An election–whether waiting on the results or dealing with the aftermath–can make anyone feel afloat in a paper boat on choppy water, small umbrella to protect from the swelling wave. A lot is at stake–both for our nation and for our market. I would not dare to predict the outcome of the hotly contested race anymore than predict how the market will respond. I do assume there will be random, chaotic price action in the indices, volatility and individual stocks, especially those that might benefit or be put under pressure from the President-Elect. For now, I am focused on what the charts are telegraphing to me, regardless of who is elected.

As I wrote in my Pre-Election Results blog, with Volatility bid up in all future months, I’m betting that Volatility, and a $SPY pullback, will revisit post election. Especially if Trump wins. Despite having a thesis for what’s next, I need triggers to trade. Oversold conditions are numerous right now, but they haven’t triggered intermediate-term buy signals, so much of what I will trade will be short-term until the waters calm. And since the last article was a review and this one is forward-looking, I feel it best to watch the sea from dry land.

Any Good Fishing?

With $SPY on tecnical support, after a -4.5% drop from the highs, and $NAMO and $NYMO near oversold levels, we will likely have a decent bounce. And there are probably some good deals out there, if carefully hedged. There are companies within the SPY ETFs that may represent value now and would be my first place for fishing around: $XHB $IYR $XBI $XLU $XLV. Money has to rotate somewhere and these ETFs have been destroyed while $XLK $XLE $XLY are now breaking down on weekly timeframes and may represent short plays, especially if the seas start to get rough with a new Prez. What bulls don’t want to see (even more of) their beloved SEMIs rolling over, or Transportation stocks breaking down or God-forbid, Financials breaking their trend lines of support. In short, tread lightly if $SMH $IYT $XLF $KRE $XLB $XLI come under pressure.

Troubled Waters!

Money started leaving the market recently, did you notice? Last week $HYG and $JNK had combined $1.8B outflows; $TIP had $1.1B inflows. And as a result, credit spreads widened (debt fear) and commodities caught a bid (inflation fear). What also caught my attention was the relatively unknown $SHY ETF shared by @cfromhertz Nov 2nd, which is essentially a stealth fear trade. It’s the 1-3 year treasury bonds, where institutional traders hide with their cash balances. Since funds don’t get paid to go into cash, they hide in short-term treasuries, and Nov 1st logged their biggest inflow this year. I would imagine this is just starting, but it may just also just be protection from the election. One to watch.

