Trump has vowed on Day One to cancel some restrictions on energy production, but we don’t quite know what that means yet. He has also said he would reignite (forgive the pun) the Keystone Pipeline. Not only is this contentious, but these policies could add oil supply to the current glut which in turn could put pressure on oil prices. This isn’t even taking into consideration the effect if OPEC doesn’t cut production.

Oil policies move oil prices. And we need oil higher, and true demand for oil higher, to propel and sustain the economic recovery Trump is promising.

One sector that could benefit from a specific policy change are the small-to-medium oil and gas refinery companies if Renewable Energy Credits (REC) are changed. I like the macro thesis and the technical set up so here are the 5 charts I like best in the Oil Refinery and Marketing sector:

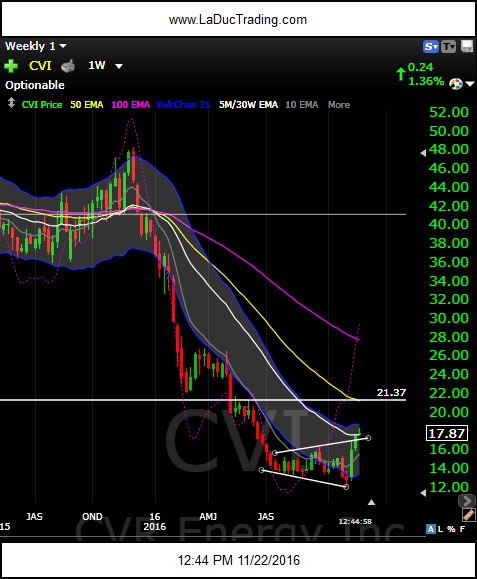

Last week I wrote CVI oil+gas refiner had gained 35% post election. I like it chart-wise as a nice bottom fishing play–see breakout of weekly wedge–but I also noted recent Unusual Option Activity and, wait for it, Icahn owns it. Curious. Not only did he write the EPA to change the renewable fuel credit market but he has the ear of Trump.

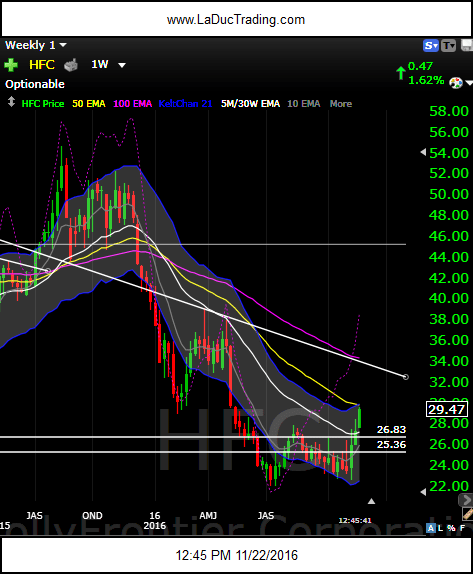

HFC is another chart and bottom fishing play I like that falls into the theme. It needs to stay above $25 as investment thesis, $27 as swing long with $28 as the 200D for shorter term play. I’m simplifying but point is the momentum is bullish but given it is pushing up against the 50W (yellow moving average), I think a little back and fill on its way up to $32 is probable.

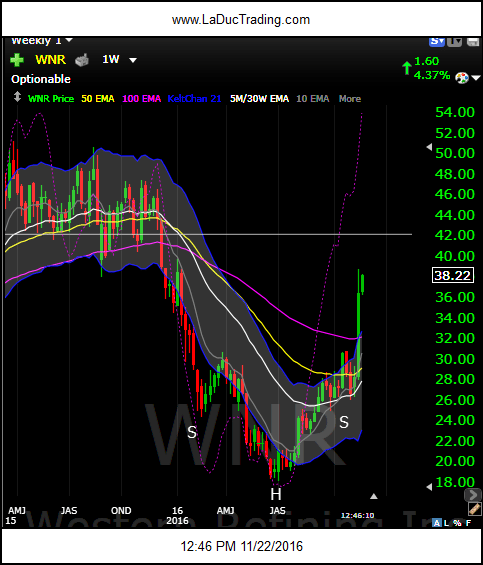

WNR has already left the station and tagged it’s measured move price target from that lovely head & shoulders pattern on the weekly. After a big gap up, assuming that holds, it still looks headed to $42.

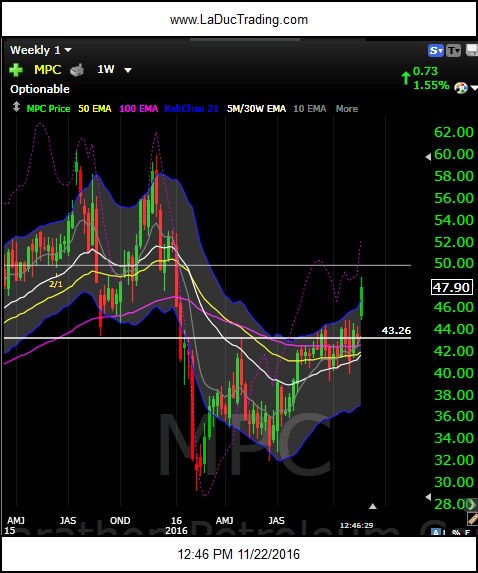

MPC was an energy play I was watching long before it gapped up this week. i like stocks long that trade right above a cluster of moving averages. It also had a decent flow of UOA and a good theme for REC. Now it needs to hold the gap above $45.

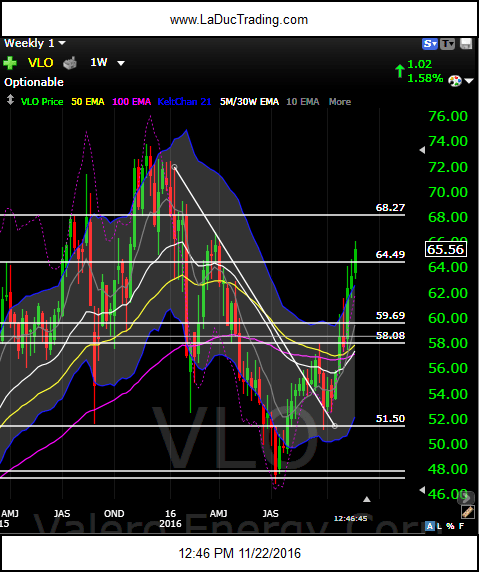

VLO is more of a short-term option play for me given it jumps around a bit, as it stair steps higher through each of my Fibonacci levels. Next up is $68.

Friendly Note:

If you wish to receive good stuff cheap from my Free Fishing Stories/Blog, it’s easy to subscribe.

You are also invited to Come Fish With Me: you choose if you fish everyday or once in a while.

Thanks for reading and Happy Trading,

Samantha LaDuc