in the United States are built in and around Elkhart County, making it a popular stop for politicians to tout their visions for U.S. manufacturing – including President Donald Trump, who staged a rally here last May.

And yet this uniquely American manufacturing sector has been caught in the crossfire of Trump’s trade war, according to interviews with industry insiders and economists, along with data showing a steep sales decline amid rising costs and consumer prices. The industry has taken hits from U.S. tariffs on steel and aluminum and other duties on scores of Chinese-made RV parts, from plumbing fixtures to electronic components to vinyl seat covers.

Stocks of Interest in the News

Boeing Sees $4.9 Billion Blow From Fallout of 737 Max Grounding

Boeing Co. plans to report a $4.9 billion accounting charge with its second-quarter results next week, a sign of the widening financial toll from the company’s beleaguered 737 Max jetliner.

The after-tax writedown, equivalent to $8.74 a share, covers potential concessions and considerations for airline customers who have been forced to cancel flights and line up replacement aircraft as the Max’s grounding enters its fifth month, Boeing said in a statement Thursday. The costs will clip $5.6 billion from revenue and pretax earnings in the quarter.

Samantha Says

Market Commentary from Samantha’s Live Trading Room and StockTwits Premium Chat Room

Jul. 18th, 8:16 am Good morning! If anyone new In this stock twits premium wants to receive my daily market thoughts and review of the trading day, please sign up to receive via email: https://laductrading.com/free-fishing-lessons/ Last Night’s Daily was posted late but it’s posted! Market Thoughts: Silver and Gold Are The New VIX What I saw. How we traded it. What’s next… A little more Micro than Macro this time. Enjoy! https://laductrading.com/2019/market-thoughts-silver-and-gold-are-the-new-vix/

Jul. 18th, 9:15 am $UNH 2019 REVENUE MAY MISS GUIDANCE, CFO SAYS That’s code for short 😉 Did it close at $266.66? $262 PM, headed for $259 support + $254 is 200D… Likely going there.

Jul. 18th, 9:45 am PM; waiting for it to settle down and confirm hold over 84.50 for long entry.

Jul. 18th, 12:57 pm Clearly the BEST trades from the open if you played them: PM, MO, IBM Best Overnight Short: DIS Best Swing trade Long: EOLS Least fave: CSX, NFLX – as they aren’t bouncing – and EBAY, MMM – as they both stopped me out.

Jul. 18th, 1:06 pm Levels I find Important for RISK-OFF: SLV >$15.15 VIX >$14.50 MSFT pulling a NFLX And with that, don’t forget to hedge!

Wall Street Jane’s Journal

Jane is not only Samantha’s Live Trading Room moderator, she facilitates client engagement and relays Samantha’s trade ideas into the LaDucTrading StockTwits Premium Room. A former banking VP during the GFC, she now trades full-time and actively shares her trading ideas, plan and process.

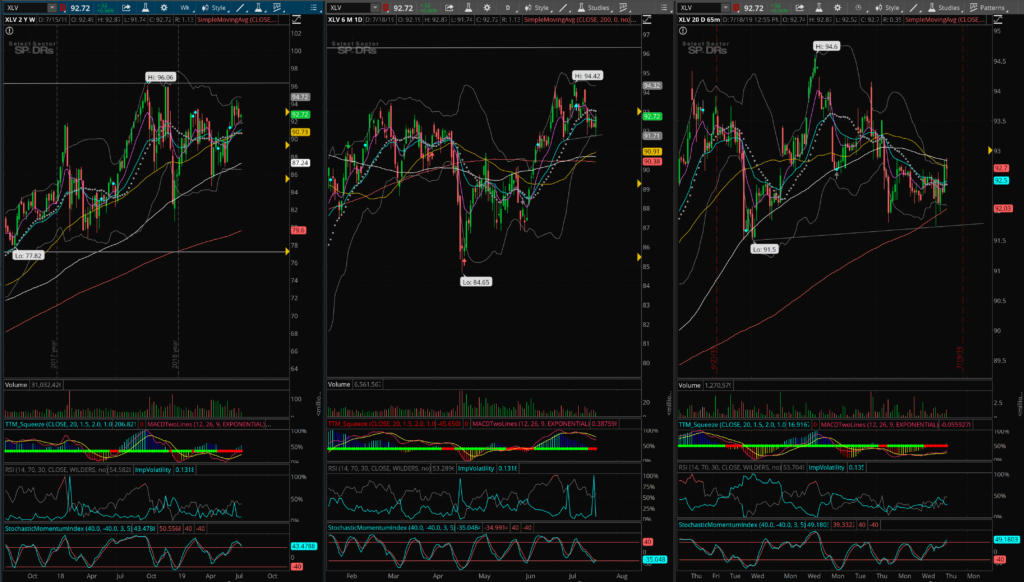

Trade Idea: $XLV

XLV has been consolidating for the last couple of weeks. It pulled back to support and bounced with a nice reversal candle today. Weekly, daily and hourly squeeze in play. Here’s the caution; The top 10 components (63 total) comprise 50% of the weighting so gauging what they’re doing is critical.. The top weighting is JNJ at 10.65%. JNJ had already taken a hit due to legal issues and fell further after earnings, but has now hit weekly trendline support so a bounce is possible. PFEat 6.96% uptrend, nice daily candle and earnings not until EOM. UNH at 6.68% reported earnings this morning and fell after some caution regarding future revenue. However, UNH had just had a huge run up and it held that support level of 259. You get the point. Know what you’re trading.

Entry at hourly hold over 93. Stop at 92. Profit targets of 94.25, 95, 96.

Great Reads

I can honestly say I never would have imagined we’d be talking about a massive “fake meat” market: Fake meat is ‘no laughing matter’: Plant-based protein will be worth $85-billion by 2030

“…nine years of research has left me with the unshakable knowledge that the lack of women + minorities in the asset management + investment industries is making everyone, from Wall Street to Main Street, poorer.”