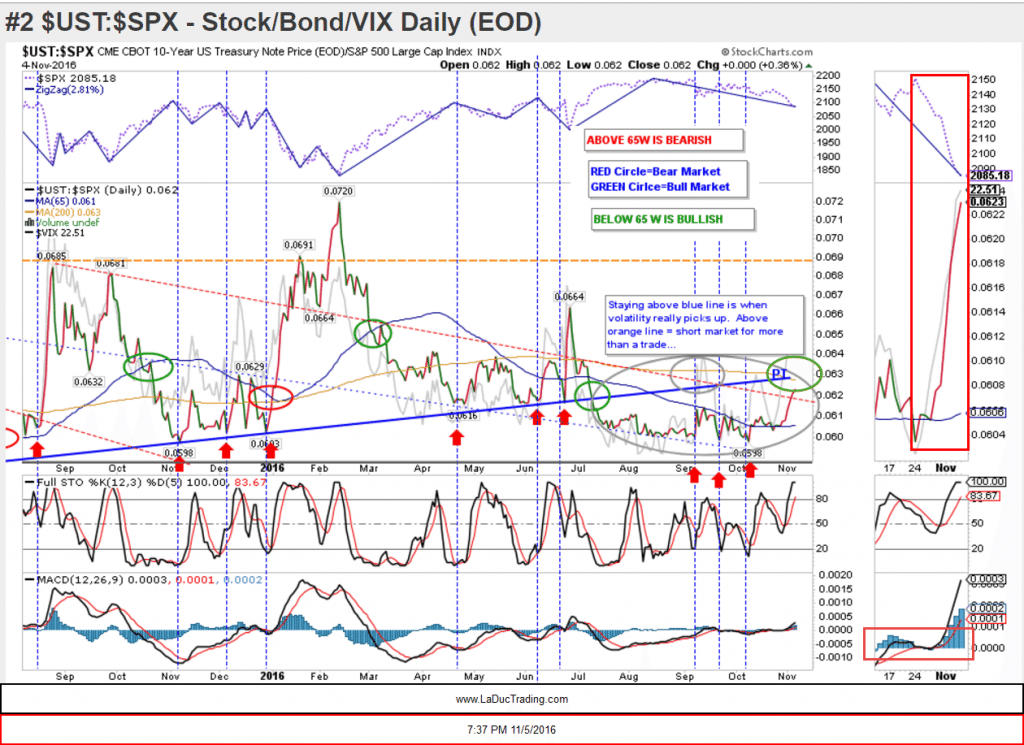

For me, I mainly watch Volatility, and my fave volatility chart, is my hard-to-interpret but always prescient Stock-Bond-Volatility Ratio. Both Weekly and Daily triggered RISK OFF Oct 28th and have not signaled a Long SPY/Short VIX trade for me, yet. It did foretell the 60% $VIX advance though.

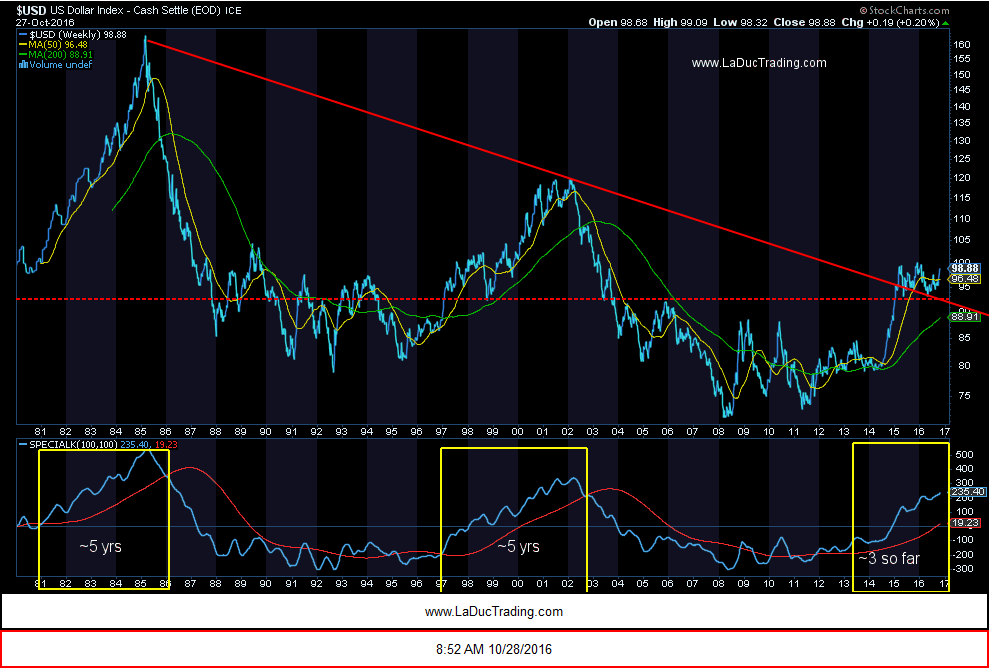

There was/is/always talk of our dollar so much so that it tends to obscure the fact we are in a trading channel past two years and until it MOVES out of this channel, all talk is noise. With that, $USD is approaching short-term support at $96.40. If it breaks, it likely heads down to $94 then bottom of channel at ~$91. Bulls and Gold Bugs would love to see the two-year long consolidation break. However, there is also a Bear Case given Yuan devaluation and FED de facto tightening. Above this channel of consolidation ~$100, we have a dollar RUN. And given the last two 5 yr cycles, it might be best to hope for the best but plan for the worst. Until then, it’s a trading vehicle not an investment thesis.

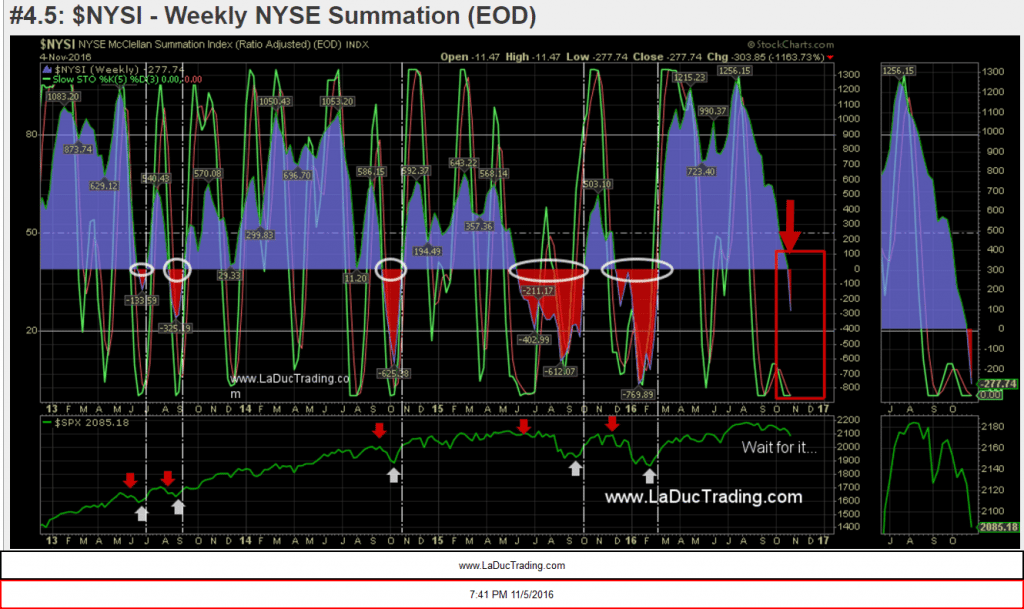

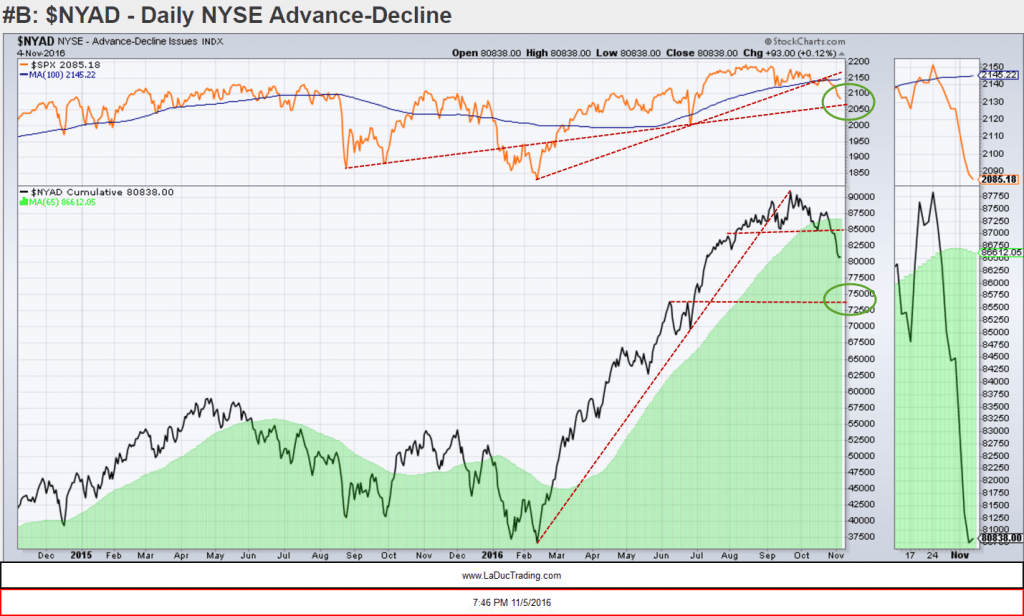

One of my favorite breadth indicators is the NYSE McClellan Summation Index. This posting Aug 13th gave me the 1st signs of deterioration despite our strong indices. My thesis was that it had topped and was likely coming down. I posted again Oct 2nd with a tease to “Wait for it…” meaning the breakdown under the surface had already begun. And again Nov 1st after $SPX broke $2120 that the index was destined to #CatchDown and that is was #NotDoneYet. Here it is now, far from finishing it’s work and with no signal to buy the dip yet.

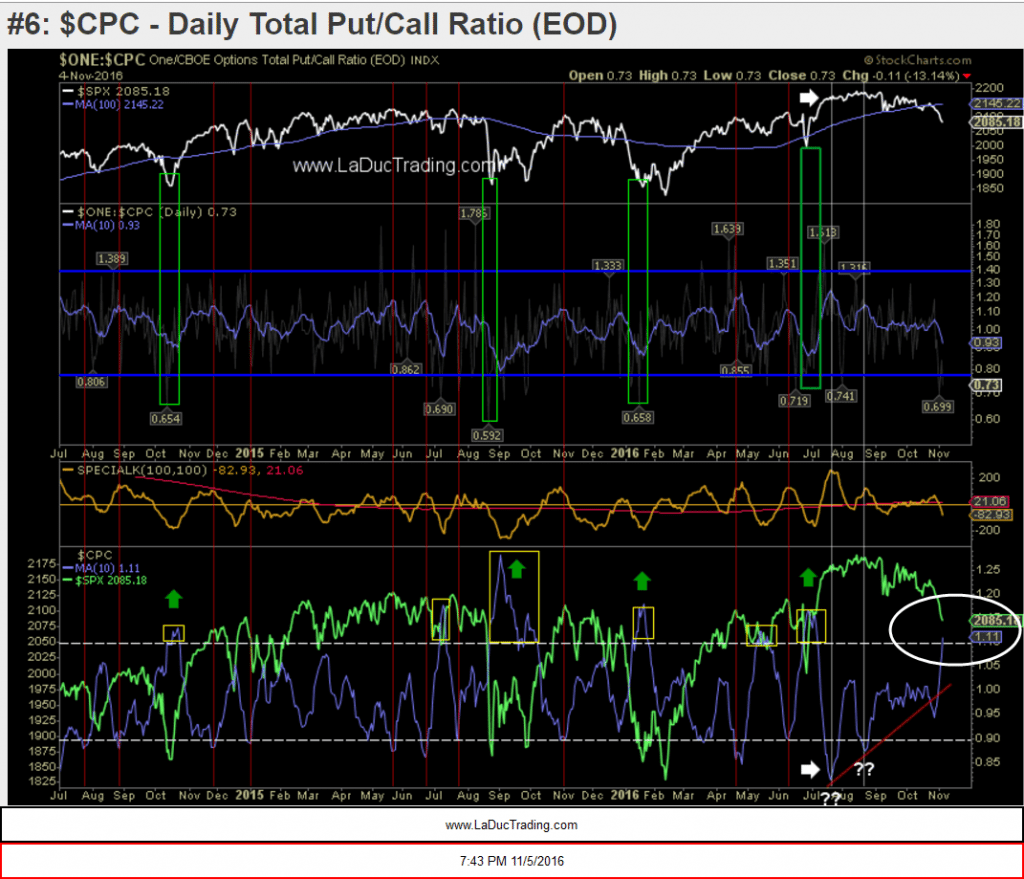

After two long months of unprecedented sideways–wicked rare for this chart–it moved higher Oct 28th. It was my confirmation that the market would pullback and with it volatility would rise. I did not know at the time that $VIX would go on to rise over 60% in one week. Now I am watching for the 10D to stay above ~> 1.10, create a reversal signal, and cross back down below it before I buy the dip and short volatility. Until then, you first.

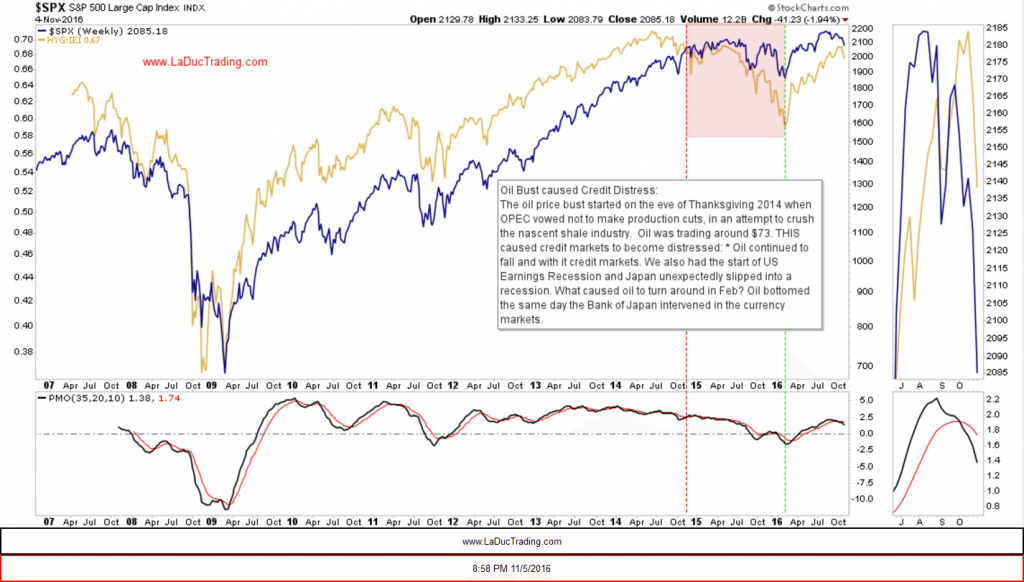

And for those who follow credit spreads, this correlation is not making a bullish case either. Lower oil got us ‘into this mess’ in Nov 2014; Japan ‘got us out’ in Feb 2016, might oil or Japan pull us down again? Not sure about the election outcome, or the new policies of the new president, but in the back of my mind I can’t help but worry about this little unknown gem of research I dug up:

Did you know: 218 Oil&Gas Cos have declared bankruptcy since 2015: E&P/drillers, midstream/pipeline + oilfield services. That’s $66B! in aggregate debt…Have we really fully assessed/survived the fall out?

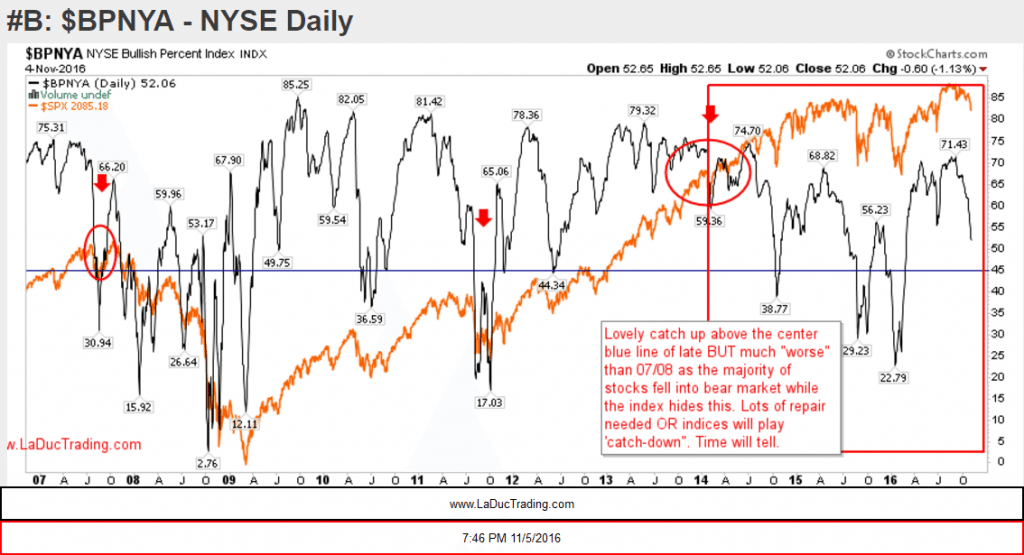

Moving on: Big picture and small, the Bullish Percent Index is not where it needs to be.

We”ll likely get a bounce in $NYAD around the $SPX $2000 level (which I’ve been speculating we could reach since Sept), but $NYAD cumulative has a distinctly different look to it further out. You know it takes much longer to hike up the mountain than down.

If you are a Bull: Look for $SPY companies to recover from their earnings recession and support their valuations, oil prices to rise and oil+gas companies to recover from their debt woes and avoid further defaults, the US and Japan to implement more fiscal stimulus and keep rates lower for longer, and the election and presidency (Russia, China and Brexit) to be smooth and uneventful. If that is just too much to ask for, at least you can can hopefully enjoy a few technical bounces.

Friendly Note: If you wish to receive future Free Blog Fish Stories, it’s easy to subscribe.

Thanks for reading and Happy Trading,

Samantha LaDuc